Re: Market Update by Solidecn.com

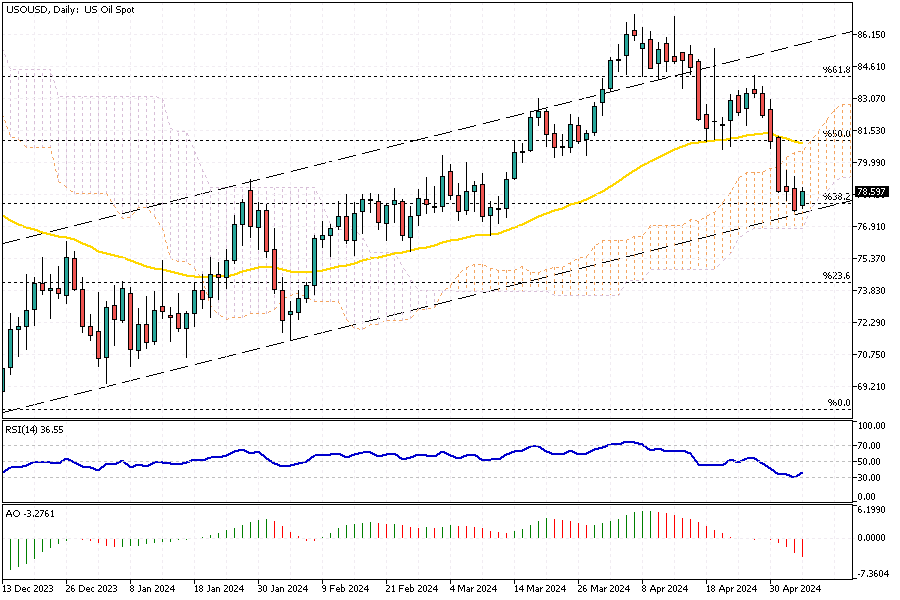

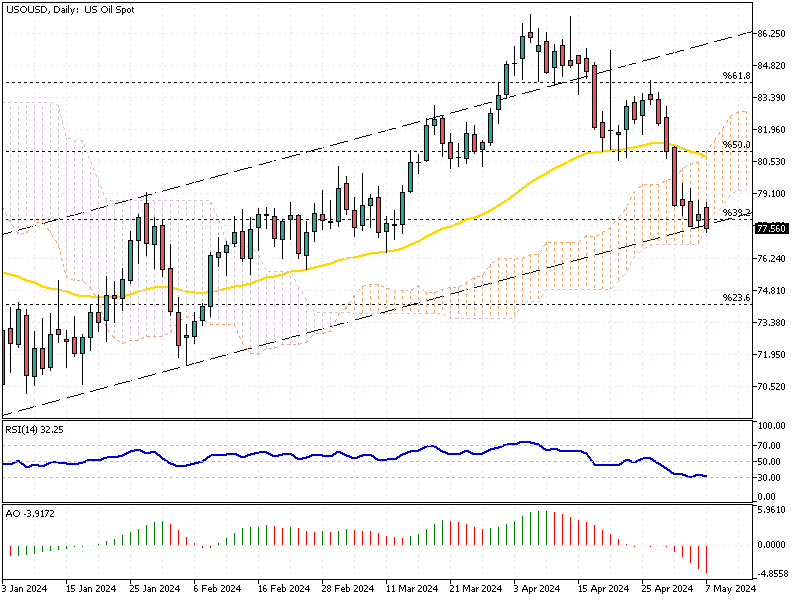

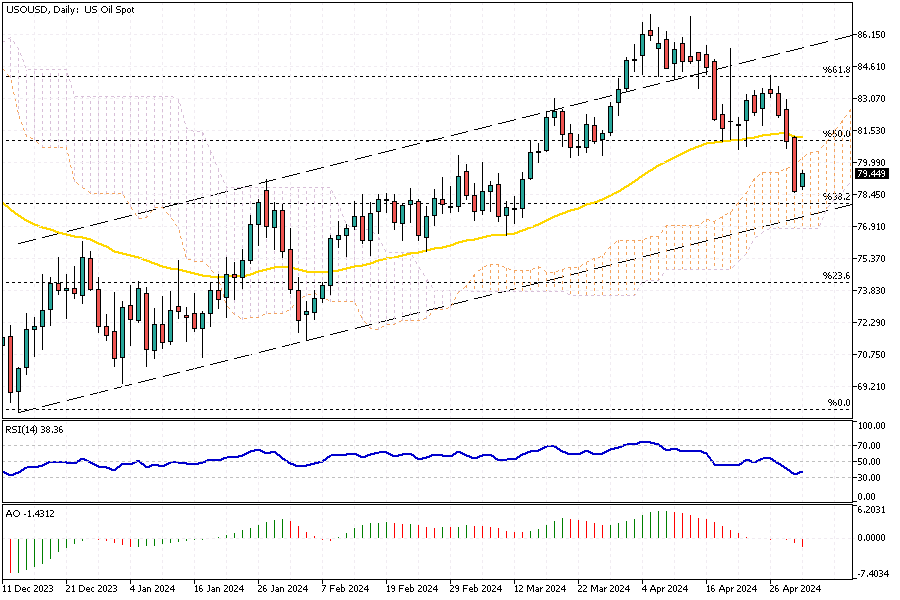

WTI Crude Stabilizes Above $79 Amid US Plans

Solid ECN – On Thursday, WTI crude oil prices settled above $79 per barrel, as there are hints that the US might plan to fill up its emergency oil stocks by purchasing oil at $79 per barrel or less. However, the prices are still near the lowest in seven weeks, falling over 5% this week.

This decline comes amid the possibility of a ceasefire between Israel and Hamas and a rise in US oil supplies. Egypt is taking the lead in restarting peace talks between Israel and Hamas, which might prevent a bigger conflict in the area. According to the EIA, US oil inventories unexpectedly increased by 7.3 million barrels last week, against forecasts of a 2.3 million barrel drop.

Additionally, US oil production surged to 13.15 million barrels per day in February, up from 12.58 million the prior month. This increase is the most significant monthly rise in over three years.