Forex Analysis & Reviews: EUR/USD. Why is the dollar appreciating?

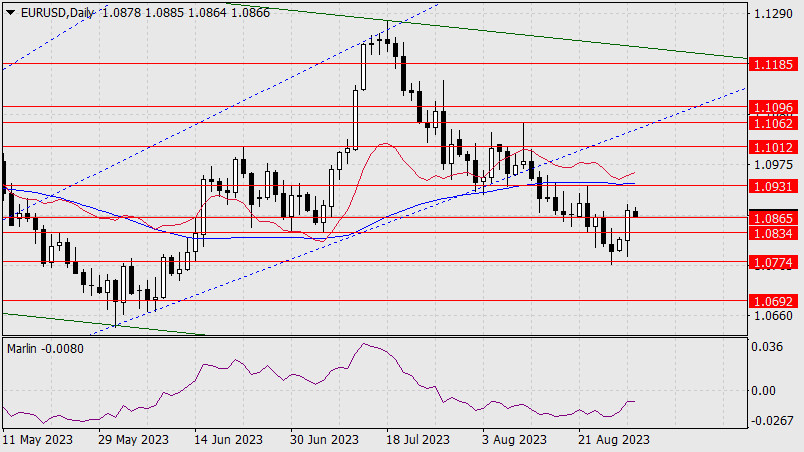

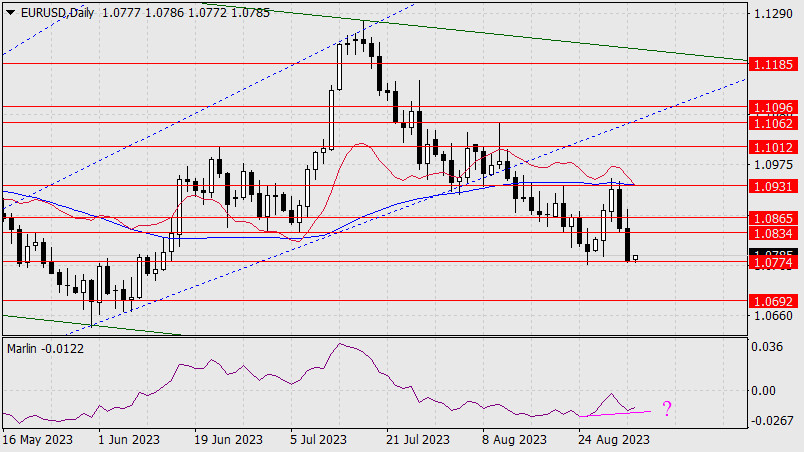

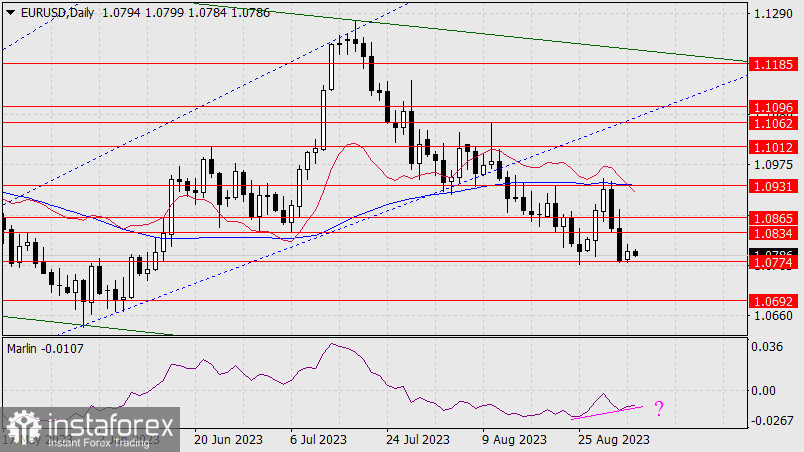

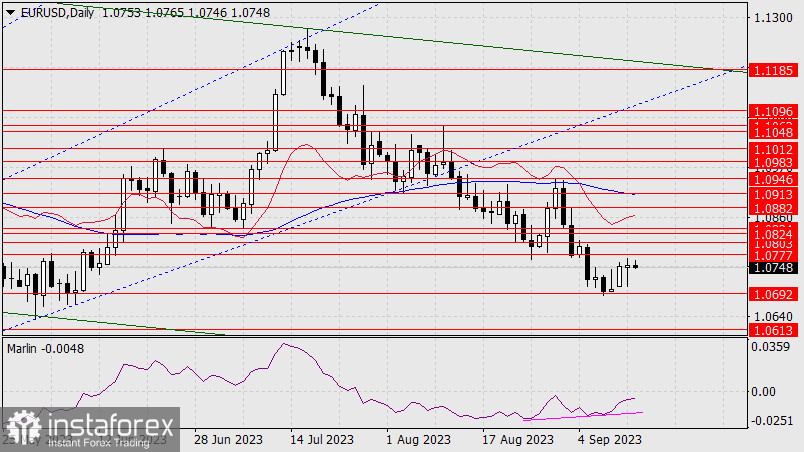

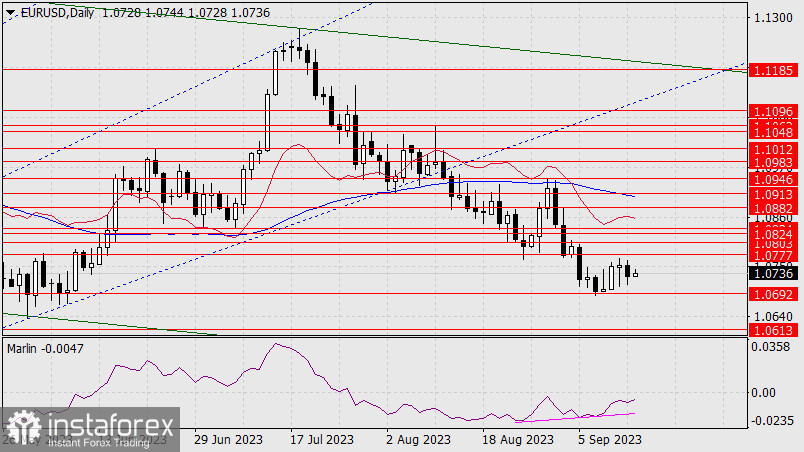

The US Dollar Index rose to a near six-month high on Tuesday. Currency pairs of the "major" group changed their configuration accordingly. In particular, the EUR/USD pair plummeted to the 1.0717 level, dropping to its lowest point in nearly three months. Moving forward, traders should be cautious about the current price dynamics. Short positions appear risky despite the swift and sharp decline in price.

Overall, Tuesday's "downward breakout" is solely due to the dollar's strength. At first glance, the greenback has strengthened without any apparent reason, given the nearly empty economic calendar. The primary reason for this has a deeper, more global nature: the dollar is trading higher amid a risk off mood. The US economy is showing signs of resilience, while there are signs that China and Europe are slowing, disappointing investors with declines in key macroeconomic indicators.

The US dollar received support from Chinese fundamental data. Notably, the decline of the Caixin Services PMI reading to 51.8 in August from 51.9 in July, missing market forecasts of an increase to 53.4 points. This is the lowest reading since January. This disappointing result has renewed concerns about the slowdown in the Chinese economy. In response to this report, the Shanghai Composite Index fell by nearly 1%, and the Hang Seng Index dropped by almost 2%.

This report should be considered in conjunction with other reports published in China over the past few weeks. For instance, China's manufacturing PMI rose to 49.7 in August from 49.3 in July. This reading has been below the 50-point mark for the fifth consecutive month. China's non-manufacturing activity index also fell short of the forecast, rising to 51.0 against expectations of 51.3. While it remains "above the waterline," the downtrend has persisted for six months.

At the end of August, The Wall Street Journal published an article on the prospects of China's economic growth. It was quite pessimistic: surveyed economists concluded that the economic model that took China to great-power status seems broken. Weak Chinese fundamental data in July and August (GDP data, trade figures, industrial indicators, PMIs) only illustrated the resounding material from WSJ.

Weak growth in other countries, primarily China and the EU, prompts market participants to acquire the US dollar. Furthermore, according to some experts, the resilient US economy, combined with high inflation (slow decreases in inflation figures), "guarantee" that the Federal Reserve's interest rate will remain high for a long time.

Recent US economic reports indicate that the American economy is feeling fairly confident, despite the extensive and rather aggressive tightening of the Fed's monetary policy. In particular, Goldman Sachs trimmed its prediction for the chance of a recession in the US to 15% from 20%. Therefore, discussions about rate cuts in early next year have essentially been put to rest. Moreover, markets are pricing in another round of rate hikes by the Fed by the end of this year (a 40% probability of a rate hike in November).

At the same time, European reports, for the most part, have been disappointing (PMIs, IFO indices), and representatives of the European Central Bank are expressing concerns about the pace of economic growth in the eurozone. The recently published minutes of the ECB's July meeting also reflected negative trends: ECB members agreed with the chief economist of the ECB that the near-term economic prospects of the eurozone had "deteriorated significantly." Such a news flow has sparked rumors that the central bank may need to start lowering interest rates in the first half of next year. Moreover, the probability of an ECB rate hike in September has decreased to around 30%. Underwhelming China macro data (the EU's largest trading partner) only adds fuel to the fire, simultaneously sparking a risk-off sentiment in the markets.

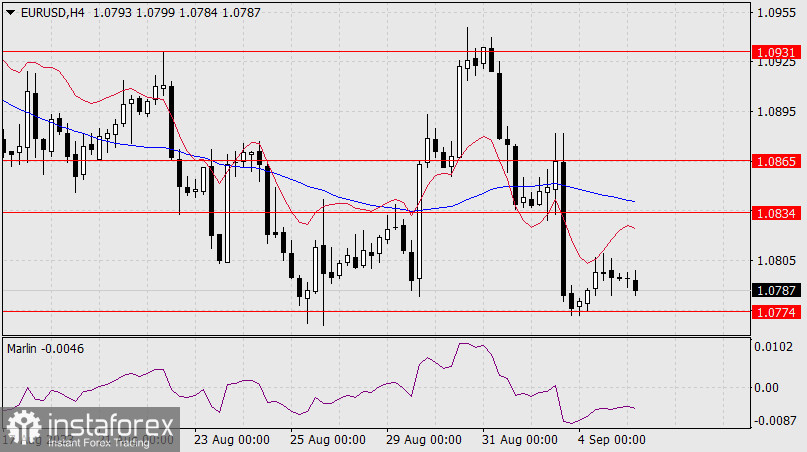

The dollar, in turn, is benefiting from this situation. On Tuesday, the euro slipped further amid risk-aversion, allowing bears to exit the 8-figure territory and establish a new price range between 1.0710 and 1.0800.

The oil market has also provided more (indirect) support to the greenback, as spike in oil prices reignited fears about US inflation accelerating. Brent crude futures rose above $90 per barrel (the first time since November 18, 2022) on news that Saudi Arabia and Russia are extending voluntary oil production cuts by a combined 1.3 million b/d.

Considering that the EUR/USD pair has approached the lower band of the aforementioned price range (1.0710 - the lower Bollinger Bands line on the daily chart), it's better to be cautious with short positions. In this case, it would be wise to either wait for a bullish correction (to enter short positions aiming for 1.0710) or a breakdown of the support level. In the latter case, the next target for the downward movement will be the 1.0640 level, which is the lower Bollinger Bands line on the weekly chart.

Analysis are provided by InstaForex.

Read More