The Fed's minutes turned out to be somewhat unexpected

Wednesday was a relatively quiet and calm day for the US currency. In the evening, the FOMC minutes were published, and this document, which usually only contains general information about the meeting, this time might have surprised the markets a bit. A month before the Federal Reserve's June meeting, the market was firmly convinced that the central bank would take a break for 1-2 meetings. After Fed Chair Jerome Powell spoke in the U.S. Congress and openly stated the possibility of two rate hikes in 2023, the chances of a rate hike in June increased. But it didn't increase for long or by much. A week later it dropped back down to 20% and remained there until the very meeting.

Therefore, there was no doubt that the rate decision was made long before the actual meeting, but, as it turned out last night, some FOMC members supported a new increase but simply found themselves in the minority. In my opinion, this is quite unexpected, as Powell in recent weeks instilled confidence in the existence of a unanimous opinion in the monetary committee. However, in any case, the document had a more hawkish stance, which could support the US currency. Since the demand for the greenback did not increase last night, and it sharply fell on Thursday morning, I conclude that the market did not find anything interesting for itself in the minutes, as often happens.

Also take note of the fact that the majority of FOMC members support two more rate hikes this year, which fully coincides with the market's expectations. However, the minutes also state that uncertainty regarding the future of the US economy and inflation is too high, so additional data (future reports) would not be superfluous in determining the rate at subsequent meetings. If inflation continues to decline at a high pace, the rate may only rise once.

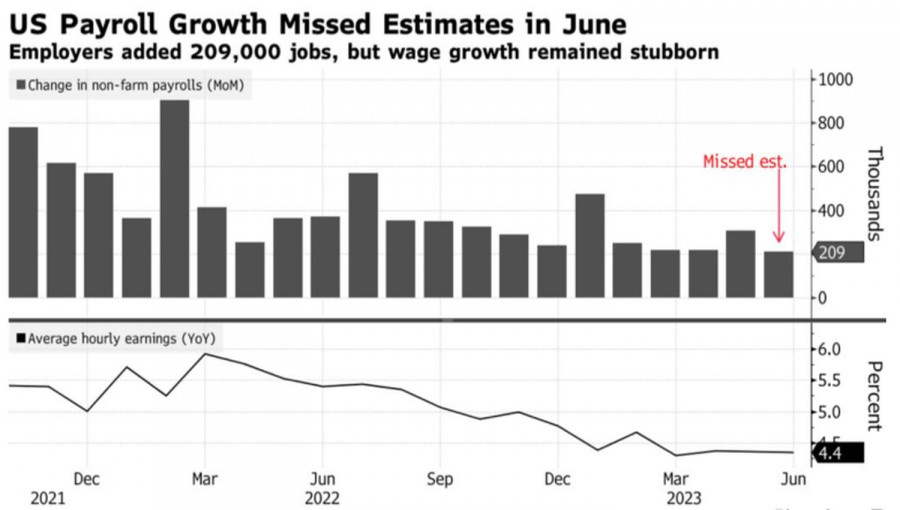

The market is left with only two reports this week – Nonfarm Payrolls and Unemployment. A report on wages will be released on Friday, but I think that the market will focus on the first two reports. Thursday's release showed that the labor market is still in excellent condition, but the data from the ADP and Nonfarm Payrolls reports often differ from each other, even though they reflect roughly the same thing. Personally, I believe Friday's release will not disappoint, but various scenarios are possible.

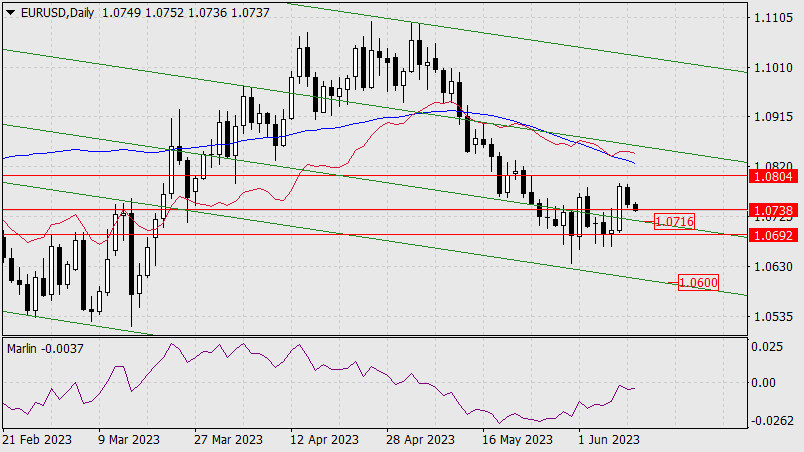

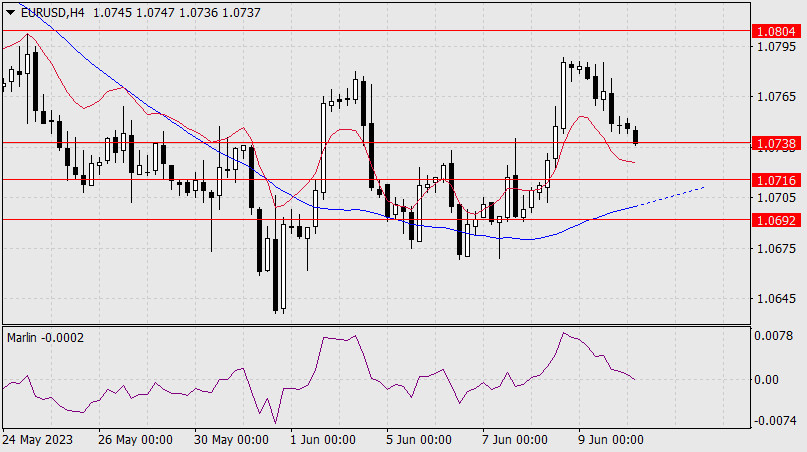

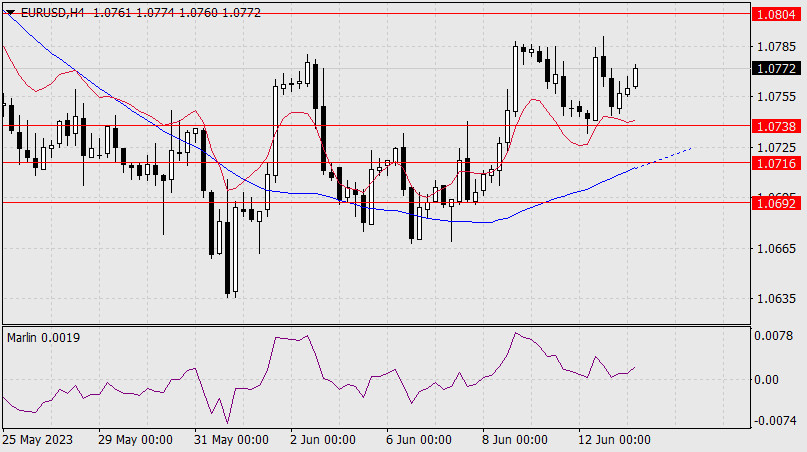

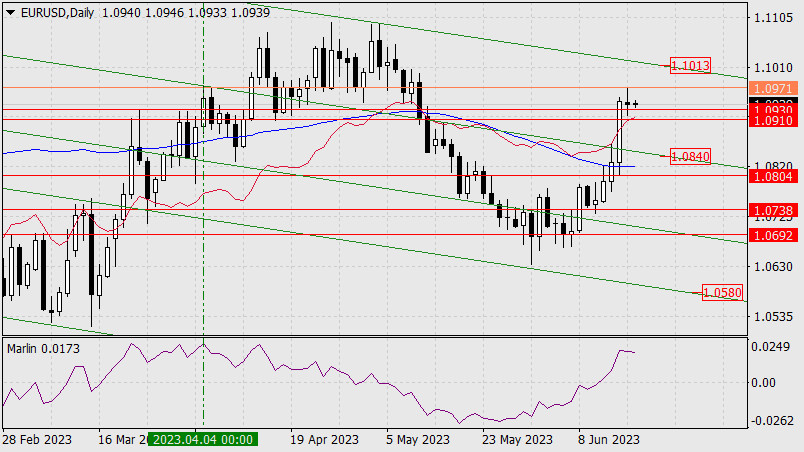

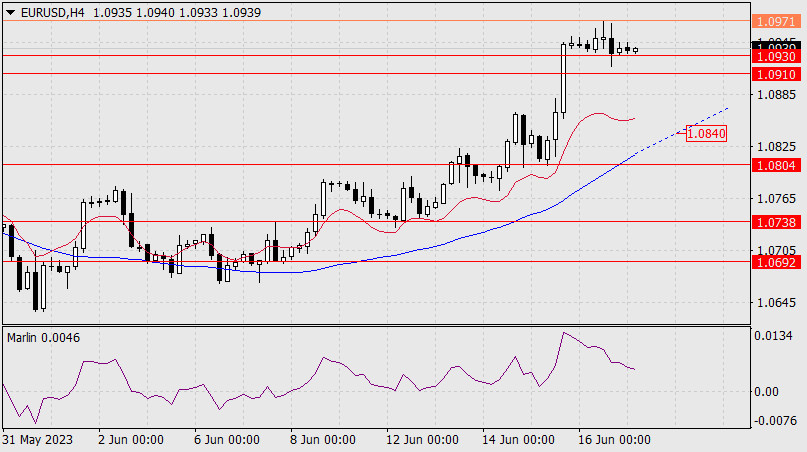

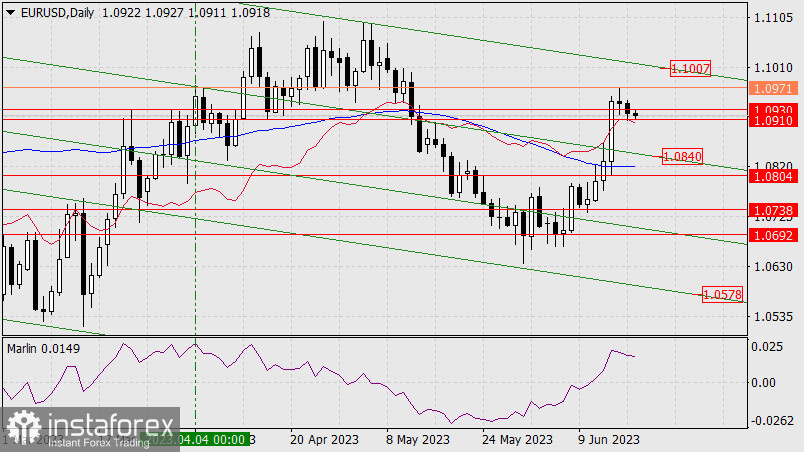

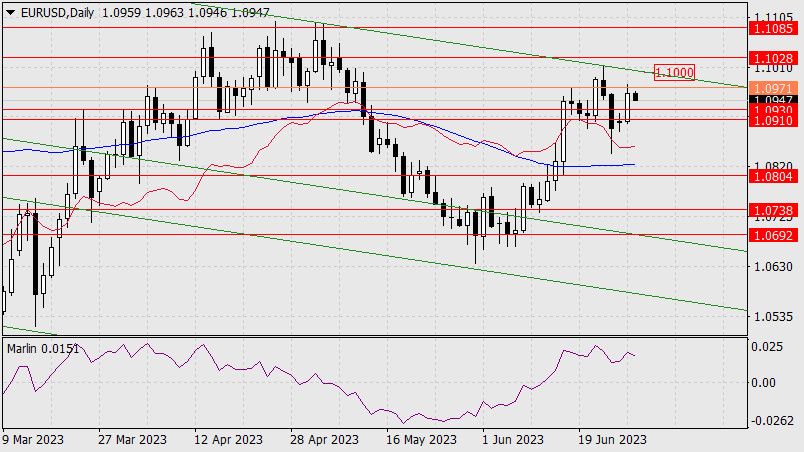

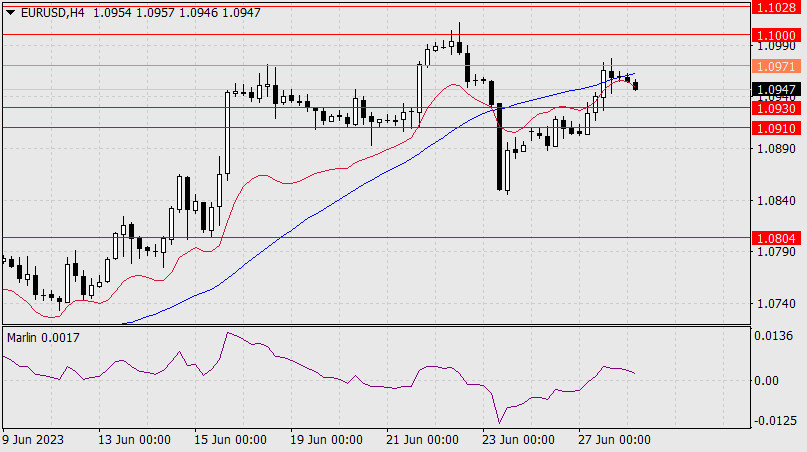

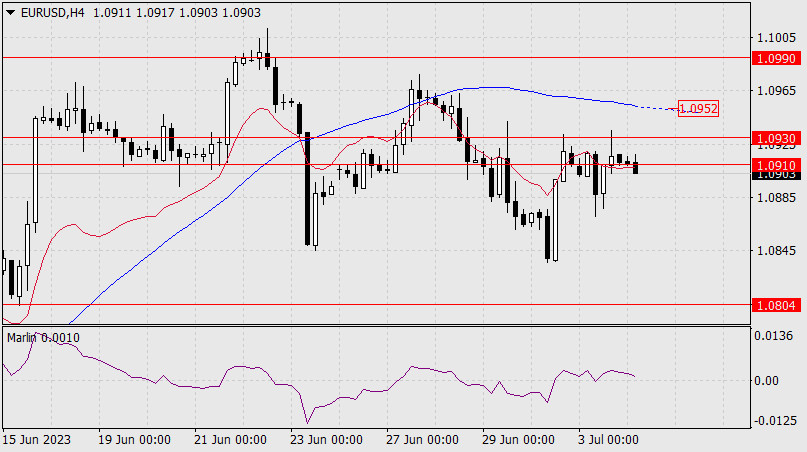

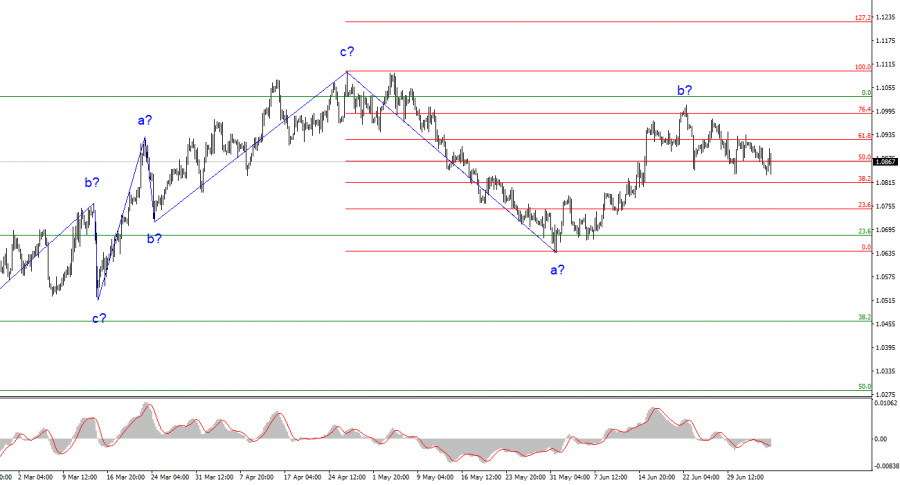

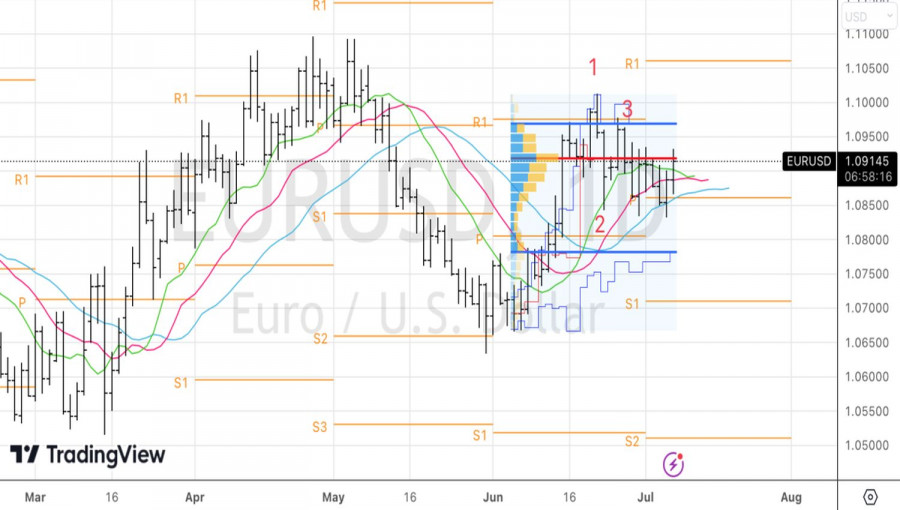

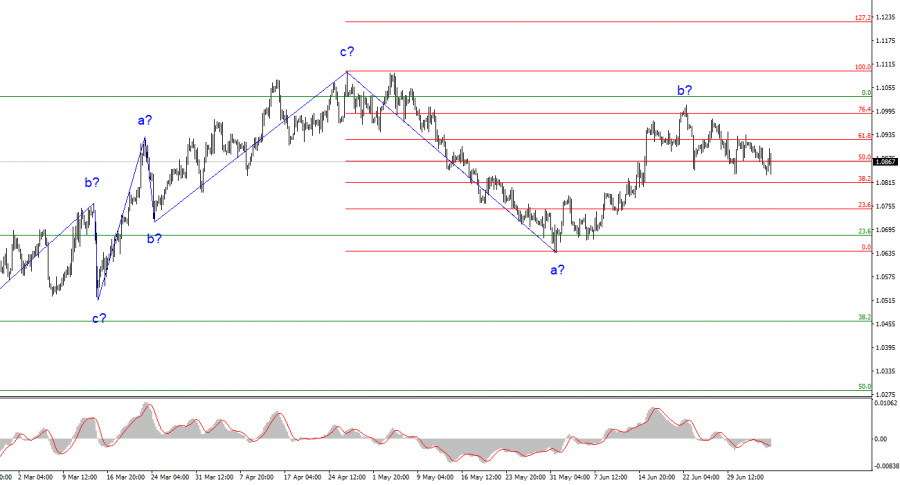

Based on the analysis conducted, I conclude that the downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument on "down" signals from the MACD indicator. The wave b is apparently over. According to the alternative layout, the ascending wave will be longer and more complicated, this will be the main scenario in case of a successful attempt to break through the current peak of the wave b.

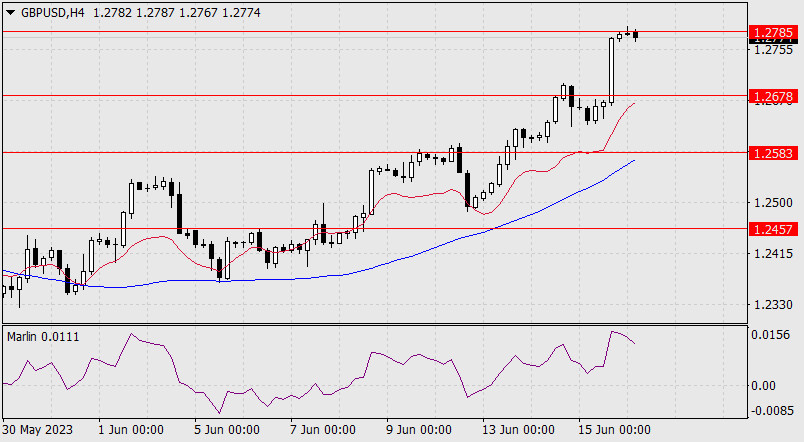

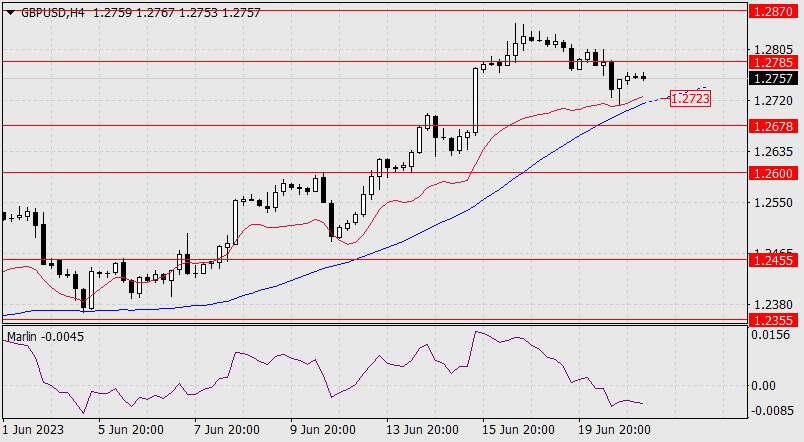

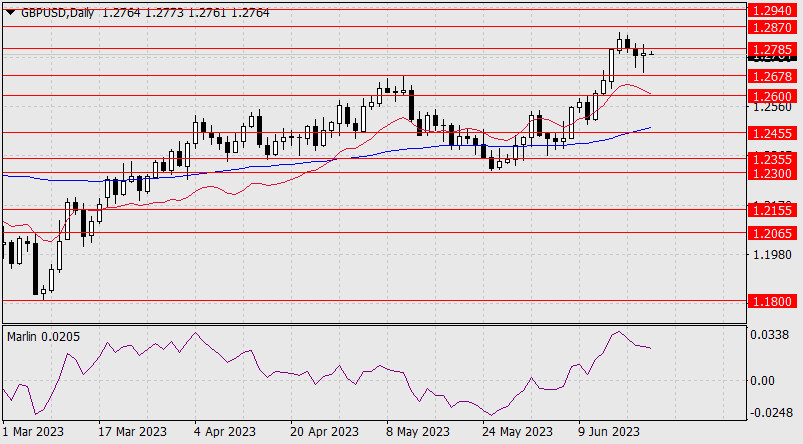

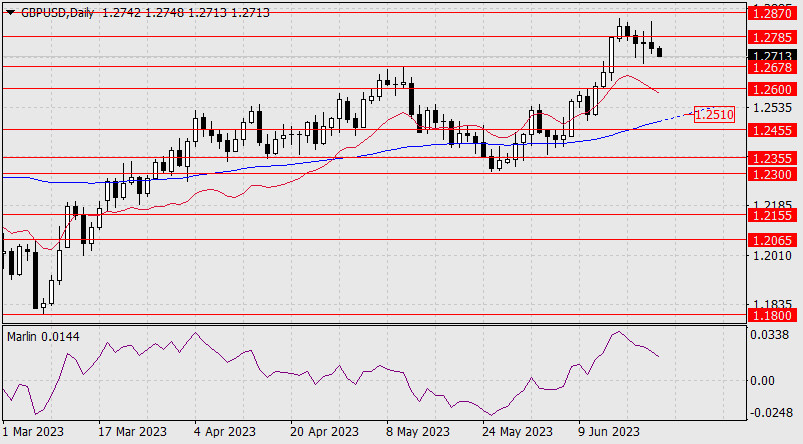

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward set of waves. Earlier, I advised buying the instrument in case of a failed attempt to break through the 1.2615 mark, which is equivalent to 127.2% Fibonacci. Wave 3 or c may take a more extended form, or wave e in a wedge will be constructed, and the instrument will return to the 1.2842 mark. Selling looks more promising and I advised it two weeks ago with a Stop Loss above 1.2842, but the signal from 1.2615 temporarily canceled that scenario. We need new signals for short positions.

Analysis are provided by InstaForex.

Read More