Forex Analysis & Reviews: GBP/USD. Overview for December 26, 2022

In contrast to the EUR/USD pair, the GBP/USD currency pair is still in motion. Now that the pound is at least moving and not just standing still, we aren't talking about a volatile movement anymore. Although, based on Friday, there were no noteworthy movements, the pound/dollar pair may also experience a flat in the upcoming months. In essence, there were the same reports from the United States on Friday regarding the pound and the euro. And as we can see, they had no impact on the pair's movement. Given that the reports were so brief, this does not surprise us. The month's major events are all over, and now that the holidays have started, there is no doubt that traders are less motivated to engage in active trading.

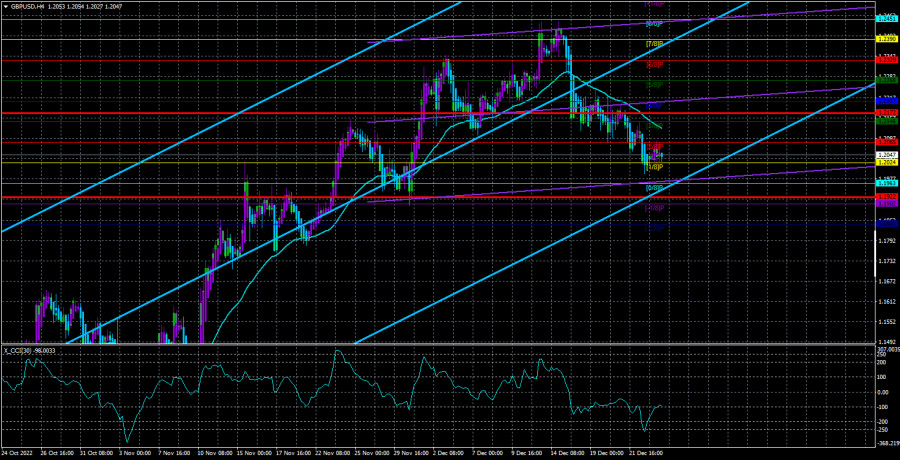

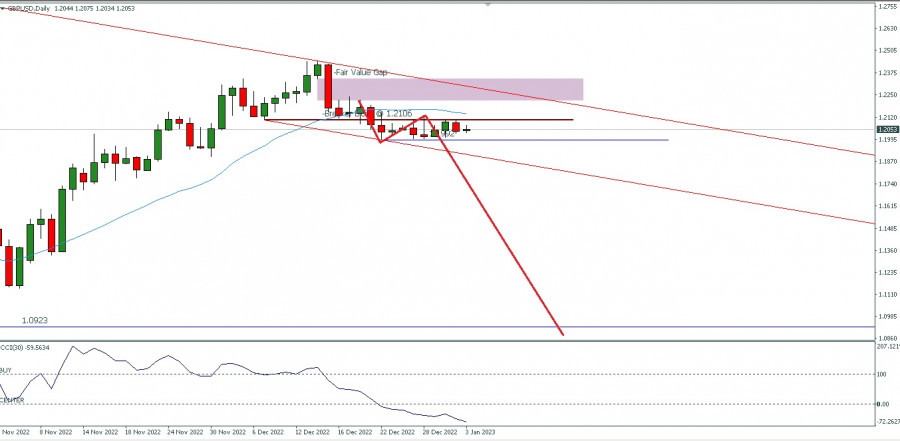

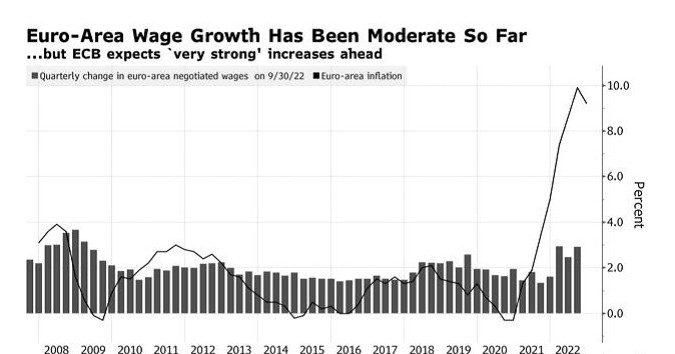

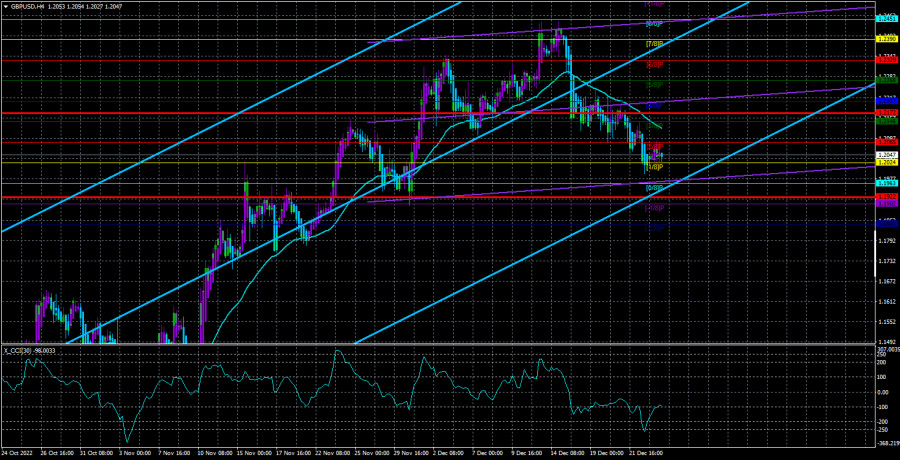

Technically speaking, the price is still below the moving average, and the downward movement is still present. Thus, everything in this situation makes sense. For the past three weeks, we have been anticipating a significant downward correction. It is not yet "strong," but at least it has something. Since the British economy may experience a severe recession and the Bank of England rate will not continue to rise at its current rate indefinitely, we think the pound should continue to decline against the US dollar. However, inflation is still out of control, and we have serious doubts that it will start to slow down soon at a rate comparable to that in the United States. This compels the Bank of England to keep tightening monetary policy, on the one hand. On the other hand, the third quarter saw a decline in the economy, and officials have predicted a two-year recession. Tightening monetary policy inevitably means making the recession worse. As a result, we don't think the British regulator will keep raising the rate by 0.50% every time they meet.

The period of consolidation might start soon.

The absence of trend movement in the overall plan is what we refer to as the consolidation period. Recall that the pair's growth over the past few months, which is a correction in and of itself, followed an approximately two-year downward trend. As a result, the correction against the correction has already started. After that, the pair may enter a long-term "swing" on the senior TF, which would indicate the absence of any new significant factors like a global tightening or loosening of monetary policy or changes in geopolitics. We won't be surprised if 2023 also has surprises because of the trend of recent years (the situation is getting worse and worse every year). The "coronavirus" is raging in China, and it is dispersing at a completely abnormal rate, according to the most recent information. One of the messages mentioned a day-long infection of 37 million people. As a result, COVID still terrorizes humanity and has not disappeared. The world will once more experience economic issues if it spills out of the Celestial Empire. Lockdowns, quarantines, and widespread infections can all begin anew. Then there are the central bank incentive plans and a new rise in inflation. Overall, it is still very early to resolve this problem.

We are also certain that there will be geopolitical news. Many military experts believe that the coming year will be crucial in the military conflict in Ukraine. We cannot define what "decisive" means, but we can only state that neither side in this conflict intends to engage in peace talks. Therefore, in our opinion, it will only get worse and continue. Additionally, the euro and the pound are risky currencies that will happily decline if the global situation deteriorates. It still hasn't even calmed down.

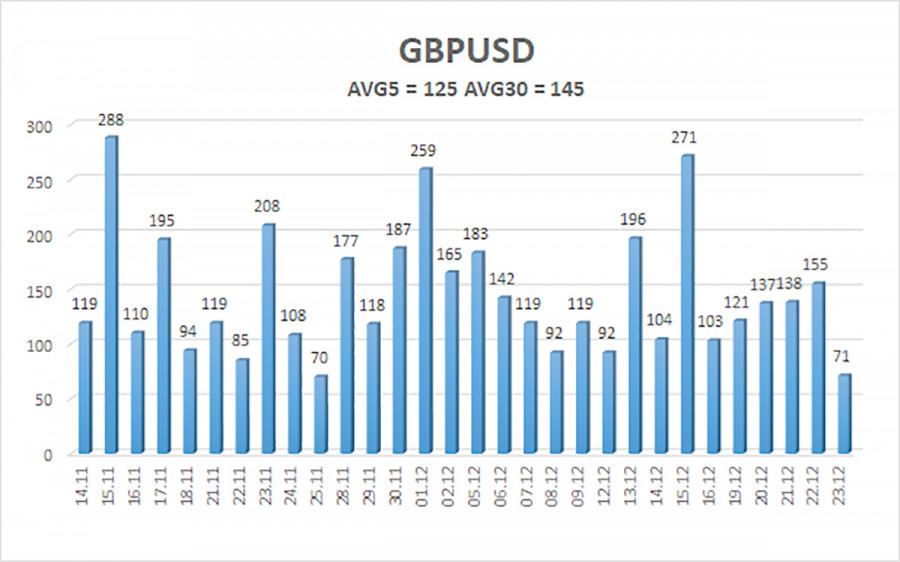

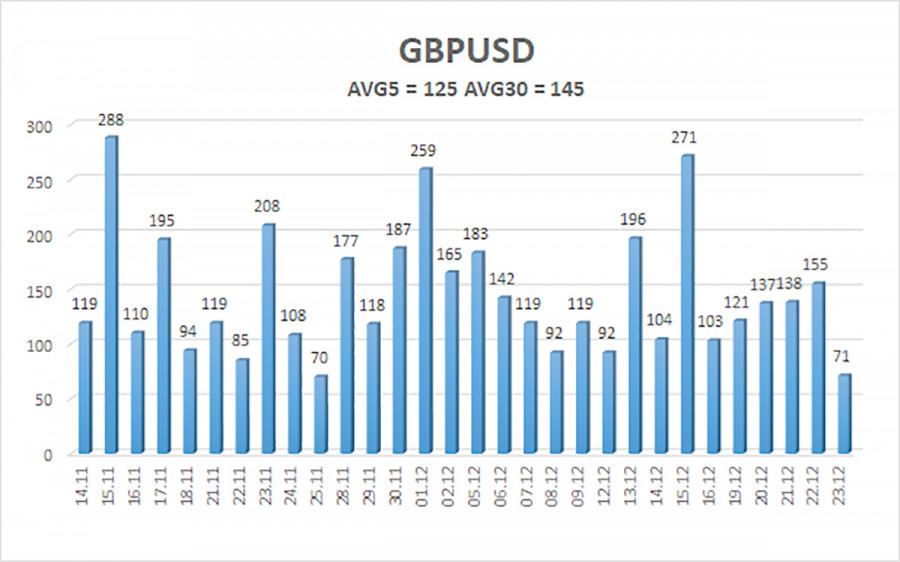

Over the previous five trading days, the GBP/USD pair has averaged 131 points of volatility. This value is "high" for the dollar/pound exchange rate. As a result, on Friday, December 23, we anticipate channel movement that is constrained by levels of 1.1899 and 1.2161. A round of upward correction will begin if the Heiken Ashi indicator reverses direction upward.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair is still trending downward. Therefore, until the Heiken Ashi indicator appears, you should maintain sell orders with targets of 1.1963 and 1.1899. When the moving average is fixed above, buy orders should be placed with targets of 1.2207 and 1.2268.

Illustration explanations:

Linear regression channels are used to identify the current trend. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

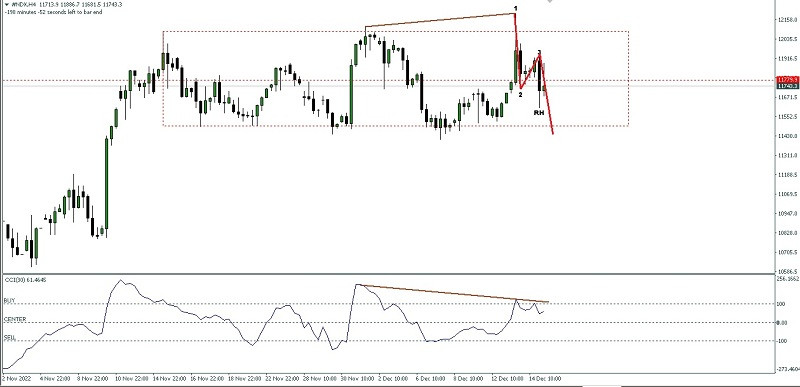

A trend reversal in the opposite direction is imminent when the CCI indicator

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More