Morning Market Review

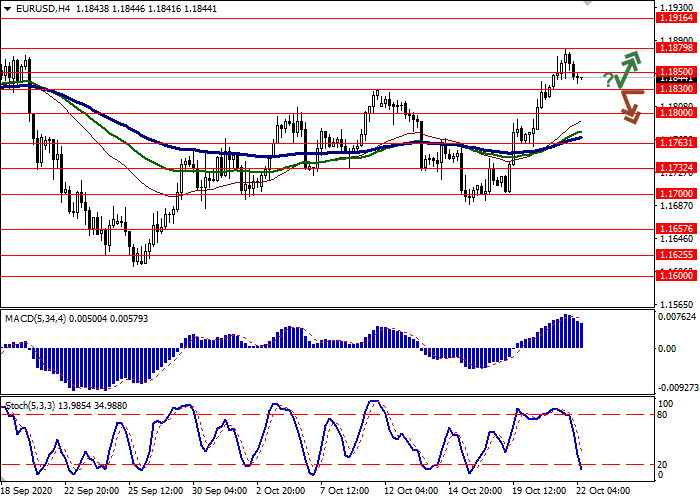

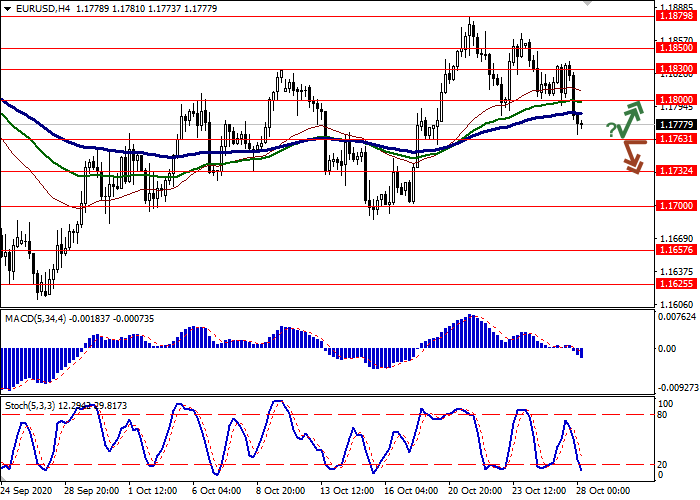

EUR/USD

EUR is declining against USD during today's Asian session, consolidating near 1.1700 and local highs since September 22, updated the day before. Another decline in EUR is due to technical factors, as investors fix their long positions ahead of the publication of the September report on the US labor market. The previously strong ADP report on private sector employment provided significant support to market sentiment. It is likely that Friday's statistics will also be better than forecasts, which, however, will only provide USD with a short-term support. The market today reacts to any optimistic signals from the US with an increase in demand for risky assets. European investors today expect the publication of data on Consumer Prices in the euro area in September. In addition, ECB Vice President Luis de Guindos will speak during the day.

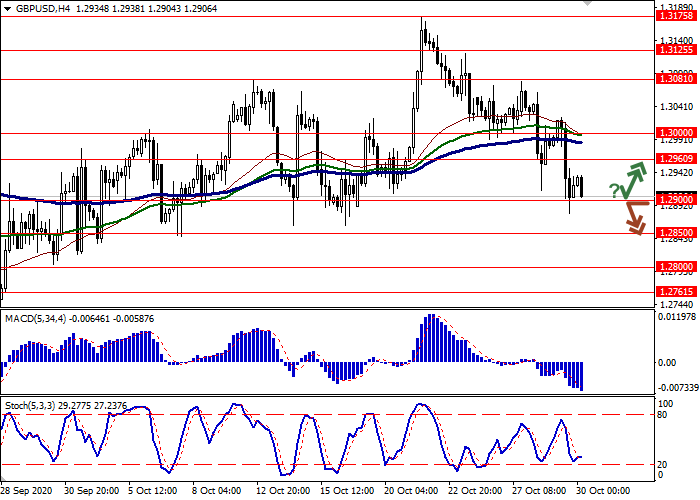

GBP/USD

GBP is declining during this morning session, developing the corrective impulse formed the day before, when the pair retreated from its highs since September 18. Market participants are closing part of their long positions on the instrument before the publication of the US labor market report for September. In addition, investors are concerned about the rapid increase in the number of new cases of coronavirus, which could significantly complicate the recovery of the British economy. Yesterday, the UK reported a decline in the Manufacturing PMI from 54.3 to 54.1 points, while analysts did not expect it to change at all. The US data was slightly better, but also reflected a slowdown in growth. The ISM Manufacturing PMI in September fell from 56 to 55.4 points against the forecast of growth to 56.3 points.

AUD/USD

AUD has declined against USD during today's Asian session, retreating from local highs since September 22, updated on Thursday. The instrument loses about 0.35%, testing the level of 0.7150 for a breakdown. Buying activity for the instrument is expected to decline at the end of the week, as investors are fixing long profits. In addition, traders are in no hurry to open new positions before the publication of the report on the US labor market, which, given the previously published strong report from ADP, may be positive. AUD was slightly supported on Friday by the Australian Retail Sales statistics. In August, sales were down by 4% MoM after falling by 4.2% MoM in the previous month.

USD/JPY

USD is growing during today's morning trading session, again approaching its local highs since September 15, which were updated at trading last Wednesday. USD is strengthening after yesterday's publication of rather optimistic macroeconomic statistics from the US. At the same time, it should be noted that strong data from the US is leading to an increase in demand for risky assets; however, paired with the "safe" JPY, USD is expected to win. The number of Initial Jobless Claims in the US for the week ending September 25 fell from 873K to 837K, which was better than market expectations of 850K. Core Personal Consumption Expenditure Index was also positive, having increased by 1.6% YoY in August, accelerating from the previous value of +1.4% YoY. JPY was also under pressure from weak data from Japan. Japan's Unemployment Rate in August rose from 2.9% to 3.0%, and the Jobs/Applicants Ratio for the same period corrected from 1.08 to 1.04.

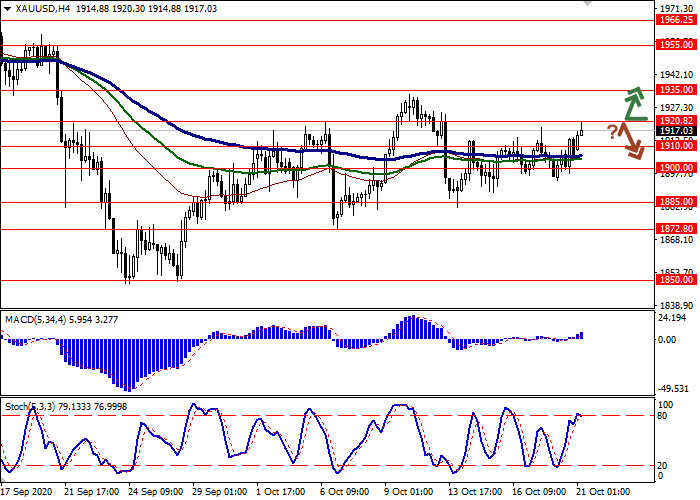

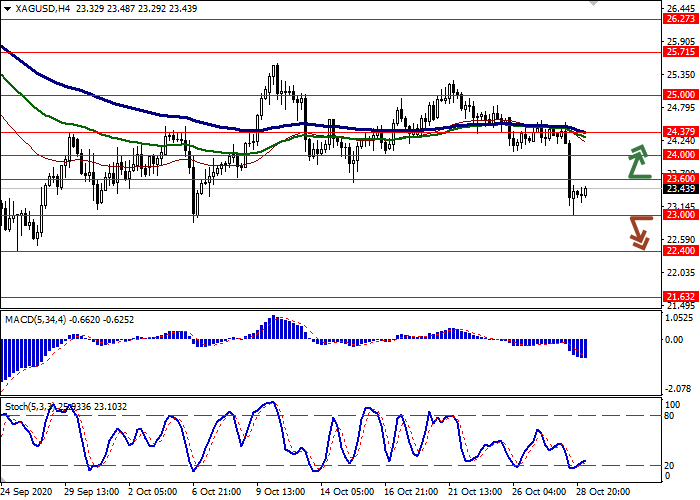

XAU/USD

Gold prices decline significantly during today's Asian session, retreating from local highs since September 22, updated the day before. Investors are fixing long positions ahead of the release of reports on the US labor market on Friday, as well as responding to some improvement in market sentiment. Strong data from the US supported the demand for risk, especially after the US Treasury officials said that the chances of early approval of the new economic aid package increased markedly. At the same time, gold continues to benefit from rising coronavirus incidence statistics in Europe. The trend has not yet been reversed, as many countries are reluctant to return quarantine restrictions, fearing to disrupt the fragile economic recovery. Today investors are focused on the publication of the US labor market report. Investors expect the emergence of 850K new jobs in Non-Farm Payrolls, which is significantly less than the previous growth of 1.371M. However, given the strong performance in private sector employment, it is possible that the real dynamics will be noticeably better.