Technical Analysis of ETH/USD for November 16, 2020

Crypto Industry Outlook:

Binance CEO Changpeng Zhao said he needed to do more to block "smart" US traders from illegally accessing its global stock exchange. In an interview with the financial media, CZ said its stock exchange needs to be "smarter about the way we block" US traders from accessing the platform:

"Basically, we are constantly trying to improve our security. Sometimes there are a few guys who want to bypass our locks and still use the platform. We have to come up with a smarter way to strengthen protection, and when we do, we lock them."

Binance, which is the world's largest cryptocurrency exchange by volume, stopped serving US traders in September 2019 due to regulatory risk. The stock market later launched Binance.US in partnership with BAM Trading Services, which was approved by the Financial Crimes Enforcement Network to serve US clients. Binance.US is a separate entity that licenses technology from Binance and receives brand support from the Malta Stock Exchange.

Binance.US transaction volumes are said to be only a small fraction of the daily turnover on the main Binance exchange. However, reported volumes are often inflated and do not reflect actual trading activity. It is said that the big stock exchanges continue to publish false figures.

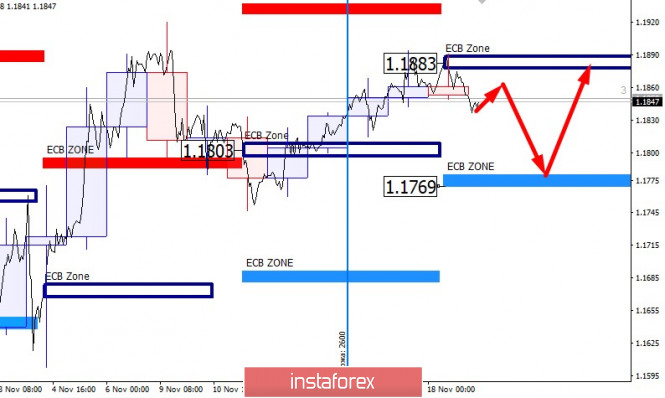

Technical Market Outlook:

The ETH/USD pair has been seen moving lower towards the level of $440 after the corrective cycle had started. The local low was made at the level of $438.18, but the market keeps moving inside of the descending channel. The outlook remains bullish and the next target for bulls is the swing high located at the level of $476.29. The nearest technical resistance is seen at the level of $459.47. Only if a daily candle closes below $360 level, then the bears will have full control of the market and might push the prices deeper below this level.

Weekly Pivot Points:

WR3 - $507.71

WR2 - $490.25

WR1 - $463.71

Weekly Pivot - $448.80

WS1 - $421.33

WS2 - $405.66

WS3 - $377.90

Trading Recommendations:

The up trend on the Ethereum continues and the next long term target for ETH/USD is seen at the level of $500, so any correction or local pull-back should be used to open the buy orders. This scenario is valid as long as the level of $309.61 is broken.

Analysis are provided byInstaForex.