Table of Contents

Quick Start

Using Expert Advisor Studio, you can easily create an Expert Advisor and discover a trading strategy by following a few easy steps:

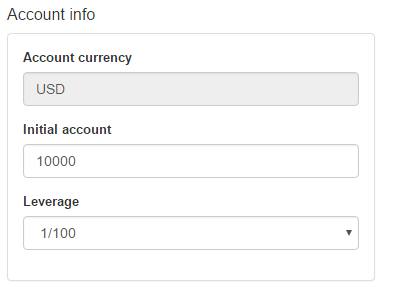

1. Set Your Account

Set up a virtual account in EA Studio the same way you set up a demo account with your Forex broker. To do this, go to the Settings tab and select your Account Currency, Initial Account Amount and the Leverage.

Ensure your settings in EA Studio correspond to your account at your broker. This ensures you achieve the same results in MetaTrader later.

2. Import Data from MetaTrader

We provide Data Export Scripts for MetaTrader 4 and MetaTrader 5 versions.

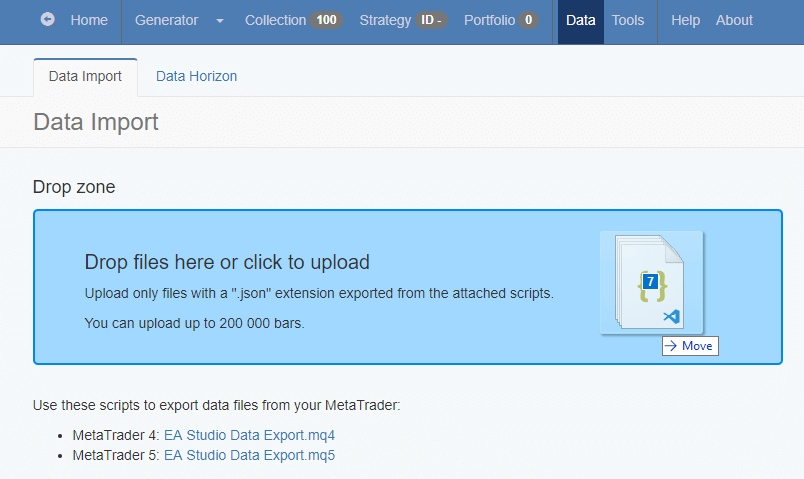

- Go to EA Studio and navigate to Tools > Data Import

- Download the appropriate script for your MetaTrader 4 or MetaTrader 5

- Open MetaTrader and go to File > Open Data Folder

- In this Windows Explorer window, find and open the MQL folder (MQL4 or MQL5). Then open Scripts.

- Paste the Data Export Script file in the Scripts folder.

- Return to MetaTrader and go to the Navigator box. Then right-click on Scripts and select Refresh

Additional steps for MetaTrader 5 (after you have done all the previous steps)

- When the script appears in the Navigator window, right-click it and choose Modify

- A text editor will open. From the menu on top, click Compile

- Close the text editor

Running the Data Export Script and Importing the Data

- Attach the script to the chart by either double-clicking it or dragging it onto your chart.

- That's it, you have saved the quotes.

- From the MetaTrader menu select File > Open Data Folder.

- From this folder navigate to MQL4 (or MQL5) > Files

- You should see a number of files. Those are the files the Export Script exported for you.

- Go to EA Studio > Data

- From the Files folder, drag and drop the files to the Drop Zone in EA Studio to upload them. (See the picture below)

3. Generate Strategies

- To manually create a strategy from the ground up, choose the entry triggers in the Editor.

- To create a strategy automatically, use the Generator. The Generator uses an advanced backtesting algorithm that was built to find strategies that work. The algorithm uses logical blocks and uses a set of rules (see Acceptance Criteria) to recognise good strategies.

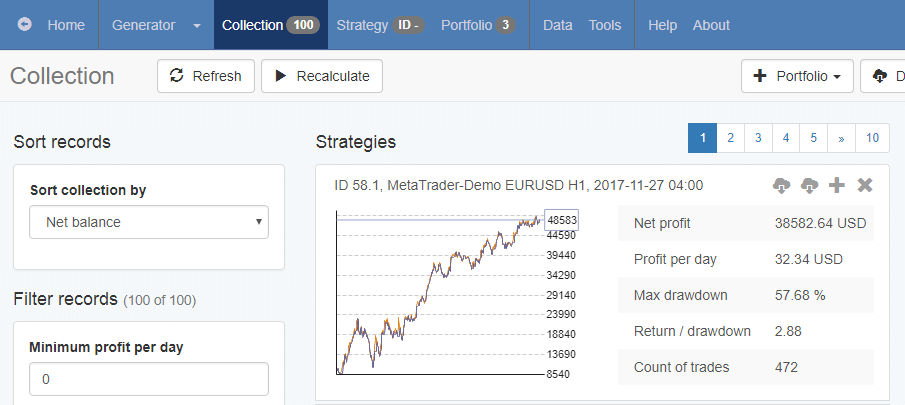

4. Choose a Strategy from the Collection

Let the Generator work for the number of minutes selected. The Generator will store the best strategies in the Collection. You can see them by clicking on Collection in the top navigation menu.

In the Collection, you can view the top strategies along with their equity curves and apply filters to select only those that meet your requirements.

5. Review the Strategy Trading Rules and Stats

In the Collection, you can click on a strategy to open it in the Editor for review.

Use the Editor to change settings, Entry Rules and indicators parameters. On the right side, a table displays the most important statistics. Below the stats is the Balance chart, where you can see the Equity chart.

You can use this information for evaluating strategies quickly. For the complete strategy backtest stats, check the Report.

When you are satisfied with your strategy, you can export it as an Expert Advisor.

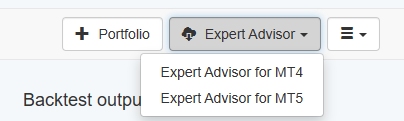

6. Export an Expert Advisor

To export an Expert Advisor, find the Export button in the upper right corner.

Click on the button and choose to export the full Expert Advisor for your MetaTrader version.

7. Test an Expert Advisor with MetaTrader

The Expert Advisors exported by EA Studio have 100% native MQL code. EA Studio Expert Advisors do not require any 3rd party code and compile in MetaTrader without any errors or warnings.

To test an Expert Advisor

- go to MetaTrader File > Open Data Folder.

- Save the Expert Advisor “MQL4/5 > Expert”.

- Additional steps if you are using MetaTrader 5

- Go to the Navigator box in MetaTrader.

- Right-click on the Expert Advisor you just imported.

- Choose Modify

- A text editor will open. From the top menu, click on Compile

- Close the text editor

- Open the MetaTrader Strategy Tester (View > Strategy Tester)

- Test the exported Expert Advisor with the correct Period, Symbol, etc.

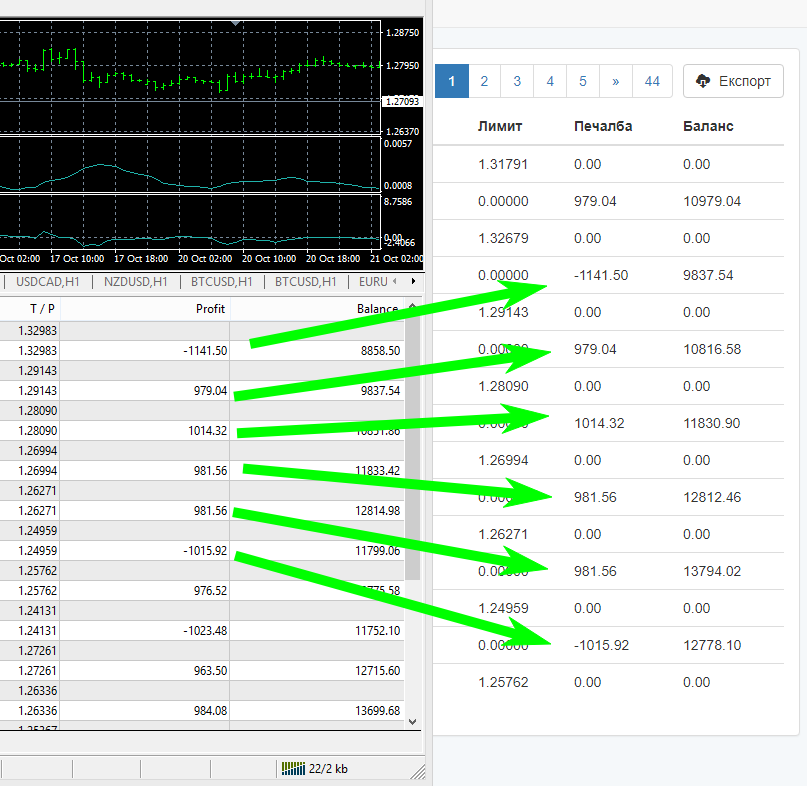

Make sure to compare both backtest results and see that they are very similar.

Expert Advisor Studio is the most advanced online platform for trading strategy creation. It enables you to use a fully automated workflow for strategy generation, strategy optimisation and strategy validation (see Reactor)

Trade Safe

Join our super-friendly Community Forums to find helpful information and insights about algorithmic systematic trading.

Other useful links:

Risk Disclosure

Futures and Forex trading contain substantial risk and are not suitable for every investor. An investor could potentially lose all or more than their initial investment. Risk capital is money that can be lost without jeopardising one's financial security or lifestyle. Only risk capital should be used for trading, and only those with sufficient risk capital should consider trading.

Hypothetical performance results have many inherent limitations, some of which are described here. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program despite trading losses is a material point which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, and all of which can adversely affect trading results.