Forex Analysis & Reviews: Technical Analysis of ETH/USD for March 7, 2022

Crypto Industry News:

The Korean Digital Asset Industry Committee, made up of South Korea's leading Blockchain experts, has called for a government committee to be formed to help and develop digital asset companies in the country.

The expert group discussed the various ways in which Korea could become a leading marketplace for digital assets and what role the government should play to achieve this. Experts believe Blockchain technology and cryptocurrencies will become key tools of the fourth industrial revolution.

Experts called on the government to support the nascent cryptocurrency industry and other emerging use cases such as decentralized finance, decentralized autonomous organizations, NFT tokens and metaverse.

South Korea's cryptocurrency laws are seen as one of the strictest, considering that nearly 200 small and medium-sized cryptocurrency exchanges had to shut down after regulators issued an injunction for crypto exchanges to create accounts with real usernames.

The Financial Conduct Authority, the country's chief regulator, also banned exchanges from conducting anonymous transactions and banned the use of private wallets. Regulators previously proposed a 20% tax on cryptocurrency profits, but the proposal was postponed due to a lack of clarity on cryptocurrency laws. While regulators have taken a strict stance on the virtual asset market, they seem quite positive about the Metaverse as the country announced $187 million investment for the domestic Metaverse project.

Technical Market Outlook

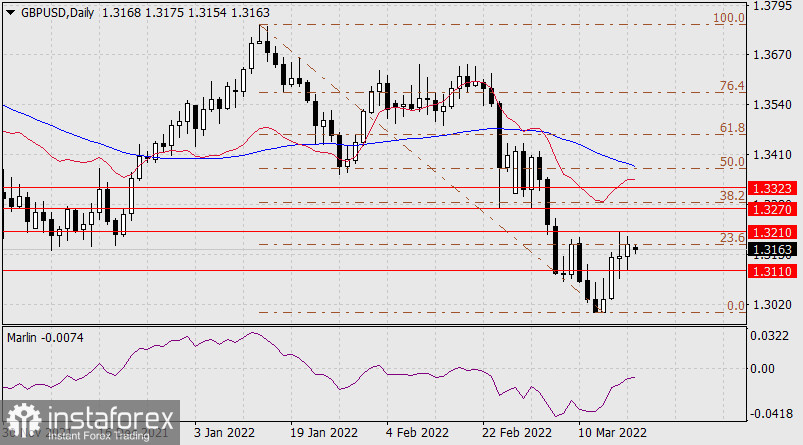

The ETH/USD pair had broken below all of the Fibonacci retracement levels after the rejection from the technical resistance seen at $3,000 level. The bears are in control of the market and the target for them is located at the swing low seen at $2,302. The momentum is weak and negative, so even despite the extremely oversold market conditions on the H4 time frame the down move might continue for some time. The immediate technical resistance is seen at the level of $2,568. Only a clear and sustained breakout above the trend line resistance located around $3,024 level would change the outlook to bullish in the near time.

Weekly Pivot Points:

WR3 - $3,323

WR2 - $3,179

WR1 - $2,855

Weekly Pivot - $2,718

WS1 - $2,386

WS2 - $2,240

WS3 - $1,190

Trading Outlook:

The market keeps trying to bounce higher after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,192 is the next key Fibonacci retracement for bulls, but the bulls had failed to break through three times already. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.

Analysis are provided byInstaForex.