Re: RoboForex - Company news and official support

Price Movements: By Chance or By Nature?

Dear Clients and Partners,

Most traders I have known want to absolutely conquer the market. Some succeed, but only every now and then, failing to turn this conquer into a permanent win. The reasons are many, from insufficient skills or experience all the way to the lack of the 'holy grail', with the 'not enough money' reason in between. Well, a good set of excuses. These reasons, however, are somewhat true, as all traders are different and use their trading potential differently.

Two major trader’s opinions

There are two major opinions in the market that divide all traders. The first are Stochastics, those who want to predict the price movements. The second, agnostics, are just moving with the market, watching it constantly. The former are an overwhelming minority, while the latter account for about 90%. And even if you are a stochastic, chances are that you're a bit of agnostic, too.

What makes traders choose one way or the other? Again, the reasons are many, but, first and foremost, people tend to back their opinions with theories, either scientific or not that much.

The effective market theory

The effective market theory, for instance, tells us that all market players have access to the same information allowing them to analyze and predict the market moves. This way, each new piece of information is already priced in the market. All market players act rationally, like robots, in order to make the most of it, while a single trader is not able to influence the market.

This has nothing to do with the reality, though. What about the legal actions involving traders who used insider hints to speculate in the markets? Or how about those who buy out a certain currency in order to raise the demand for it? That's it. Theories work for ideal markets, not the real ones.

Reasons for market movements

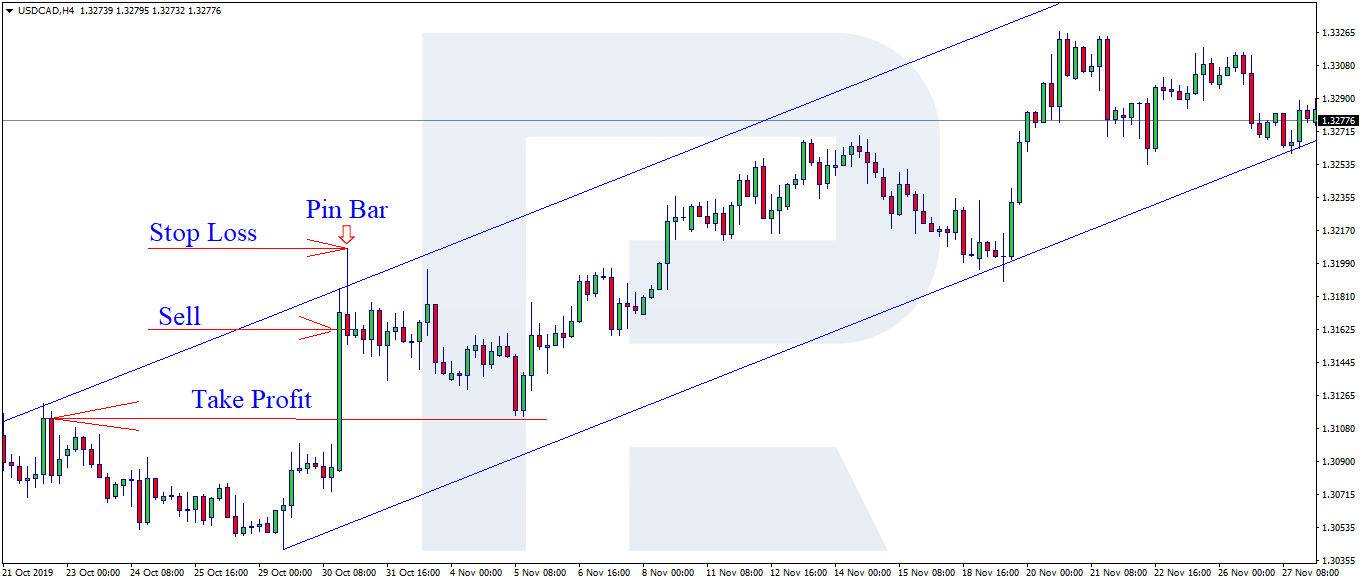

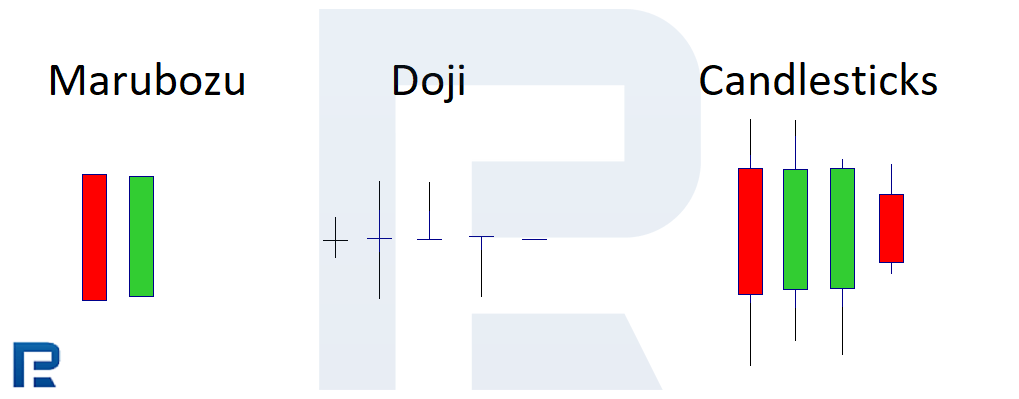

Any move that happens in a real market has a medley of reasons behind itself; at any given moment, those reasons may be different, and the correlation between them may also be different. The point to understand is that no emotion, speech or data release may influence the price without someone's placing a real buy or sell order. If a bullish candle is rising, this means people are hitting the Buy button on and on, even with the ask price rising,

And the same is for a bearish candle. These are the basics of the price movement mechanics. Why do then massive buyouts and selloffs occur? The effective market theory has a ready-made answer for us again. A trader will sell a country's assets in case the local key interest rate is cut, the unemployment is rising, a war conflict breaks out, and so on. In other words, if a trader understands an asset is under risk, they attempt to get rid of it as soon as possible, even if the price is not that good.

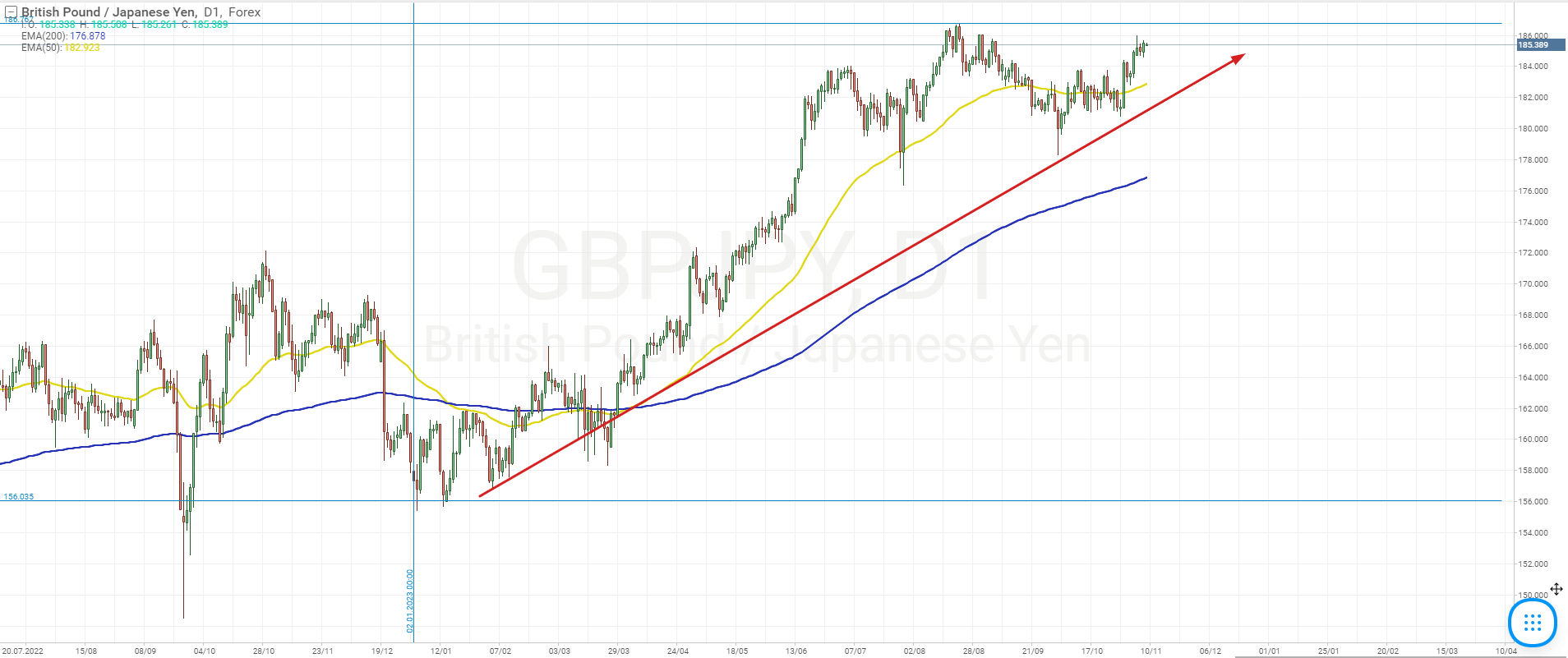

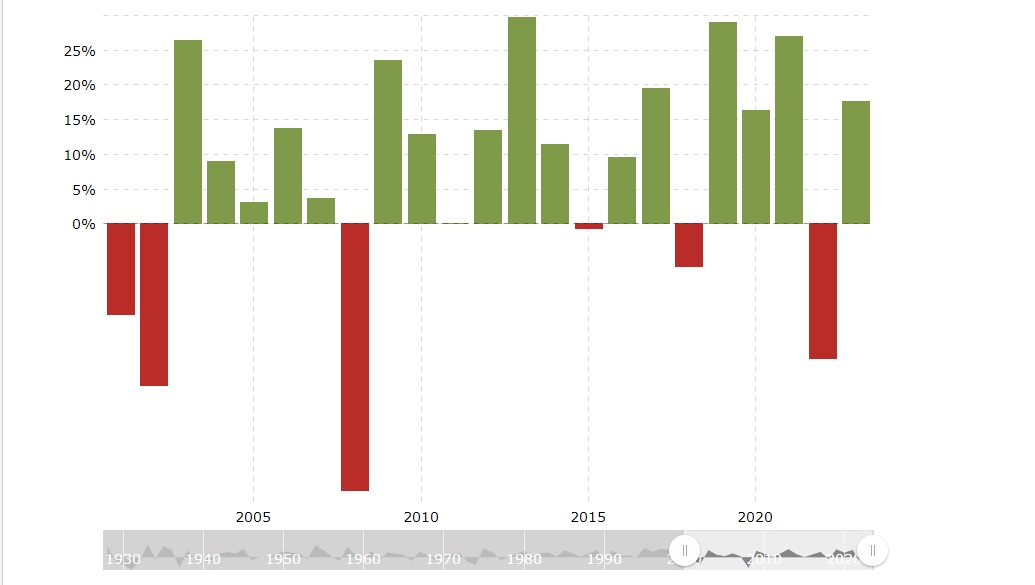

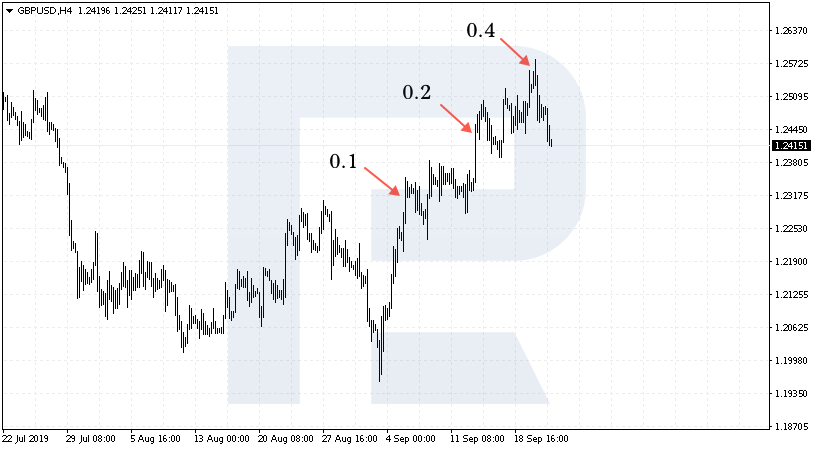

Conversely, if the key interest rate is being risen, or, say, a QE program is coming to an end, a trader will buy out the appropriate assets. You understand, of course, however, that any market has trends, both short term, midterm, and long term, each of them being influenced by various factors and with different weight. Before a long term trend is reversed, the short term one ought to fade out first. Besides, any market has all types of players: large, medium, and small, and all of them operate at different levels on different time frames.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team