Re: RoboForex - Company news and official support

How to Use Personal Income and Personal Spending in Forex

Author : Victor Gryazin

Dear Clients and Partners,

This overview is devoted to two macroeconomic indicators — Personal Income and Personal Spending —and their influence on the currency market.

What is Personal Income

Personal Income represents monthly changes in the income of physical persons. This indicator assesses in percent the changes of the aggregate income of people in the country over a reporting month compared to the previous month. For calculations, income from several sources is used:

Wage/salary

Bonuses

Income from owning real estate

Income from holding financial assets

Income from enterprises

In the USA, Personal Income is calculated and published by the Bureau of Economic Analysis (BEA), alongside Personal Spending.

Monthly changes of personal income is one of the key macroeconomic indicators that the BEA uses for assessing business activity in the country. Personal Income changes are published monthly in the Economic Calendar.

What is Personal Spending

Personal Spending demonstrates monthly changes in expenses of physical persons. It assesses in percent how aggregate expenses of people in the country have changed over the reporting month compared to the previous one. This includes all main expenses of the population:

Spending on services

Spending on durable and not goods

Spending on banking transactions, commission fees, etc.

This indicator is also calculated monthly and published by the BEA alongside Personal Income. Consumer expenses are part of the GDP, hence, PS helps forecast its growth. Also, it is one of inflation growth indicators. Changing Personal Spending is published monthly in the Economic Calendar.

How do these indicators influence the currency market?

For analyzing the influence on the economy of a country, Personal Income and Personal Spending are used together. If the actual data turn out to be dramatically different from the forecast, volatility in the currency market can increase.

On average, these indicators change within 1-2%. Unexpected growth or decline by 3% or more can influence the rate of the US dollar against other currencies.

Both indicators normally have a moderate influence on currency rates. The influence will be most prominent if they grow or fall simultaneously.

If the price dynamics are of different directions — one indicator grows, the second one falls — market reaction can be ambiguous. Let us see how the market can react to simultaneous growth or falling of the indicators.

Growth

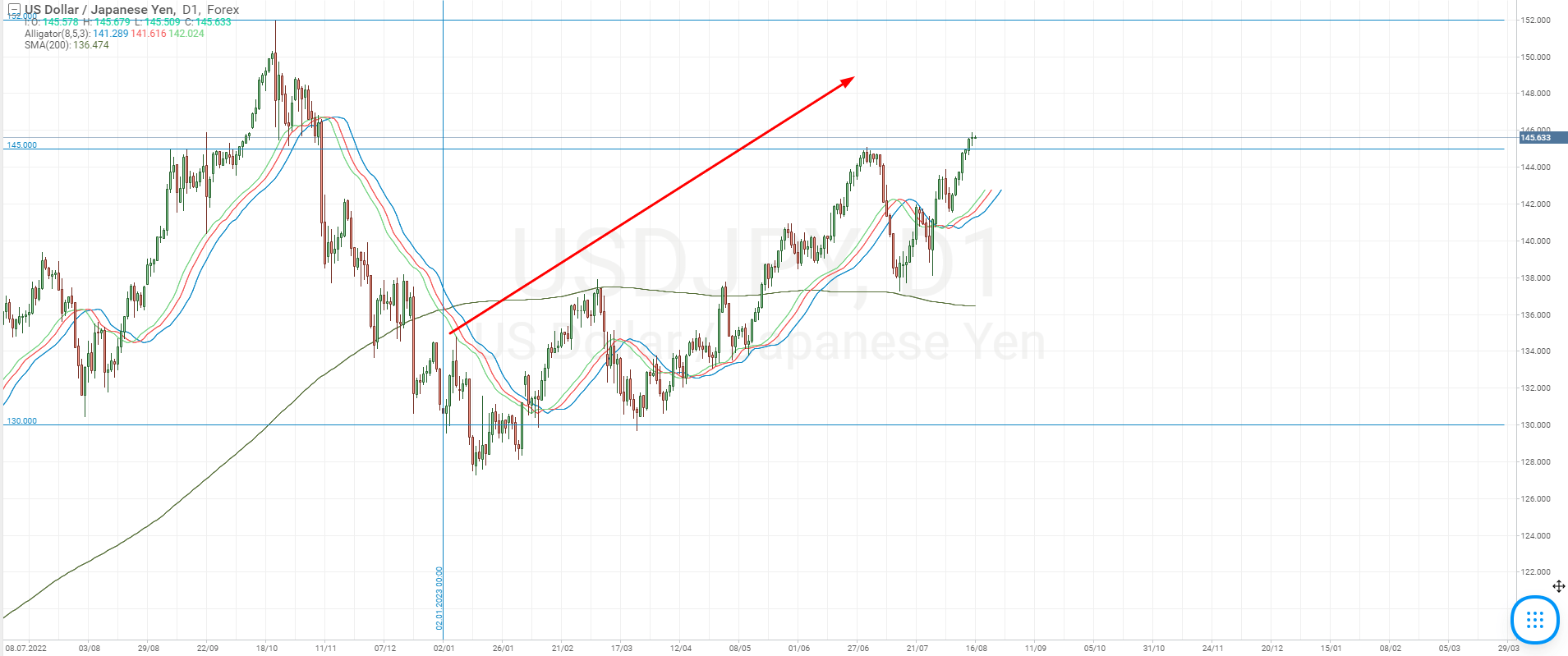

Confident growth of Personal Income and Personal Spending makes the USD become stronger. Such growth can heat up consumer market, support the growth of the GDP and speeding up of inflation.

As a result, to hold back overheating of the economy and decrease inflation, the Fed can raise the interest rate. Expectations of this possible increase in the interest rate attracts investors who buy the dollar.

Falling

Steep falling of both indices can make the USD fall against other currencies as well. Decreasing Personal Income and Spending demonstrates some unfortunate trends in the economy, which result in a decline of the GDP and inflation.

Later on, the Fed can liven up and support the economy by various stimulation measures and a decrease in the interest rate (if possible). On these expectations, investors will be selling the dollar.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team