EURUSD: Unemployment will only provide temporary support for the euro, while other indicators will continue to disappoint

The euro rose after a report that the number of applications for unemployment benefits in Germany fell, and the unemployment rate in the eurozone fell. This indicates a good state of the labor market, which has recently caused concern to the European Central Bank.

However, ahead of the report on the labor market, there were indices for manufacturing in France, Italy, Germany and the eurozone, which leave much to be desired, confirming the negative impact of the protectionist policies of the United States and the slowdown in the global economy against trade conflicts.

As I noted above, according to published official data, the number of applications for unemployment benefits in Germany in June of this year fell by 1,000, after rising by 60,000 in May. The employment agency noted that the weak economic situation continues to be reflected in the labor market. Taking into account the seasonal adjustment, unemployment in June remained at the level of 5.0%, whereas in April of this year it reached a record minimum of 4.9%. The number of registered vacancies in June was 798,000, which is also less than in May.

The sharp rise in the euro occurred after it became known that the unemployment rate in the eurozone in May of this year fell, not coinciding with the forecasts of economists. However, looking ahead, it is necessary to say that speculative traders in vain ignored the report on the eurozone production index for June, the decline of which will force enterprises to reduce staff, adversely affecting the June report on the labor market.

According to the data, in May of this year, the number of unemployed in the eurozone decreased by 103,000 people, while the unemployment rate itself fell to 7.5% (the level of the crisis of 2008) from 7.6% in April. The report noted that the largest reduction in the number of unemployed was registered in Spain and Italy.

Why is low unemployment so important for the ECB? In addition to influencing the growth rate of the economy, low unemployment also stimulates the acceleration of inflation, which the regulator is counting on.

Data on lending to companies in the eurozone were ignored by traders. According to the ECB report, in May of this year, compared with April, lending to non-financial companies increased by 3.9%, which corresponds to the April rate. Lending to households in the euro area in May increased by 3.3%, as well as in April. Eurozone M3 monetary aggregate grew by 4.8%, while economists had expected the indicator to grow by 4.6% in May.

As I noted above, ignoring weak reports on production activity will not lead to anything good. According to the data, the PMI Purchasing Managers Index for the Italian manufacturing sector fell to 48.4 points in June, while Italy's manufacturing PMI was 49.7 points in May. In France, the same index rose slightly in June, reaching 51.9 points, against 50.6 points in May.

In Germany, the situation with production activity remains at a very bad level. There, the index remained below 50 points, which indicates a reduction, and amounted to 45.0 points in June against 44.3 points in May. In the euro area as a whole, the PMI purchasing managers index for the manufacturing sector in June dropped even more - to 47.6 points versus 47.7 points in May.

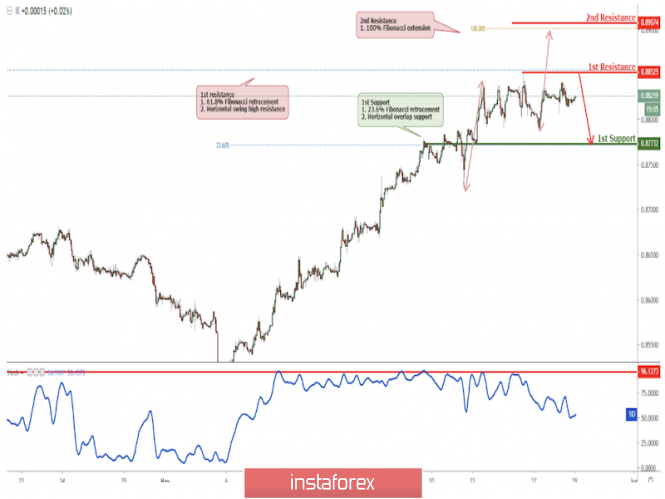

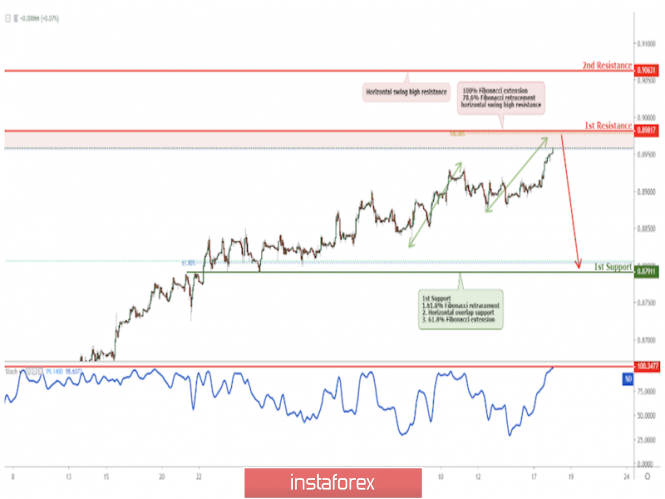

As for the technical picture of the EURUSD pair, it remained unchanged. The upward momentum after a good report on the eurozone labor market helped to carry out a number of stop-orders of speculative players, but the market remains on the sellers side. The purpose of the bears is the support test of 1.1310, below which the lows open as early as June 21 - 1.1285 and June 20 - 1.1225. In case of a breakout level of 1.1350, the upward correction will be limited to a high of 1.1370.

Analysis are provided by InstaForex