Re: Technical Analysis by FXOpen

EUR/USD Gains Bullish Momentum While USD/CHF Eyes Recovery

EUR/USD started a major increase above the 1.0800 resistance. USD/CHF is rising and might aim more gains above the 0.9220 resistance.

Important Takeaways for EUR/USD and USD/CHF

The Euro started a fresh increase from the 1.0720 support against the US Dollar.

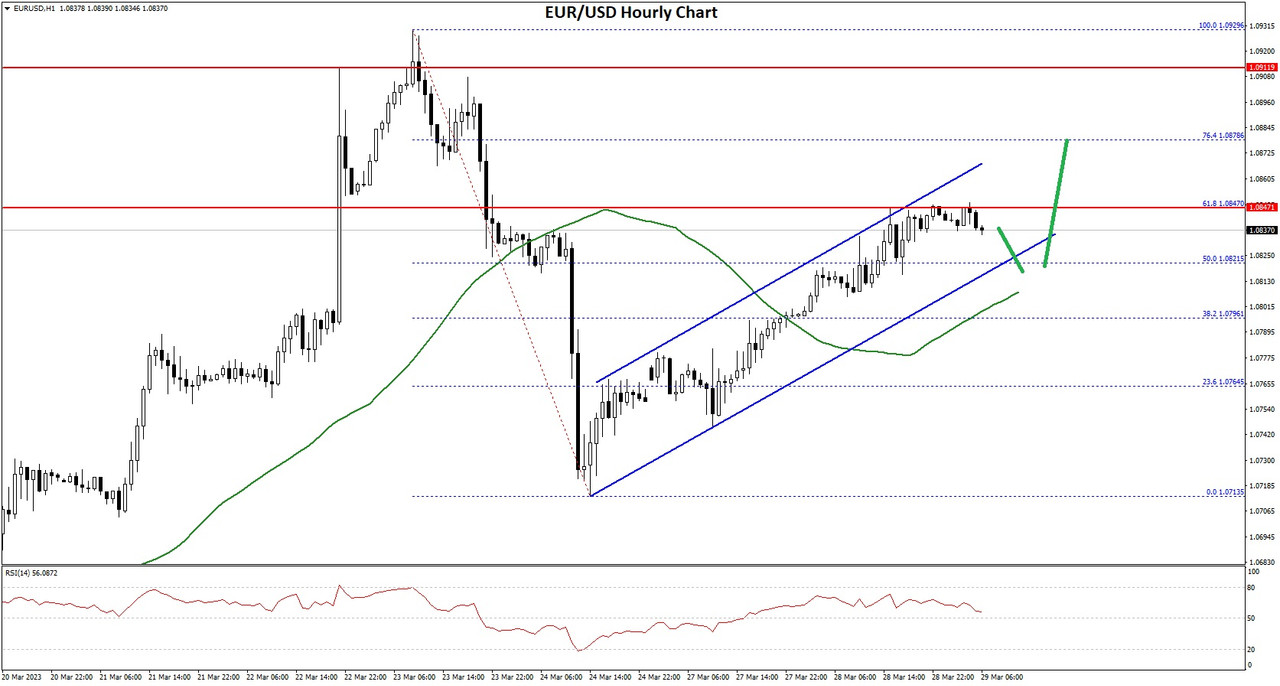

There is a key rising channel forming with support near 1.0830 on the hourly chart of EUR/USD.

USD/CHF started a fresh increase above the 0.9150 resistance zone.

There was a break above a major bearish trend line with resistance near 0.9175 on the hourly chart.

EUR/USD Technical Analysis

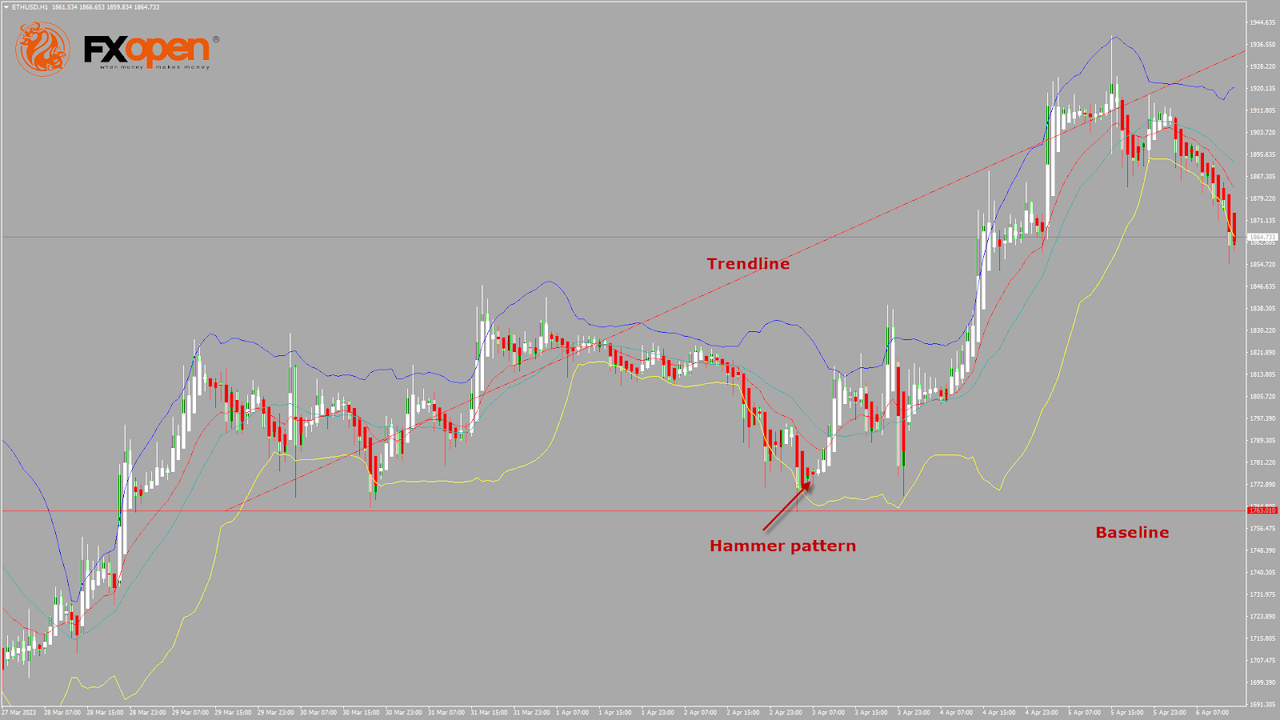

After a steady decline, the Euro found support near the 1.0720 zone against the US Dollar. The EUR/USD pair formed a base above the 1.0720 level and started a fresh increase.

There was a clear move above the 1.0750 and 1.0760 resistance levels. The pair was able to clear the 50% Fib retracement level of the downward move from the 1.0929 swing high to 1.0713 low (formed on FXOpen). It is now trading above the 1.0800 level and the 50 hourly simple moving average.

EUR/USD Hourly Chart

An immediate resistance is near the 1.0850 level. It is near the 61.8% Fib retracement level of the downward move from the 1.0929 swing high to 1.0713 low.

The next major resistance is near the 1.0880 level. A clear move above the 1.0880 resistance zone could send the pair further higher towards 1.0920. Any more gains might open the doors for a move towards the 1.1000 level.

If there is no move above 1.0850 recovery, the pair might start a fresh decline. On the downside, an immediate support is near the 1.0830 level. There is also a key rising channel forming with support near 1.0830 on the hourly chart of EUR/USD.

The next major support is near the 1.0800 level. A downside break below the 1.0800 support could start steady decline towards the 1.0750 level.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.