Re: InstaForex Analysis

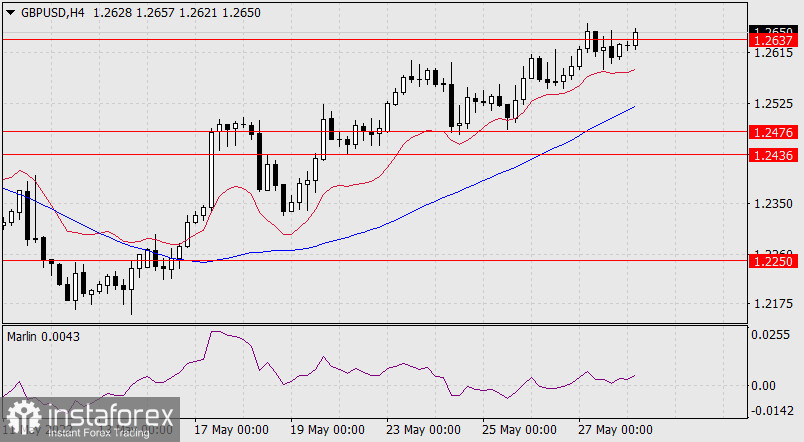

Forex Analysis & Reviews: Forecast for GBP/USD on May 13, 2022

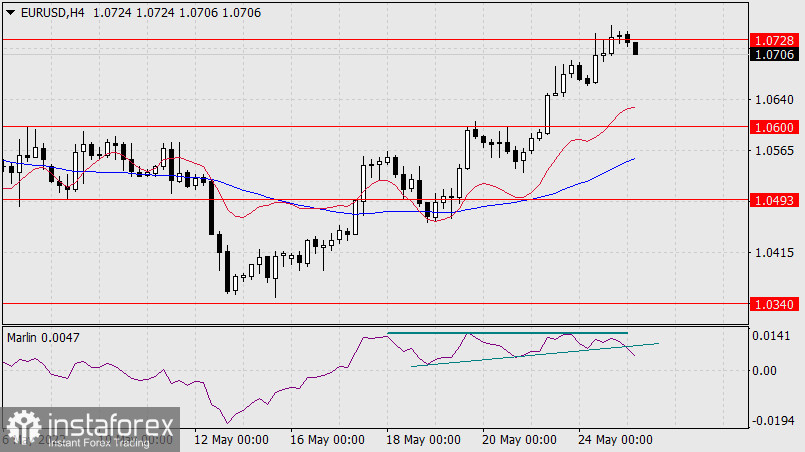

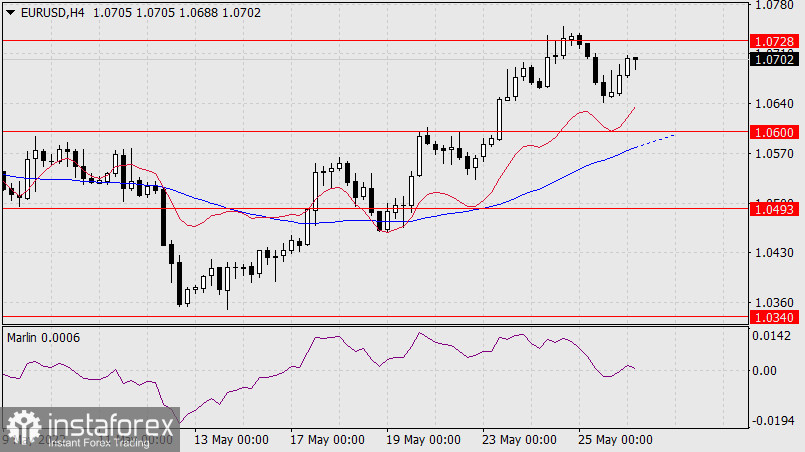

Yesterday the pound broke through the target level of 1.2250, now it is hardly moving towards the next support at 1.2073 (May 2020 low). The difficulty is created by the convergence with the Marlin Oscillator on the daily scale. However, the convergence is not pronounced, it can be easily broken and lose its already weak appearance.

There is also a slight divergence on the four-hour chart, the signal line of the Marlin Oscillator is consolidating in the range rather than trying to indicate the trend's potential. The most likely development in the current conditions is a gradual decline to the target level of 1.2073 under the MACD line, as it has been for the last week.