Re: InstaForex Analysis

Forex Analysis & Reviews: GBP/USD. Overview for May 3. Market sentiment is changing to "bearish"

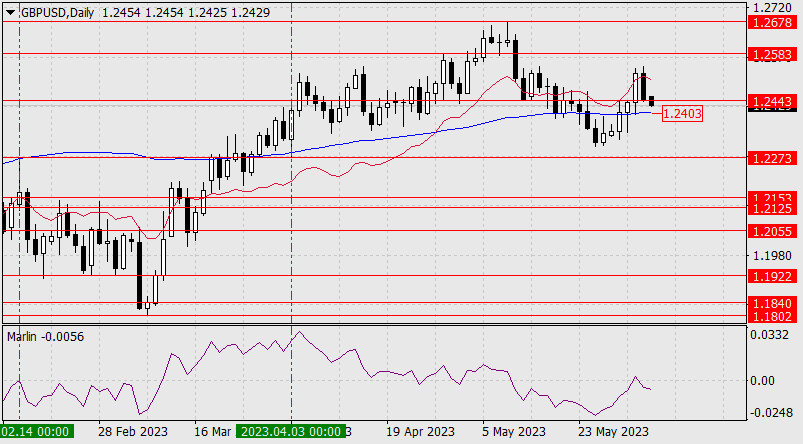

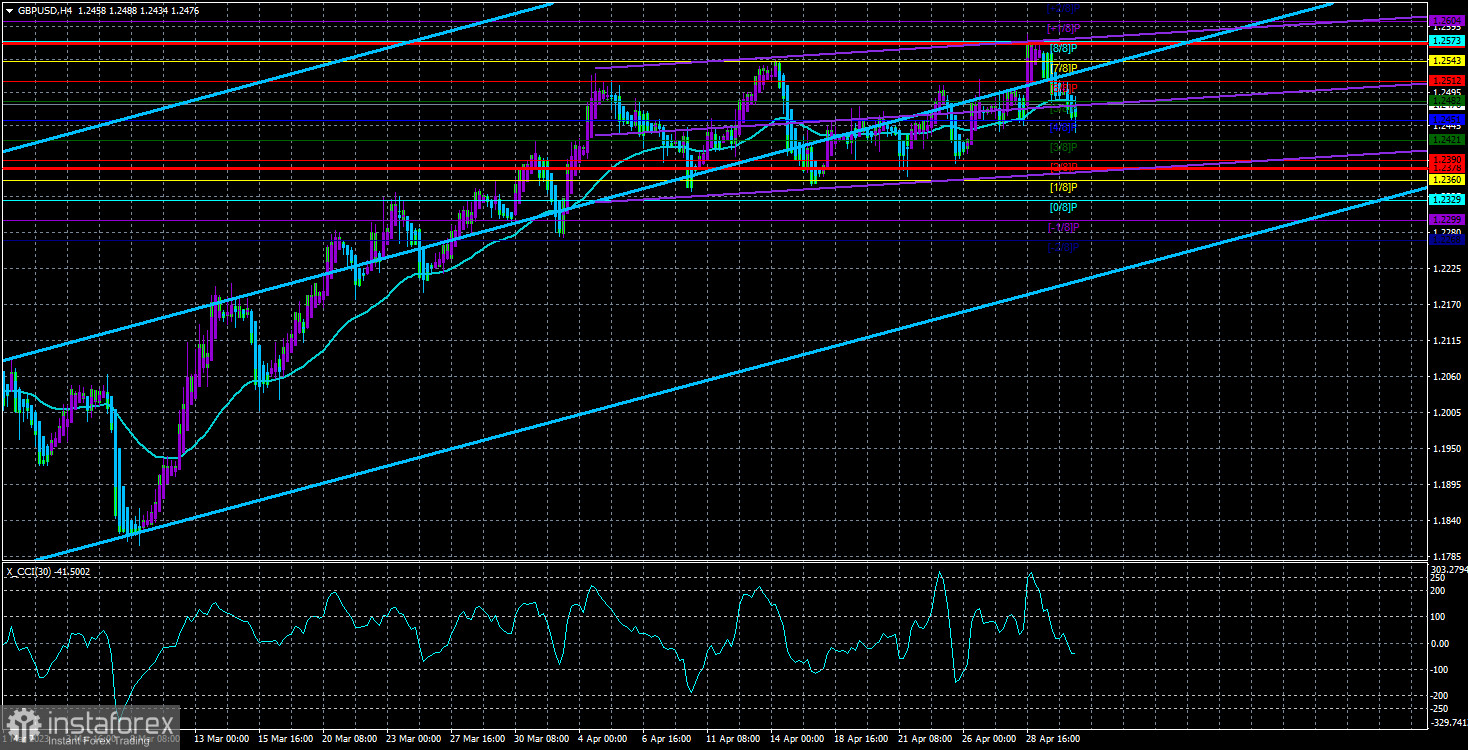

The GBP/USD currency pair continued its not-too-strong decline for most of the day on Tuesday. All the week's most important events are still ahead, so the market is in no hurry to rush into opening trading deals. Moreover, the ECB and FRS decisions, likely to be announced on Wednesday and Thursday, have already been factored into the market. This means we may see sharp spikes in activity these days without significant changes in currency pair rates. In the case of the British pound, there has been uncorrected growth for two months. Uncorrected, not unstoppable, as the upward trend has weakened in recent weeks. The pound moved up with its last strength. The pain of the bulls, who desperately wanted to maintain the upward trend and interpreted almost every report favoring the pound, was visible. Still, at the same time, they received an extremely small number of real factors supporting the British currency. In any case, the pound has grown by 700 points in 2 months, and almost everything shows that a strong correction should begin in the 4-hour timeframe.

On the 24-hour timeframe, it should also begin and be stronger than on the 4-hour. On the daily chart, about 2200 points were passed upward, implying a significant correction. Of course, making such conclusions on the eve of three central bank meetings is presumptuous, but if we see unprovoked growth in both pairs again at the end of this and next week, it will be too much. The market cannot be forbidden to trade in any direction, even if there are no reasons for it. But in this case, you can close your eyes to fundamental and macroeconomic analysis. What's the point if the market doesn't pay attention to it? The price has once again consolidated below the moving average line, which we have observed for the last two months at least seven times. No decline started after any of these overcomes. The CCI indicator has already entered the overbought area twice, which is a strong sell signal, so we continue to expect a powerful drop in the British pound.

The US labor market continues to shrink.

We would like to note one significant moment from yesterday, which may mean a change in market sentiment to "bearish." In the second half of the day, the JOLTs report on the number of job openings in the US labor market was released, which again turned out to be worse than the forecast value - 9.59 million against 9.775 million. The number of job openings has been falling for three months, which means a deterioration in the atmosphere of the labor market. We may see weaker reports on nonfarm payrolls and unemployment on Friday than currently expected. But that's not important. The US dollar practically did not fall immediately after the publication of this report. Earlier, traders would have had enough for the American currency to lose 60–80 points. On Tuesday, it lost 50 but quickly tried to return to its original path - to the south.

This moment indicates that the market is refusing further purchases, regardless of the decisions made by the FRS and ECB. Of course, this conclusion is quite risky, but simultaneously, the pair cannot constantly move in one direction. Sooner or later, a turning point must come. Why not a day before the FRS meeting and a week before the Bank of England meeting? After all, surprises are unlikely, and in the case of the BoE, we may see a refusal to tighten policy for the first time in a long time. We believe that the rate will be raised once again, as inflation is still above 10%, but at the same time, we believe that one or two more increases - and this cycle will be completed regardless of the current inflation rate. The pound, like the euro, is losing one of its main support factors, of which there have been few recently.

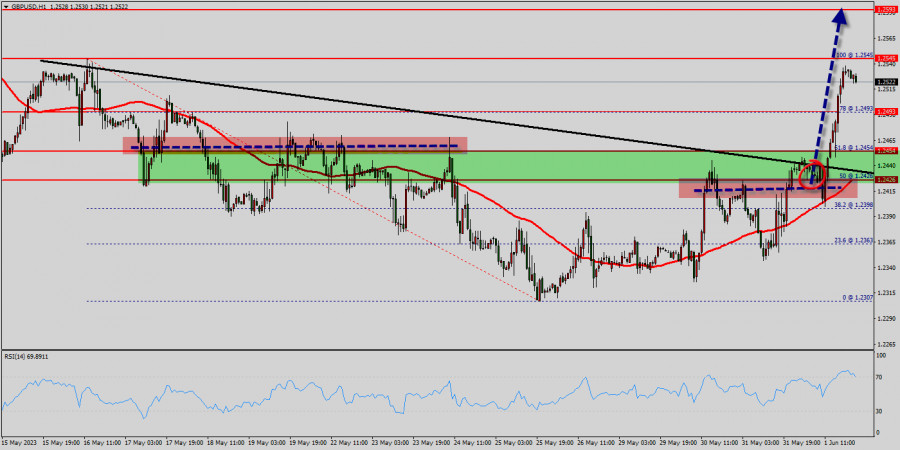

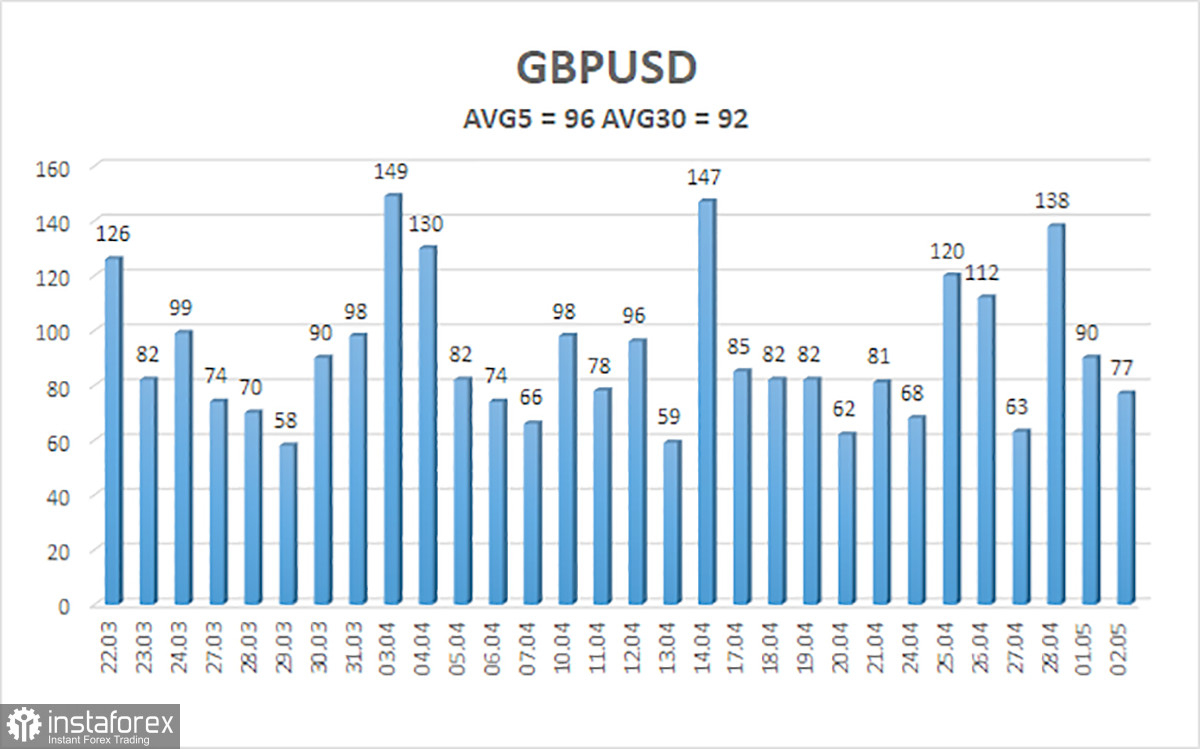

The average volatility of the GBP/USD pair over the last five trading days is 96 points. For the pound/dollar pair, this value is considered "average." On Wednesday, May 3, we thus expect the movement within the channel to be limited by levels 1.2378 and 1.2572. A reversal of the Heiken Ashi indicator upward will signal a new round of upward movement.

Nearest support levels:

S1 – 1.2451

S2 – 1.2421

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2482

R2 – 1.2512

R3 – 1.2543

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe has corrected to the moving average. Sideway movement may resume again, as in recent weeks, we often observe flat rather than a trend. Trading can be done again only by reversing the Heiken Ashi indicator or on younger timeframes. Explanations of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which it is now advisable to trade.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.

Analysis are provided by InstaForex.