Re: Market Update by Solidecn.com

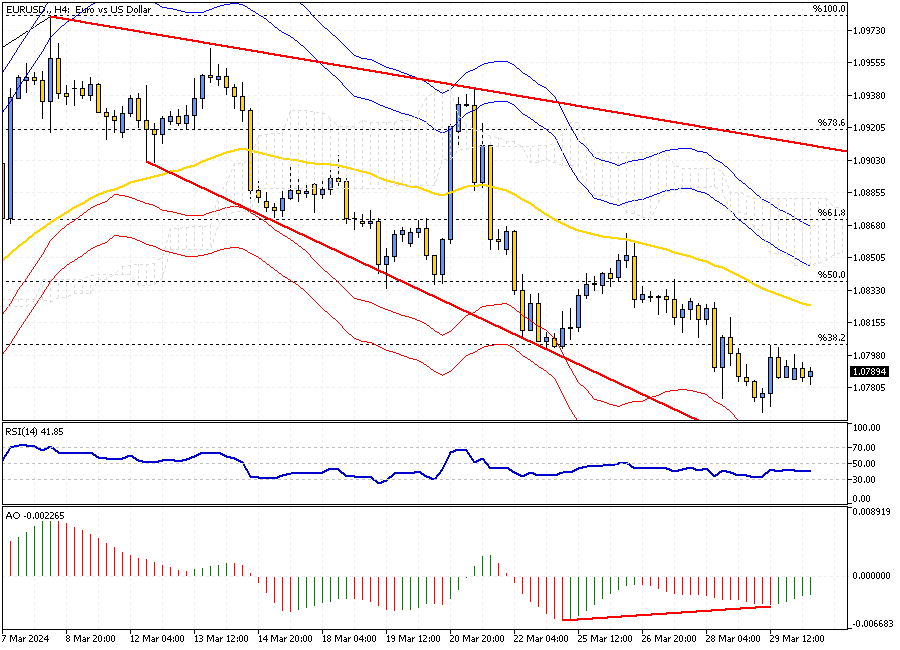

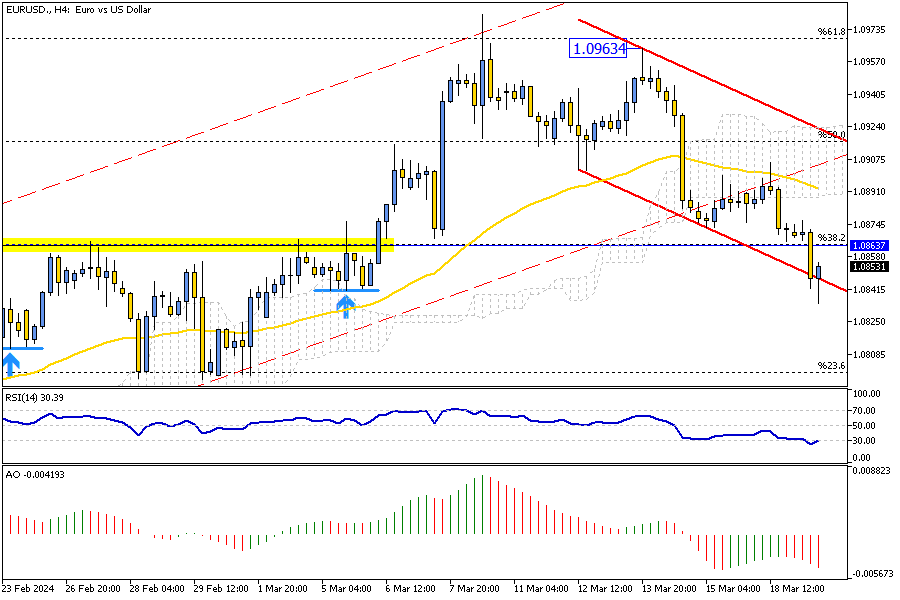

EURUSD Hits New Low: Analyzing the Latest Bearish Wave

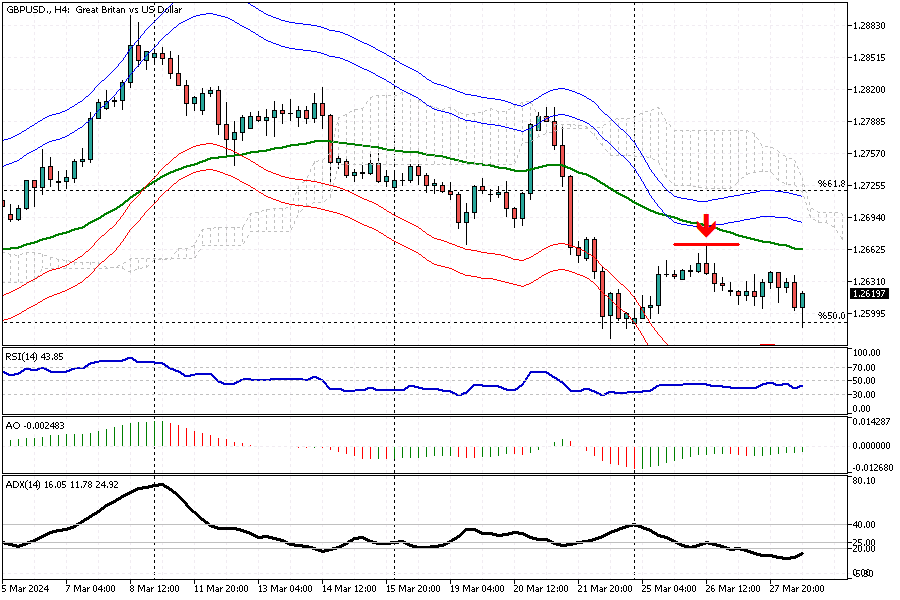

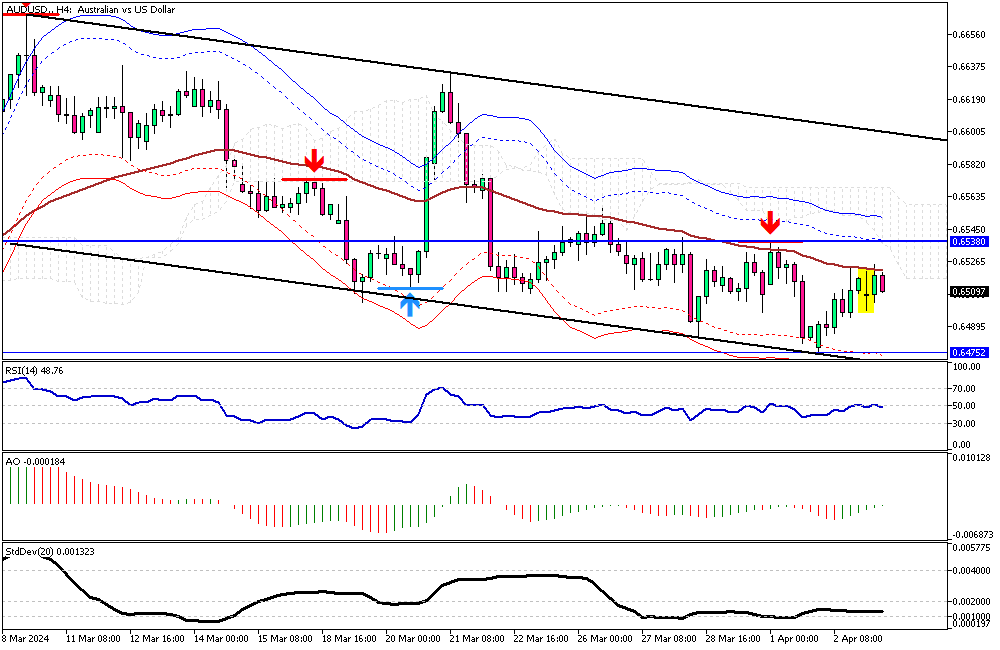

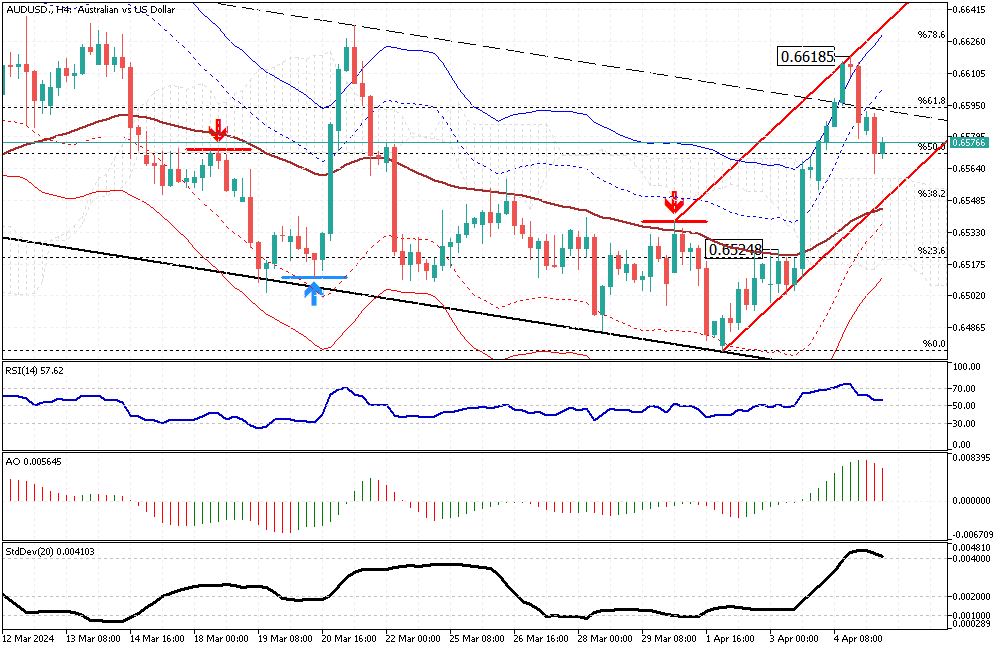

Solid ECN – In today's trading session, the European currency dipped toward the 1.08 mark, its lowest since March 1st, against the U.S. Dollar. The drop was expected from a technical perspective because the bears formed an inverted hammer clinging to the EMA 50 yesterday. The failed attempt to cross above the moving average has led the EURUSD price to experience a new bearish wave.

As of this writing, the pair is testing the lower band of the bearish flag. The RSI indicator hovers in the oversold area; therefore, the market might make corrections below the EMA 50 before a new wave emerges.

From a technical standpoint, the primary market is dominated by bears if the price is kept below the cloud. Due to the RSI being in the oversold zone, we suggest waiting for the price to show some correction before joining the bear market. With the price below the mentioned resistance areas, the 23.6% Fibonacci support could be the next target.

The price must flip and stabilize itself above the cloud for the bear market to be deemed invalid.