Re: InstaForex Analysis

ECB meeting: the bearish triumph did not work, but buying EURUSD is risky

Trading "on the news" is extremely risky - today traders could once again see this. The January meeting of the ECB turned out to be very intense, but the expected "bear triumph" turned out to be an illusion or, more simply, a trap.

The initial decline in EUR/USD to the bottom of the 13th figure was very reasonable. Mario Draghi began his press conference with a series of negative comments that did not bode well for the pair's bulls. First, he reiterated that the latest macroeconomic data turned out to be much weaker than the ECB's preliminary forecasts and in the short term this trend will continue. In his opinion, the root cause of such a dynamic is a decrease in external demand in the EU countries. First of all, of course, we are talking about Germany, which showed in last year's lowest growth of the economy over the last 5 years.

Secondly, Draghi recalled that the European Central Bank "has all the necessary tools" for regulating monetary policy and, if necessary, the central bank uses them. What kind of levers of influence are we talking about, the head of the ECB did not elaborate, however, even without this nuance, it became clear that if the downward dynamic of inflation continues, the regulator will apply retaliatory measures to soften its policies.

Third, Mario Draghi was rather pessimistic about Brexit's prospects. In his opinion, the uncertainty in this issue is growing, and the negative factors associated with the "divorce process" only exacerbate the difficult situation in the eurozone economy. "If the factors continue their impact, the economy will show a weakening over a longer period of time," said the ECB head. This is a fairly transparent allusion to the upcoming events to be held in the British Parliament next week. If the parties do not find mutual understanding and do not approve the deal, the uncertainty will have a negative impact on both the European economy and the British one.

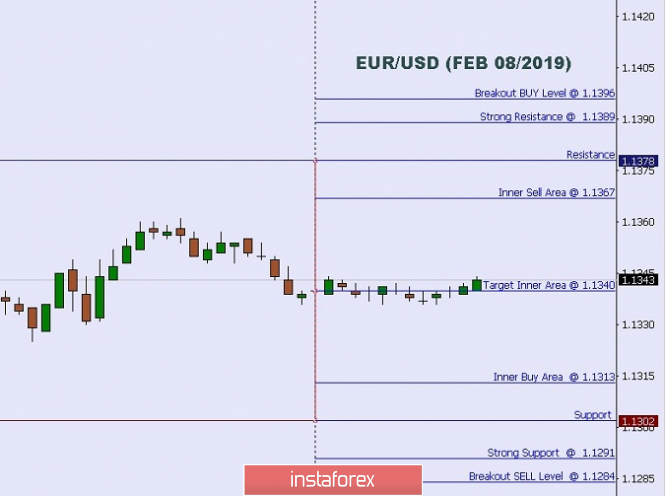

Such a portion of the "dovish" comments pulled the EUR/USD to the mark of 1.1307, thereby attracting bears. However, literally in a few minutes the situation changed radically. During the question and answer period, Draghi not only offset the "dovish" mood, but also provoked a demand for a single currency throughout the market. First of all, the head of the ECB said that at the moment there are no grounds for implementing the next TLTRO program. According to him, this issue was discussed at the meeting, but no decision was made on it, and in general this topic requires a "good justification".

It should be noted that TLTRO is perceived by the market as one of the tools to mitigate monetary policy, so this position of Draghi played into the hands of the European currency. Although many experts warned that members of the regulator were still discussing the possibility of a new round of long-term lending programs in December. The previous TLTRO program ends in mid-2020, however, according to some economists, the banking sector may already need liquidity this year. Nevertheless, the central bank is not in a hurry with this issue, and this fact has supported the bulls of EUR/USD.

Afterwards, Mario Draghi made quite optimistic assessments in contrast to his initial statements. In his opinion, the growth rate of core inflation will accelerate in the medium term, given the positive dynamics of wages in the eurozone and the ECB accommodative policy. By the way, Draghi emphasized that in some EU countries full employment has been achieved, and the labor market continues to strengthen steadily. In addition, members of the regulator at the January meeting came to the unanimous opinion that the probability of a recession in the eurozone countries is close to zero. This thesis is consistent with the assessment of the prospects for the Chinese economy - according to "some members of the ECB" (Draghi did not specify exactly who we are talking about), the decline in the PRC economy will not last long, as "Beijing responds to all risks in a timely manner."

The final chord of the January meeting was the question of the prospects of the interest rate. Here Mario Draghi said that traders are laying in the current price of the first increase in early 2020: "...and this suggests that the markets understood us correctly," he added. However, the ECB at the end of the meeting said that it is not going to raise the rate "until the end of summer". And although the market did not receive a clear answer to the question – whether the rates will be changed within the current year – EUR/USD bears could not take advantage of this fact. Too "dovish" expectations of traders did not materialize, so they began to buy back the pair when approaching the bottom of the 13th figure.

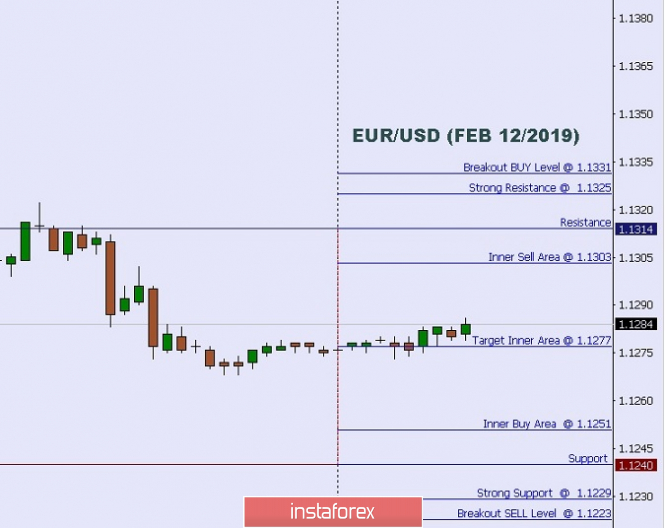

In summary, it should be noted that now we should be especially careful with long positions on the EUR/USD pair. First, the dollar received support from the manufacturing PMI. Secondly, the demand for the US currency may increase due to ambiguous news about the US-China trade negotiations. Representatives of Beijing and Washington voice opposite theses – but if the risk of another failure increases, the dollar will rise in price throughout the market, and the EUR/USD pair will not be an exception.

Analysis are provided by InstaForex