Re: Technical Analysis by FXOpen

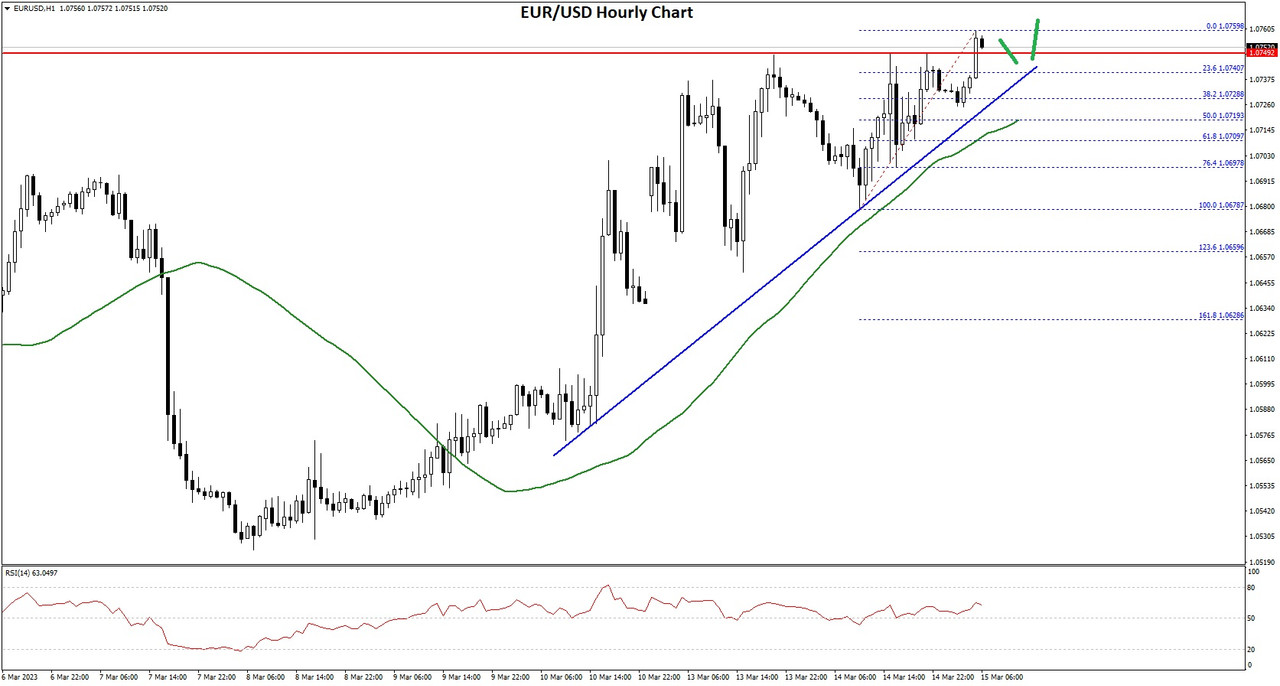

Euro hits one-month low against the US Dollar

It could be fair to say that the US Dollar, and the wider economy across the United States is an anomaly and has been for over a year.

Despite the same lockdowns in many major centers as other Western economies, the same supply chain difficulties disabling all sectors of industry to the same extent as that of Western Europe, and a similar approach toward involvement in geopolitical matters between the West and Russia, the American economy is not in anything like the bad condition experienced in other regions.

To compound this oddity further, the US Dollar has retained a very strong position against all other major currencies throughout the entirety of last year.

Yesterday, the US Dollar has shown its strength again, as the Euro has fallen to a one-month low against the greenback, with the rate now being at the low end of the 1.05 range during the early hours of the European trading session.

Some data released on Tuesday has put a dampener on the value of the Euro, one such metric being that retail sales within the Euro-denominated area, a good proxy for consumer demand, rebounded much less than expected in January, challenging other data, including PMI surveys, which pointed to a steady recovery.

Energy prices are continuing to soar across Europe, contributing massively to the overall increases in cost of living, which in some areas of Eastern Europe is compounded by inflation rates at over 25%, meaning that spending is outstripping earnings on a continual basis.

In Western Europe, the 10% average inflation is still a major barrier to economic stability and growth, whilst in the United States, the levels of inflation have been reducing over the past 6 months and are now at around 6%.

Manufacturing and productivity in the United States remained at least partially open during 2020 and 2021 with the states of Florida and Texas not conducting lockdowns. These are both heavily industrialised states and aside from their existing high technology, medical products, agricultural, energy production and scientific research sectors, attracted many other businesses from across the United States which relocated their offices to these states during 2021 and 2022.

This could be a contributor to the strength of the US dollar by comparison to the Euro, as the entire Eurozone limped in and out of lockdowns for almost 2 years and now the piper has to be paid.

Retail sales rose 0.3% on the month, below the 1% rise forecast by economists, and were down 2.3% year on year, demonstrating that this stagnation is continuing, and with more interest rate rises on the horizon, the belt is tight.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.