Re: RoboForex - Company news and official support

Bear Market: Characteristics and Tradings Principles

Author: Victor Gryazin

Dear Clients and Partners,

This overview is devoted to the bear market, its signs, and several popular trading strategies at the bear market.

What is bear market

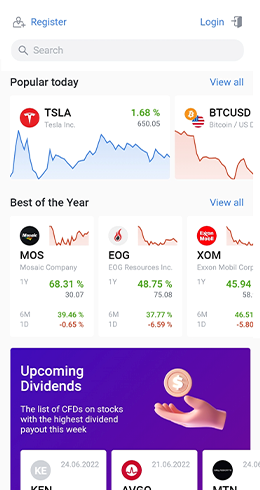

The bear market is the state of the financial market when asset prices are falling steeply, and investors are nervous or even panicking. The notion usually characterises the stock market, but can also be used for the currency, commodity, crude materials, and real estate markets, as well as other branches of economy.

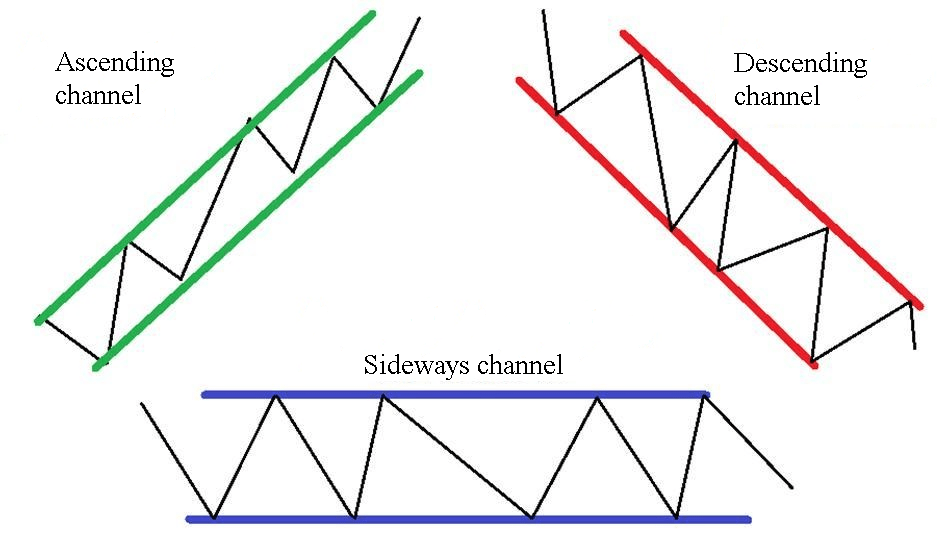

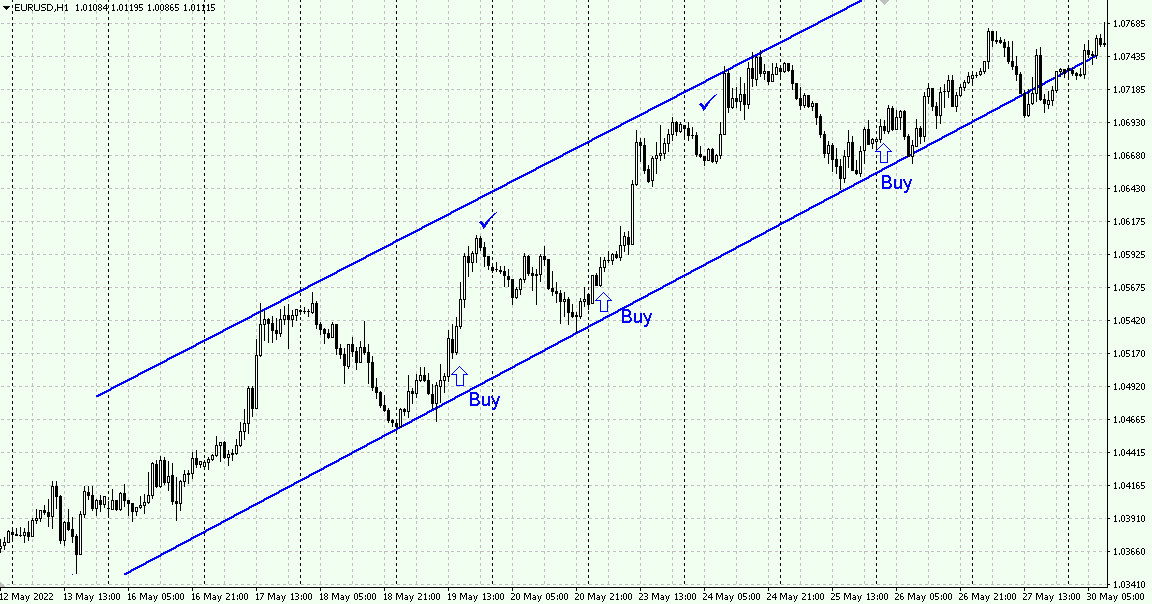

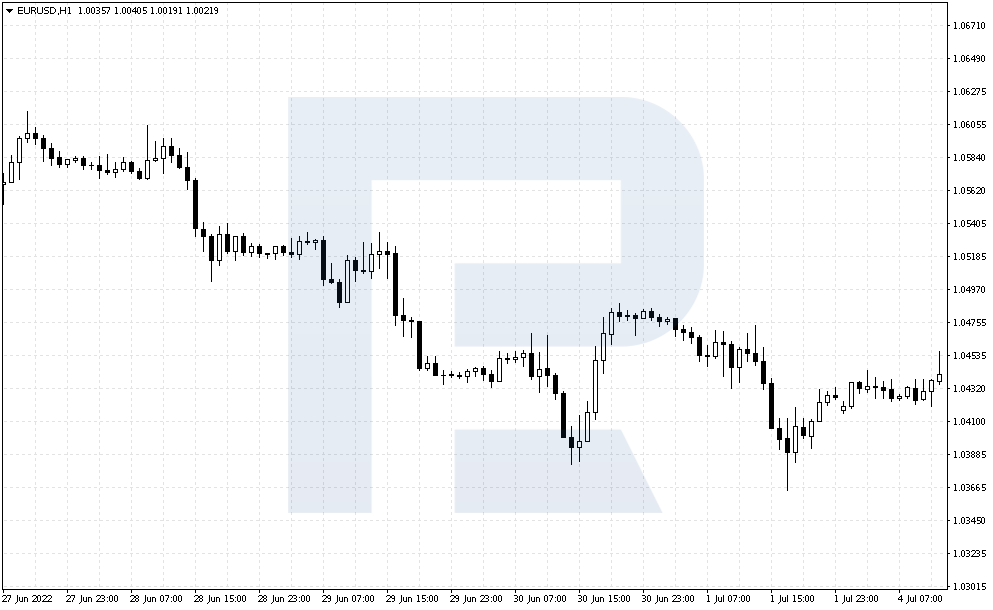

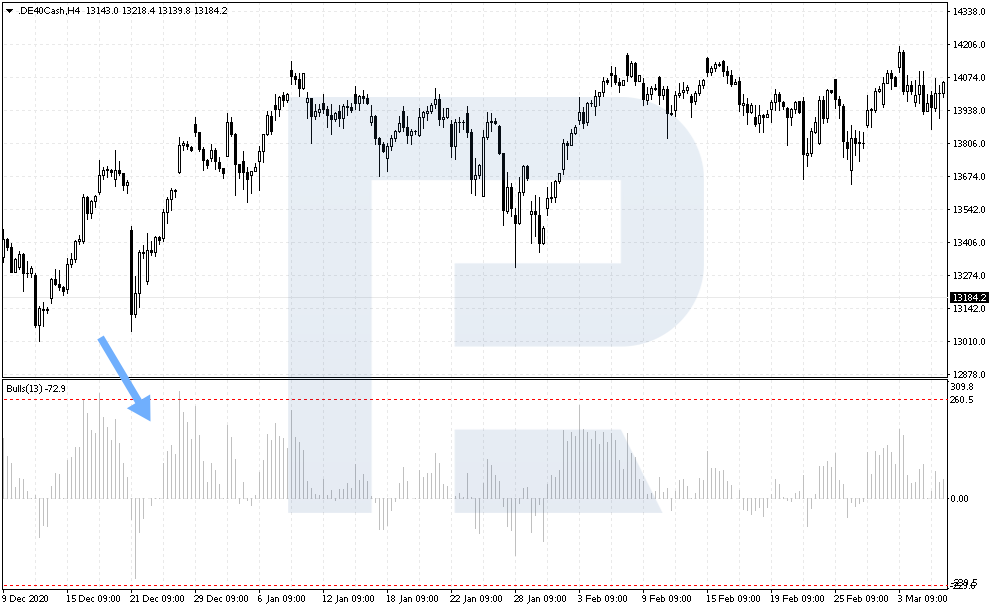

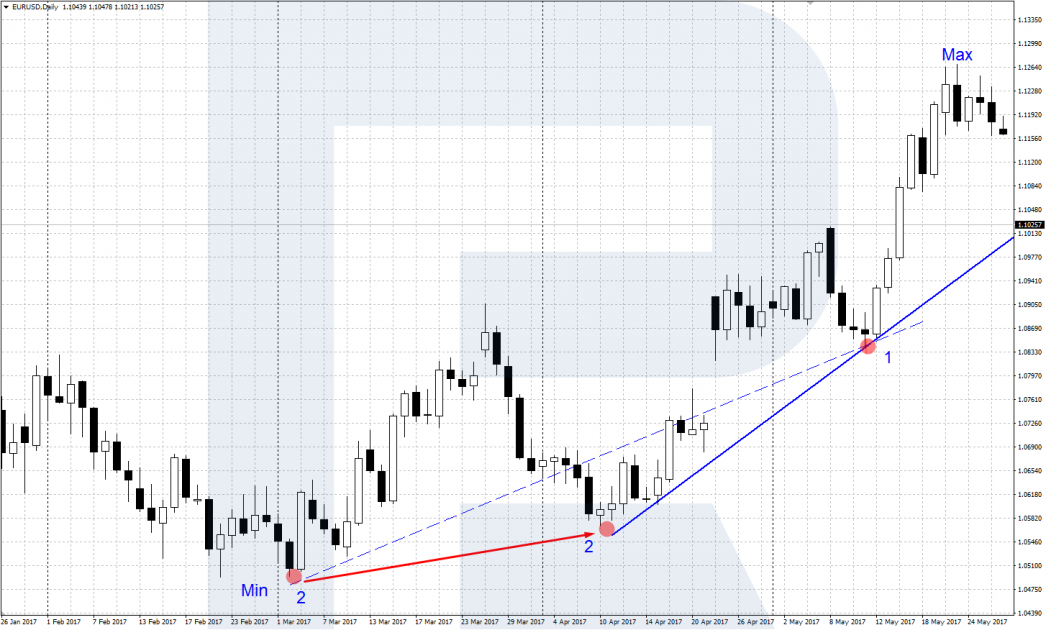

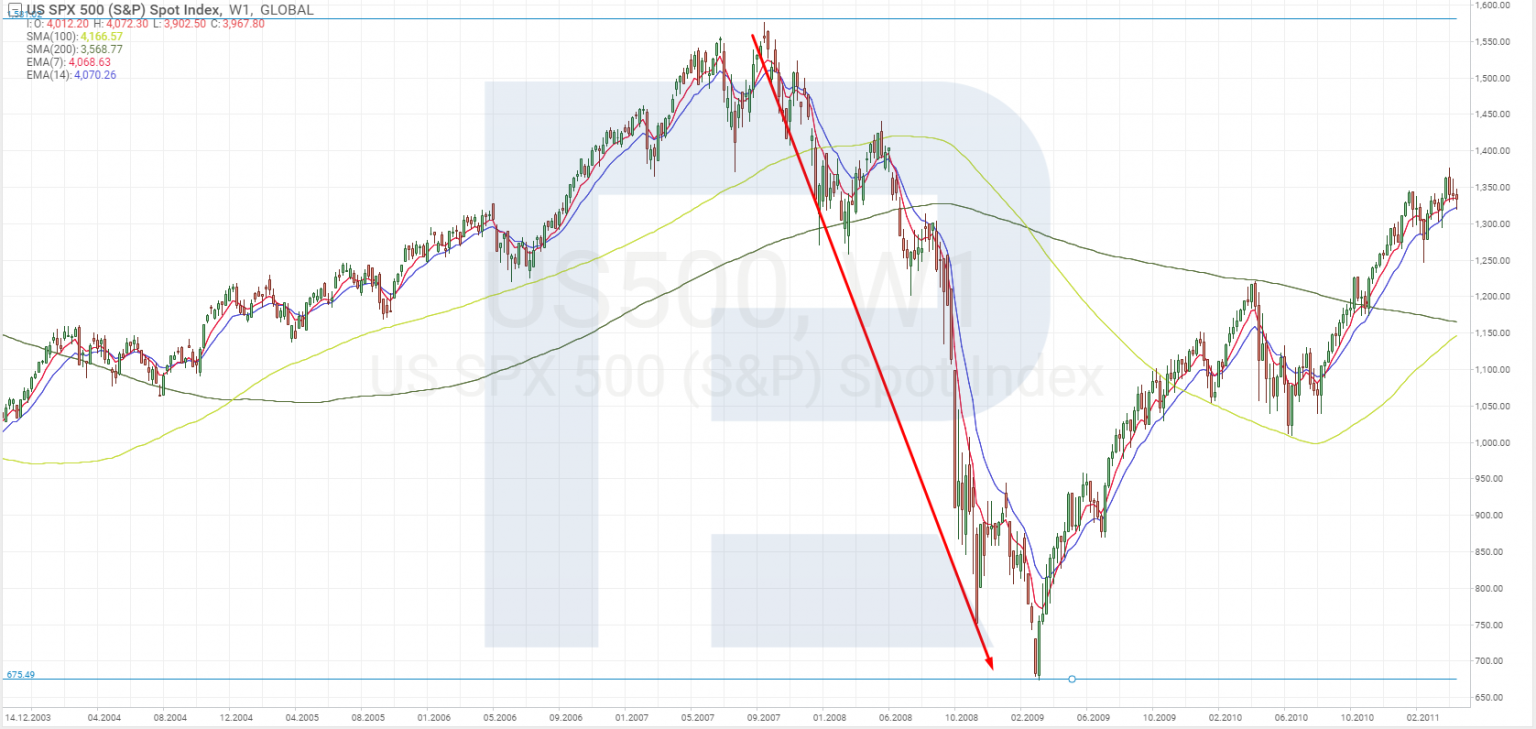

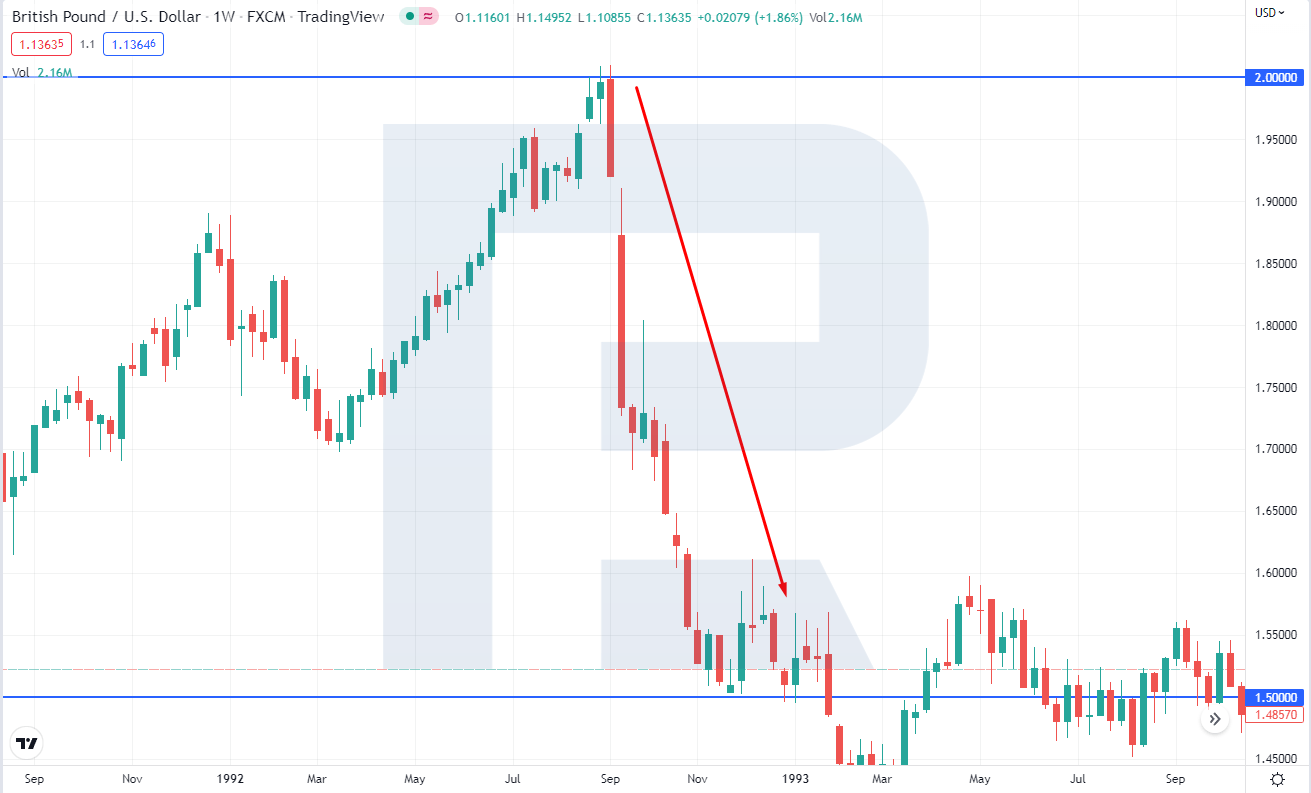

The bear market is the direct opposite to the bull market we have already told you about. During this phase, the prices of most stocks are falling, dragging behind stock indices. In other words, there is a downtrend: new lows are set regularly, and small local highs turn out to be lower than the previous ones.

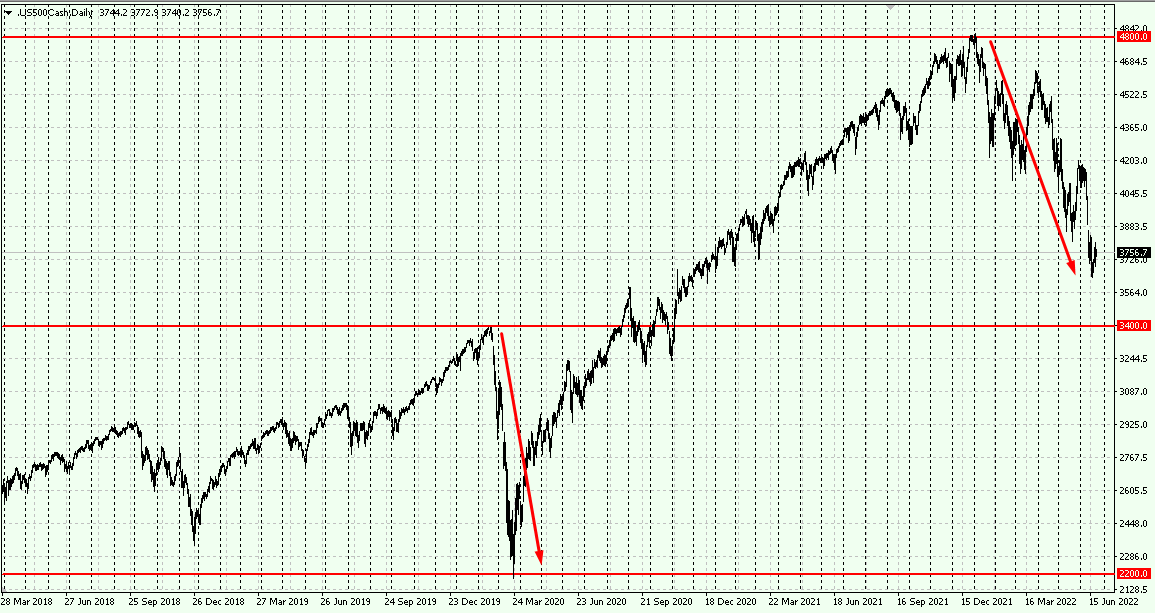

Unlike bull markets, bearish ones last rather short – on average, from six months to two years. However, they are characterised by increased volatility – prices might be falling very fast. The main reason for the market to become bearish is a crisis in the global economy that involves the decline of all main macroeconomic indices.

Previous such period lasted for about six months and was provoked by the pandemic of COVID-19 in 2020. When the crisis was over, times of active growth (bull market) followed, coming to an end in January 2022. Now we are in another bull market, created by the decline of indices of the global economy due to the geopolitical situation and fast growth of prices for energy carriers.

How to detect bear market

The beginning of an economic crisis, swift growth of prices for energy resources, various bubbles bursting in the stock market — these are the main reasons for the bear phase to start. At these times, the market is pessimistic and panicking; investors try to withdraw money from high-risk assets and thus save their capital.

Main signs of the bear market:

Fast falling of asset prices. In the stock market, stock indices and share prices fall. A rough landmark at which the bear market begins would be the phase where main stock indices lose 20% of their recent highs.

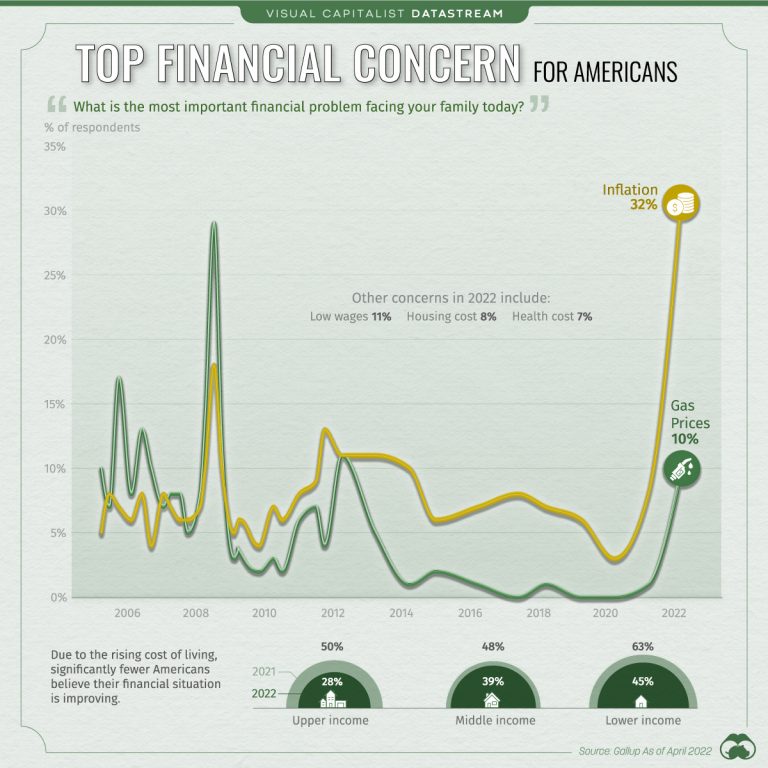

Negative economic reports. Inflation and unemployment grow, the GDP is falling, threatening a recession (negative GDP), companies suffer losses.

Pessimism and panic among market players. Investors try to sell shares as fast as possible lest they fall too much and put money in cash or bonds, gold and other protective assets.

How to trade in bear market

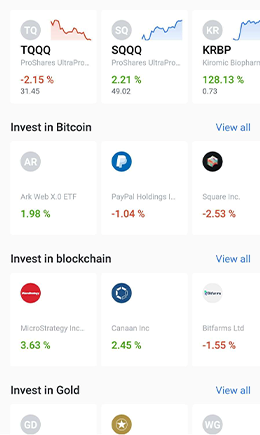

Such times are no doubt scary for investors: no one ever wants to see the price of their portfolio fall. On the other hand, chances appear to make money work in the long run while shares are traded with a big discount. One can even make a profit on short-term sales, or simply shorts. Let us take a look at several popular strategies for trading in the bear market.

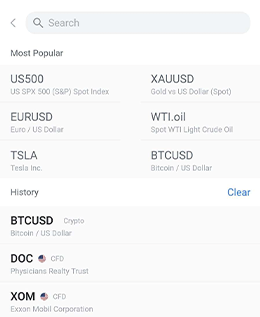

Withdrawing cash and hedging

Experienced investors can use special protective instruments for hedging their portfolios. The idea is to use futures, options, or other instruments that yield a profit at a falling market. However, hedging might cost a lot and requires a high level of financial literacy.

The simplest and most available way to keep one's capital safe when asset prices begin to fall is withdrawing cash. Cash is the safest haven; one can wait for the crisis to end transferring their capital into one or more safe currencies — the US dollar, Swiss franc, or the Japanese yen. As soon as the acute phase of the crisis is over, and the market starts reversing upwards, the investor may start to buy shares again. Their money is safe, while asset prices might turn out really appetising.

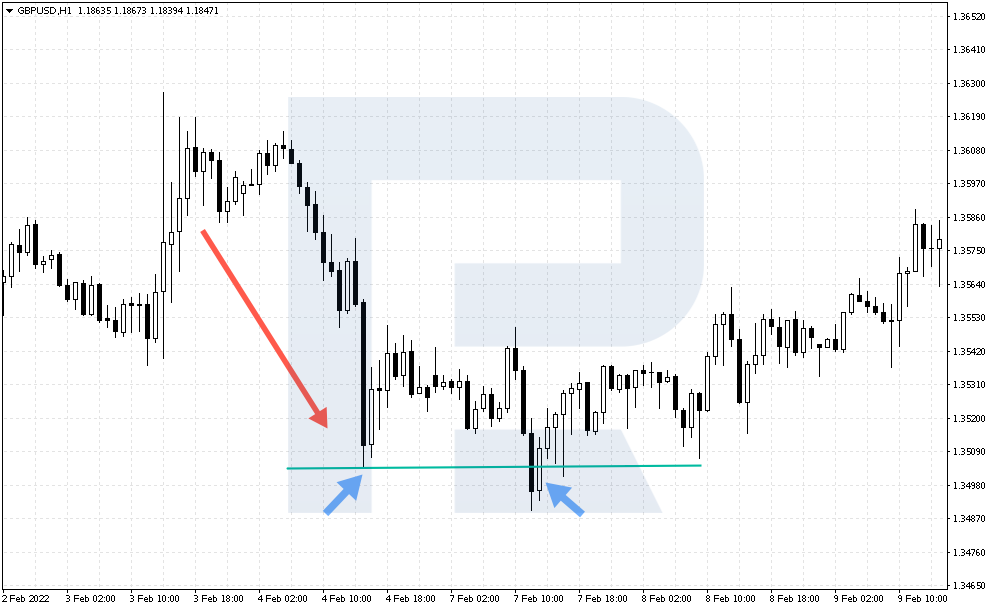

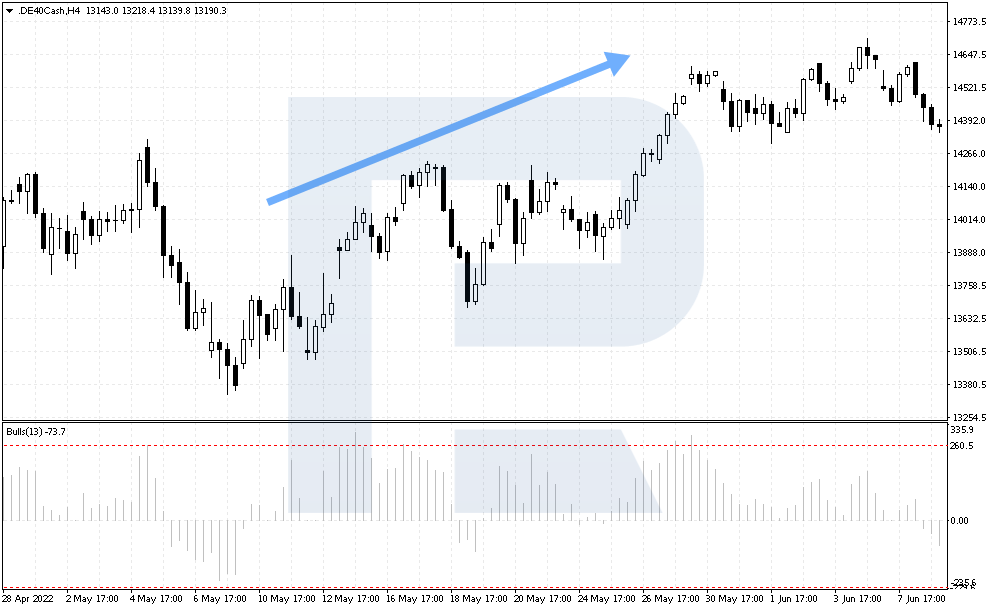

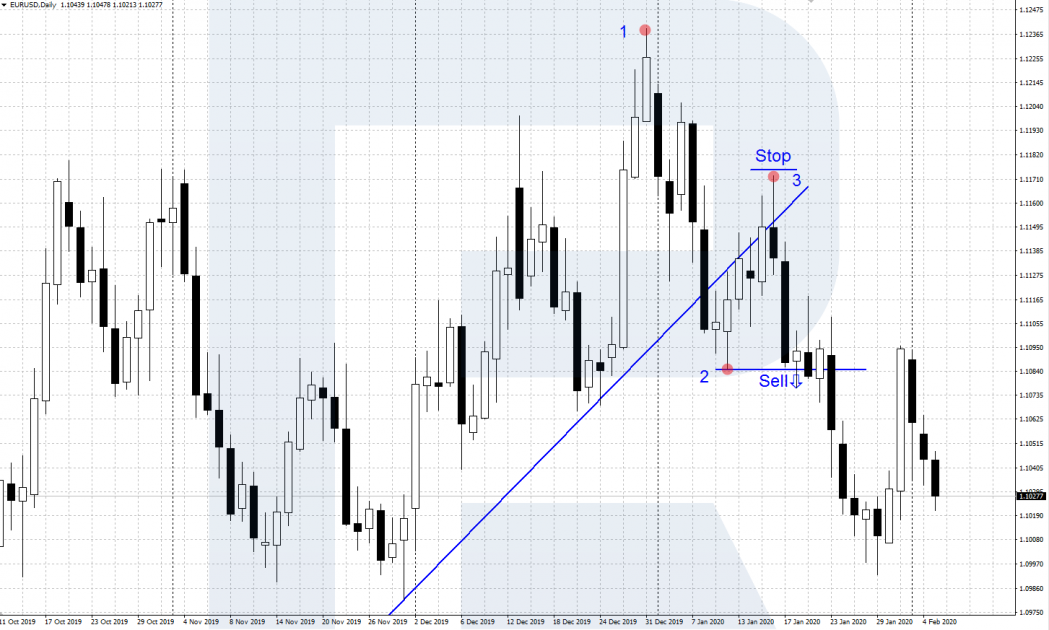

Playing short

In the falling market, one can make money on short positions, selling assets at higher prices than they buy them. If the investor does not have the shares of the company they need, they can address a broker and borrow them. Then they can be sold, bought after they fall at a lower price, and returned to the broker with a profit on price differences. Stock indices can be sold via futures, options, or CFDs.

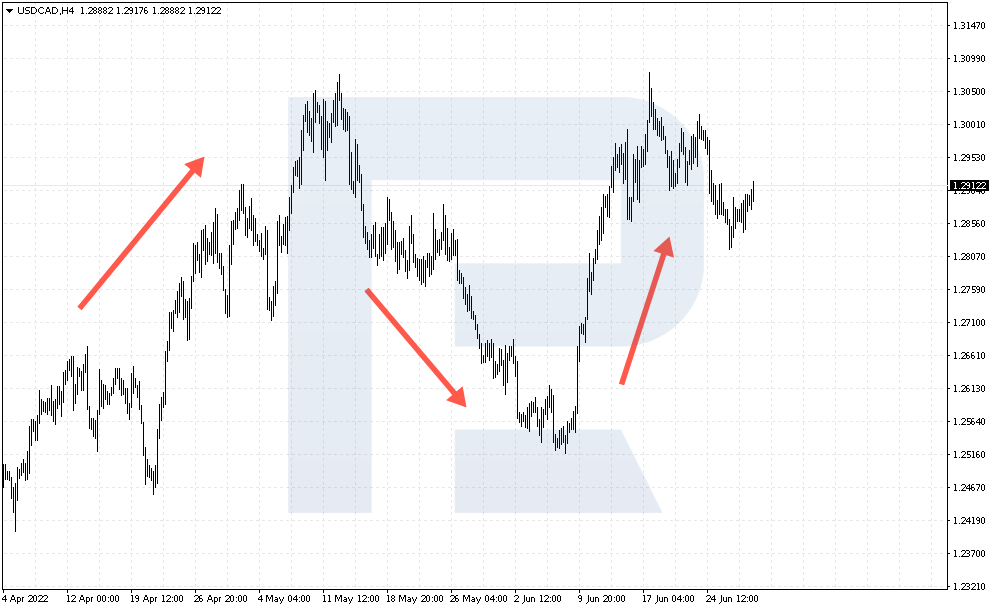

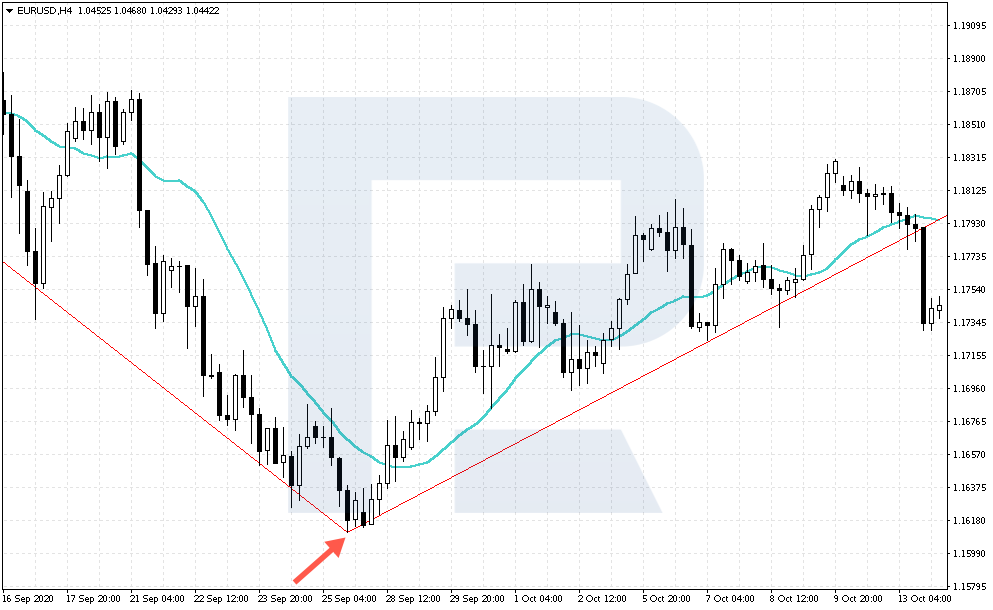

A short position is naturally short-term: the trader sells the asset and holds the position open for several days or weeks. The goal of such a trade is to catch the declining wave and take the profit at the beginning of an upward reversal. Such trading requires the experience of active trading, the skill of using tech analysis instruments and indicators, and strict following of risk management rules

Read more at R Blog - RoboForex

Sincerely,

RoboForex team