Re: Forex Technical Analysis & Forecast by RoboForex

Fibonacci Retracement Analysis 05.08.2021 (Brent, Dow Jones)

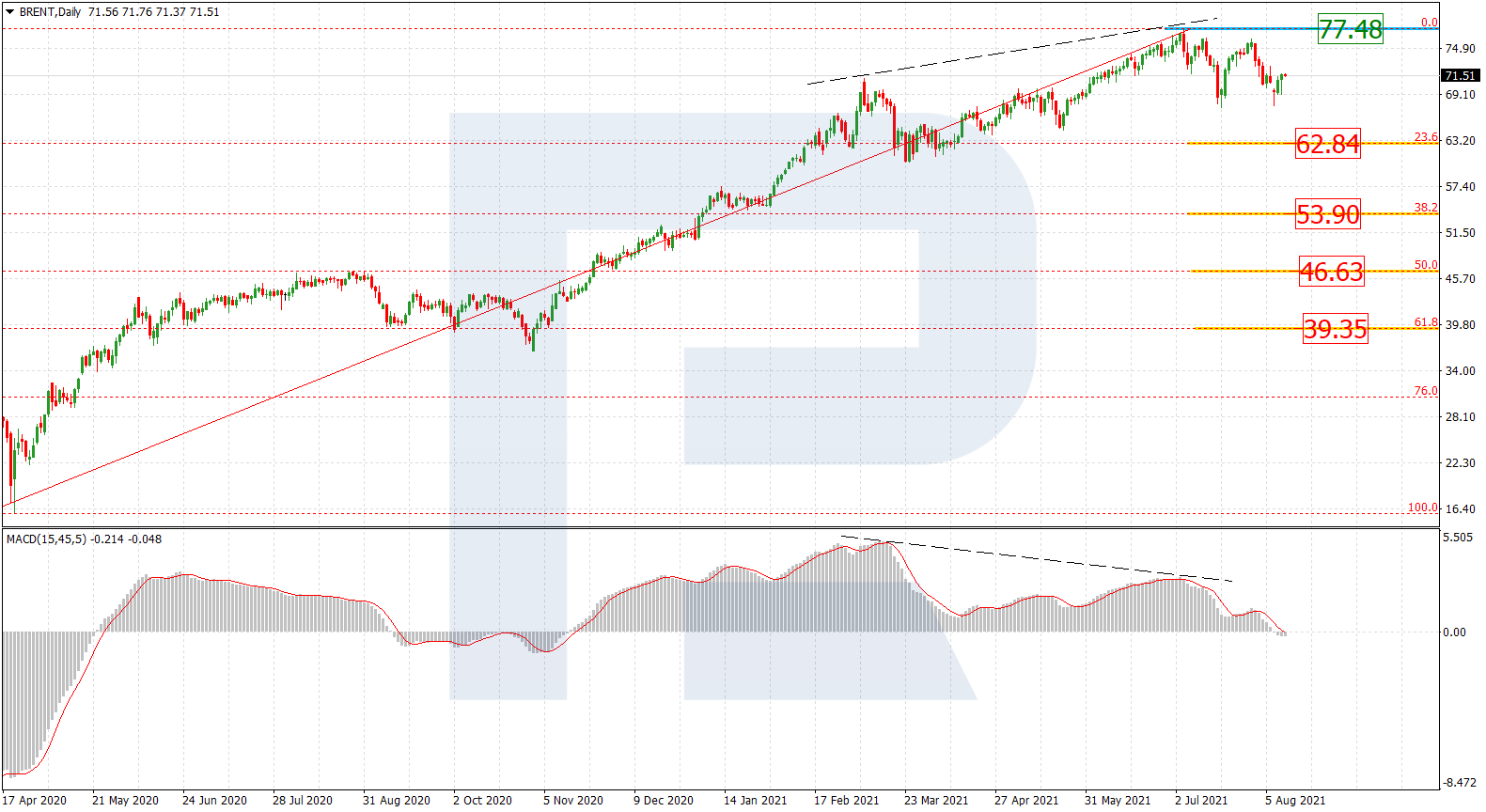

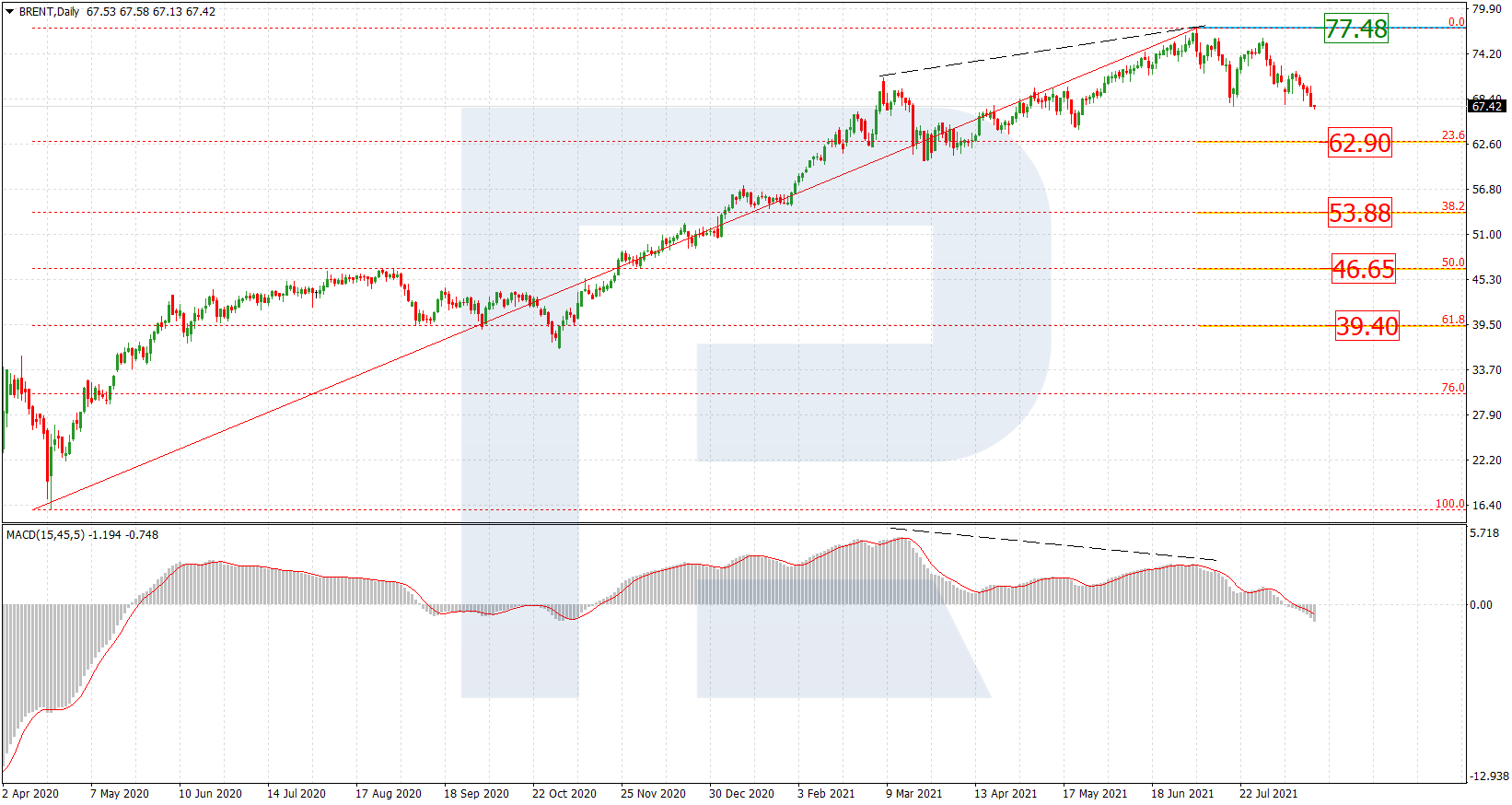

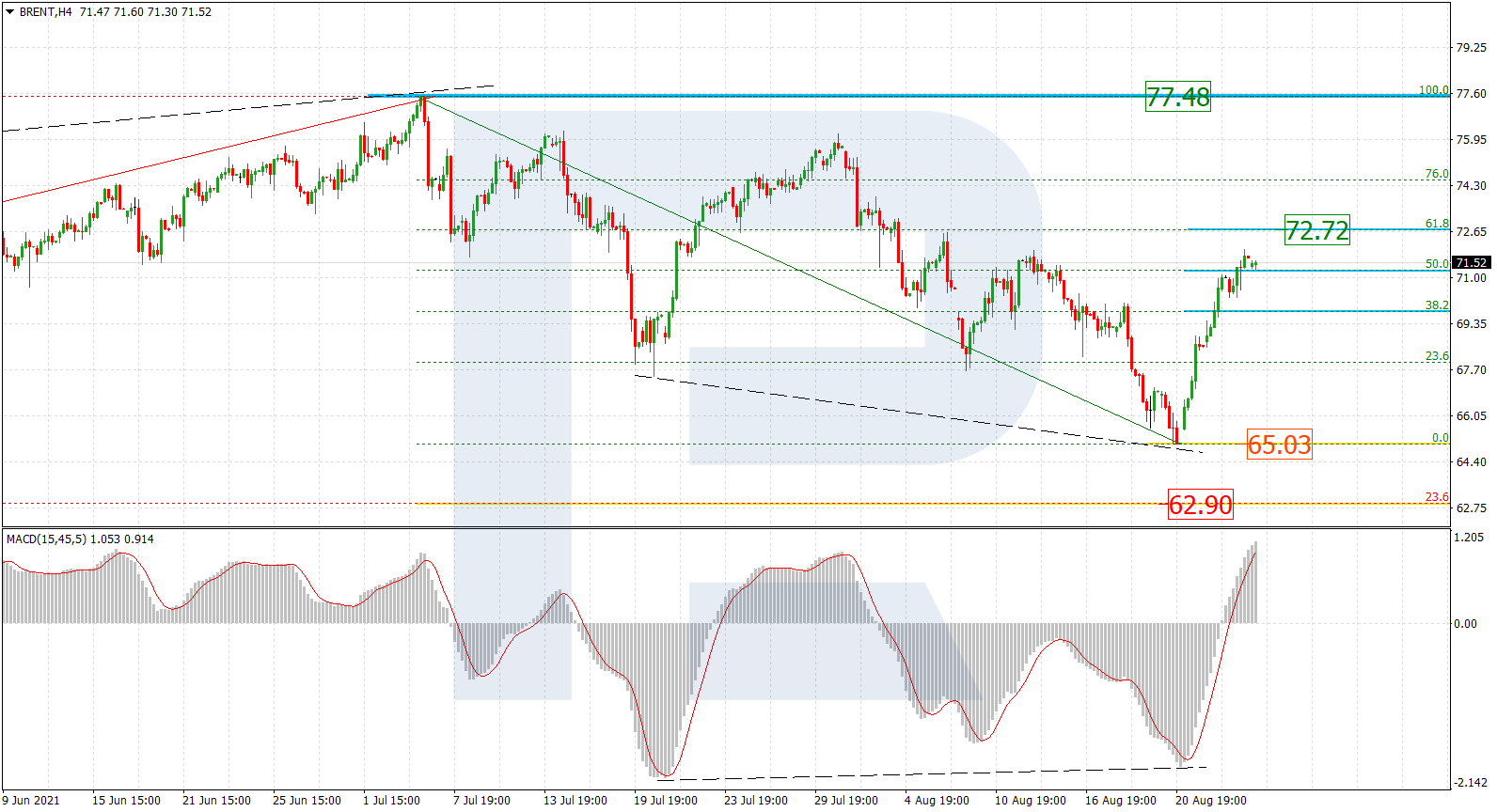

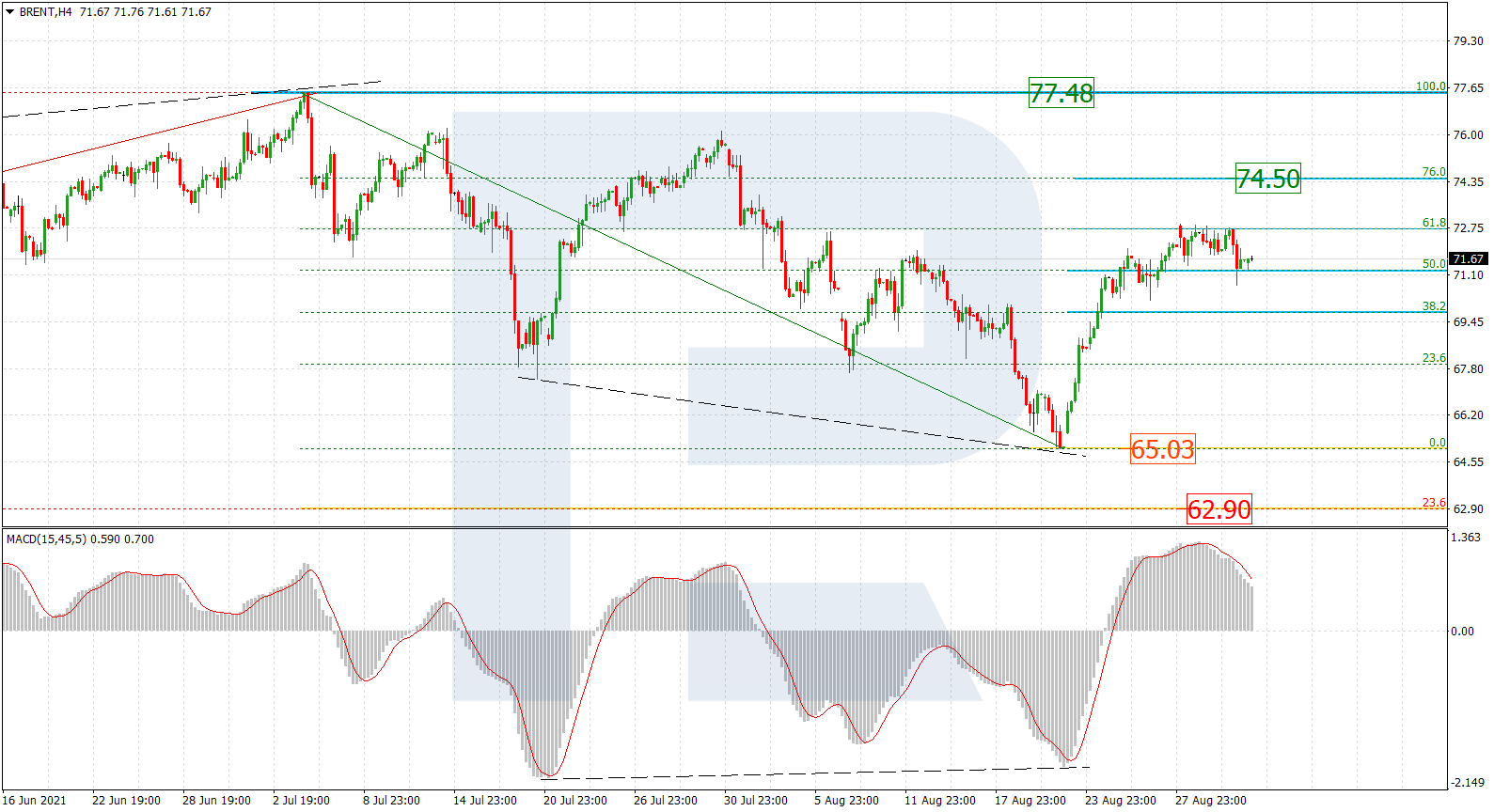

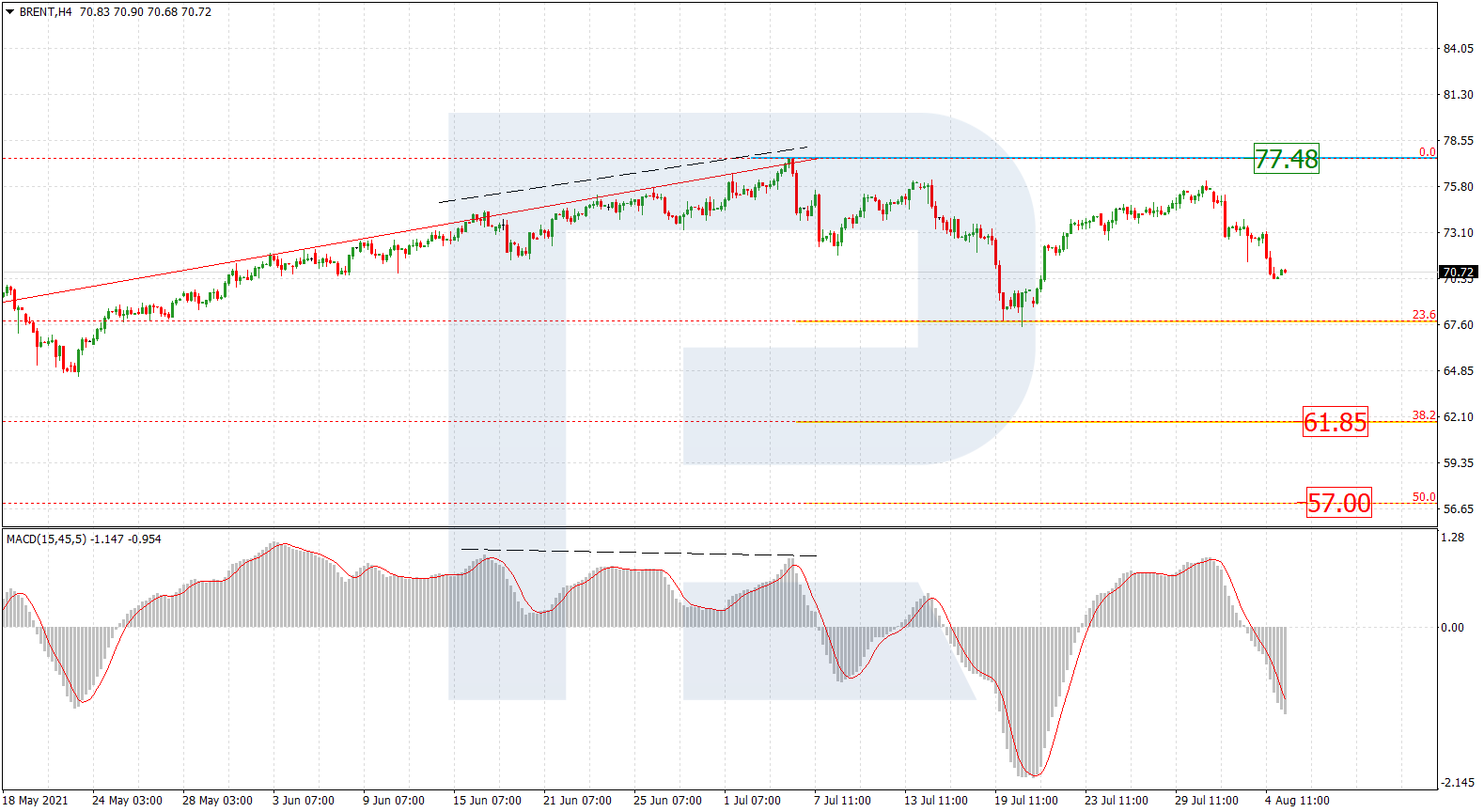

Brent

On H4, after growth and a bounce off the fractal resistance level, the market is developing another wave of decline. While the first declining wave tested 23.6% Fibo, the next one will aim at 38.2% (61.85) and 50.0% (57.00). The resistance level remains at 77.47. If it is broken away, the quotations may rise to the fractal peak of 87.09.

Read more - Fibonacci Retracements Analysis Brent, Dow Jones