Table of Contents

Testing Strip

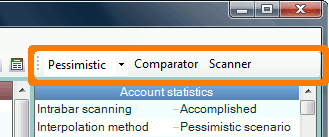

This toolbar contains the drop-down menu where you can choose the interpolation method, as well as the buttons staring the method comparator and the intrabar scanner.

Interpolation methods

During back testing Forex Strategy Builder enters in each data bar and seeks for orders in its range. However, sometimes there is more than one order available and the program has to choose which of them to execute first. The Interpolation Methods represents different algorithms for tracing an individual bar. The method chosen is extremely important when the back test shows Ambiguous Bars. Five options are available:

- Pessimistic - this is the default method. It tends to execute the order in such a way that brings less profit. It's the most safe method.

- Shortest - interpolates a bar by following the shortest way from Open, through High / Low (which is closer) and ends at the Close points.

- Nearest - executes first the nearest one from all orders.

- Optimistic - it's opposite to the Pessimistic method. It must be used for information only.

- Random - it chooses randomly which order to execute. Nearest orders have greater probability of being reached first.

When there are no ambiguous bars, the interpolation algorithm does not play a role in the backtests.

Comparator

When the strategy contains ambiguous bars, the interpolation methods produce different results in the historical test. None of the methods is better or worse than the others. Each of them has its own advantages or drawbacks, depending on the strategy or the market.

The Comparator button activates the Method Comparator tool. This tool serves to compare the results of the various interpolation methods.

It becomes useful if the strategy contains ambiguous bars.

Scanner

This button activates the Intrabar Scanner tool. It serves to load all intermediate data available in order to achieve greater accuracy when calculating the strategy.

The Intrabar Scanner becomes useful when the strategy contains ambiguous bars.