What It is Important to Know about NFT in 2022

Author: Andrey Goilov

Dear Clients and Partners,

Last year, when people started selling NFT for millions of dollars, these digital assets became a new investment option. Some investors remained skeptical, while others became quite confident that non-fungible tokens would change the market.

For example, Twitter founder Jack Dorsey sold the tokenised version of his first personal tweet for $3 millions. For your information, he put up for sale a tweet saying “just setting up my twitter”, and the demand was insane.

What is NFT crypto token

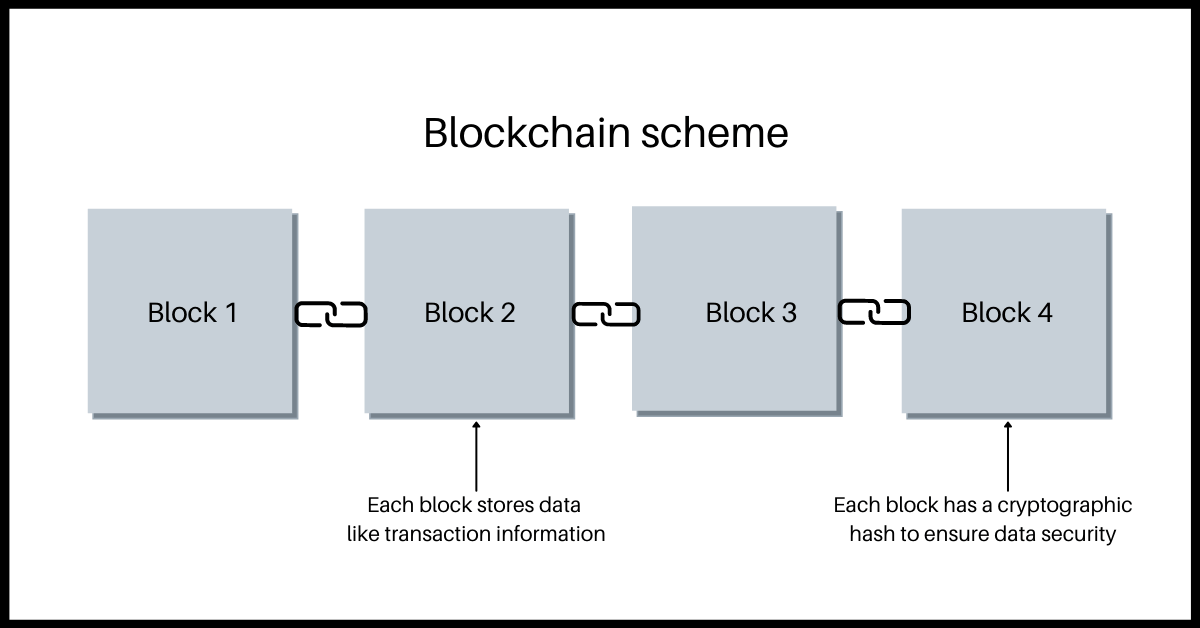

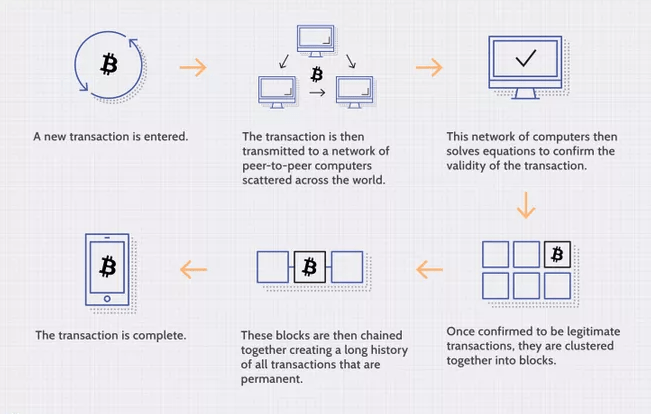

Non-Fungible Tokens are unique blockchain-based digital assets the, among other things, have peculiar metadata. NFTs are coded by the same software that is used for digital currencies. They are sold and bought on digital platforms for crypto.

The NFT technology is used for creating a unique digital certificate of a valuable thing, such as a painting, photo, music, video, and even real estate. Moreover, tokenising tangible assets makes buying them more efficient and fraud-safe.

Current popularity of NFT crypto tokens is explained by how easy they are to buy. In December last year, there were NFTs sold for $12 billion.

How NFT differs from crypto

NFT and crypto have two obvious similarities: both are digital currencies and blockchain-based. However, digital money is fungible, and crypto exchange confirms it.

Moreover, each altcoin remains valuable regardless of the platform it was bought on. For example, each BTC equals any other BTC.

A less obvious common feature of NFT and crypto are speculation markets that create agitation around currency prices. The price of a token depends on demand: when the token is popular, the price grows, when the demand shrinks – the price follows it.

Types of NFT

In most cases, non-fungible tokens are created from tangible or non-tangible objects. Most popular options are virtual and physically existing real estate, sport events, and gaming accessories.

Real estate

Apartments and houses have unique furnishing and decoration, which means they satisfy the conditions of NFT. There are already examples of selling real estate as NFTs.

Now NFT companies can gather money for building a new apartment complex by selling ownership to individual investors as NFTs. Then those investors will be able to sell their NFTs to next investors while the real estate is being built.

Virtual real estate

Metaverse is a digital reflection of the real world, and the demand for it is growing all too fast. An example of NFTs in metaverse is the Decentraland project.

This is a three-D gaming world where gamers buy virtual land plots and build houses on them. Each land plot is a non-fungible token. Investors recommend keeping an eye on this market: virtual towns are built much faster than real ones.

What perspectives NFT market has

Flourishing growth provoked overwhelming skepticism of market experts, and many of them still insist on NFTs being a trivial bubble. However, these days such global brands as Nike or Microsoft keep experimenting with NFTs and the metaverse.

Analysts declare that NFTs and crypto will eventually be a part of the metaverse, and NFTs will integrate in the virtual world much faster. This idea is confirmed by the strong concern of global brands about digital assets.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team