Because of the gap, the position cannot be open at the exact indicator price. It is open at the first price available at the signal triggering.

A strategy activates signals at the following way:

1. it calculates the indicator value. (It is the indicator's up Band in your case.)

2. At every tick, the strategy checks if the Bid price becomes equal or lower than the indicator price.

3. If the above happens, the strategy sends a signal at the tick price.

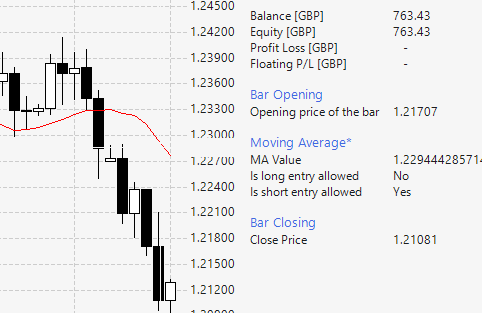

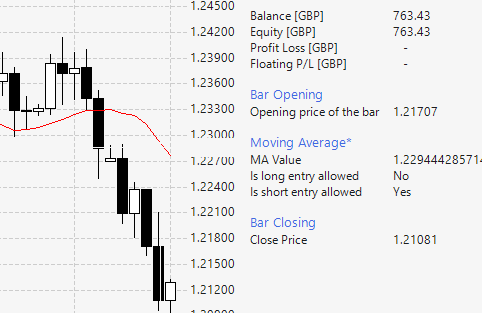

It is a rare case to have the market price to be exactly equal to the indicator value. If we want an exact match, we will have almost no deals. Let's take Ma. If you press Ctrl + F12, the chart will show the indicators values with a higher precision.

You see that the value is 1.2294442857...

Because the prices are rounded to the 5 digits, it will never become exactly equal to a value like that. To make the trade ever possible, FSB rises the signals on a specific way, depending on the trading logic. A simplified example is:

previous_tick > ma_price and current_tick <= ma_price

I said "simplified" because the real world is much more complex.

The real code of that signal is on line 335 : IndicatorBaseCalc.cs

An unpleasant side effect of the above formula is that it allows entries on unfavorable gaps. A workaround is to use an additional indicator that may prevent entries on gaps: Open Close Gap