Sidebar

Table of Contents

Generator

The Generator is a unique tool which:

- composes Binary Options strategies automatically;

- calculates the strategies' backtest against historical data;

- presents the results in stats and charts;

- collects the best strategies in a Collection;

- shows the most profitable strategy for the calculating session;

- works in the background when you let it run and open another page.

Quick Start

- Load data from the Editor – the Generator uses the data set selected in the Editor. The Generator shows the loaded data info in the Market Info panel.

- Set the Investment amount – set the amount that will be invested on opening a new position.

- Set the Expiry – the Expiry period sets when the open option will expire.

- Start – press the Start button and the Generator will make thousands of calculations per minute in order to find the best strategy. You can leave the Generator working while you work on another strategy in the Editor tab.

- Edit – you can edit the best strategy in the Editor.

- See all strategies – the Generator collects the best profitable strategies in the Collection page.

User Interface

The Generator page consists of several parts:

- Toolbar - located at the top, it controls the Generator;

- Parameters – the configuration panels are located at the left hand side;

- Information – the Generator shows information for the Market, the Backtest statistics, Indicator chart and Balance chart.

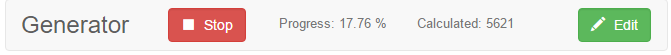

Toolbar

The Generator’s toolbar contains a button for start and stop, the percentage shows how much of the current task is complete. In the toolbar you can also see the number of the calculated strategies and a button for editing the best of the current session.

Start / Stop button – Starts / Stops the generation process. When the Generator is running, it composes and calculates strategies. It stops automatically when the pre-set working time expires.

Progress - the progress value represents the percent of the time that passed from the start of the generator compared to the pre-set working time.

Calculated - the number of the calculated strategies for the current run.

Edit - the Edit button loads the current strategy in the Editor. You can view and change the indicators there.

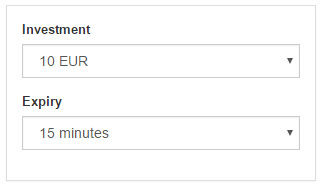

Strategy Properties

Investment – this number sets the money for opening a new position. Please consider the value well. It must correspond to your initial account.

Expiry – sets the expiration period of an open Option.

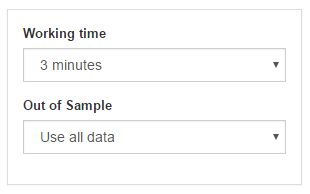

Generator Settings

Working time – the working time of the Generator. You can start the Generator, let it work and it will stop after the given time.

Out of Sample – OOS is a very important concept and it is almost always used by experienced traders. Using it makes the strategy much more reliable.

When you use the “Use all data” option, the Generator searches for the best strategy by comparing the net balances of the calculated strategies.

When you use 30% OOS, the Generator first calculates the position of the data bars, which corresponds to the 30% of the data series. Then it takes this bar balance for comparing.

The OOS is basically a simulation of real trading. So, if you have designed the strategy using the first 70% of the data and after that you trade the strategy for the remaining 30% of the data. This is also called “future test in the past” or “testing with unknown data”. The goal of OOS is to achieve a smooth upward line in the OOS Zone. If this is not the case, the strategy is not fit to be traded. On the other hand, even if the balance line is smoothly raising this in no way guarantees the strategy will be profitable, but it will certainly have a much greater chance to make profits than a strategy with a fluctuating balance.

Market info

Shows information for the loaded historical data. You can change the data source, the symbol and the period from the Editor page.

Backtest results

The panel contains the statistical information from the backtest of the shown strategy.

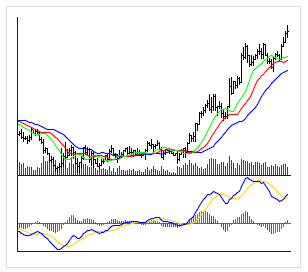

Indicator chart

The Indicator chart outlines the price bars and the indicators used in the strategy. You can find a more detailed chart in the Report page.

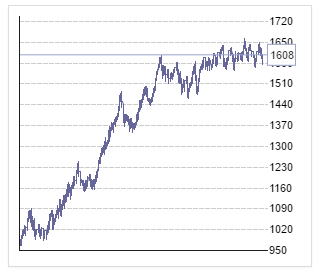

Balance chart

The Balance chart shows the strategy performance for the whole time of the backtest.

~~DISQUS~~