Table of Contents

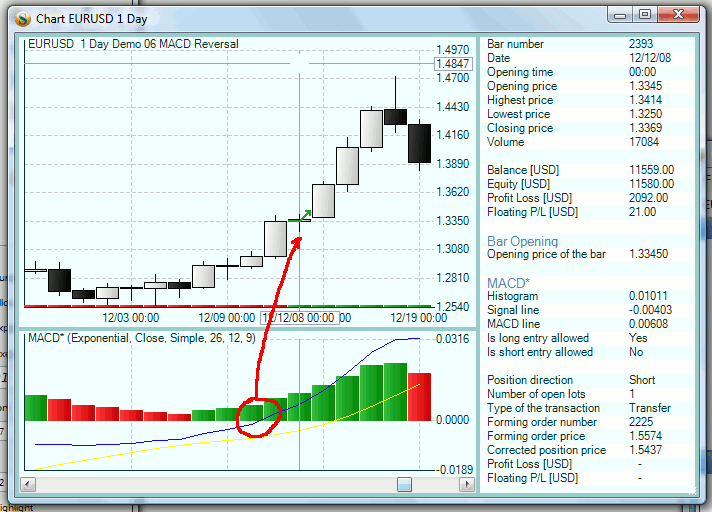

Demo 06 MACD Reversal

Author's Description

This strategy is for demonstrational purposes only and real-time trading is not advised.

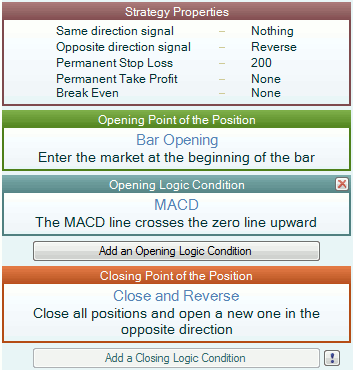

“MACD Reversal” strategy demonstrates the “Close and Reverse” technique of forex trading.

This is a classic reversal strategy with additional stop-loss. It keeps our position opened almost 100% of the time.

We get a signal when the MACD line crosses the zero line, and that signal reverses our position when the next bar opens.

The “Close and Reverse” logic, which is set in the “Closing Point of the Position” slot, is the condition that determines the reversal every time we get a signal. Whenever Forex Strategy Builder gets such signal it closes the current position and immediately opens a new one in the opposite direction.

Notice that the “Opposite direction signal” dropdown menu in the strategy properties dialog is locked to “Reverse” mode. The “Close and Reverse” exit logic makes this the only possible option.

The “Permanent Stop Loss” limits our loss to 200 pips. When the market reaches the stop loss level, the strategy closes the position without reversing it. That is the only time when we are out of the market.

The value of the “Same direction signal behavior” is not important here because it is impossible to have another signal in the same direction. MACD cannot cross the zero line twice in the same direction which means that the next signal we get will always be in the opposite direction to our current position.

Generated Description

Opening (Entry Signal)

Open a new long position or reverse a short position at the beginning of the bar when the following logic condition is satisfied:

- MACD* (Exponential, Close, Simple, 26, 12, 9); the MACD line crosses the zero line upward.

Open a new short position or reverse a long position at the beginning of the bar when the following logic condition is satisfied:

- MACD* (Exponential, Close, Simple, 26, 12, 9); the MACD line crosses the zero line downward.

Closing (Exit Signal)

- Close an existing long position and open a new short one, at the entry price, when a sell entry signal arises.

- Close an existing short position and open a new long one, at the entry price, when a buy entry signal arises.

Handling of Additional Entry Signals

Entry signal in the direction of the present position:

- No averaging is allowed. Cancel any additional orders which are in the same direction.

Entry signal in the opposite direction:

- Close the existing position and open a new one in the opposite direction using the entry rules.

Trading Size

Always trade a constant number of lots.

- Opening of a new position - 1 lot.

- Reversing a position - 1 lot in the opposite direction.

Permanent Protection

- The Permanent Stop Loss limits the loss of a position to 200 pips plus the charged spread and rollover.

- The strategy doesn't use a Permanent Take Profit.

* Use the indicator value from the previous bar for all asterisk-marked indicators!