Re: Forex Technical Analysis & Forecast by RoboForex

Fibonacci Retracements Analysis 16.03.2020 (GOLD, USDCHF)

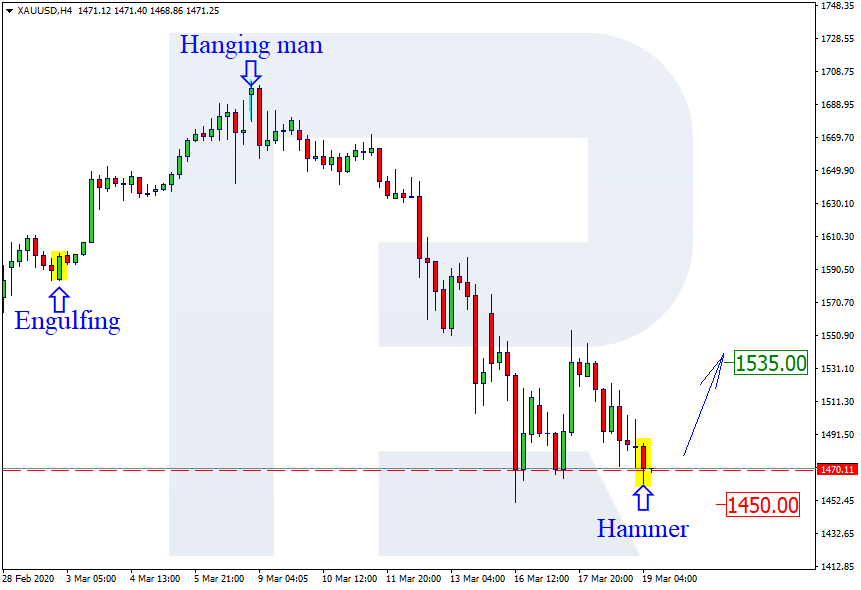

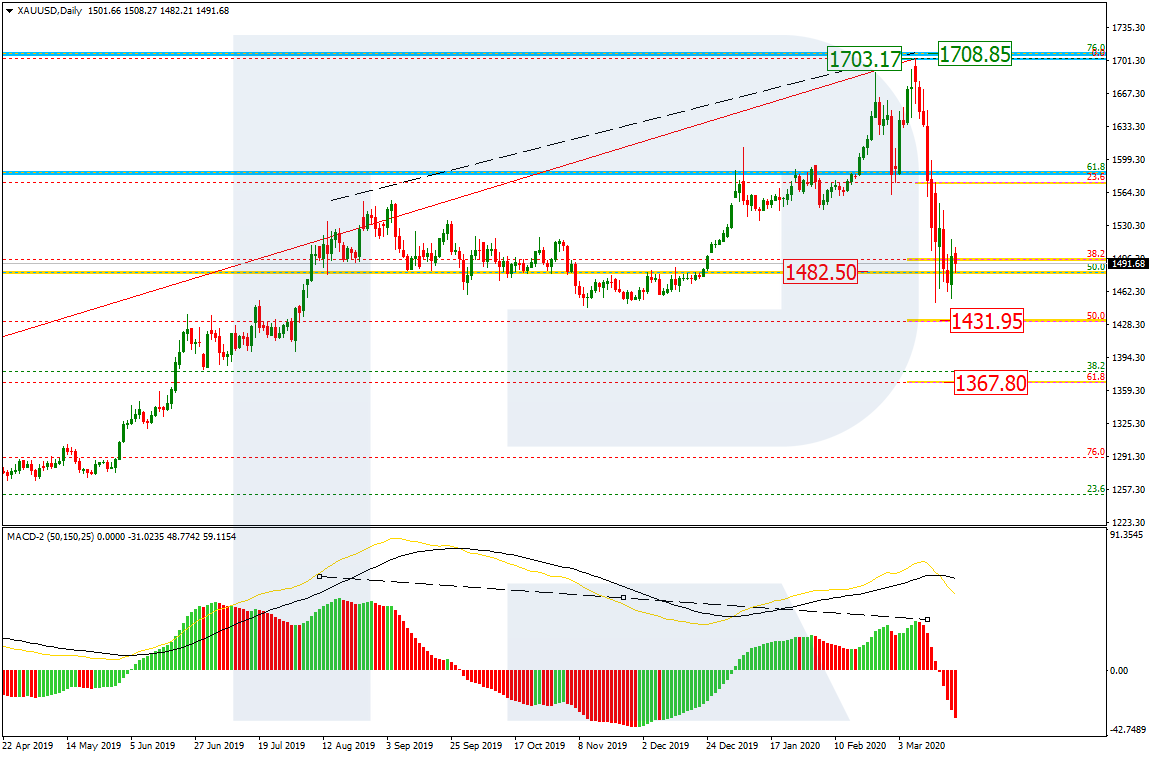

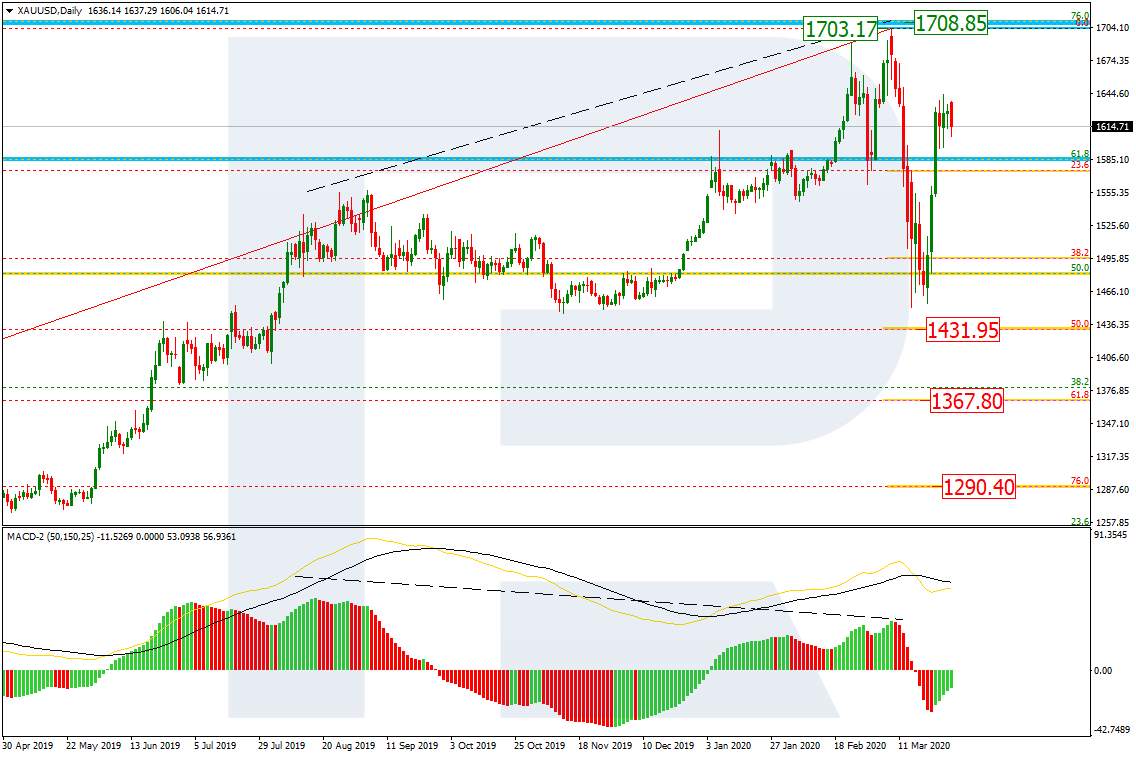

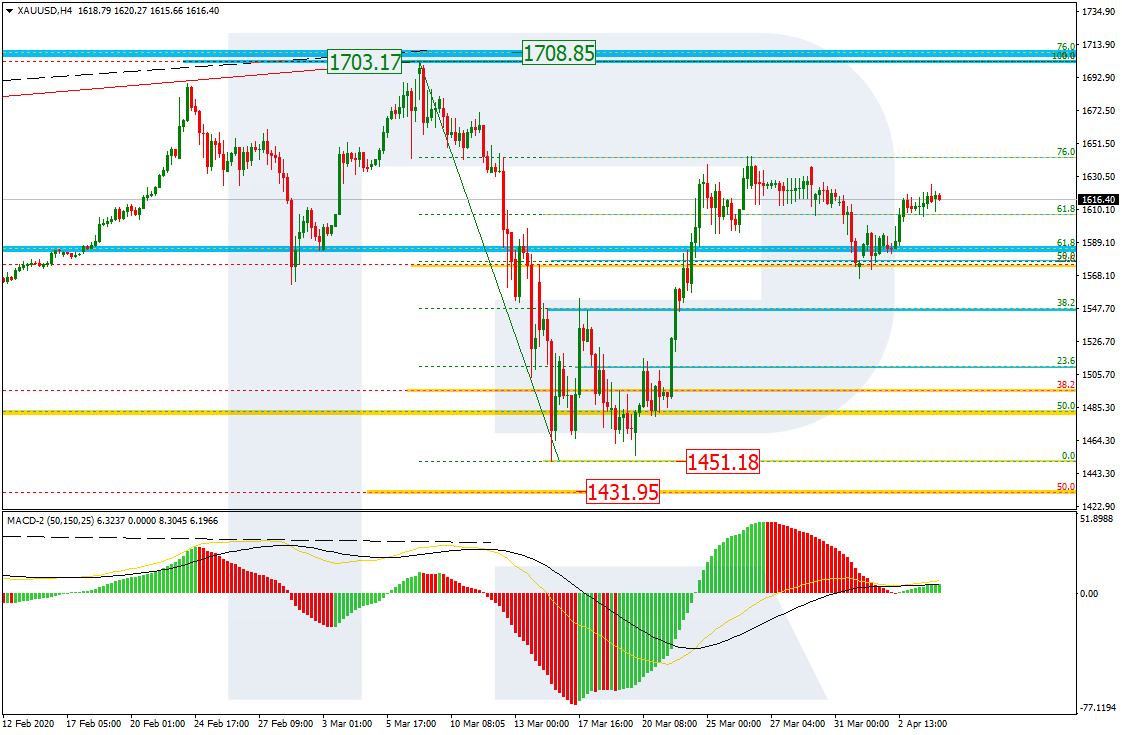

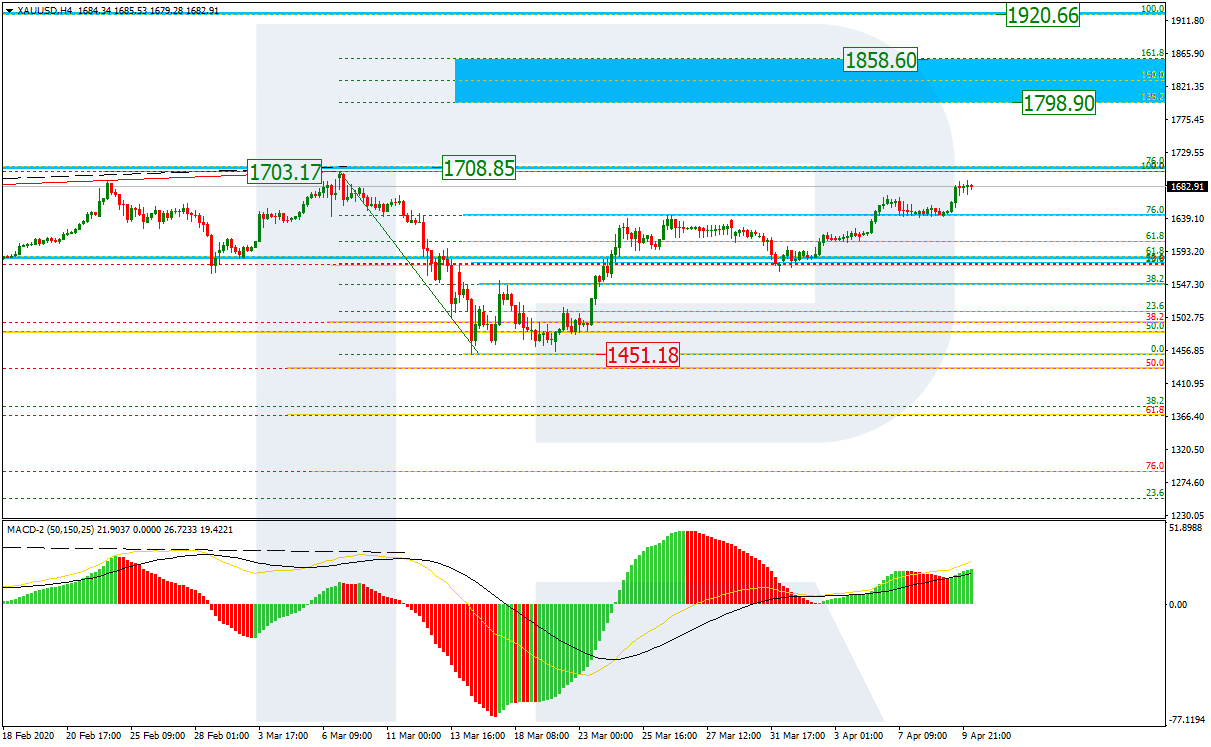

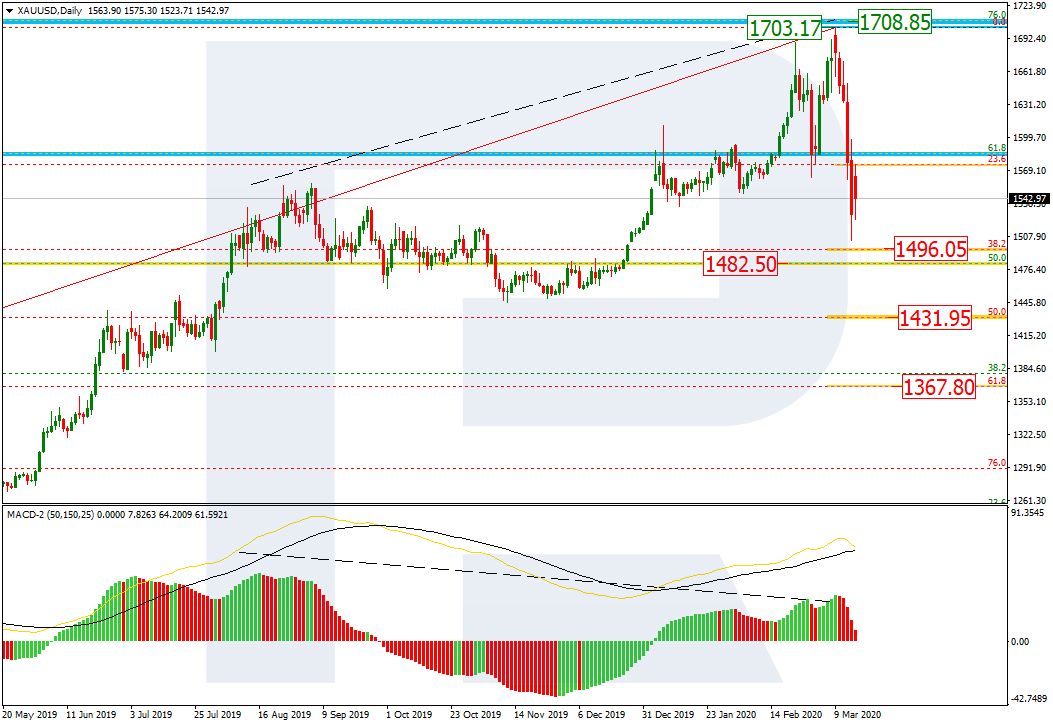

XAUUSD, “Gold vs US Dollar”

As we can see in the daily chart, the divergence made the pair reverse to the downside after reaching 76.0% fibo at 1708.10. Right now, XAUUSD is getting closer to 38.2% fibo at 1496.50, which is a long-term support level not far from 50.0% fibo at 1482.50. After reaching and breaking this area, the price may continue falling towards 50.0% and 61.8% fibo at 1431.95 and 1367.80 respectively. The resistance is the high at 1703.17.

Read more - Fibonacci Retracements Analysis GOLD, USDCHF