Re: InstaForex Analysis

Forex Analysis & Reviews: Forecast for GBP/USD on July 26, 2022

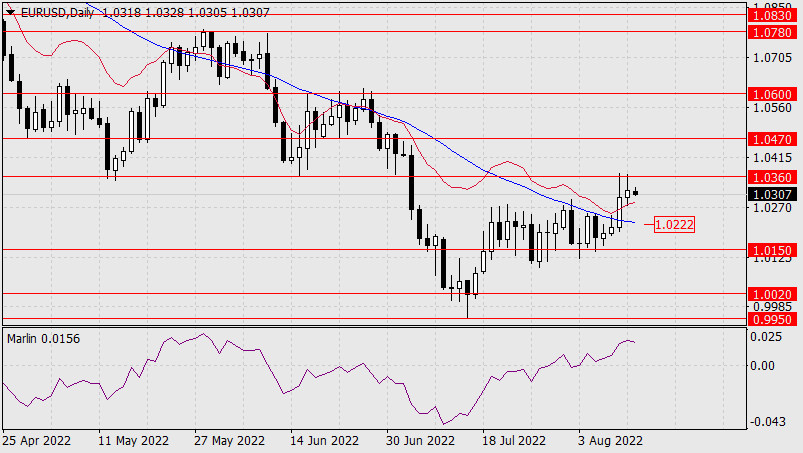

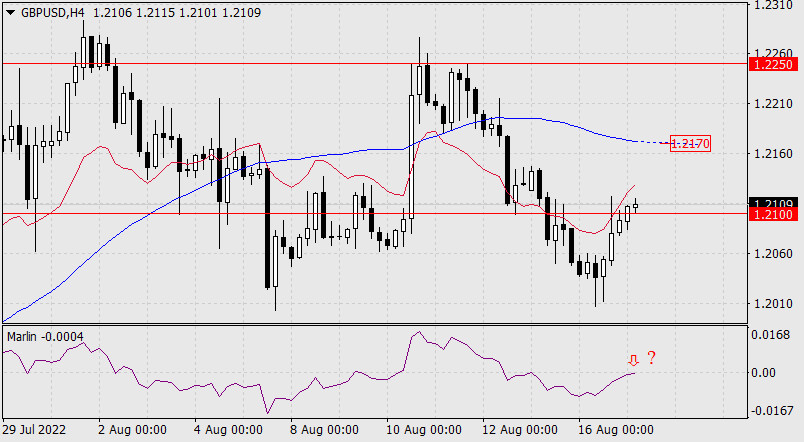

Yesterday, the British pound made the first attempt to break above the MACD indicator line on a daily scale. This morning, the pound is more confidently going above this resistance, approaching the target level of 1.2100. Surpassing the level opens the 1.2230 target. Consolidating above 1.2230 may extend the price growth to the level of 1.2435.

The Marlin Oscillator is actively growing in the positive area, instilling optimism in the bulls. Of course, it is possible that the price will not be able to overcome the strong level of 1.2100, and then Marlin's exit above the zero neutral line will become false, and the price will turn towards 1.1800.

The price is completely in an upward position on the H4 chart, since its local growth occurs above both indicator lines and the Marlin Oscillator develops in the positive area. A signal for the development of growth will be the price consolidating above the level of 1.2100. The absence of a signal can turn the price in the opposite direction.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.