Re: Market Update by Solidecn.com

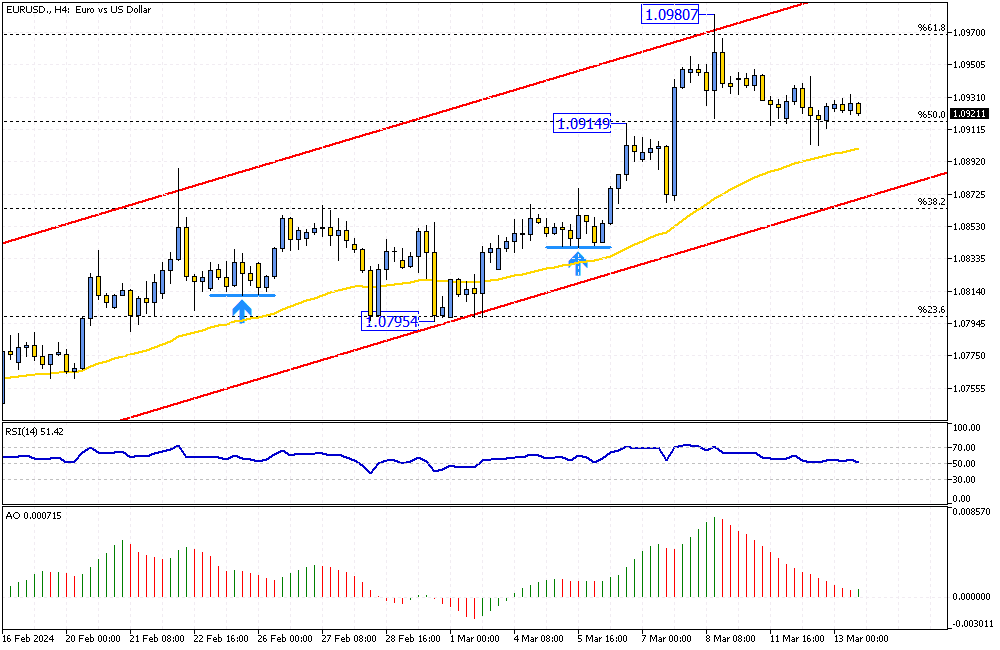

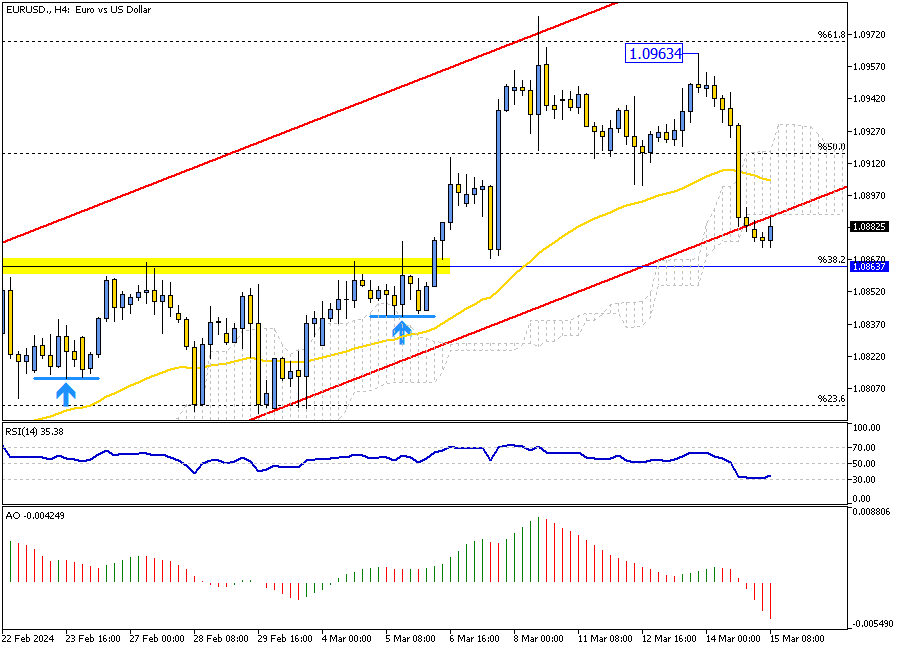

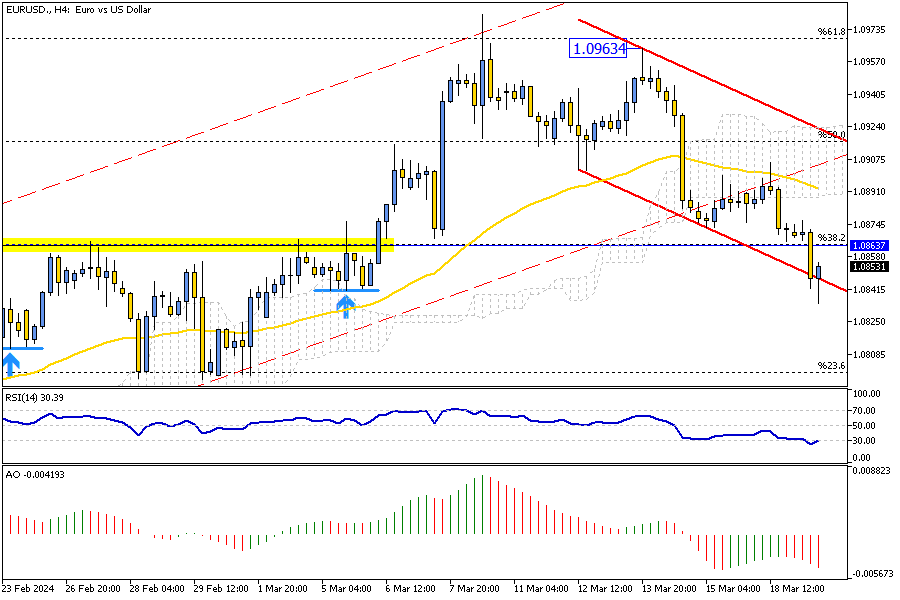

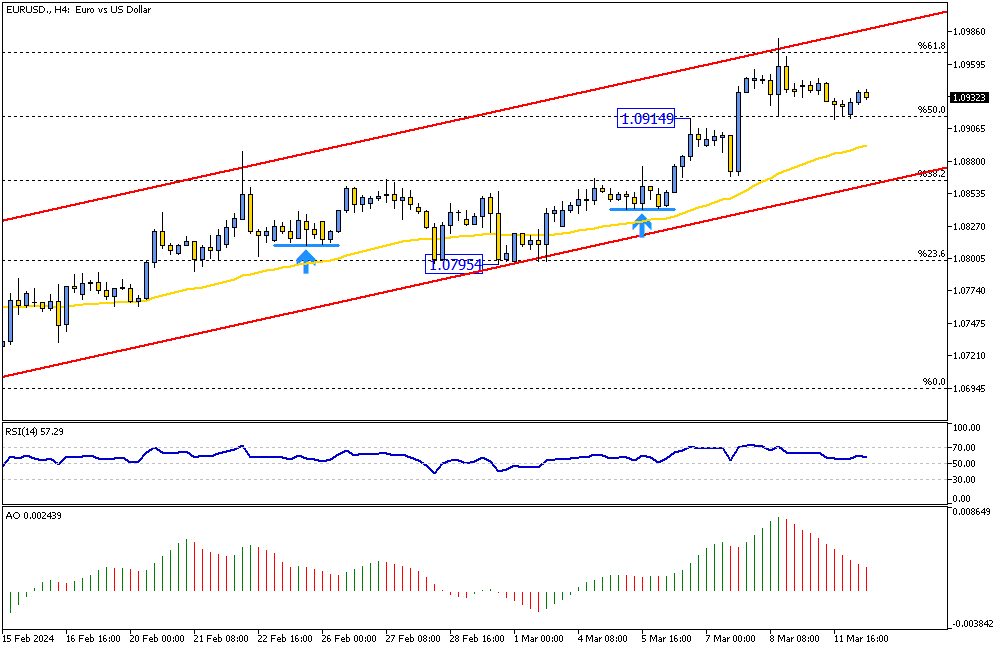

EURUSD's Next Move: Navigating Above 1.091 Key Support

Solid ECN – The EURUSD formed a hammer candlestick pattern on the 4-hour chart, clinging to the 50% Fibonacci support level at the 1.0914 mark. As of writing, the pair is trading at about 1.093, slightly above the resistance. While the European currency gains ground against the U.S. dollar within the bullish channel, the technical indicators do not offer significant insights.

From a technical standpoint, the next target would be 1.1 if the price maintains its position above 50%.

Conversely, if the price dips below the 50% level, it will likely decline to the 38.2% level, coinciding with the lower band of the channel.