EUR/USD. The first week of January: Fed minutes, Eurozone inflation, and Non-Farms

Major global trading platforms are closed on January 1st due to New Year celebrations. Therefore, we can expect a shortened but still quite interesting trading week.

Tuesday

"Monday starts on Tuesday." Typically, the first working day of the week doesn't bring important news or reports, which means that Tuesday will be no exception. During the European session, we will receive the final assessment of December's PMI data. According to most experts, the final assessment is expected to match the initial one. In particular, Germany's Manufacturing PMI is expected to remain at 43.1 points. On the one hand, this indicator remains below 50 points, indicating contraction. On the other hand, the index has been showing an upward trend for the fifth consecutive month (after plummeting to 38 points in July). If the data is not revised towards deterioration or improvement, the market will likely ignore this release. The same applies to the U.S. Manufacturing PMI, which will be released during the U.S. session. Here too, the final assessment should match the initial one (48.2).

Wednesday

Key labor market data for Germany will be released. According to forecasts, unemployment in December should remain at the November level, which is 5.9%. This is a relatively high figure – the last time (before November 2023) unemployment was at this level was in June 2021.

However, the German labor market rarely has a significant impact on the EUR/USD pair. On the other hand, the ISM Manufacturing Index, which will be released during the U.S. session, could provoke increased volatility. This crucial indicator has shown an uptrend from July to September (inclusive), reaching 49 points. It sharply dropped to 46.7 in October, and remained at the same level in November. According to most forecasts, it will slightly increase to 47.2 in December. This fact is unlikely to impress EUR/USD traders. However, if this indicator falls into the "red" (more precisely, if it falls below 46.7), then in that case, market participants may react strongly to the data, as dovish expectations regarding the Federal Reserve's future course of actions could rise again.

The minutes of the December Federal Reserve meeting is also set for release on Wednesday. Take note that the December meeting was the most dovish one in 2023. Instead of the widely expected "moderately hawkish" stance, the central bank expressed very accommodative comments, stating its readiness to lower interest rates in 2024 (according to the updated dot plot – by 75 basis points over the year). Fed Chair Jerome Powell mentioned that during this meeting, Committee members discussed the timing of the rate cuts. In this context, he noted that the general expectation is that the rate cut will become the main topic for further discussion. Given the rhetoric of the accompanying statement and Powell himself, we can assume that the Fed Minutes will exert additional pressure on the greenback.

Thursday

The key economic report on Thursday is the German inflation data. According to most experts, the Consumer Price Index accelerated to 3.7% year-on-year in December, following a decline to 3.2% in November. The harmonized CPI is also expected to show growth, rising to 3.8% year-on-year (after falling to 2.8%). If these figures come in at least in line with expectations, the bulls will have another reason to push the pair higher, as German data often (almost always) correlates with the overall European data.

Friday

The euro area is set to release its inflation data on Friday. This should be viewed in light of the previous statements made by representatives of the European Central Bank. To recall, over the last two weeks of December, several members of the ECB stated that the central bank would keep interest rates at their current levels for quite a while, at least throughout the first half of 2024. The common theme of these statements is that it's too early for the eurozone to celebrate victory over inflation. If December's figures show accelerated growth, this will provide support to the euro. According to preliminary forecasts, the CPI will rise to 3.0% in December after dropping to 2.4% in November. The index will show an upward trend for the first time after seven consecutive months of decline. The core index is expected to decrease to 3.4%. If it unexpectedly surges (after four months of decline), this will place the bulls in a favorable position.

Key labor market data will be published during the U.S. session. Preliminary forecasts do not bode well for the dollar. For instance, the unemployment rate is expected to rise to 3.9%, and the number of employed is projected to increase by just 160,000. The indicator may also disappoint dollar bulls: it is predicted that the average hourly earnings will decrease to 3.9% on an annual basis (the weakest growth rate since June 2021).

Conclusions

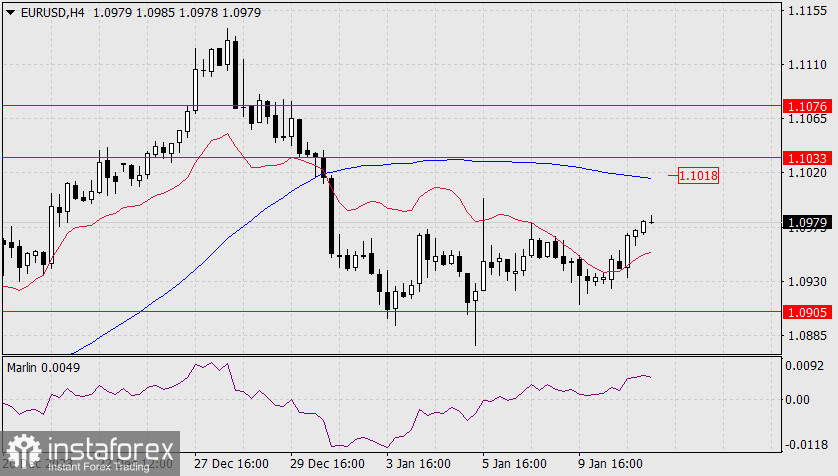

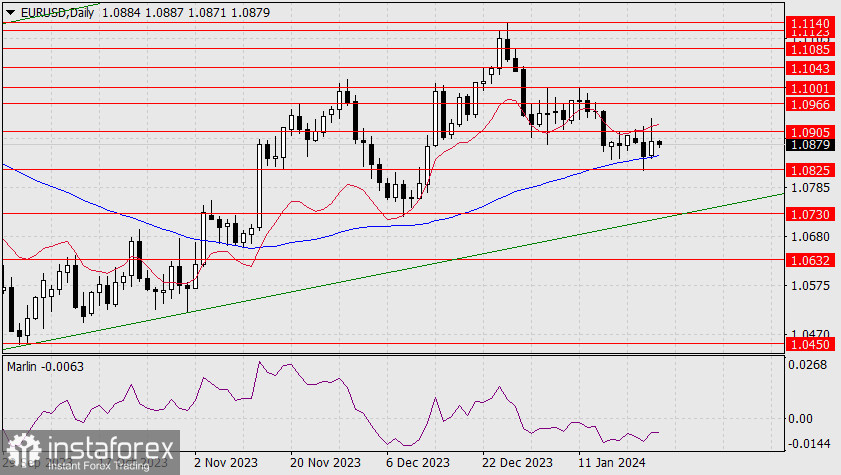

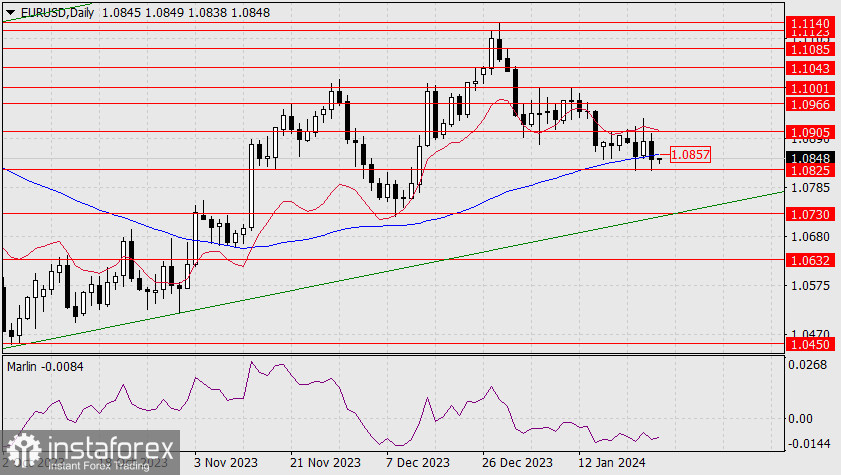

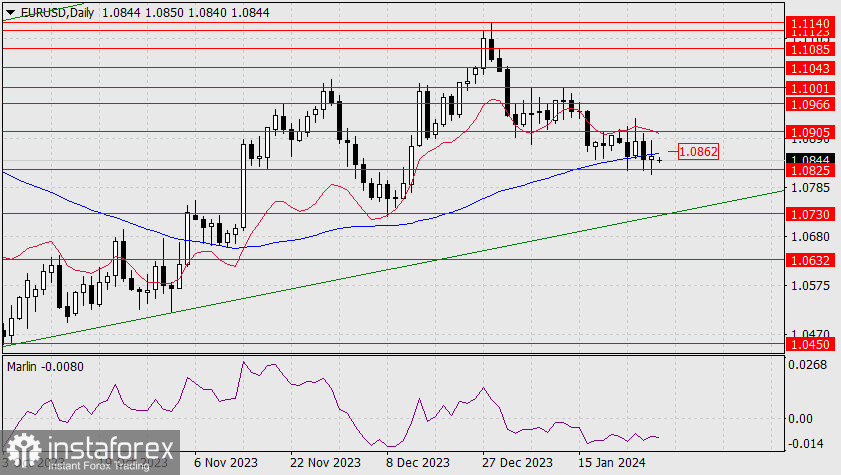

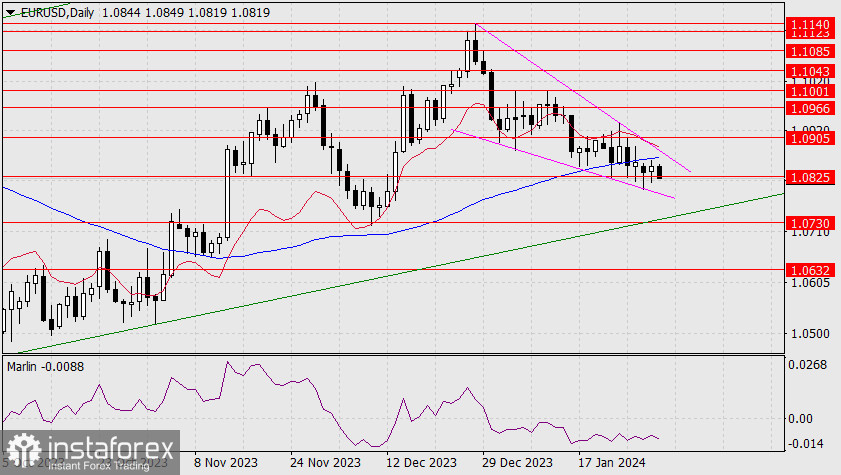

The EUR/USD pair still has the potential to rise. Soft Fed minutes, accelerated inflation in Germany and the eurozone, as well as weak Non-Farms, will support the pair's uptrend, assuming that all events align with the expectations of most experts. In this case, buyers can expect the pair to return to the 1.1130 level, which corresponds to the upper Bollinger Bands line on the daily chart. The primary target of the uptrend is at the 1.1250 level (the upper Bollinger Bands line on the monthly timeframe), but it's too early to talk about that price level at this point.

Analysis are provided by InstaForex.

Read More