Re: InstaForex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on January 17, 2023

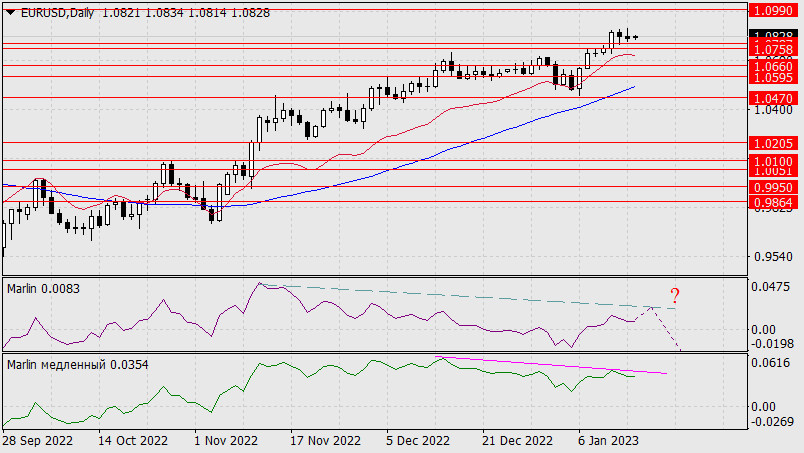

As we expected in yesterday's review, due to the US holiday, the euro moved sideways, confirming the consolidation above the target range of 1.0758/87. But over the past 24 hours important nuances appeared, while the main idea of the price breakdown of t1.0990 is preserved.

Our traditional Marlin oscillator still has the potential to form a renewed flat divergence, which is marked with a dotted line, and the so-called slow Marlin managed to form a traditional divergence, which increases the probability of a price reversal from the current levels. This will be confirmed once the price crosses the lower limit of the support range at 1.0758/87. Crossing yesterday's high at 1.0874 will push the pair to rise towards the target at 1.0990.

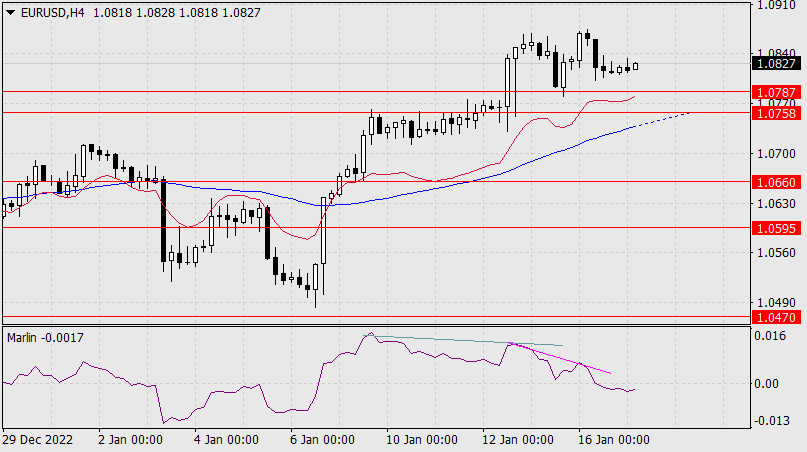

On the four-hour chart, under the pressure of a double divergence, the signal line went under the zero line, into the area of the downtrend. Now the price will be under pressure in the short-term. On the current chart, we see that crossing the lower limit of the range at 1.0758 coincides with crossing the MACD indicator line, and this will enhance the signal for further downward movement. We wait for the development of events.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.