Re: InstaForex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on January 27, 2022

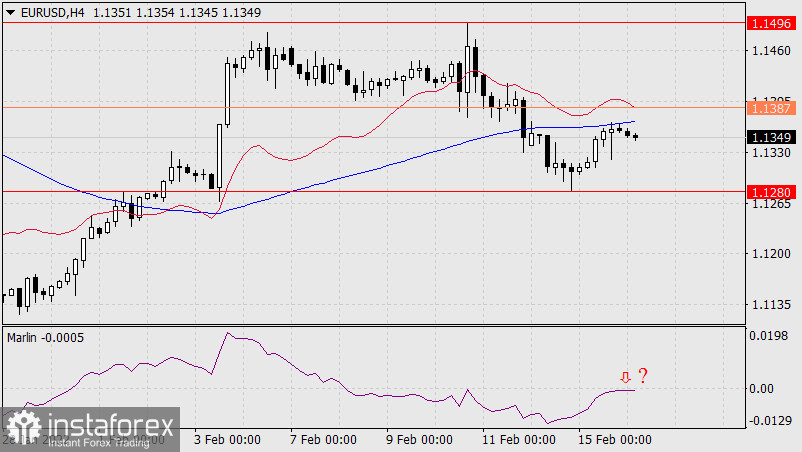

So, at yesterday's FOMC meeting, the Federal Reserve made it clear that the conditions for a rate hike are ripe, that rates can rise without a negative impact on the labor market, and the first increase will be in March. As a result of the day, the dollar index strengthened by 0.51%, the euro lost 60 points. The yield on 5-year US government bonds increased from 1.564% to 1.678%.

On the whole, the Fed's decision, like any thesis of Fed Chairman Jerome Powell's speech, was expected. But the fall of the euro shows that the markets have not yet taken into account the beginning of the US rate hike cycle, as is sometimes expressed in the media. And, perhaps, this is the main idea that has matured as a result of yesterday.

The price settled under both indicator lines on the daily chart – under the balance line and the MACD line. The price is approaching the first bearish target (1.1170) as planned. Consolidation below the level will open the second target (1.1050).