Re: InstaForex Analysis

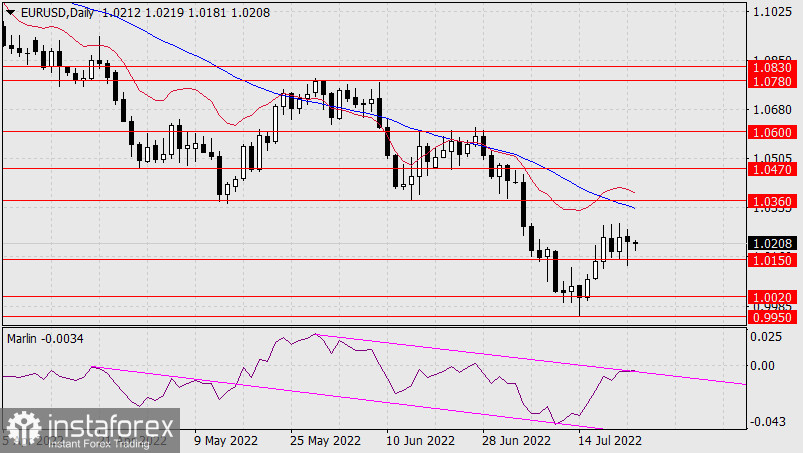

Forex Analysis & Reviews: Technical Analysis of EUR/USD for June 20, 2022

Technical Market Outlook:

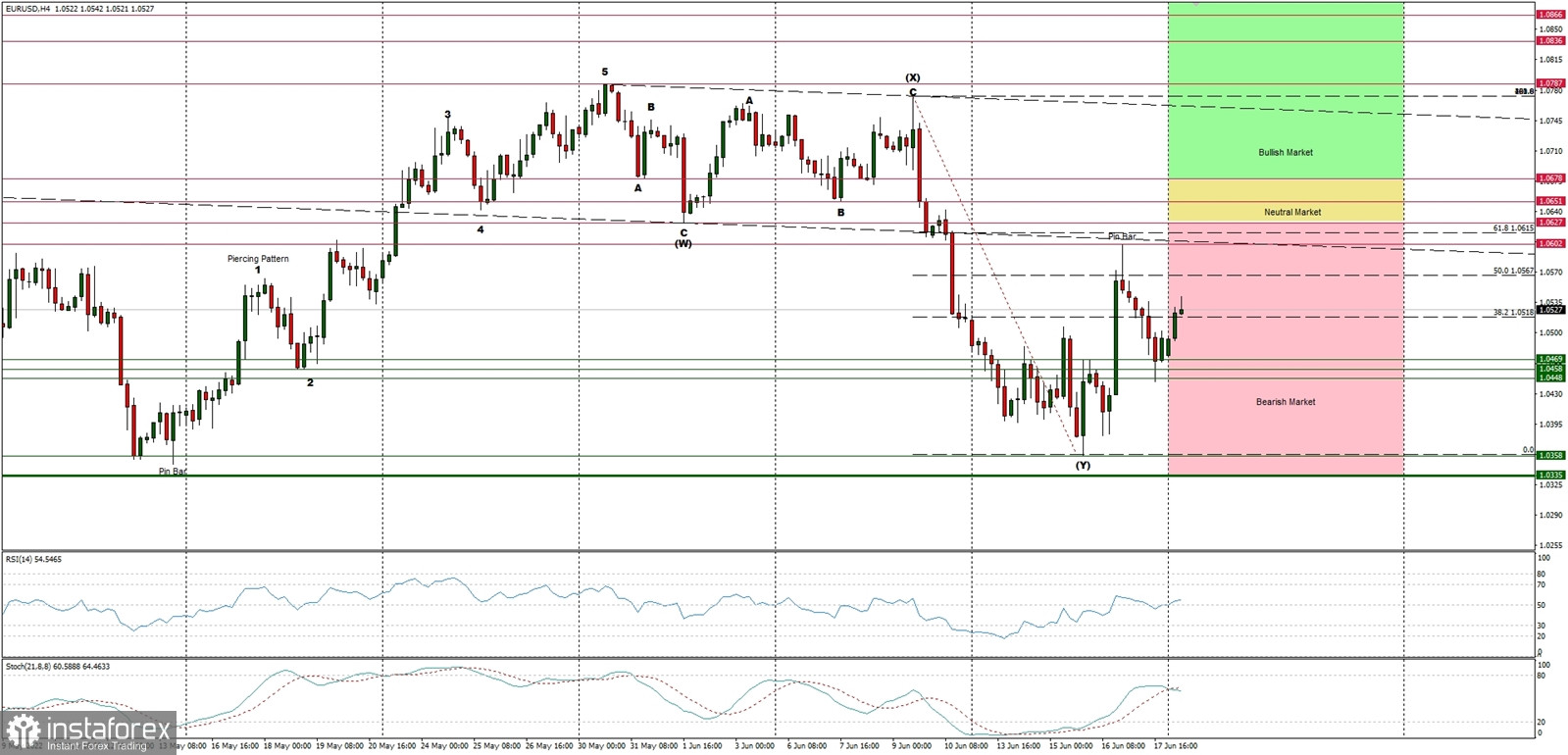

The EUR/USD pair had almost retraced 61% of the last wave down and made a Pin Bar candlestick at the level of 1.0661, 14 pips away from the Fibonacci retracement level. Since then, the bulls keep trying to continue the bounce, keep making the local pull-backs, but the level of 1.0615 is still unreachable for them. The nearest technical support is seen at 1.0469 - 1.0448, so as long as the market trades above this zone, the outlook remains bullish. Please notice, that despite the recent efforts, the bulls are still trading inside the bearish zone and they need to break above the level of 1.0678 to enter the bullish zone.

The up trend can be continued towards the next long-term target located at the level of 1.1186 only if the complex corrective structure will terminate soon (above 1.0335) and the market breaks above 1.0678 level. The bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0335 or below.