Re: NordFX.com - ECN/STP, MT5, CQG, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 24 - 28 July 2017

First, a review of last week’s forecast:

- The main view on EUR/USD was that it would break through1.1500 and grow to the 2016 high at 1.1615. The next target would then be the maximum of August 2015: 1.1715. The main impetus for the pair's upswing was given by the head of the ECB Mario Draghi, who said on Thursday that the euro zone stimulus program (QE) will not end and will remain unchanged. Against the background of these comments, the euro's exchange rate against the dollar jumped by 0.5%, and the pair reached the height of 1.1680 by the end of the week session;

- As for GBP/USD, the forecast ended up being 100%. Accurate. Recall that the vast majority of experts, supported by one third of oscillators, were confident that the upward impulse of the pair had dried up, and it was expected to decline first to 1.3000, and then even lower. As a result, the pair dropped to 1.2930, then rebounded and finished the week at the level of 1.2994;

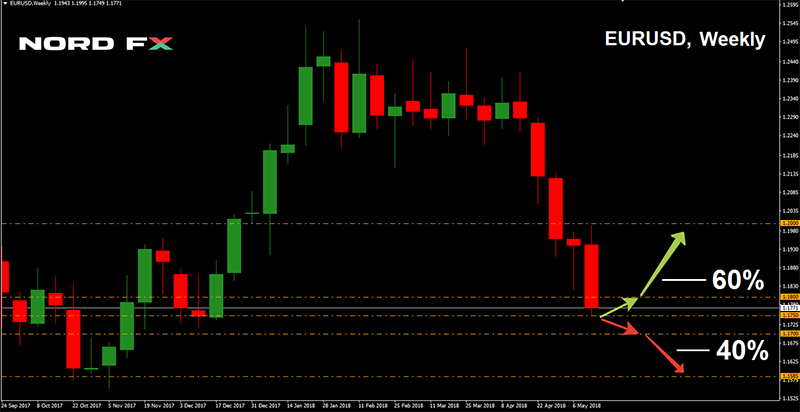

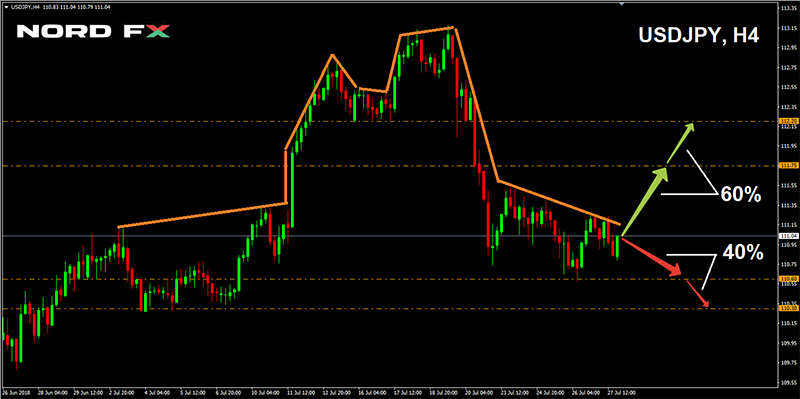

- USD/JPY. Indicators on H4 and only one third of analysts spoke about the fall of this pair last week. But it was them who turned out to be right, having predicted its decline to the level of 111.00, which became the week’s minimum.

- Predicting the future of USD/CHF, the majority of analysts (85%) insisted on it falling to at least 0.9500-0.9550, and possibly even lower. The pair obediently did so, having lost 190 points in a week and started touching a local bottom at 0.9437.

***

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

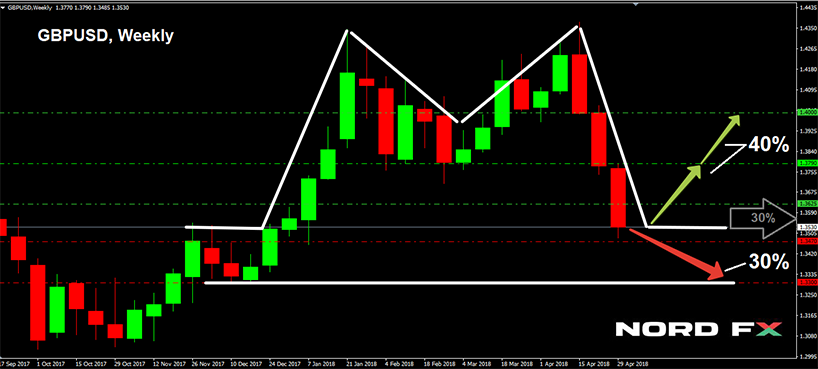

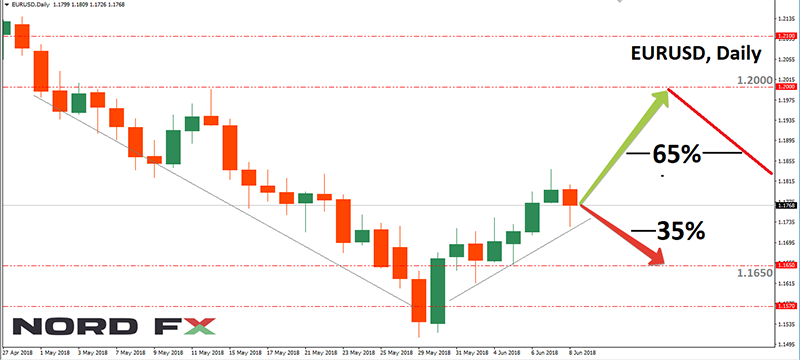

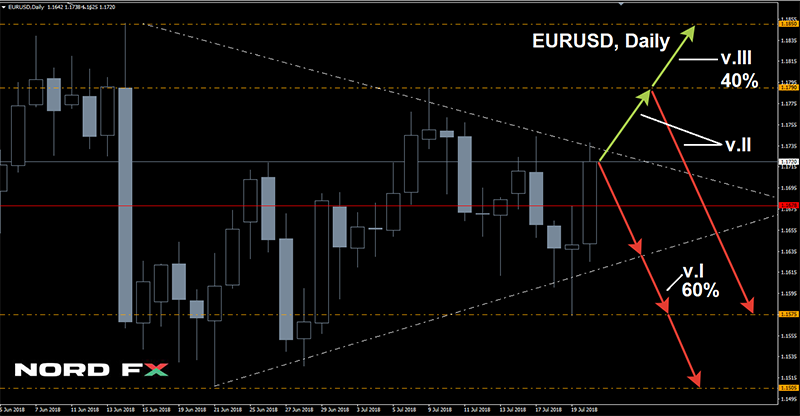

- EUR/USD. After an impressive upwards spurt last week, the future of this pair now looks quite ambiguous. 55% of experts, 100% of trend indicators and graphical analysis indicate the uptrend will continue. The August 2015 maximum - 1.1715 - is named as the nearest resistance, the next target is 100 points higher.

An alternative point of view is represented by 45% of experts and more than a third of oscillators on H4 and D1, indicating the pair is overbought. In their opinion, the pair should return to 1.1480-1.1580. The following events can also contribute to the strengthening of the dollar: on July 26, the Fed will provide commentary on a possible increase in interest rates before the end of the year, and on July 28 we will see the publication of annual data on US GDP;

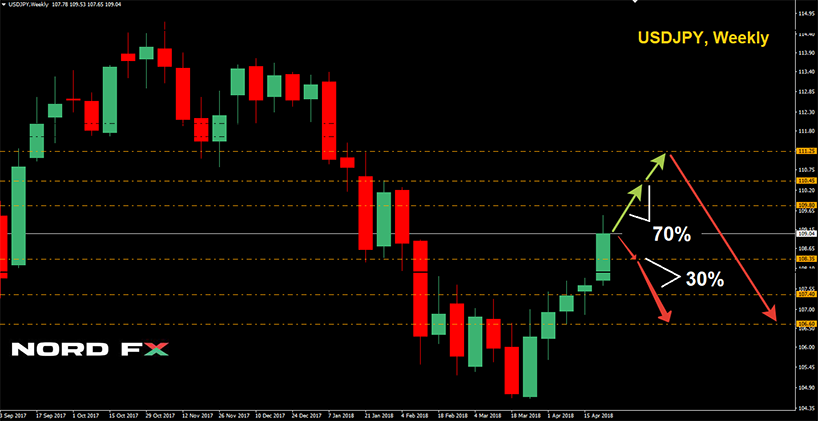

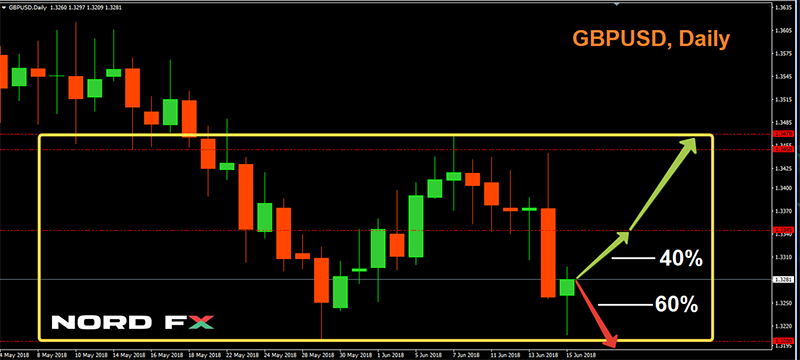

- GBP/USD. If we try to bring together the opinions of experts and technical analysis, we can talk about the prevalence of bullish sentiment and the movement of this pair in the 1.2950-1.3120 channel. In figures, it looks like this: 50% of analysts are for the growth of the pair, the other 50% are for its fall. Trend indicators: 70% look to the north, 30% to the south. Oscillators: one third is colored red, one third is green, and the rest are neutral. As for graphical analysis, on D1 it says that, starting from the support at 1.2950, the pair will try to gain a foothold above the level of 1.3100 and, if successful, rush to the resistance at 1.3280. Otherwise, it is expected to return to around 1.2950;

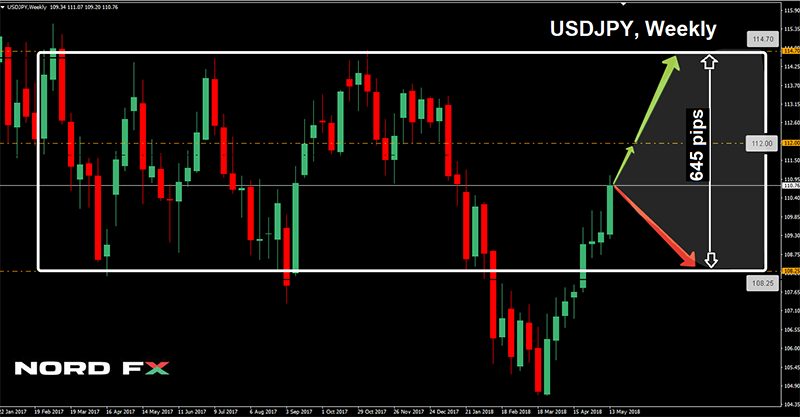

- The medium-term outlook for USD/JPY indicates that it should return to the height of 114.50. But it's too early to talk about the reversal of the trend, and the pair will continue to descend in the coming week. 65% of analysts agree with this point of view, as well as about 80% of indicators. At the same time, a quarter of the oscillators are already signaling that the pair is oversold. The main support levels are 110.85, 110.25 and 109.00;

- The last pair of our review is USD/CHF. 100% of experts, 100% of trend indicators, 75% of oscillators and graphical analysis on H4 and D1 expect the continuation of the downtrend and fall of the pair first to 0.9400, and then 100 points lower. However, one should bear in mind that, as in the case of USD/JPY, a quarter of the oscillators already indicate the pair is oversold, so it is impossible to exclude the correction to the north. The nearest resistance is at the level of 0.9525, the next one is 0.9560.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd, #gbpusd, #usdjpy, # forex, # forex_forecast, #forex signals, # binary_options

https://nordfx.com/