Sidebar

Table of Contents

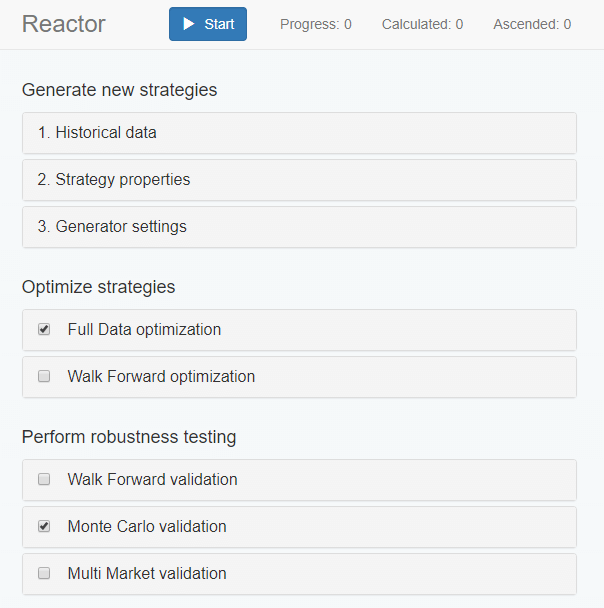

Reactor

The Reactor provides a way to automate the process of generating, optimizing and validation strategies. Ir is also known as an Automated Workflow for creating trading systems.

The Reactor comprises a Generator and additional tools for optimization and validation of the generated strategies. For example, you can enable the Monte Carlo tool in the Reactor and each generated strategy will be validated by a number of Monte Carlo tests. It will then be added to the Collection only if passes the Monte Carlo tests and all other enabled validation tools.

You can enable or disable each option. When this is done, the Reactor shows the corresponding option stats on the right side of the screen. This tool is extremely powerful and there are many ways to use it.

How it works:

- it generates a strategy (with the corresponding goal, criteria and OOS),

- optionally, it can optimize the strategies. You can use separate settings for this.

- the strategies may be additionally validated against the Monte Carlo and the Multi Market tools.

- finally, if the strategy passes all validations successfully the reactor will ascend it to the Collection.

The final goal of the tool is to provide strategies that have passed all robustness tests. So we can start the EA Studio Reactor at night, and we will have ready-to-use strategies in the morning.

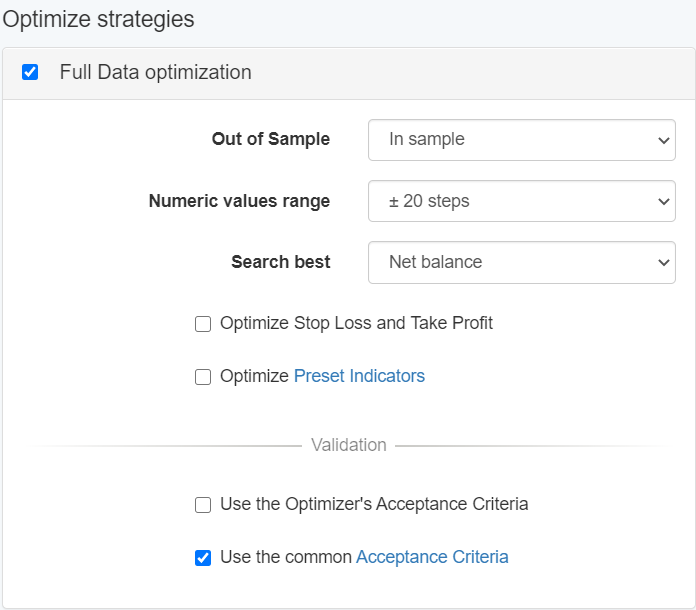

Optimize strategies

Full Data Optimization

If you use the Optimization feature, the Automated Workflow tries to optimize every strategy produced by the Generator. You can use individual settings for this optimization tool different than the main Generator settings. After the optimization is ready, the app validates the best found strategy against the Acceptance Criteria. If the strategy fulfils the criteria, the app continues to the next workflow tool. If no more tools are enabled, the app pushes the strategy to the Collection and runs the Generator. You may find it useful to increase the Generator's working minutes in order to let it run longer

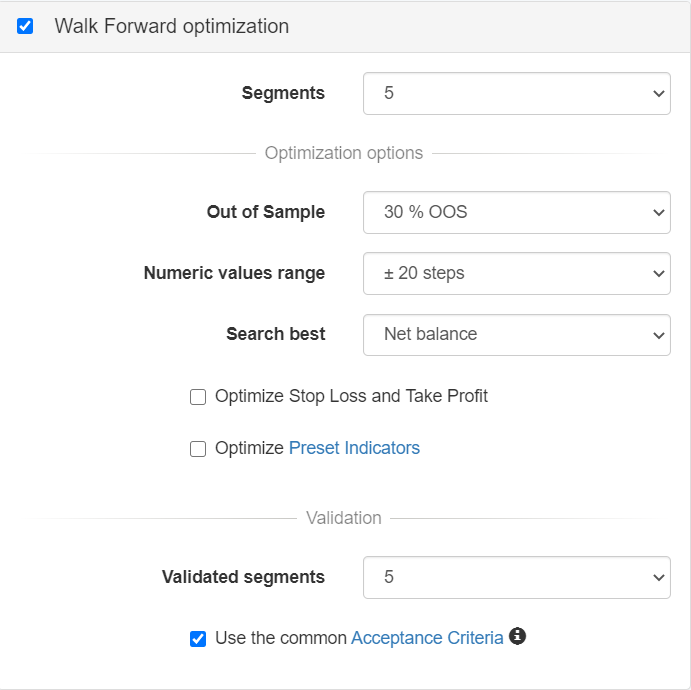

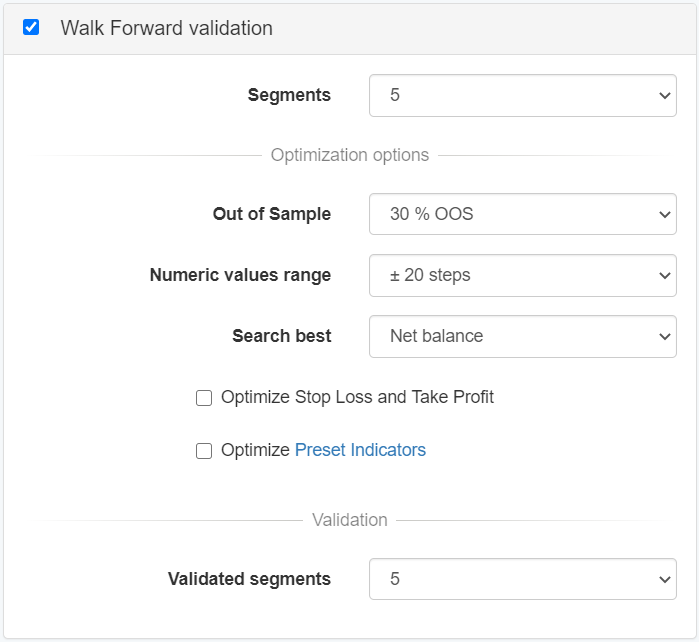

Walk Forward optimization

Walk Forward analysis (WFA) or Walk Forward optimization (WFO) is a sequential optimization applied to an investment strategy. The name of the analysis is called “walk forward” because we have a moving window that progressively traverses the whole period of the data history with a pre-established step. Algorithmic traders apply this type of analysis to decrease the over-optimized parameters used in the investment strategy as we don’t want only a great looking backtest result, we also want a system that doesn't fail in a live, real money account.

Read more about it at Walk Forward

In the Reactor context you can apply this optimization to the strategy, if the WFO results (Out of Sample net) perform better than the original strategy (full data backtest) the last parameters used by the optimization will be accepted to the strategy.

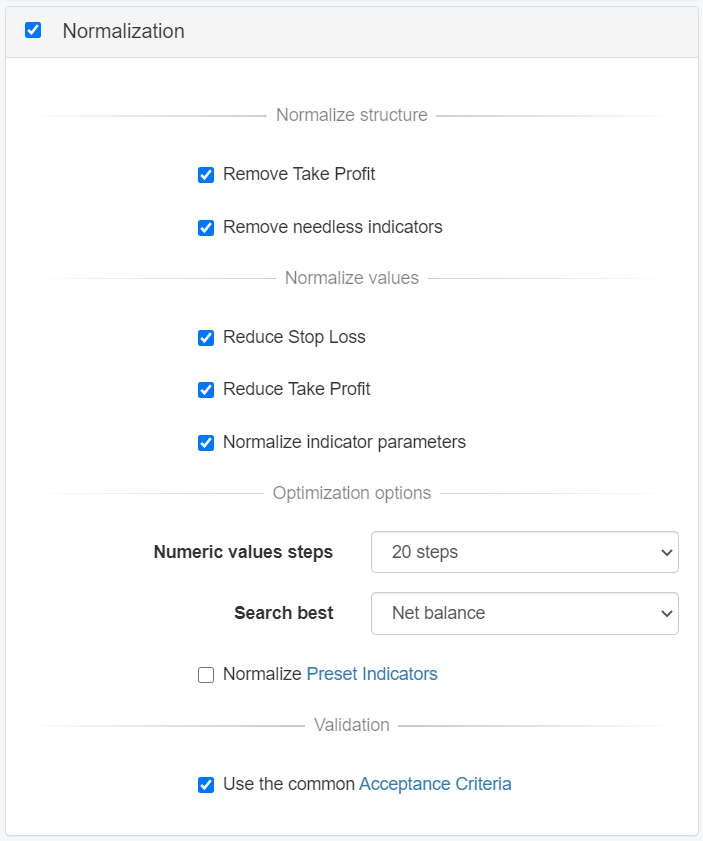

Normalization

The Normalizer is the most recent feature added to the EA Studio Trading Software Automated.

It allows the traders to simplify the trading strategies. It reduces the SL and pushes the parameters of all indicators closer to the default values.

Any changes are accepted, only if the results are better. The Normalizer doesn't change the strategy, it just make it faster and easier.

Perform robustness testing

Walk Forward Validation

You can use WFO as validation tool and it returns only strategies that pass the validated segments without changing the original parameters of the strategy.

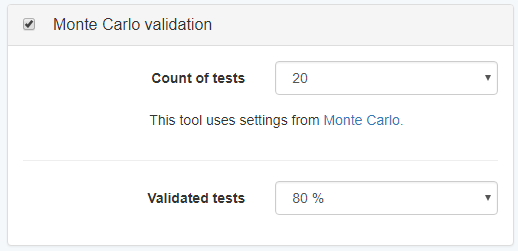

Monte Carlo Validation

The Monte Carlo validation tool performs random test of the strategy and validates the output.

You set the percent rate of the tests on profit. In the shown example, all simulations must finish on profit in order to pass the strategy to the next tool.

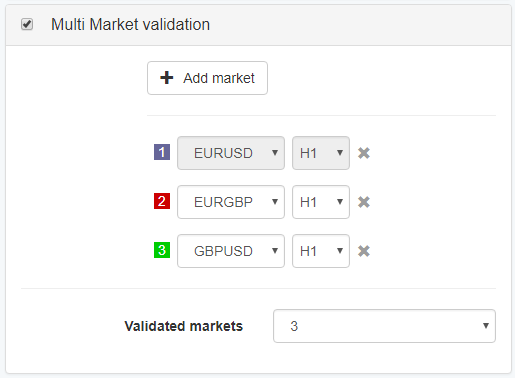

Multi Market Validation

The Multi Market tool tests the strategy against different markets. Your validation criteria is the minimum count of tests that are on profit.

We have 6 markets on the example above and the validation threshold is 3. That means that if 3 or more tests end on profit, the strategy will ascend to the Collection.

Hint for Reactor / Validator

It is best to use only one of the following tools:

- Full Data optimisation

- Walk Forward optimisation

- Walk Forward validation