Forex Analysis & Reviews: Trading signal for GBP/USD for December 10-11, 2020. Focus on Brexit.

British Prime Minister Boris Johnson, European Commission President Ursula von der Leyen and their negotiating teams did not achieve a much-desired breakthrough on Brexit. After concluding that they remain "very separate," the EU and the UK agreed to extend the talks until the end of the weekend. This can further weaken the British pound if they do not reach a deal before the transition period expires.

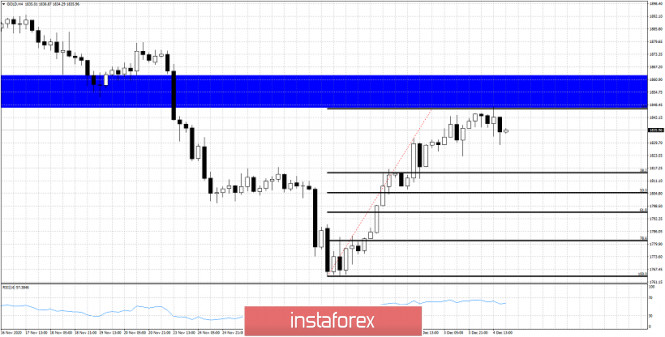

As talks continue in Brussels, the news is likely to move the British pound. Due to this, the British pound is under downward pressure on the 4-hour technical chart. However, it is facing an upward channel on the 4-hour timeframe and at the 200-day EMA.

Looking up, the resistance is at 1.3360, where the 21-period moving average is located, followed by 1.3427, 6/8 Murray. At the upper target of 1.3549 (7/8 Murray), we should wait until the pound breaks above the 21 day EMA. If so, we can place buy positions with a final target at 1.3670. This boost is sure to appear if good news about Brexit is released.

We gave detailed recommendations and made analysis on Monday and Tuesday. We will leave the links below so that you can review our statistics on GBP/USD. Now if you open a bearish position, you can still hold it until the price touches the 200-day EMA. If the price bounces in this area, we can expect a new upward momentum. If the bearish trend is too strong, we recommend selling the pair with targets at 1.3180 and 1.3060.

The market sentiment in the early American session shows that there are 56% of investors who are selling the pound sterling. If this figure decreases, we could see a bearish breakout of the key level of 1.3220, and the price could fall to the area of 1.3060 in the coming days. So please be careful if you enter the market with to buy. The last opportunity to buy is above the 200 EMA, below this level, the downward pressure may accelerate.

Trading tip for GBP/USD for December 10 – 11

Buy above 1.3360 (EMA 21), with take profit at 1.3427, stop loss below 1.3320.

Buy if the pair rebounds around 1.3255 (trend channel), with take profit at 1.3310 and 1.3360, stop loss below 1.3210.(EMA 200)

Buy if the pair rebounds around 1.3220 (EMA 200), with take profit at 1.3270 and 1.3305 (5/8), stop loss below 1.3180.

Review our analysis for December 08, GBP/USD.

Review our analysis for December 09, GBP/USD.

Analysis are provided byInstaForex.

Best regards, PR Manager / Learn more about InstaForex Company at http://instaforex.com