Brent Crude Oil: prices are recovering

Current trend

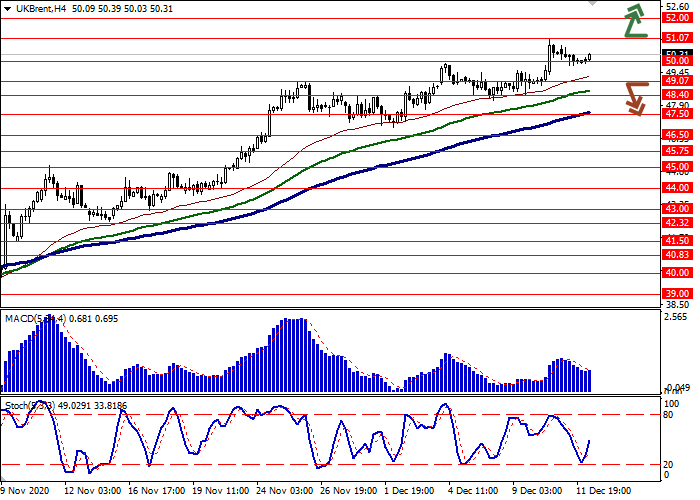

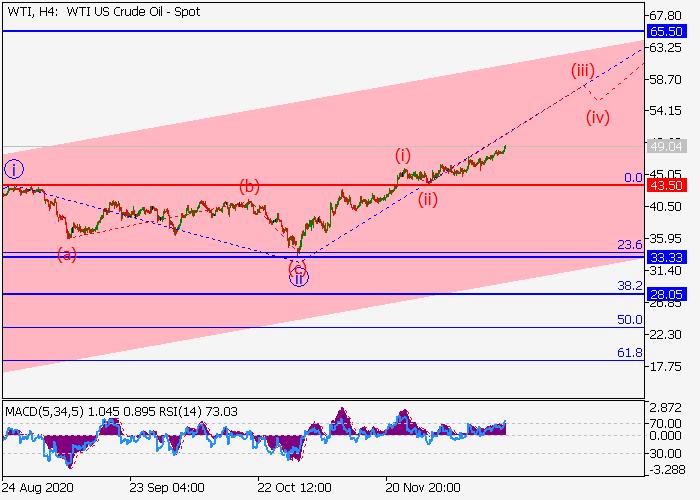

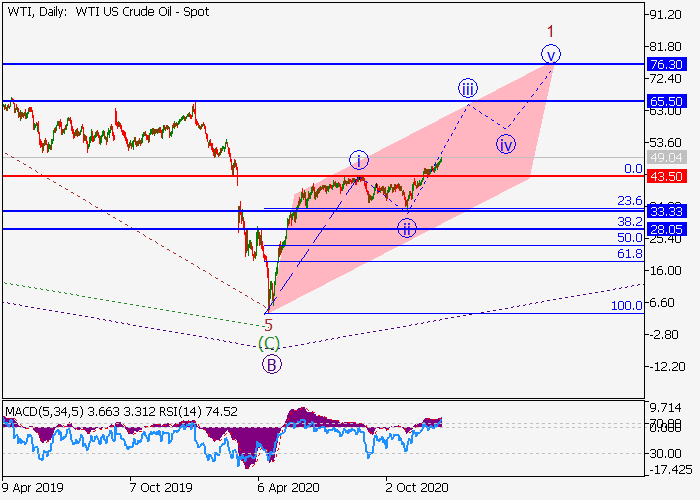

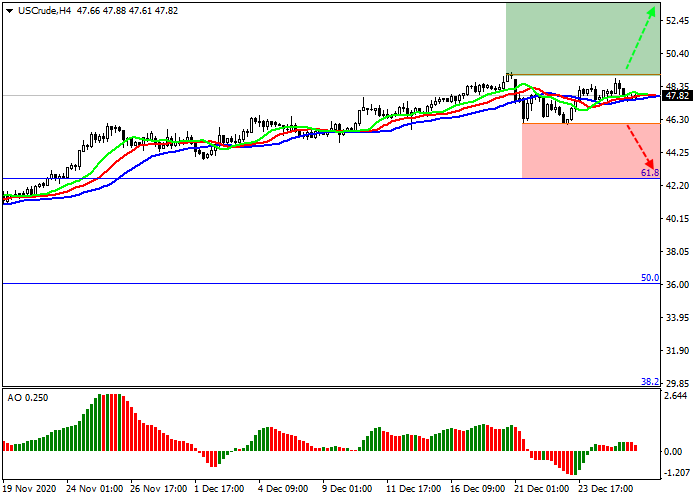

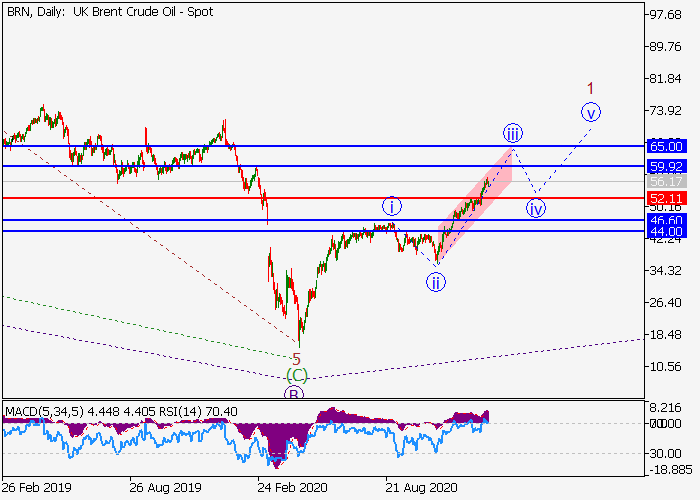

Today, during the Asian session, oil prices are showing upward dynamics, trying to consolidate above the psychological level of $50 per barrel. The instrument dropped slightly at the end of the last trading week, however, it was caused by technical factors.

The quotes are strongly supported by optimism regarding vaccines against COVID-19. Last weekend, it became known that the US Food and Drug Administration (FDA) noted the advantage of the vaccine from Pfizer and approved its use for the population over 16 years old. A vaccination campaign is expected to start soon in the US, which will strengthen the market's confidence that the next year can be survived without new lockdowns.

Meanwhile, Baker Hughes' report on active oil platforms in the US, released on Friday, again reflected a solid increase from 246 to 258 units.

Support and resistance

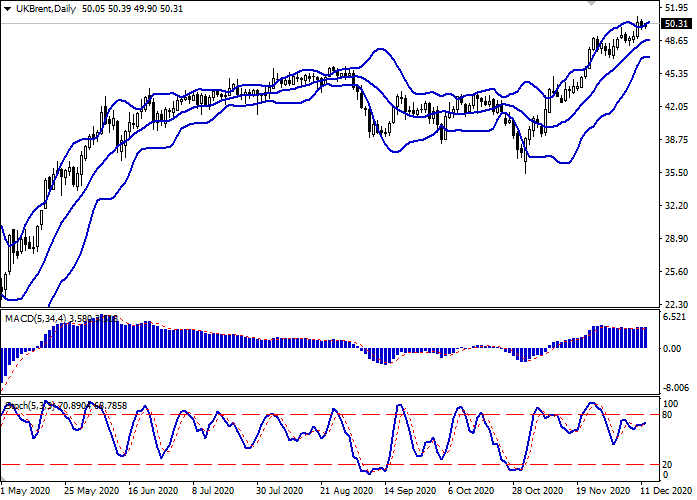

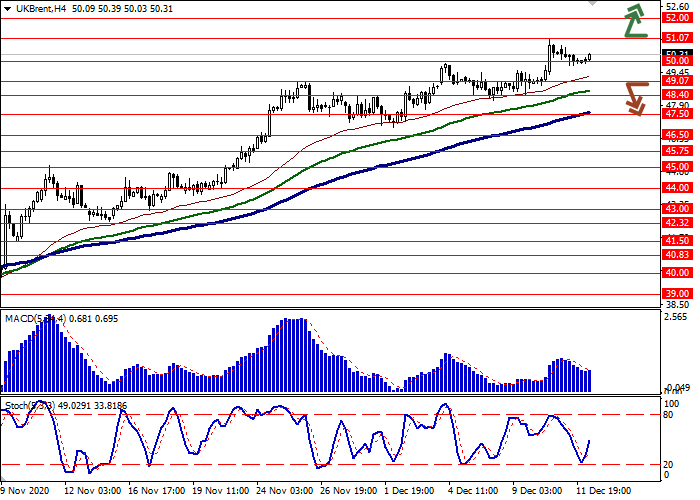

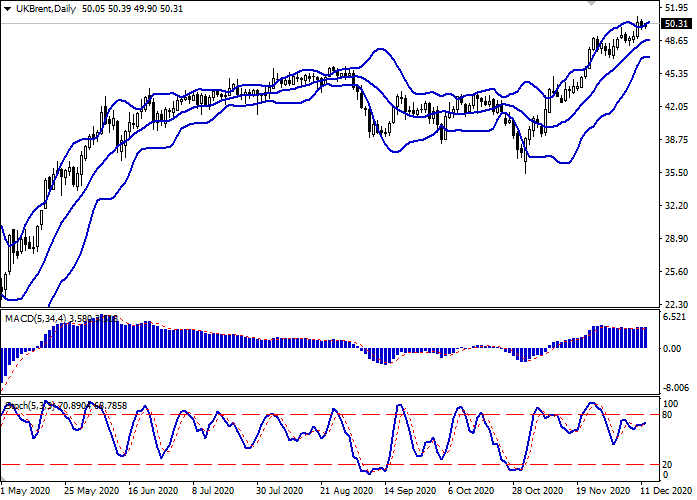

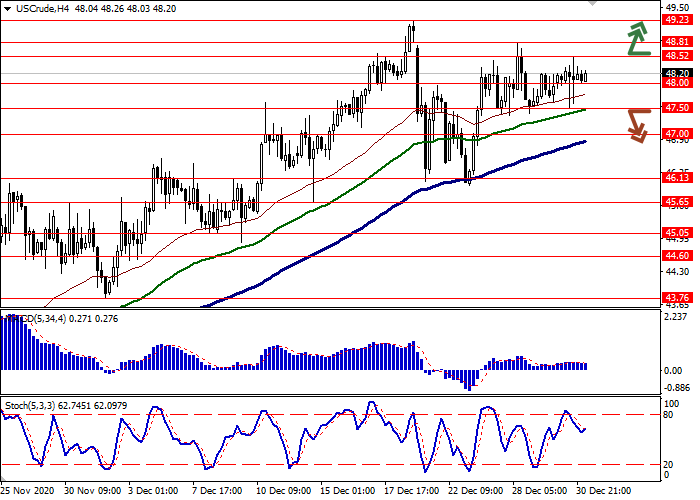

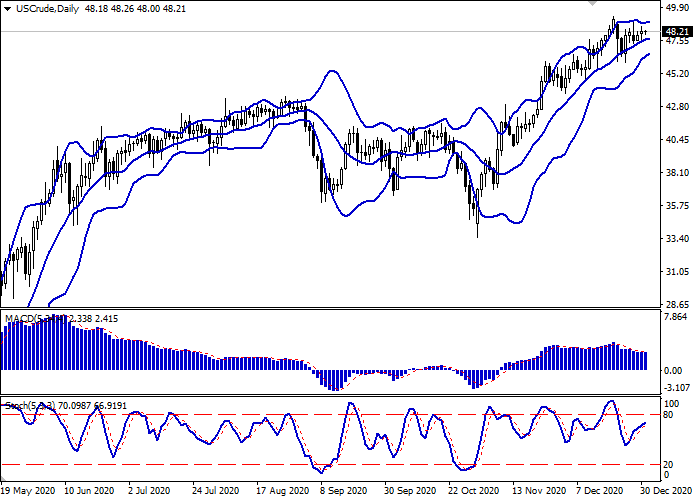

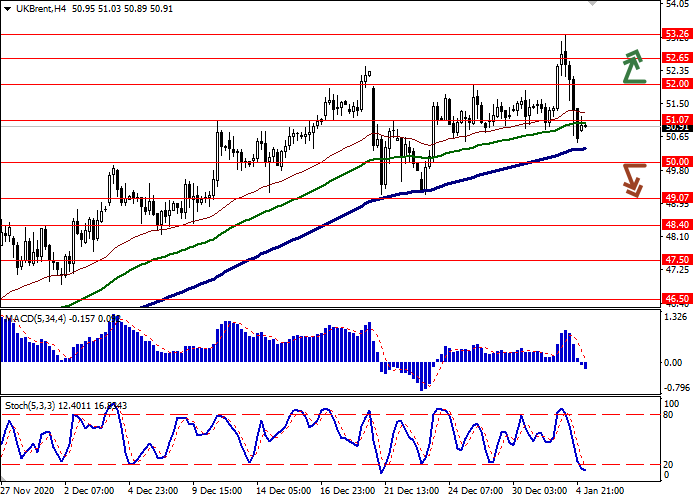

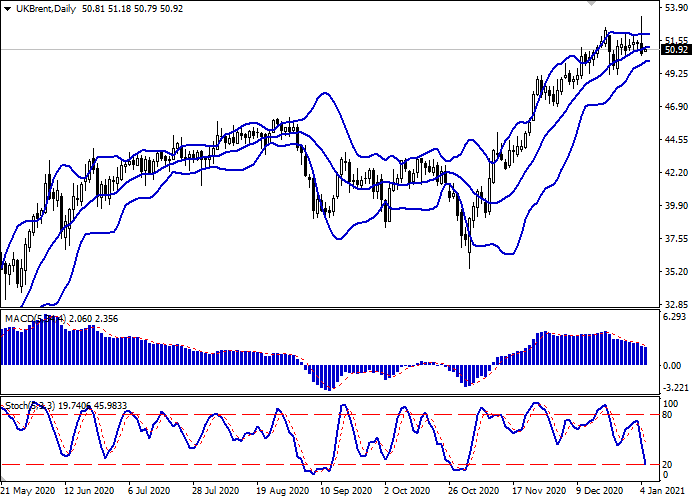

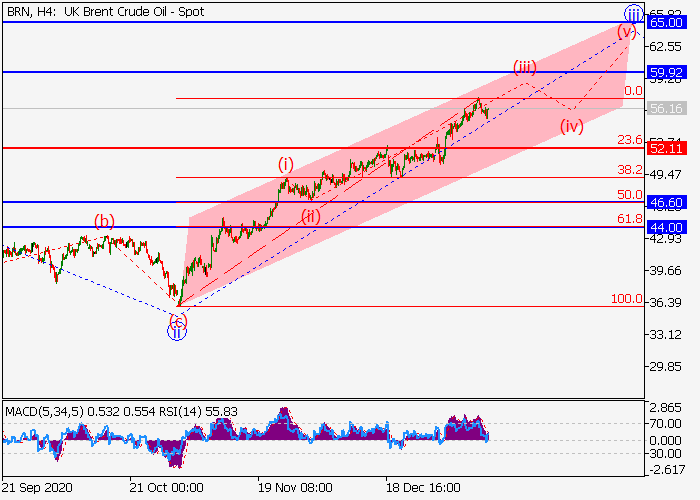

On the daily chart, Bollinger Bands reverse into a horizontal plane. The price range is expanding from above but not as fast as the “bullish” dynamics develop. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, without reaching the overbought area, reversed into a horizontal plane near the level of 80, indicating the ambiguous nature of the last days' trading.

The current readings of technical indicators do not contradict the further development of upward dynamics.

Resistance levels: 51.07, 52.00, 53.00.

Support levels: 50.00, 49.07, 48.40, 47.50.