GBP/USD. Trumps of the pound and the dollar's hopeless prospects

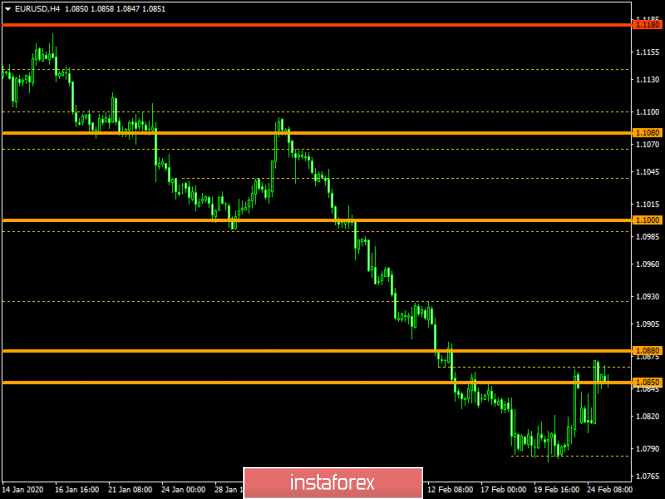

EUR/USD

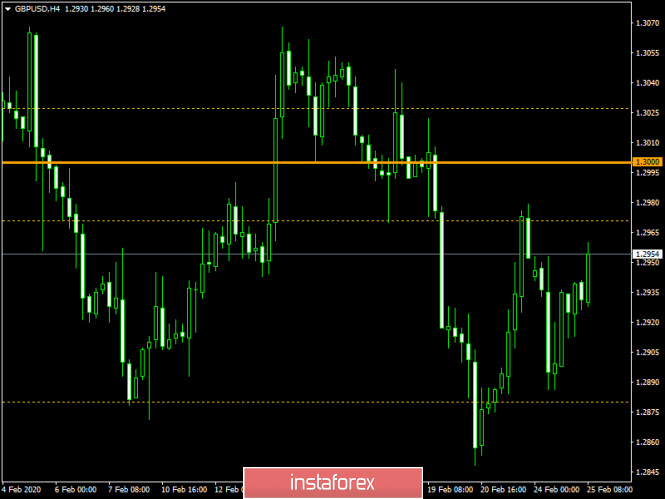

The pound ended the trading week on a major note: paired with the dollar, the pound was able to return to the area of the 30th figure, after falling to around 1.2725 at the end of February. Such dynamics is explained not only by the weakness of the US currency. The buyers of GBP/USD gave a rather positive assessment of the first results of the negotiation process between Brussels and London, although representatives of the parties announced serious disagreements that could not be overcome yet. Nevertheless, the negotiators also voiced encouraging theses - it was on them that the market focused its attention.

In particular, the head of the European delegation Michel Barnier expressed confidence that they will be able to negotiate with the UK, despite the "very, very serious disagreements." He noted that the parties initially had completely different positions on key issues, so these differences in views were not a surprise to anyone. Nevertheless, he was optimistic about the prospects for negotiations.

The market seized on this phrase, although it is actually unclear how the parties plan to find a common denominator. Barnier named four points on which there are serious differences. According to him, if no compromise is reached on these issues, an agreement is unlikely to be signed.

First, it is about maintaining European standards that would guarantee equal trading opportunities. At the moment, London does not want to oblige itself to comply with these standards, and most importantly, it is opposed to the creation of appropriate mechanisms that could monitor the situation and record "unjustified commercial advantages".

Secondly, the British refuse to recognize not only the jurisdiction of the European Court of Justice, but also the European Convention on Human Rights and the rules for the exchange of data. As Barnier noted, if the parties do not come to an understanding on this item, then further cooperation in this area will be "carried out in accordance with the norms of world law". Here you can also mention the contradictions in the field of law enforcement: we are talking about coordinated actions to combat terrorism, financial crime, organized crime and so on.

Another contradiction is more fundamental. We are talking about the legal basis for future relationships. Britain plans to enter into several agreements – in every area where this is necessary. Brussels insists on signing a single, comprehensive agreement. In addition, the UK does not want to agree to common terms for both sides in the deal.

And the last, fourth, disagreement is about fishing. London insists that fishing matters be discussed on a regular basis, that is, annually. On the contrary, Europeans want to include fishing in the structure of the general economic agreement. According to Barnier, the British position on the issue of fishing is "unacceptable".

As you can see, the positions of the parties are still at different poles, and the first round of negotiations was inconclusive. But the market nevertheless "trusted" Barnier's optimism, which expressed confidence that Brussels and London would still come to a common opinion on all key issues.

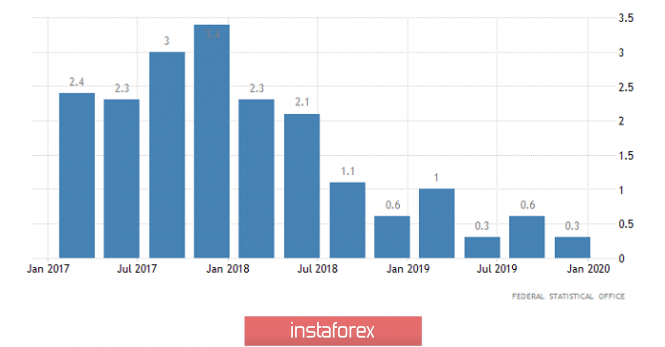

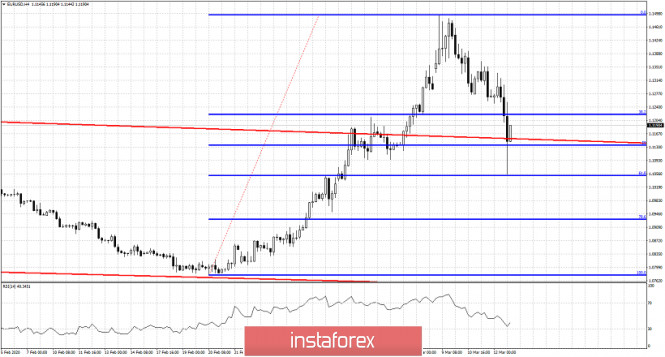

It is worth noting that last week, figuratively speaking, Brexit "did not prevent" the GBP/USD from growing, while the main driving force of the upward movement was the dollar, which swooped down on all fronts. Yesterday, the Federal Reserve Bank of New York significantly lowered its forecasts for US GDP growth in the first quarter of this year. While the previous estimate was at 2.15%, expectations have now dropped to 1.7%. Comments from Donald Trump's economic adviser, Larry Kudlow, also put pressure on greenback. According to him, certain sectors of the US economy will feel the "strong negative impact" of the epidemic, but it is "too early" to make decisions about supporting the economy with fiscal measures. At the same time, Trump himself is demanding that the Fed should hold another round of rate cuts.

In this case, we can talk about a certain de-correlation. For example, if the head of the Bank of England (Andrew Bailey) insists on applying fiscal responses, the White House is trying to offset the impending threat with monetary policy. And the Fed seems to agree with this scenario. At least, the latest comments from the Fed representatives (Bullard, Kaplan) indicate a willingness to further soften monetary policy. While representatives of the BoE and the ECB are increasingly reminded that they are limited in their actions – in particular, Bailey allowed a rate cut to 0.1%, but at the same time excluded the option of reducing to a negative area.

Thus, the pound is still in a winning position relative to the US currency. According to general market expectations, the Fed will lower the rate by another 25 basis points at the March meeting, and later, by another 25 basis points by the beginning of summer. In turn, the BoE can maintain a wait-and-see attitude on March 26, saving an arsenal of available actions for the future. Such a de-correlation provides support for GBP/USD, especially against the background of quite calm rhetoric of the Brexit negotiators. If this fundamental background for the dollar and the pound persists next week, the pair can test the next resistance level, which is located at 1.3105 - this is the lower boundary of the Kumo cloud on the daily chart.

Analysis are provided byInstaForex.