Sidebar

Indicators

EA Studio includes a set of indicators. The same indicators are used in MetaTrader. This guarantees compatibility between EA Studio's Expert Advisors and MetaTrader.

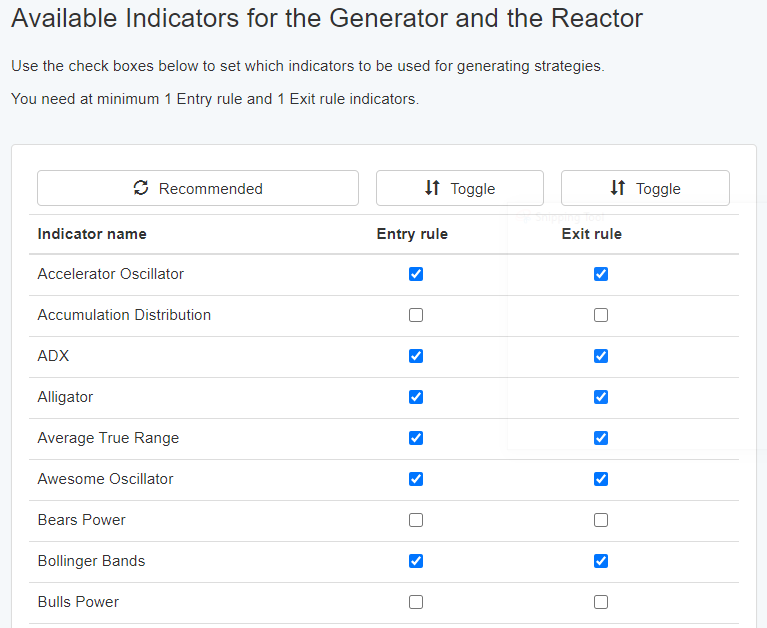

In the strategies, Indicators can be used as Entry rules and Exit rules. Therefore there are two columns in the interface (see above). The toggle button above each column allows you to enable/disable all indicators in that column at once. Of course, if you want to find strategies easily you want to enable as many indicators as you can. On the other hand, EA Studio gives you the option to select only specific indicators that will be used by the Generator and to disable specific indicators if you choose not to use them.

Recommended Indicators

The “Recommended” button makes the recommended indicators available for the Generator. The remaining indicators are disabled. They are all stable and work well in EA Studio and MetaTrader, but have some specifics. You may enable all of them if you wish.

Here are the notes of why some indicators are not recommended:

- “Accumulation Distribution” includes the sum of the volumes since the beginning of the data series. It will give different values if you test your strategy on data with different length or from a different broker or data server.

- “Bears Power” and “Bulls Power” are not completely symmetrical for long and for short positions. They also use only the Exponential Moving Average in MetaTrader.

- “Donchian Channel” indicator measures the bars High and Low for a particular interval. Because EA Studio trades only at Bar open, it seems that this indicator gives signals only when there is a gap in the data, which is not very common for the forex market.

- “Entry Time” and “Exit Time” indicators determine entry and exit time intervals. The Generator may choose intervals that are not very suitable for our market. These indicators are best for use as “Preset Indicators”.

- “Long or Short” makes the strategy trading in one direction only. It may be good for experiments or for some stock markets but is not suitable for every case because generally, we want symmetrical strategies.

- “MACD”, “MACD Signal”, “Moving Average of Oscillator” use only Exponential Moving Average (EMA) in MetaTrader. The EMA calculates its current value based on its previous value. This method leads to slightly different values for different length of the data series. It may give different signals if we have different data for testing and trading. Using EMA is OK if we import the full data series from the broker.

- “On Balance Volume” uses volume, which may give different signals if we use different data.

- “Do not Exit” - obviously we want our strategies to use indicators for an exit. The indicator is useful if we are sure we want to exit only at Stop loss or at Take Profit.

~~DISQUS~~