Re: Forex Technical Analysis & Forecast by RoboForex

Ichimoku Cloud Analysis 11.09.2020 (GBPUSD, AUDUSD, USDCAD)

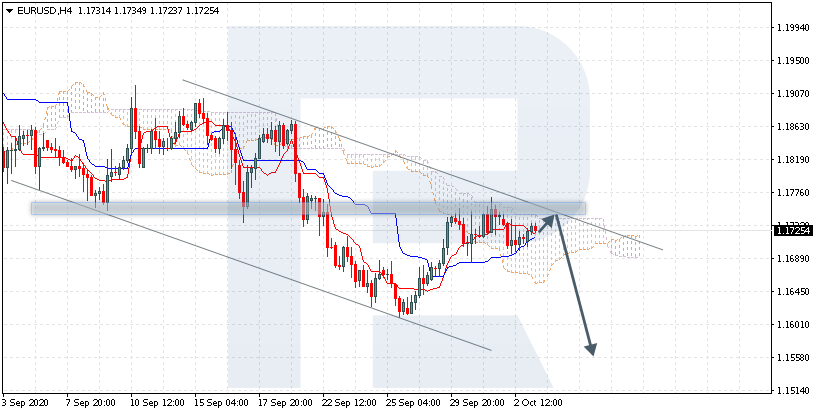

GBPUSD, “Great Britain Pound vs US Dollar”

ВGBPUSD is trading at 1.2820 under the Ichimoku Cloud, suggesting a downtrend that remains very strong. A test of the lower border of the Cloud at 1.2895 is expected, followed by falling to 1.2545. An additional signal confirming the decline will be a bounce off the upper border of the descending channel. The falling will be canceled in the case of a breakaway of the upper border of the Cloud and securing above 1.3065, which will mean further growth to 1.3155.

Read more - Ichimoku Cloud Analysis GBPUSD, AUDUSD, USDCAD