Forex Analysis & Reviews: Hot forecast for EUR/USD on November 22, 2023

Market trends do not unfold continuously as periodic pullbacks could happen. That is exactly what happened yesterday, despite the extremely weak data on existing home sales in the US, which fell by 4.1%, and has been decreasing for five consecutive months, with a total reduction of 11.9%.

At the beginning of the year, US home sales declined by 6.0%, but in February, it improved slightly, showing a 13.8% increase. Even so, the cumulative decrease is quite significant, naturally not inspiring any optimism. This should have resulted in dollar weakening, but pound fell instead.

The Fed's hawkish stance on monetary policy could not be the reason as the meeting took place before the sharp slowdown in inflation became known. Most likely, the movement is a technical rebound, which means that dollar will show its expected decline soon, especially since today, data on durable goods orders will be published. The figure is expected to fall by 2.8%. The potential 5,000 increase in jobless claims may also spark further dollar weakening.

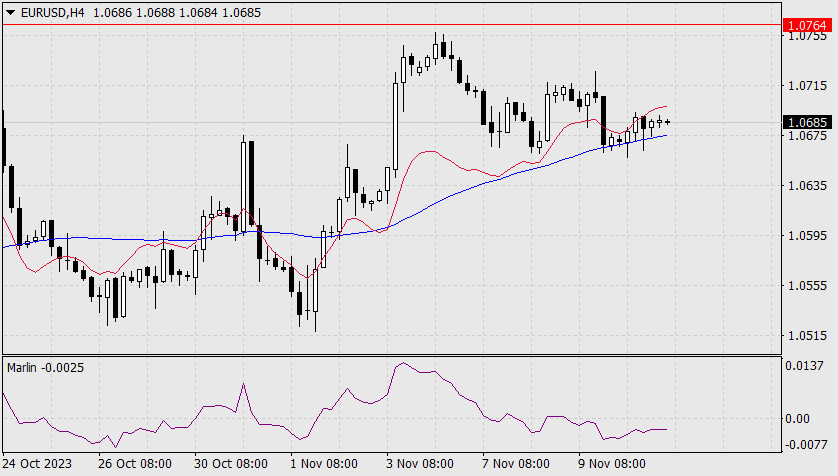

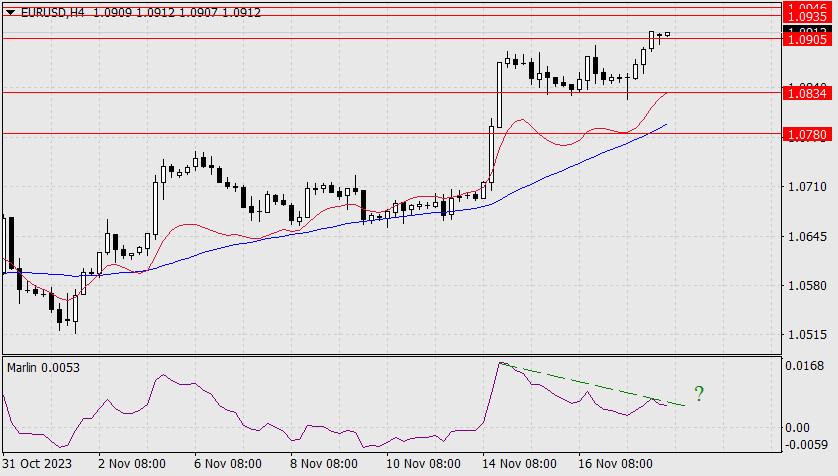

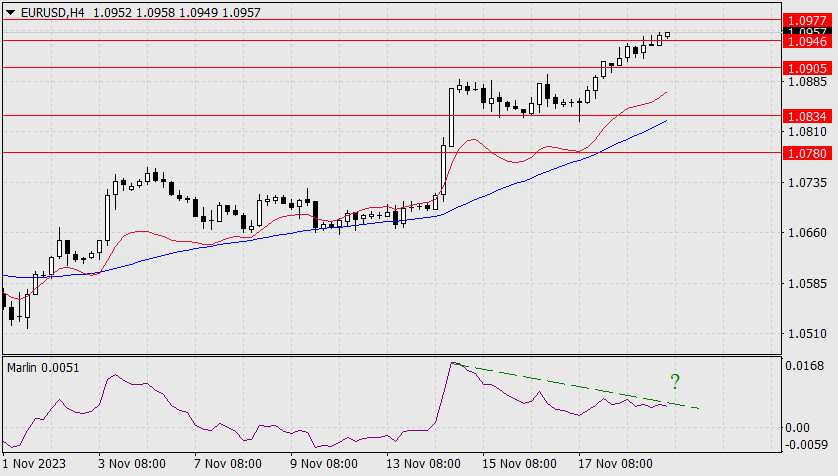

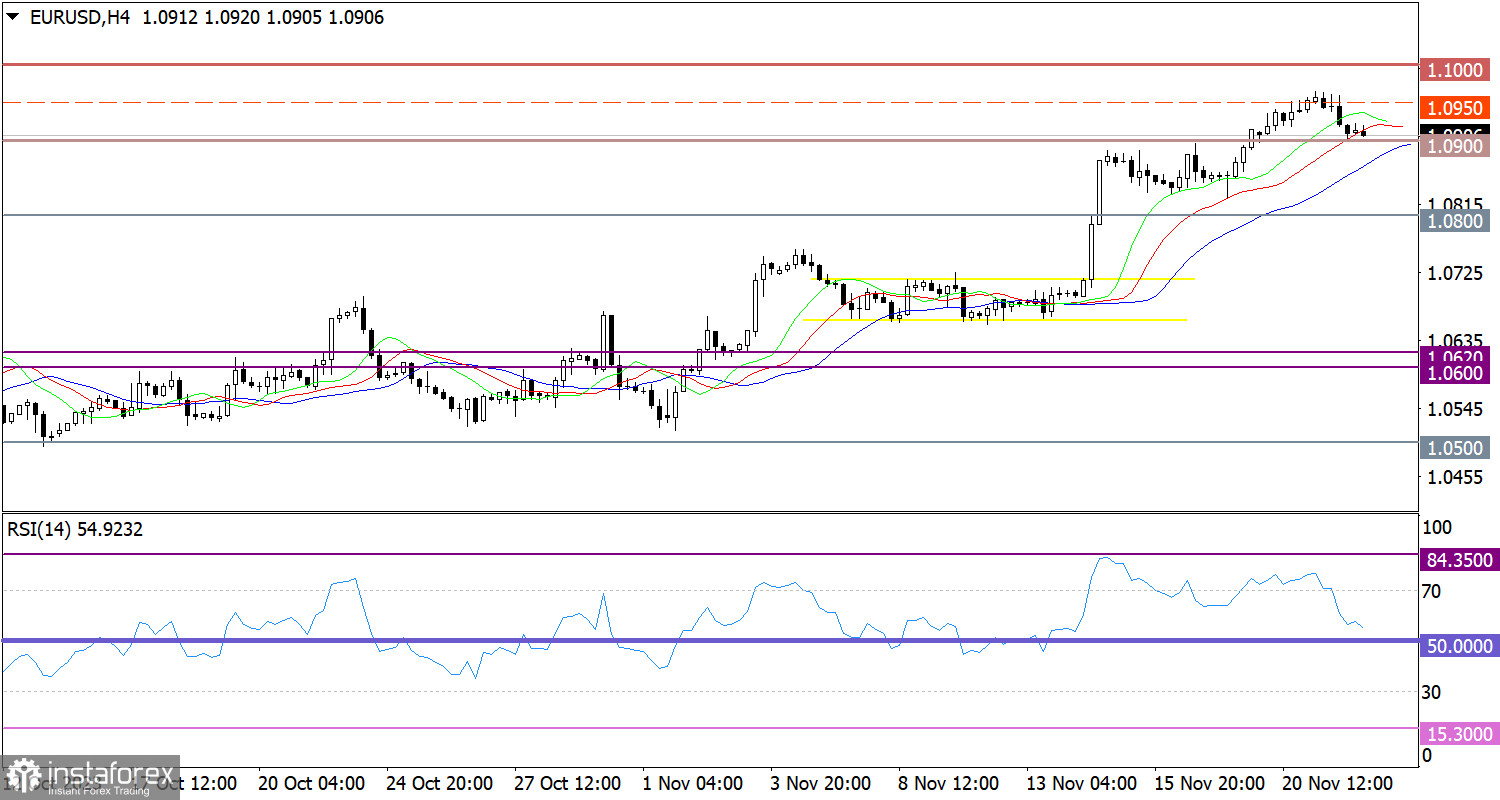

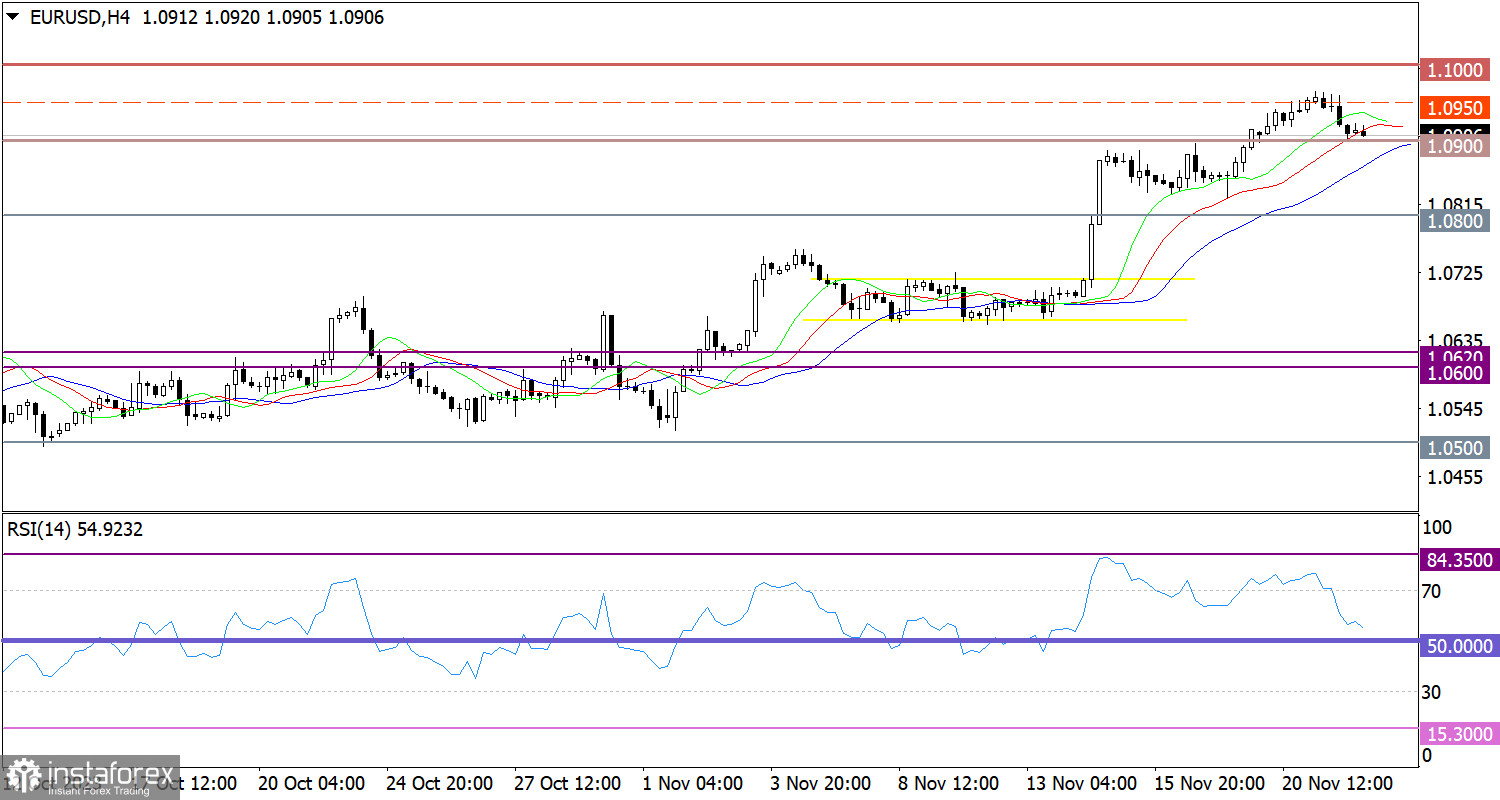

EUR/USD hit the lower range of the psychological level of 1.0950/1.1000, resulting in a decrease in the volume of long positions. This led to a pullback, which may also be due to the overbought condition of euro.

Looking at the RSI H4, there is an exit from the overbought area due to the pullback.

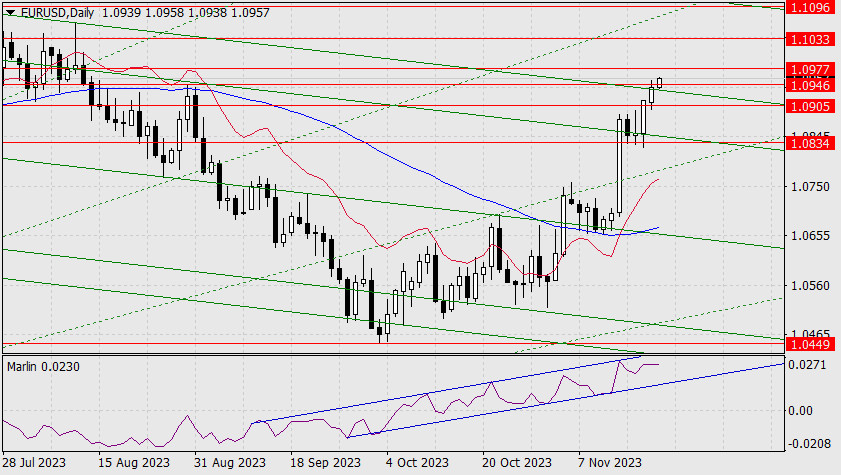

In the daily period, the indicator is moving near the 70 zone.

As for the Alligator H4 indicator, it ignored the pullback, with the moving MA lines pointing upwards.

Outlook

For further decline, traders need to keep the price below 1.0900, as that will spark a complete correction. Alternatively, there could be a decrease in the volume of short positions around the level of 1.0900, treating it as support. In this scenario, there will be another attempt to break the psychological level of 1.1000.

The complex indicator analysis points to an upward cycle in the short-term, medium-term and intraday periods.

Analysis are provided byInstaForex.

Read More