Morning Market Review

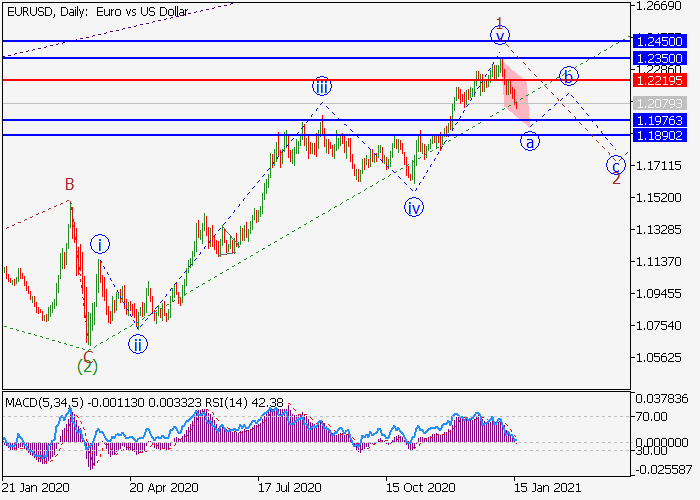

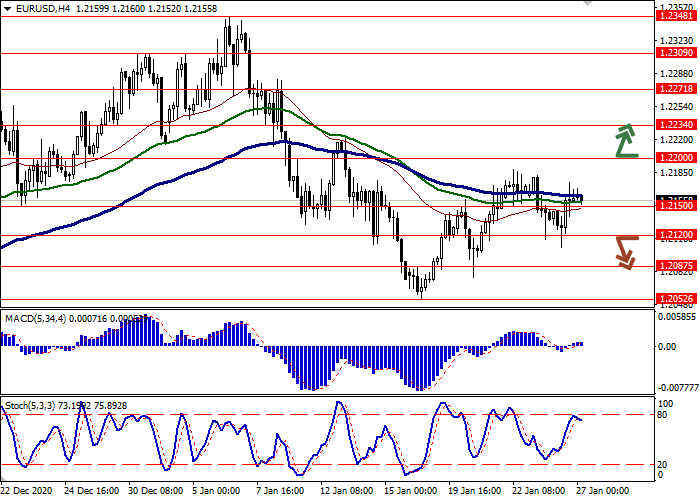

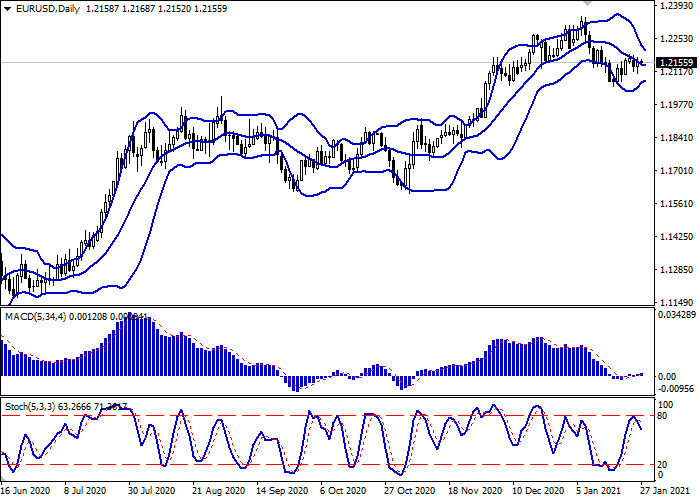

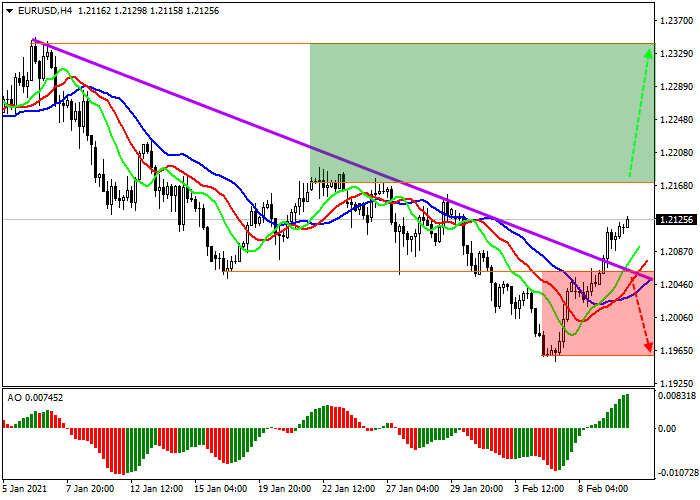

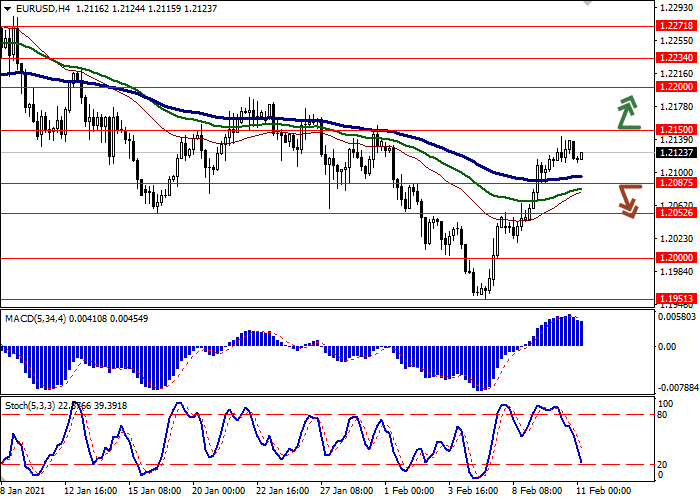

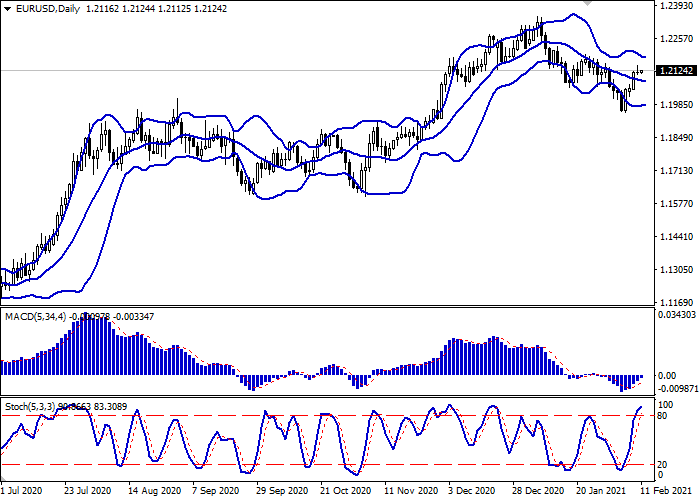

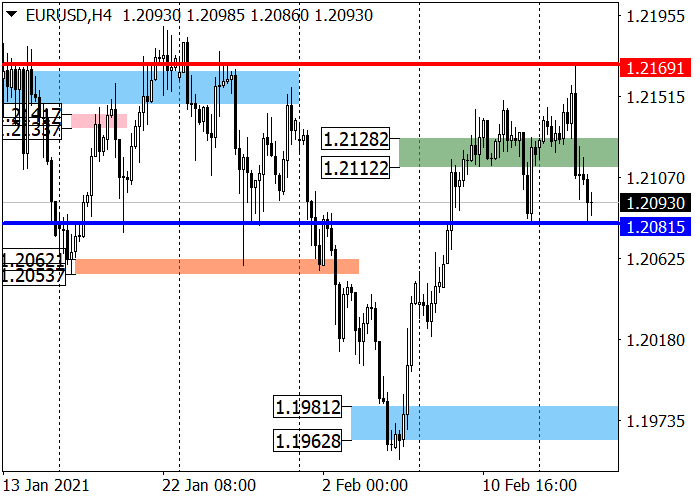

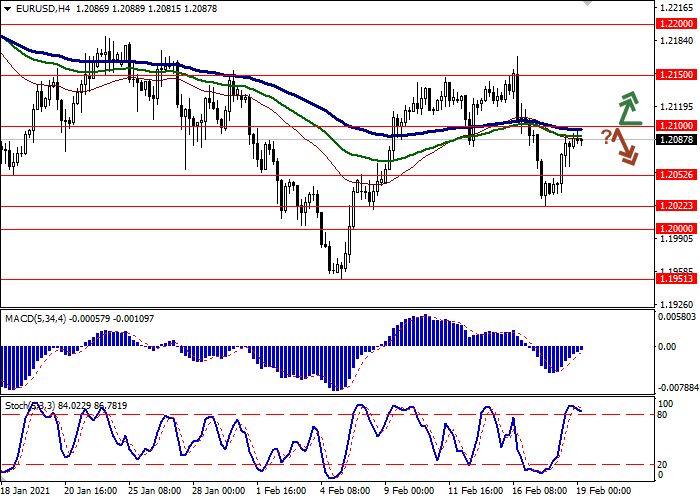

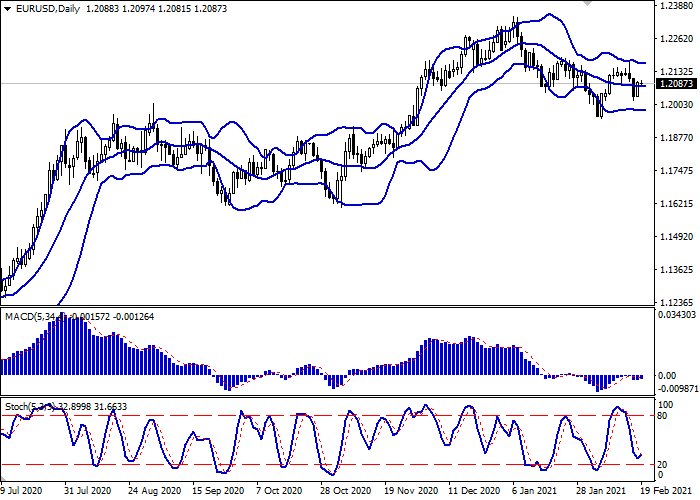

EUR/USD

EUR shows flat dynamics of trading against USD during today's Asian session, consolidating after an active decline the day before, as a result of which the instrument has updated local lows since February 8. USD was supported yesterday by strong macroeconomic data from the US on the dynamics of retail sales. In January, sales volumes increased by 5.3% MoM after a decline of 1% MoM in the previous month. Analysts had expected "bullish" trend to appear, but counted only on +1.1% MoM. Excluding car sales, the indicator in January increased by 5.9% MoM, which is also significantly better than the market forecasts of +1% MoM. Industrial production data for the same period was not so optimistic. In January, production slowed down from +1.3% MoM (revised from +1.6% MoM) to +0.9% MoM. However, the real dynamics again turned out to be noticeably better than market expectations at +0.5% MoM.

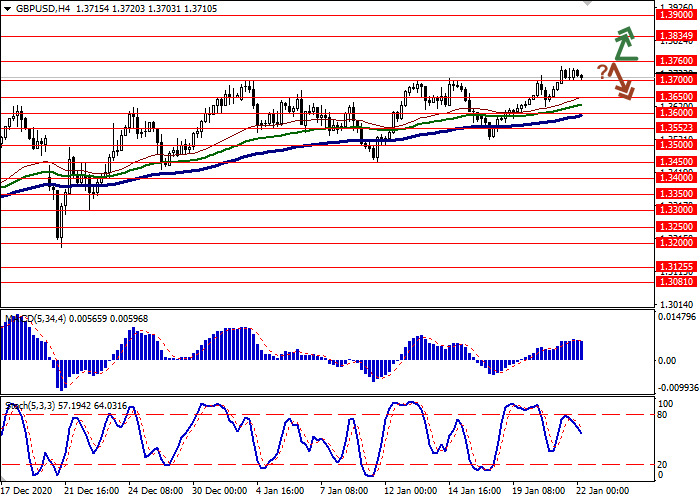

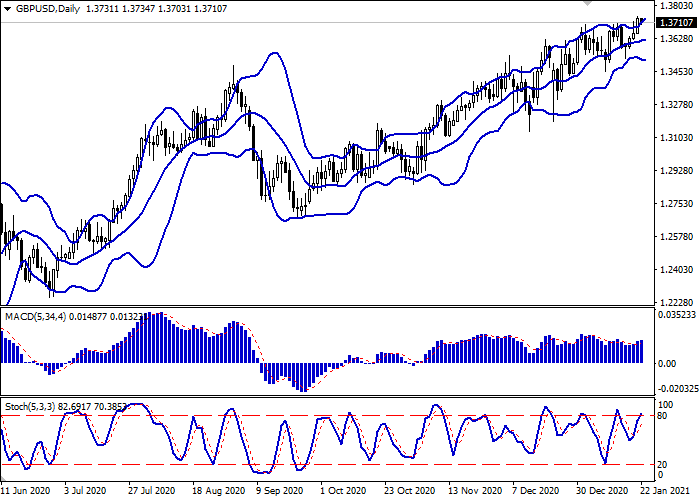

GBP/USD

GBP is trading ambiguously against USD during today's morning session. The day before, the instrument retreated from its record highs, responding to the strengthening of USD in response to the publication of strong macroeconomic statistics on retail sales in the US. In turn, the British statistics were not so optimistic. The Consumer Price Index in the UK in January fell by 0.2% MoM after growing by 0.3% MoM in December. Analysts, however, had expected a twice as strong fall. On an annualized basis, the index accelerated from +0.6% YoY to +0.7% YoY, beating the forecasts of +0.5% YoY. The Retail Price Index for the same period fell by 0.3% MoM after rising 0.6% MoM at the end of last year. Analysts had expected decline by 0.4% MoM.

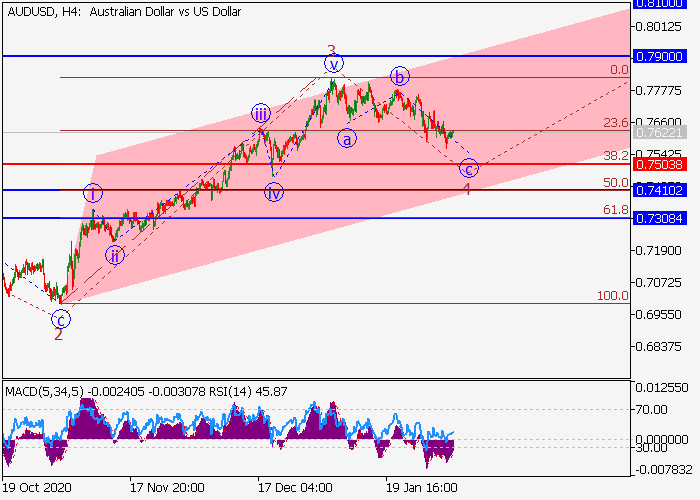

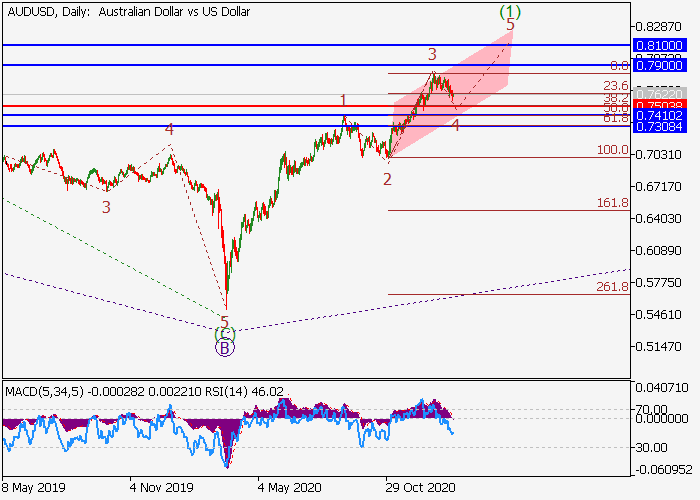

AUD/USD

AUD is relatively stable against USD in Asia today. The instrument is consolidating near 0.7750, recovering slightly after the decline at the beginning of the week. The focus is on macroeconomic statistics on the labor market from Australia. The Unemployment Rate in Australia in January fell from 6.6% to 6.4% against the forecast of 6.5%. At the same time, the Employment Change increased by only 29.1K after an increase of 50K in December. Analysts expected growth of 40K. Curiously, the growth in employment as a whole is due to an increase in the level of Fulltime Employment, while Part-Time Employment in January fell by 29.8K jobs. The Participation Rate in January fell slightly from 66.2% to 66.1%.

USD/JPY

USD is showing a slight increase against JPY in trading this morning session, trying to win back some of the losses suffered the day before. USD is still supported by the positive macroeconomic data from the US on the dynamics of retail sales, released on Wednesday, and many analysts associate the appearance of negative dynamics only with technical factors. Today, investors are focused on the statistics on the dynamics of jobless claims in the US. The indicator is expected to continue its moderate decline, reflecting the gradual recovery in the US labor market after the pandemic. It is also worth paying attention to the publication of data on the dynamics of building permits in January and the Philadelphia Fed Manufacturing Survey for February. Interesting statistics from Japan will appear only on Friday with the release of the inflation cut in January-February and Jibun Bank Manufacturing PMI for February.

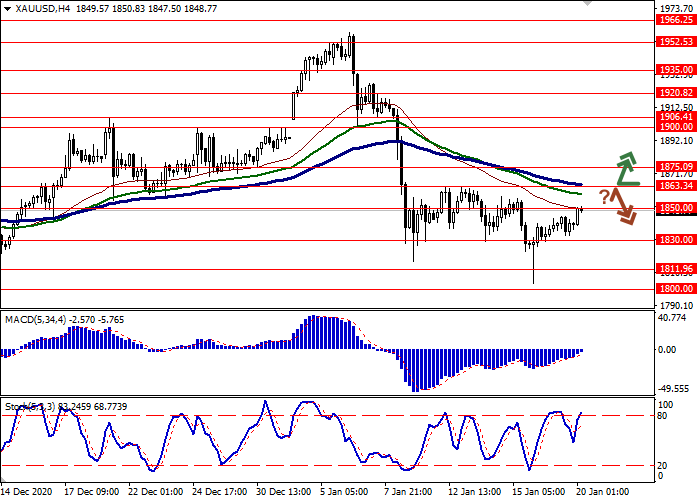

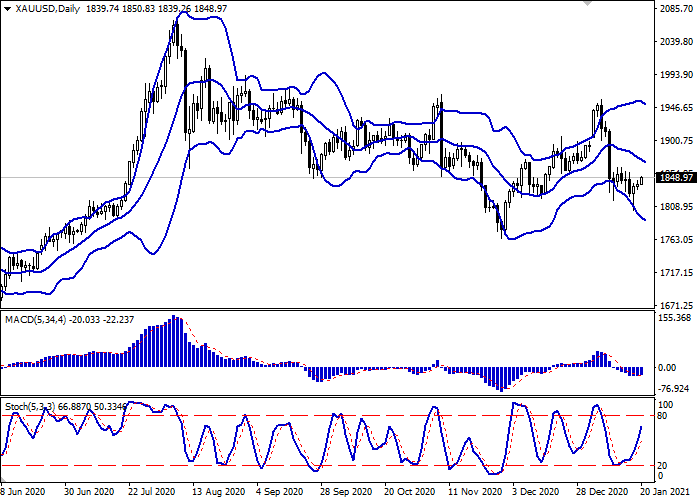

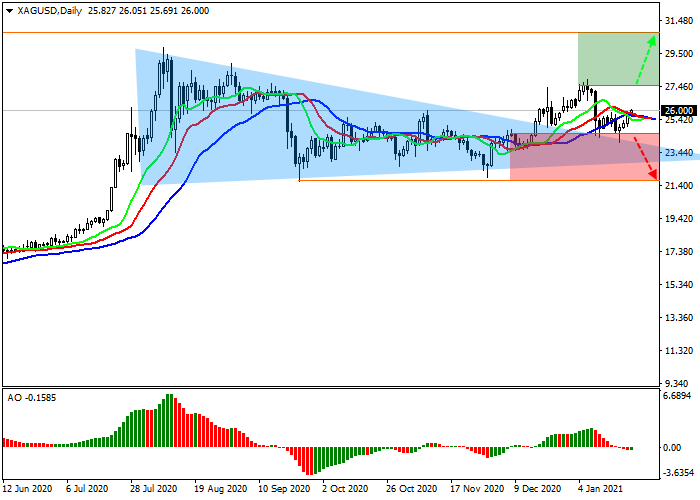

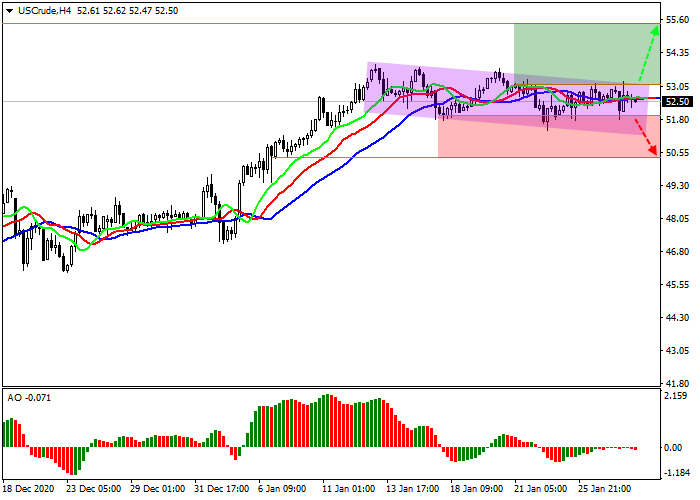

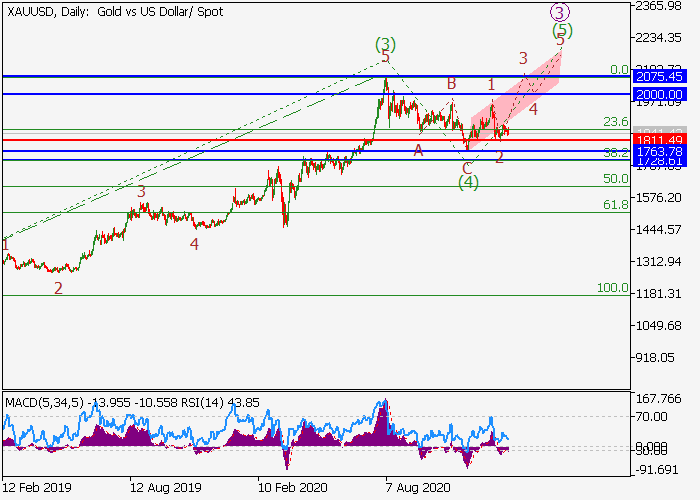

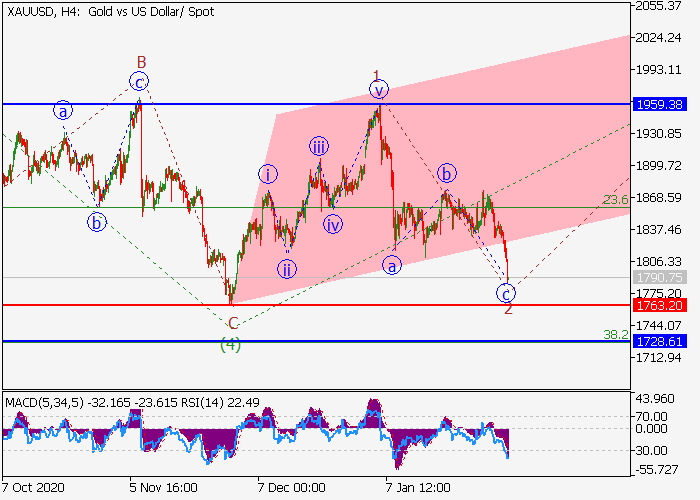

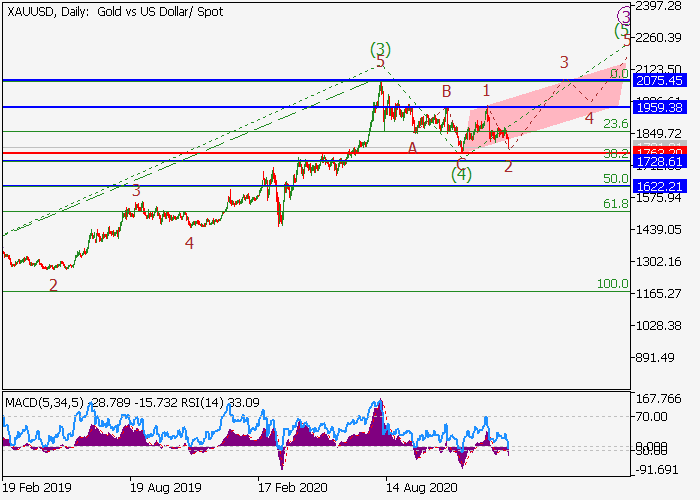

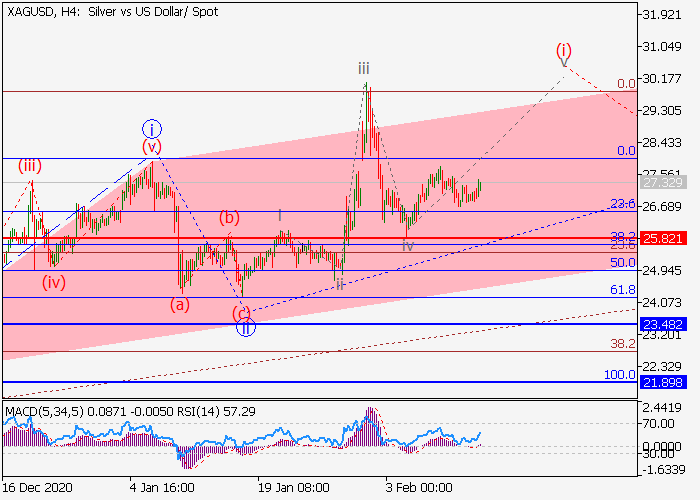

XAU/USD

Gold prices are showing quite active growth during today's morning trading session, offsetting the no less active decline the day before, which led to the renewal of local lows since November 30. The uptrend was triggered by technical factors, while USD gained additional support in the form of strong US retail sales data for January. In turn, investors are still expecting the development of the situation with the stimulus package for the US economy at USD 1.9 trillion. It is predicted that the approval of such an expensive program, taking into account the current situation in the US domestic market, will lead to a noticeable increase in inflationary pressures. In the meantime, traders are more interested in the yield of US Treasury securities, which are breaking new local records.