Re: InstaForex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on February 2, 2024

EUR/USD

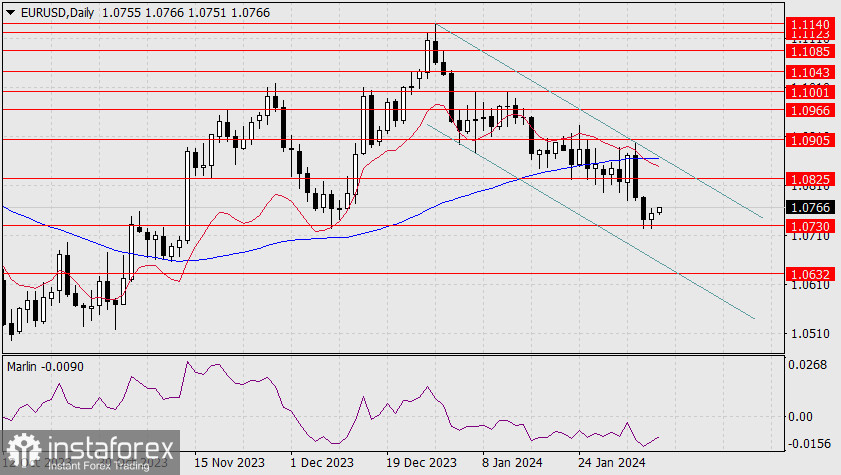

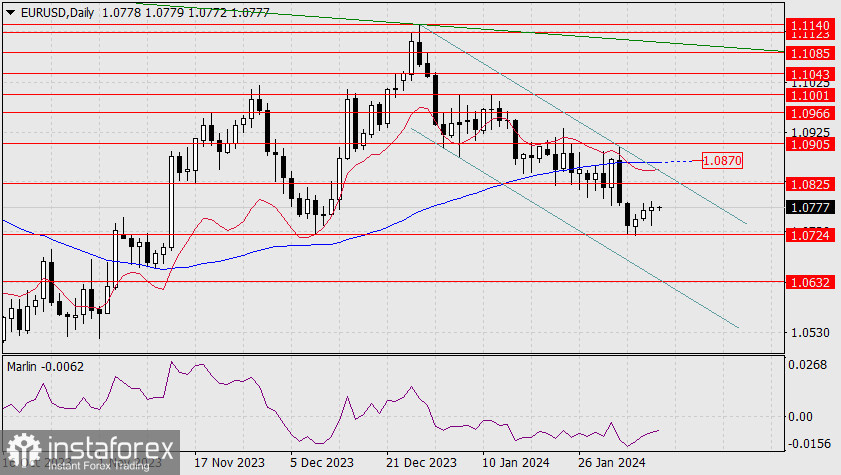

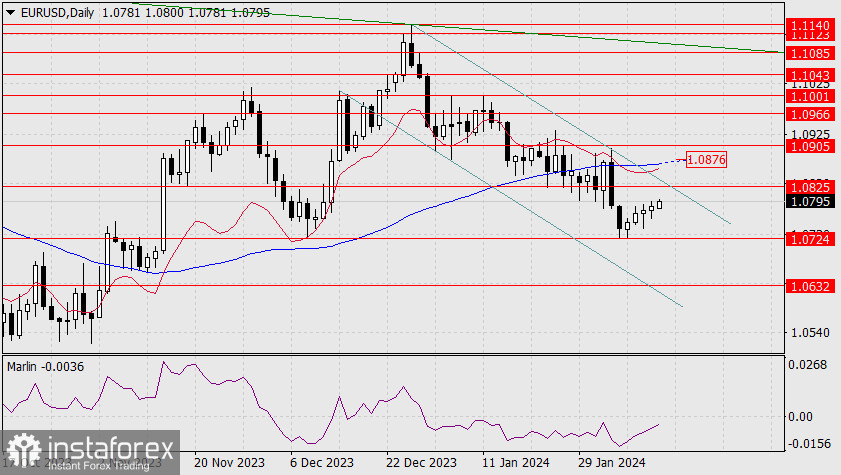

Yesterday, the euro, which was losing momentum, received support from the stock market, which gained 1.25% (S&P 500) and lifted the euro by 54 pips. On the daily chart, the price broke out of the descending wedge and is attempting to settle above the MACD line. The Marlin oscillator is also ready to rise; soon, it will move into the growth territory.

Today, the market expects the U.S. employment data to show minor weakness. In the non-farm sector for January, 187,000 new jobs are forecasted compared to 216,000 in December, and an increase in the unemployment rate from 3.7% to 3.8%. However, the stock market, along with other instruments, often developed a risk-on sentiment against labor data, for instance, on November 3rd, when non-farm payrolls for October were 150,000 against an expectation of 180,000.

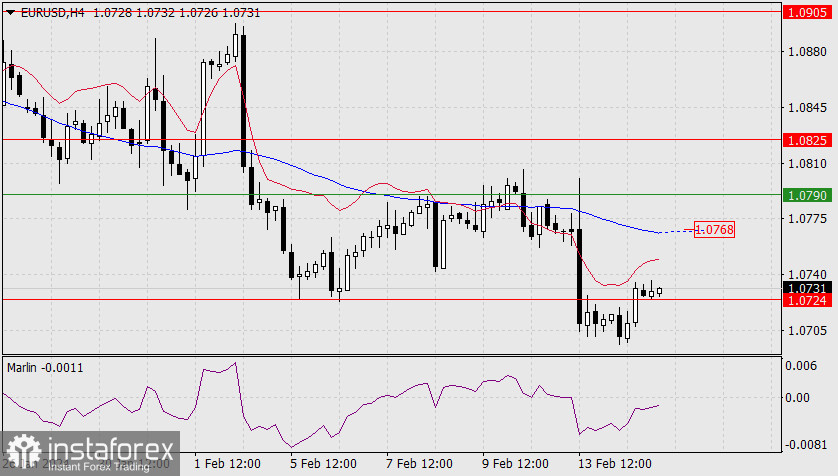

On the 4-hour chart, the price has already settled into the uptrend territory – it is currently moving above both indicator lines, and Marlin has been stable in the bullish territory. We expect the euro to rise towards the target levels of 1.0966, 1.1001 (the peak of January 11th), and 1.1043, while keeping a close eye on the stock market.

Analysis are provided by InstaForex.