Re: NordFX.com - ECN/STP, MT5, CQG, Multiterminal broker

Forex Forecast and Cryptocurrencies Forecast for December 10-14, 2018

First, a review of last week’s forecast:

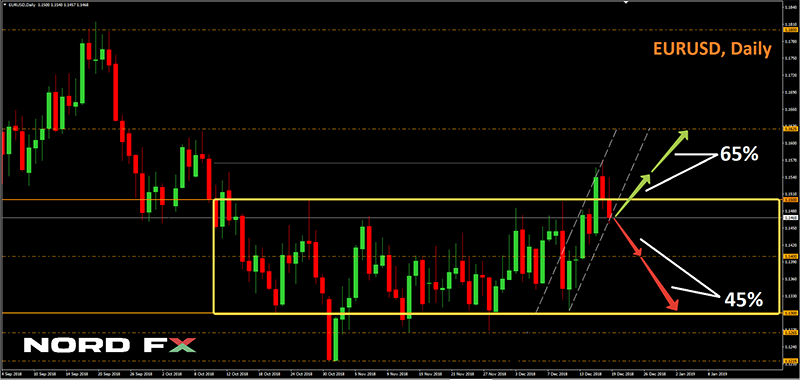

- EUR/USD. Our forecast for relatively weak labor market data turned out to be 100% correct. ADP and ISM in the service sector were not pleasing either, and one of the key indicators, NonFarm Payrolls, fell from 237K to 155K, that is, by as much as 35%.

The forecast regarding consolidation of the pair in the area of 1.1350 turned out to be correct as well: last week it switched to lateral movement in channel 1.1310-1.1415 with Pivot Point in the area 1.1350-1.1360.

The difference between the weekly high and low barely exceeded 100 points, although it seemed that there were quite a lot of important events during these days. These are the above-mentioned statistics on the US labor market, supplemented by a decrease in the country's GDP, and the OPEC meeting and Iran’s petroleum statement, and the arrest by the US law enforcement agencies of the financial director of Huawei Meng Wanzhou... But the pair reacted quite calmly to all this. The reason for this seems to be only one: the approach of Christmas, the time when the sharks of the market sum up their annual results and no longer want to make any sudden movements;

- GBP/USD. This pair also behaved quite calmly, although with a slightly higher volatility: the swing of oscillations was about 180 points. The expected fall to 1.2600-1.2620 did not take place, and the pair, barely reaching 1.2655, turned around and left for Pivot Point of the week, ending the five-day period at 1.2725;

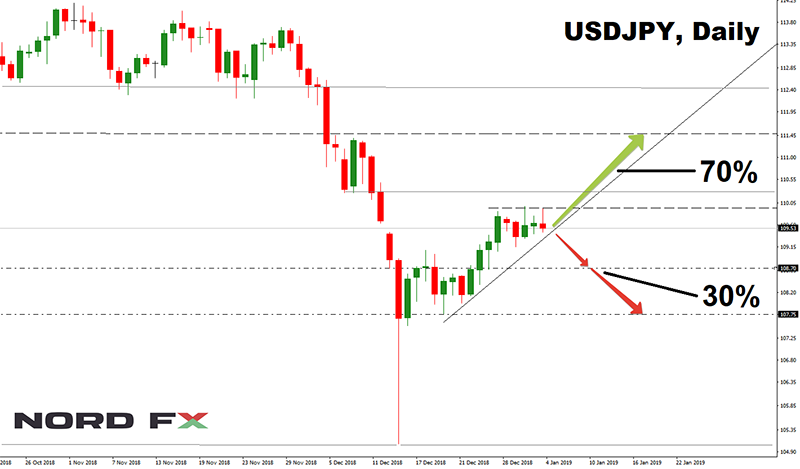

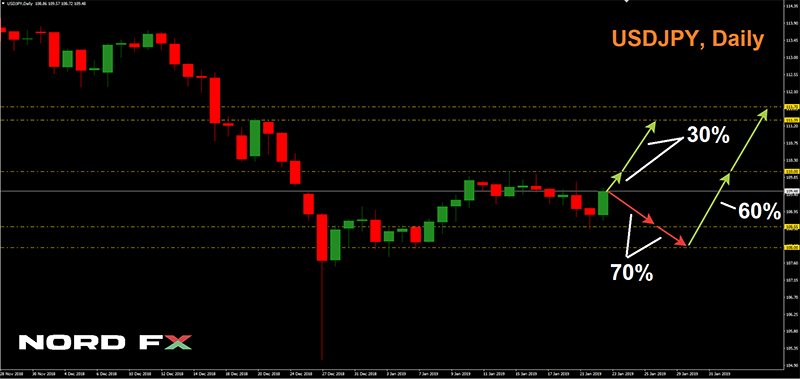

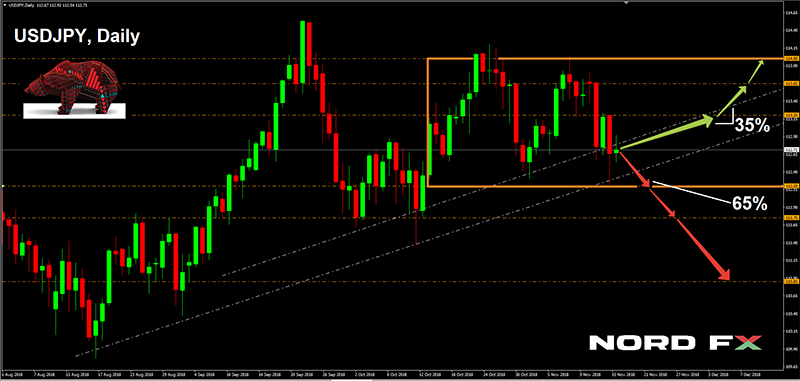

- USD/JPY. Last week, expert opinions were equally divided: one half voted for the pair’s growth, the second one was for its fall. In this situation, we advised to move from weekly to longer-term forecast, and we were right. Here, the picture was already different: most analysts (65%), supported by graphical analysis, expected the yen to strengthen and the pair to decline to the 112.00 zone. This was what happened: having won back the losses of the previous two weeks, it reached the level of 112.20. The pair met the end of the trading session at the level of 112. 70, that is, in the same place where it was already trading in the middle of November;

- Cryptocurrencies. There’s really nothing to say: the graphs vividly confirm that the worst predictions are coming true. 60% of experts predicted a further drop in Bitcoin, and on Friday evening, it recorded another annual low at around $3,275, having lost another 16% in seven days. Following the “reference” (now in quotes) cryptocurrency, the altcoins fell further down. Ethereum (ETH/USD) fell by 24% during the week, Litecoin (LTC/USD) - by 26%, and Ripple (XRP / USD) - by 18%.

According to Ernst & Young, 86% of all coins are now trading significantly lower than the originally declared value, and the crypto market capitalization fell to $113 billion, having lost exactly 700 billion in 11 months (86%).

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

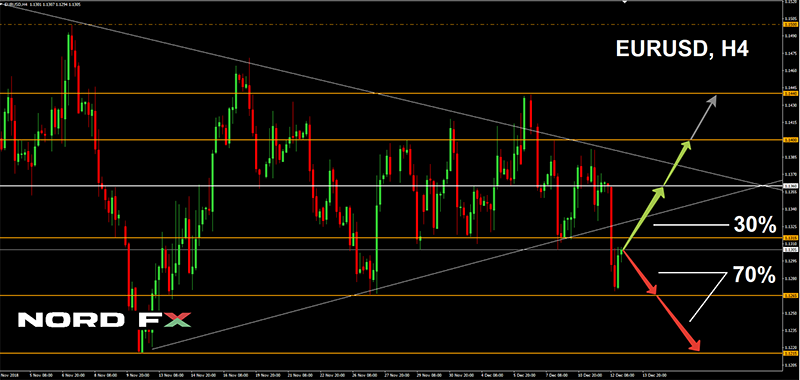

- EUR/USD. As has already been mentioned, it is time for the market to record annual profits. Or losses (it depends). However, the coming week is expected to see a number of macroeconomic data, which may still affect the change in quotations.

Thus, on Wednesday, December 12, there will be data on inflation in the United States, and the higher it turns out, the higher the likelihood of interest rate increases, the better the dollar will feel. In the meantime, judging by the futures, players and investors do not particularly expect that the Fed will raise rates in March next year.

On Thursday, December 13, a decision is expected on the interest rate in the Eurozone. Most likely, nothing will change, and the rate will remain at zero, so more attention should be paid to the subsequent press conference of the ECB President Mario Draghi.

On Friday, we expect statistics on retail sales in the United States. And, of course, the market will closely watch the reports from the theater of operations of the American-Chinese trade war throughout the whole week. Another aggravation in this conflict was caused by the arrest of Huawei's CFO, and everyone is waiting to see what President Trump does in this situation.

In the meantime, the overwhelming majority of experts and indicators have taken a neutral position. The bulls have a very small advantage, calling the area 1.1500-1.1550 as their target. Supports are at levels 1.1265 and 1.1215. The basic forecast almost repeats the scenario of the past week: the movement in channel 1.1310-1.1415;

- GBP/USD. Here, analysts' forecast is similar to what has been given for EUR/USD: the advantage of the bulls is only 5%. But almost 90% of trend indicators and 70% of oscillators are colored red. The formation of trends may be affected by the data on the UK GDP, which will be released on Monday December 10, and the data on average wages on Tuesday December 11. But of interest is the vote on Brexit in the British Parliament, which will take place at the same time, on Tuesday. Recall that, according to forecasts, the parliamentarians may not approve the Agreement on the terms for leaving the EU, and then a second vote will be scheduled for February 2019, which will play against the pound. The support levels are 1.2660, 1.2540 and 1.2500, the resistance levels are 1.2810, 1.2850, 1.29250;

- USD/JPY. On Monday, December 10, statistics on Japan’s GDP will be published and, strictly speaking, these are the only data from the country of the Rising Sun that may affect the pair’s quotes. Investors pay much more attention to the trade war between China and the United States and the use of the yen as a safe haven currency. That is why most experts (65%), with the support of trend indicators, vote for the strengthening of the Japanese currency and the reduction of the pair to at least 112.20 support. The next support is on horizon 111.75, then 110.85. As for the resistances, they are in the zones 113.20, 113.65 and 114.00.

Graphical analysis also indicates a fall of the pair. However, on H4 it assumes that at first it will rise to the height of 113.10, only then it will turn to the south.

- Cryptocurrencies. The states increasingly clamp the market which had initially been decentralized, in the grip of regulation, which creates an additional negative news background. This is what the crypto community is expecting soon:

In South Korea, a tax on income from operations with cryptocurrency is planned to be introduced; in Japan, in addition to the state registration of all ICOs, crypto exchanges will be obliged, upon request of the tax authorities, to disclose information on customer incomes; in Singapore, all ICO market participants must now obtain a license and take measures to combat money laundering; Switzerland is also planning a number of legislative amendments. And so on.

It is highly likely that, recognizing the benefits and possibilities of blockchain, many states intend to put an end to the current crypto freedom and begin to issue their own digital money (which Honduras and Iran have already taken up). But this is not a one-day deal.

In the meantime, analysts' opinions are distributed as follows: 65% expect a further fall to $2,500-3,000, 25% have voted for the side trend along the $3,000 horizon and 10%, as before, remain optimistic, expecting Bitcoin to return to the levels of $4,000-5,000 in the medium term.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin