Re: InstaForex Analysis

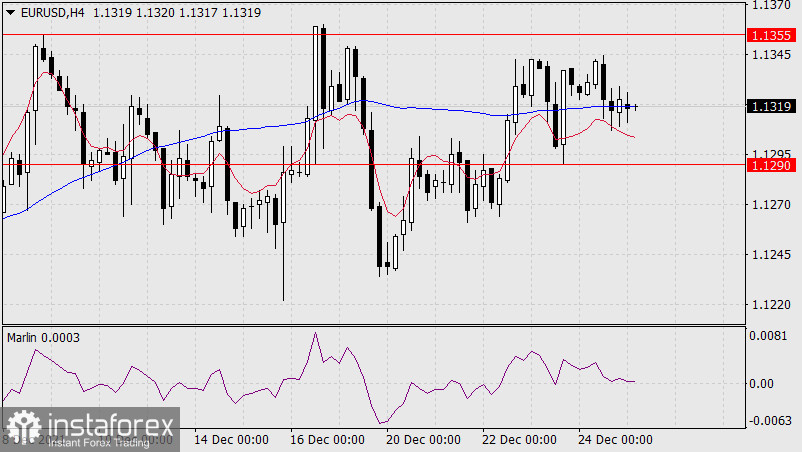

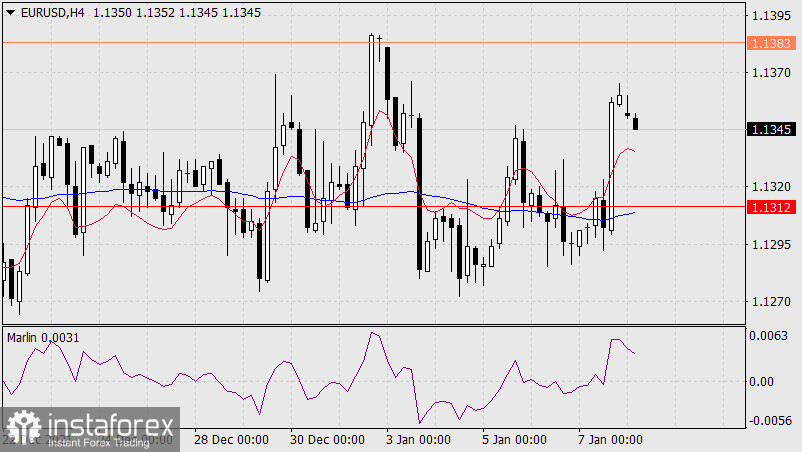

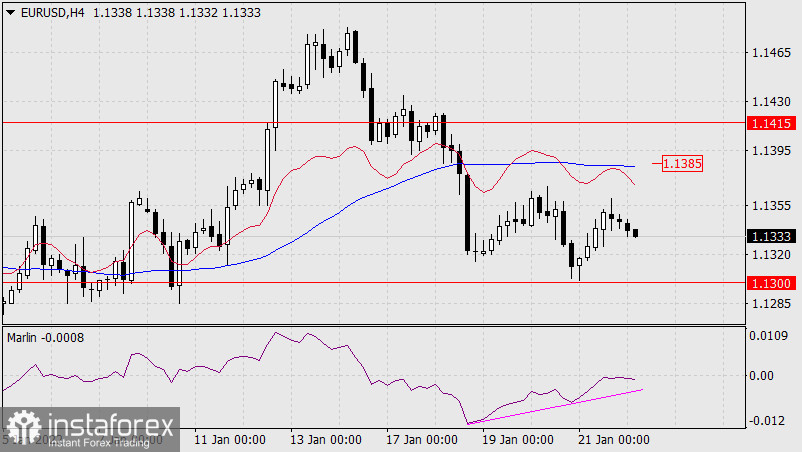

Forex Analysis & Reviews: Forecast for EUR/USD on December 23, 2021

Yesterday, the euro decided to choose an upward direction, intending to complicate and lengthen the horizontal movement, which began on November 29-30. There are about 20 points until the resistance of the MACD line (1.1363), and without breaking the main scenario and its own sideways movement, it is likely that the price will turn down from this resistance. If it overcomes the 1.1363 level, the main scenario will change to a price reversal from the target level of 1.1415. But if the price settles above 1.1415, then an alternative scenario will take effect with the price rising to the target level of 1.1572 (the January 2019 high).

An interesting situation develops on the Marlin Oscillator. Yesterday's exit of the signal line from the rectangular area of consolidation, marked with a gray area, repeats the exit of the signal line from the same consolidation on October 28 - it is marked with a red oval. And, as you can see, after the signal line returned to the range, the price fell.

On the four-hour chart, the price settled above the MACD line, Marlin is confidently rising in the positive area - the situation is upward. Probably, the price will decide to test the strength of the resistance range of 1.1363-1.1415.