Blaiserboy wrote:Rich.....

Would it be possible for you to illustrate some settings re the 85/15.

I think I am grasping your approach but I am lost as to how you execute the plan.

Would you be able to clarify a bit

Thanks very much

daveM

Hi Dave

I do this stuff mostly within MT4....but I was thinking that a way to apply it for EA Studio would be as follows.

If you wanted to do this exercise within EA studio using the validation tool, you would need to upload your entire data history into EA Studio. I think we can have up to 500,000 bars in EA Studio (not sure).

Undertake your workflow process to data mine using the data horizon for say the last 5 years (up to say last month) using D1 data for your trend following model. The reason why I suggest a trend following model is that it is very unlikely that other methods will stack up over such large data sets.

Rather than optimise these strategies, simply generate lots of different 'entry' types of trend following models using your presets where possible and use initial stop and trailing stop only for exits. Diversification is what you are looking for.

This will generate a collection per market of say 100 solutions that have been data mined over the 5 year range (no OOS). Save this set and then create another set on another market. Let's say we get a collection of 10 different markets with say 100 solutions each. Assume we use validation criteria that sets the bar fairly high for this short term testing.

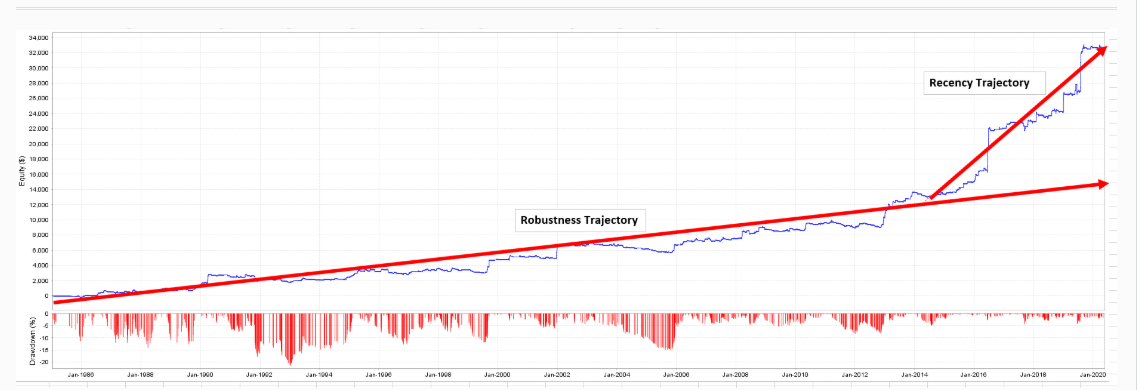

Now that you have your sets of 100 x 10 markets..save these collections and name them and then re-import into the validator but then retest the entire set of collections on very long range data also up to last month. Approximately 85% of the data in this phase will be OOS. Set the validation criteria a bit lower but ensure that your criteria demonstrate positive expectancy and good return/drawdown.

Save the successful candidates from the run. You may find you need to redo the entire workflow to this point a few times until you build a sufficient stock pile of collections that have passed both the short range and the long range test period.

Let's say you create a stockpile of say 100 solutions per market that are both:

1) Short term solid performers - This ensures that your solutions are 'recent' strong performers; and also

2) Robust candidates long term (that won't fall over as soon as you implement them live). This preserves your capital.

Then re-import back into the validator and use the short term settings again and rank your validated results from top to bottom using your preferred metric. I would probably use return to drawdown again.

You will then need to compile say the top xx of them into a preferred sub portfolio (per market) using portfolio compiler software (say QuantAnalyzer) to get the best bang for buck in terms of correlation.....and then further compile these sub portfolios into multi-market solutions that offer 'the best bang for buck' in terms of correlation.

Put onto a demo (only for a short period to confirm it is free of execution issues) and deploy as soon as you can.

Retain these collections and rerun using the validator next month using a rolling 5 year window) but retain all the history for the robustness phase (this should just keep growing)...but the rolling 5 year window ensures your EA's keep fairly sharp. Continue to add to your base collections as well so that you continuously grow your collections.

This process would only be advised for trend following models where Monte Carlo and Walk forward testing methods are not recommended.

Something like this Dave. I hope it makes sense :-)

Cheers

Rich

Diversification and risk-weighted returns is what this game is about