Table of Contents

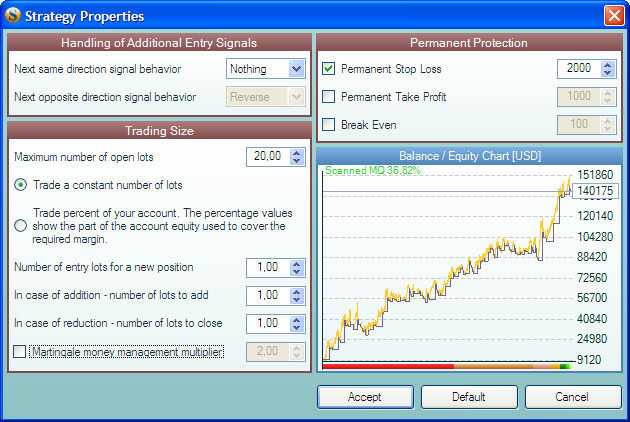

Strategy Properties

Here you can set the strategy's behaviour when additional signals are sent, the amount of the sums traded and the permanent limitation of loss and profit.

These parameters are a part of your trading strategy. They are saved together with it and apply to it only.

Handling of Additional Entry Signals

The signals a trading strategy sends can be divided into two types:

- entry the market signals. These are signals opening a position, which are sent by the entry logic of the strategy; and

- exit the market signals. These are signals closing the current position. They are sent by the exit logic of the strategy.

It is obvious what entry signals do when there is no open position at the moment - they open a new position. What happens, however, when an entry signal arises during an open position? Forex Strategy Builder allows us to test various variants depending on this dialog box settings.

Next same direction signal behaviour

This parameter sets the behaviour of the additional entry signals, which have the same direction as the position already opened. The opening of additional lots in the same direction is called Averaging.

There are three possible types of behaviour:

- Nothing - the signal has no effect. If an entry order has already been sent and its price reached, FSB will cancel the order. 1)

- Winner - this setting allows the adding of lots to an already open position but only if it is making profit at the moment of averaging. If the position is at a loss, FSB will cancel the entry order.

- Add - allows the adding of lots to a position.

Next opposite direction signal behaviour

Here you can set the behaviour of the additional entry signals, which have a direction opposite to the direction of the already opened position.

There are four possible types of behaviour:

- Nothing - cancels the signal or order;

- Reduce - the position is reduced with a certain number of lots. If at the time of reaching the price of the order the position has the same number of lots or less as the order, the position is closed;

- Close - the opposite direction entry signal closes the current position;

- Reverse - the current position is closed and a new position is opened in the opposite direction.

NB: We are analyzing the behaviour of those entry signals only sent by the strategy to enter the market. Although those are opposite direction signals and can reduce, close or reverse the position, they are not exit signals. Exit signals irreversibly close the position. Their behaviour cannot be changed.

Trading size

You can set the maximum number of open lots here. Regardless of how the lots were opened (at once or via adding).

There are two possibilities when setting the number of lots to be traded:

- a fixed number of lots;

- a percent of the available account (equity).

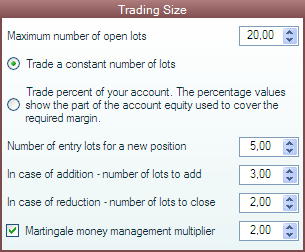

Trade a constant number of lots

With this option on the number of lots traded will always be the same for the given operations. In the given example:

Every time a position is opened it will include 5 lots.

In case we have adding to a position, 3 lots will be added. The total amount of lots traded cannot exceed the maximum number of lots set previously. In this case 20 lots.

If the logic of the strategy allows removal of lots from opened position, the number of lots closed will be 2.

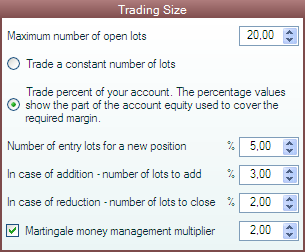

Trade a variable number of lots

If this option is on the number of lots traded will depend on the amount of the current account available (equity). The chosen number indicates the exact percent of the account used as a margin. The traded amount will be equal to the largest whole number of lots that could be opened with the selected margin.

Example:

Lets use the following account settings:

Initial account - $10 000

Lot size - $10 000

Leverage - 1 / 100

In this case, to open 1 lot worth $10 000, with 1/100 leverage, the required margin will be 100$ (10 000 / 100 = 100).

The allowed lots are set to 5% of the equity. 5% out of $10 000 is $500. That means that the allowed margin for opened lots is $500, equal in our case to 5 lots (using 1/100 leverage).

If our account grows to let's say $14 700, our trading margin will also grow to $735 (5% of $14 700 is equal to $735). However, we cannot open a third of a lot (only whole numbers), so we'll be able to open 7 lots (using $700 of the trading margin).

The same process is used to calculate the allowed lots for all the other operations.

You may change the lot size from the Instrument Editor tool.

Account currency, initial deposit and leverage are set in the Account Settings tool.

Martingale Money Management

Martingale is a popular money management system. It's main idea is to double the trading size after a losing trade. Martingale management in Forex Strategy Builder expands this principle by adding Martingale multiplier coefficient.

Martingale multiplier can be changed between 0.01 and 10. It's default value is 2.

When Martingale multiplier = 2, every next loosing trade has double size. The trading size is reset to the normal size after a winning trade or after a partial close or reversing a position.

When Martingale multiplier = 1, the trading size is not changed. It is same as if Martingale option was switched off.

The formula for calculating entry size is:

NextAmount = EntryAmount * (MartingaleMultiplier ^ ConsecutiveLoses)

Example:

| Multiplier | Initial Entry | After 1st Loss | After 2nd Loss | After 3rd Loss | After Win |

|---|---|---|---|---|---|

| 2.0 | 10000 | 20000 | 40000 | 80000 | 10000 |

| 1.5 | 10000 | 15000 | 22000 | 34000 | 10000 |

| 1.0 | 10000 | 10000 | 10000 | 10000 | 10000 |

| 0.5 | 10000 | 5000 | 2000 | 1000 | 10000 |

Permanent Protection

Permanent Stop Loss

If this option is on, every position we open will have a Stop Loss order attached to it with a price lower/higher than the entry price with the selected amount of pips. This option, as well as your exit logic, can close your positions. This way your position is protected from a loss greater than the selected number of pips.

Practically this means that if the price moves in a direction opposite to your position (long/short) with the amount of pips selected, your deal will be closed preventing further loss. Moreover, if this happens within more than 1 day, the rollover fee will also be added to the loss.

Permanent Take Profit

The Permanent Take Profit option places an additional exit level to your strategy. It closes a position after the market has moved in you favor with certain number of pips.

If you broker uses 5 digits quotation (3 for JPY), you have to consider that the TP and SL must be 10 times higher than on a 4 digits quotation. For example: 25 pips SL on 4 digits quotation is equal to 250 pips on 5 digits quotation.