Re: InstaForex Analysis

Forecast for EUR/USD on March 27, 2020

EUR/USD

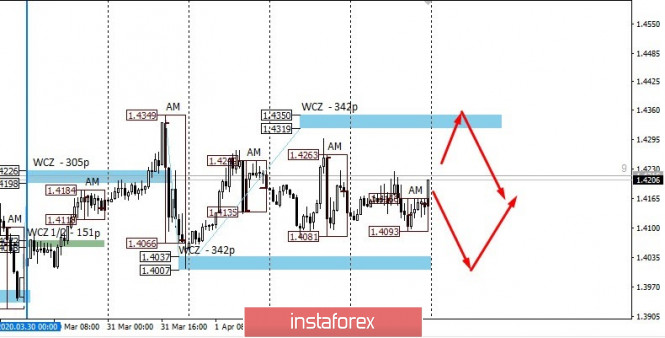

The euro climbed 150 points on Thursday due to rising risk appetite amid massive infusion of dollar liquidity by the Federal Reserve worth 75 billion dollars a day, the stock market will grow more than 6% (S&P 500 6.24%) and at the same time on the tragic data on applications for unemployment benefits – this past week showed the US economy's opinion in antivirus quarantine, the number of applications reached 3.283 million (!) against the forecast of 1.648 million Before the highest record figure was 669,000 in April 2009. The employment forecast for the next week shows economists' expectations for an increase in unemployment in March from 3.5% to 4.0% and a decrease in non-agricultural employment by 420,000 (in September 2008-422,000). In the euro area, the employment situation is even worse than in the US, but the markets in this situation have traditionally reacted sensitively to the very fact of bad data. Unemployment in Germany for March is expected to rise to 5.1%. We are cautious about the growth of the euro. Also, in the market, investors are taking risks with caution – the trading volume was even less than in the previous days of the week.

The correction was already 50% of the fall on March 9-20. The euro's desire to continue its corrective growth to 61.8% will be fraught with even greater difficulties. The Fibonacci level range of 50.0-61.8% contains multiple technical levels that have accumulated since July 2019. The price is currently above the MACD line and the Marlin oscillator has broken into the growth zone, but the market just needs to swing down a little and the indicators will again be in negative values. Consolidating the price above the Fibonacci level of 50.0% (1.1070) will make it possible to continue growth from the Fibonacci level of 61.8% at the price of 1.1170. Moving the price under the 38.2% Fibonacci level, which will also mean breaking through the support of the price channel (1.0970), opening a promising goal of 1.0630 along the lower line of the price channel. The intermediate target level of 1.0879 is the low of October 1, 2019.

The price is still in a growing position on the four-hour chart, but the leading indicator Marlin is already turning down. We are waiting for the development of events.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.