Re: InstaForex Analysis

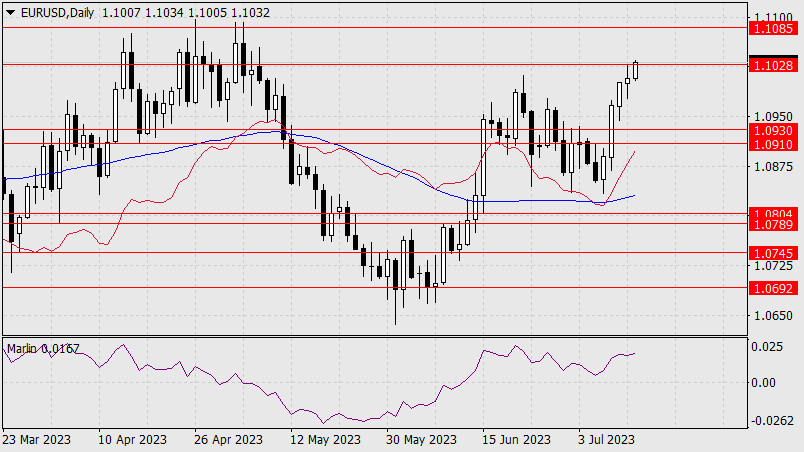

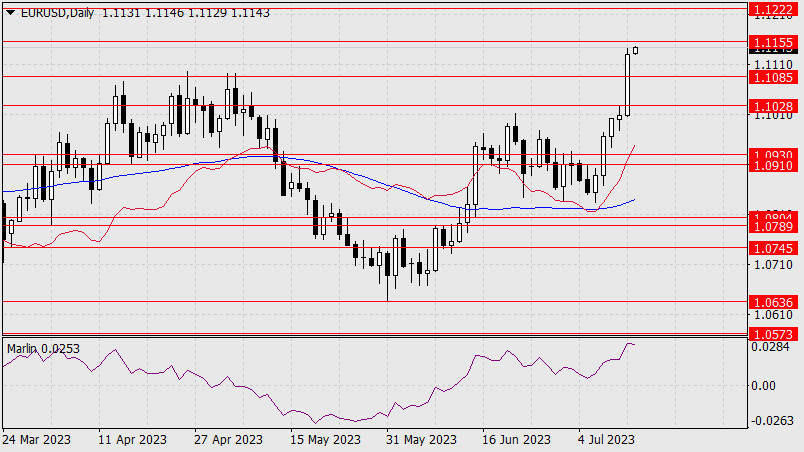

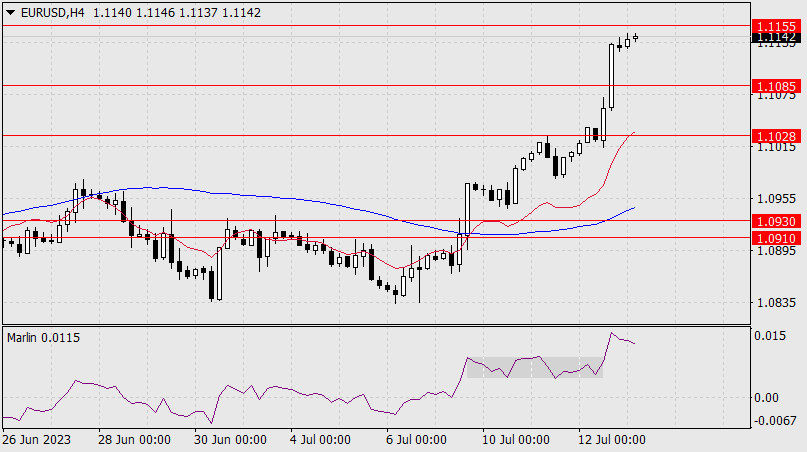

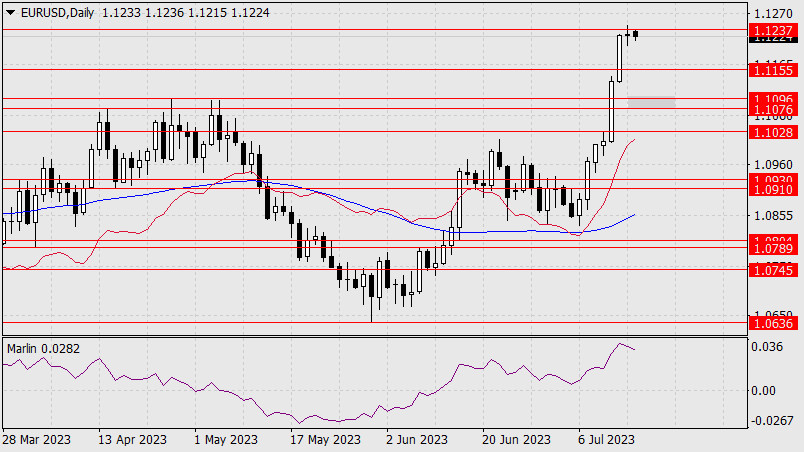

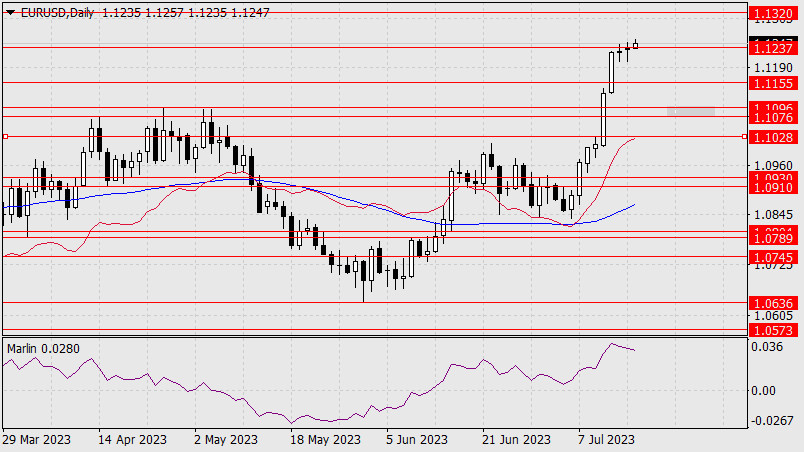

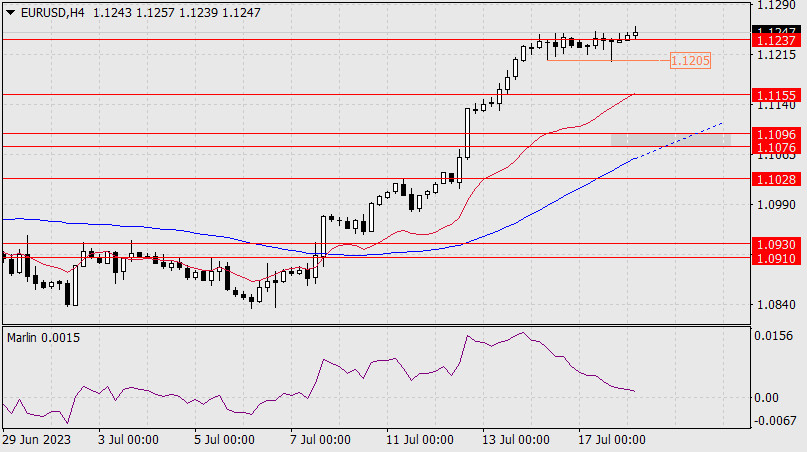

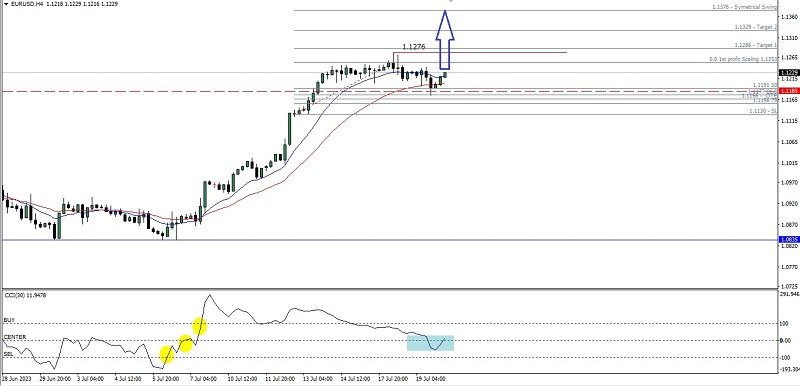

Technical Analysis of EUR/USD for July 11, 2023

Technical Market Outlook:

The EUR/USD pair has broken above the intraday technical resistance seen at the level of 1.0974 and made a new swing high at the level of 1.1023 (at the time of writing the analysis). The intraday technical support is seen at the level of 1.0974. Please notice, the momentum has hit the extremely overbought conditions again, so there is a confirmation of the bearish pressure on the lower time frame charts. In a case of a breakout lower, the next target for bears is seen at the level of 1.0901 and 1.0876. Only a sustained breakout below the moving average dynamic support around 1.0900 would change the outlook to more negative.

Weekly Pivot Points:

WR3 - 1.09927

WR2 - 1.09761

WR1 - 1.09665

Weekly Pivot - 1.09595

WS1 - 1.09499

WS2 - 1.09429

WS3 - 1.09263

Trading Outlook:

Since the beginning of October 2022 the EUR/USD is in the corrective cycle to the upside, but the main, long-term trend remains bearish. This corrective cycle might had been terminated at the level of 1.2080 which is 61% Fibonacci retracement level. The EUR had made a new multi-decade low at the level of 0.9538, so as long as the USD is being bought all across the board, the down trend will continue towards the new lows.