Forex Analysis & Reviews: Forecast and trading signals for GBP/USD for December 17. Detailed analysis of the movement of the pair and trade deals. The pound has fully worked out the Bank of England's decision to raise the rate

Forex Analysis & Reviews: Forecast and trading signals for GBP/USD for December 17. Detailed analysis of the movement of the pair and trade deals. The pound has fully worked out the Bank of England's decision to raise the rate

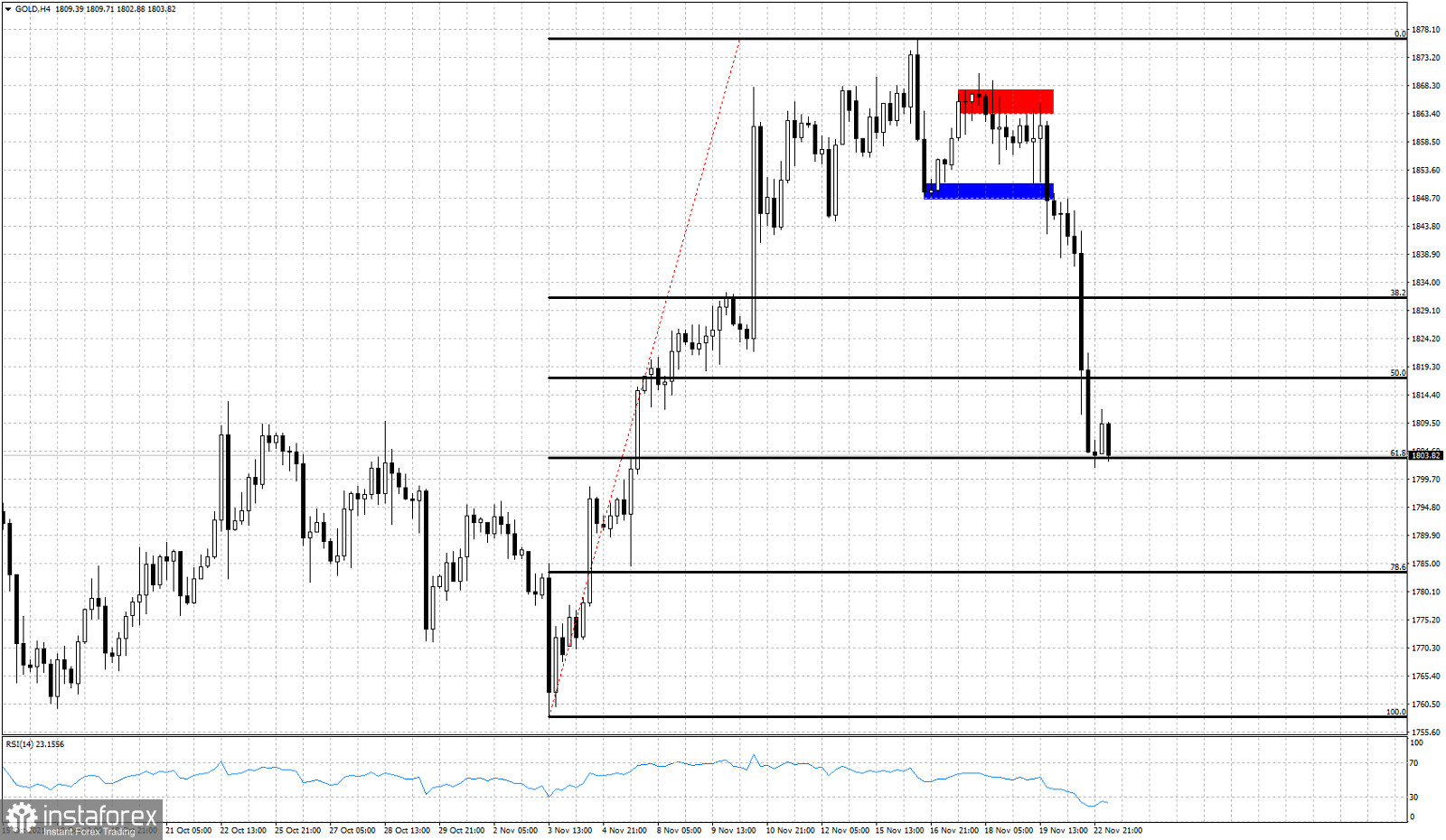

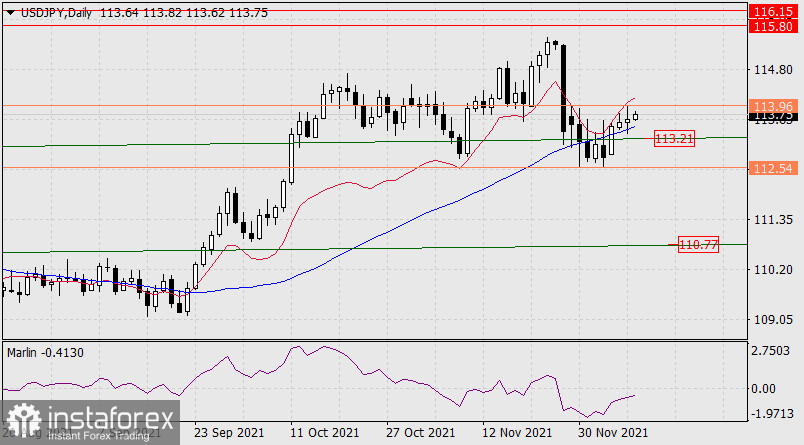

The GBP/USD pair showed volatility equal to 135 points on Thursday. The growth of the British currency's quotes began at the European trading session. Thus, British traders worked out the results of the Federal Reserve meeting. The British currency rose a bit more, but then rolled back down, as the index of business activity in the UK services sector turned out to be weak (figure "1" in the chart). However, the downward movement did not last long, so the Bank of England decided to raise the key rate to 0.25%, which provoked a strong growth of the British currency to the resistance level of 1.3367. But with the release of American statistics, it could give the impression that it was she who provoked the growth of the dollar. But we believe that this is not the case, since the US data is hardly strong. As a result, the pair "flew" perfectly from side to side yesterday, and we just have to deal with the trading signals and understand how to work out all these movements. The first buy signal was formed when the pair overcame the Senkou Span B line and the extreme level of 1.3276. After that, a little more than 20 points were passed up, which allowed traders to set the Stop Loss to breakeven. According to this order, the purchase transaction was closed. Then the pair returned to the area of 1.3265 - 1.3276 and not very confidently, but bounced off it, forming another buy signal. However, it was formed exactly at the time when the Bank of England announced the results of its meeting, so traders could hardly have time to open a deal and set a Stop Loss on it in order to take a risk. Thus, it simply did not work out to work out this signal. But the pound still allowed traders to earn. The pair very quickly reached the extreme level of 1.3362, from which it bounced and formed a sell signal, after which an equally strong downward movement began and in the late afternoon the quotes dropped by about 45 points from the point of forming a sell signal. Thus, near the level of 1.3317, short positions could be closed manually. Although a little, but it turned out that one could earn yesterday.

GBP/USD 1H

On the hourly timeframe, the pound/dollar pair has been in the stage of strong growth for a whole day, but at this time it has started a new round of downward movement and may well return to its original positions, as well as the euro currency. Formally, there is an upward trend now, since the price settled above the descending channel earlier, but after two important meetings of the central banks, we need to let the market calm down a little and see where the pair will be at the end of this week. On December 17, we highlight the following important levels: 1,3186 - 1,3193, 1,3276, 1,3362, 1,3406. There are no levels below, as the price has not been so low for more than a year. The Senkou Span B(1.3265) and Kijun-sen(1.3272) lines can also be signal sources. Signals can be "rebounds" and "breakthroughs" of these levels and lines. It is recommended to set the Stop Loss level to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator can move during the day, which should be taken into account when searching for trading signals. On Friday, a report on retail sales for November will be published in the UK, but this report is likely to be overshadowed by two meetings that took place earlier this week. Thus, we are not waiting for the reaction of traders to this report. Nothing interesting is planned in the United States today.

We recommend you to familiarize yourself:

Overview of the EUR/USD pair. December 17. Predictable Fed and passive ECB.

Overview of the GBP/USD pair. December 17. An unexpected expected surprise from the Bank of England.

Forecast and trading signals for EUR/USD for December 17. Detailed analysis of the movement of the pair and trade deals.

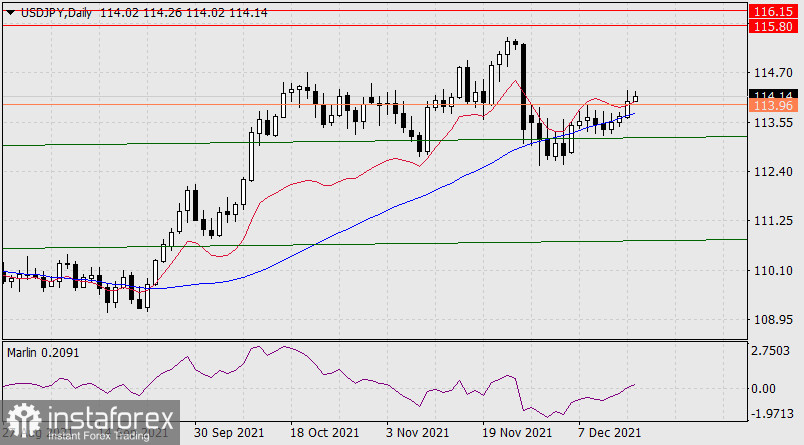

COT report

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

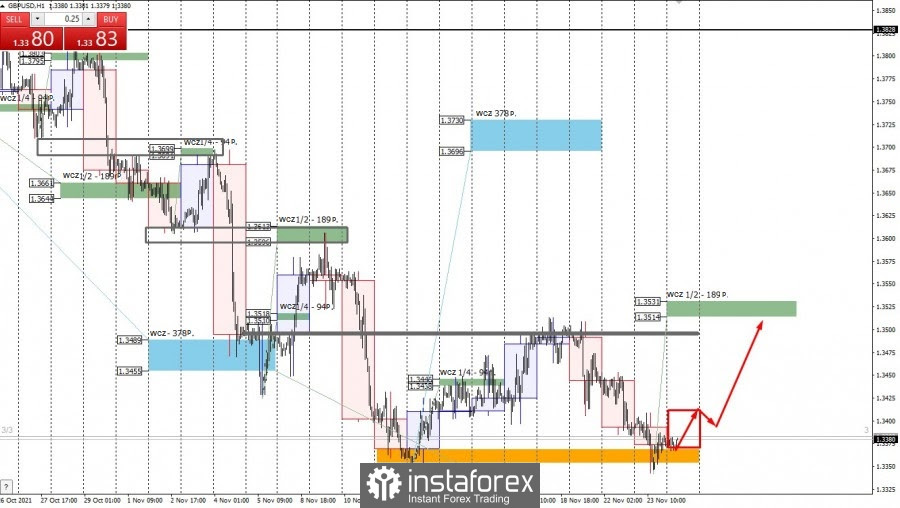

The mood of professional traders became a little less bearish during the last reporting week (November 30 – December 6). Professional traders closed 3,600 sell contracts (shorts) and 2,100 buy contracts (longs) during the week. Thus, the net position for the "non-commercial" group of traders increased by 1,500 contracts. This is a very small change even for the British pound. In general, the mood of non-commercial traders continues to be bearish, and quite strong. We draw your attention to how low the green line of the first indicator is located in the chart above, which reflects the net position of the non-commercial group. Thus, unlike the euro, the pound's decline in recent weeks looks just logical: major players sell off the currency, and it falls. A further decline in the British currency is also now quite likely, but at the same time we draw your attention to the fact that the green and red lines of the first indicator have moved quite far from each other. This may indicate that the downward trend is drying up. Thus, we get a situation in which the euro currency is not moving down quite logically, and the pound may complete its movement in the near future. Thus, for both major pairs, we recommend waiting for the downward trend to end, but do not start buying until specific buy signals are formed.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.