Forex Forecast and Cryptocurrencies Forecast for June 03 - 07, 2019

First, a review of last week’s events:

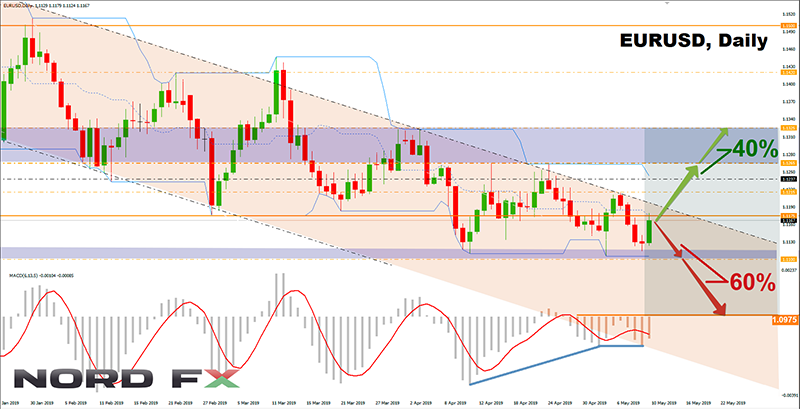

- EUR/USD. President Trump decided to shake up the markets once again. Putting Chinese problems aside for the time being, he turned his eyes towards Mexico. As he failed to build a wall on the border with it, in order to stop the flow of illegal immigrants, we will punish Mexico with the dollar, the US president decided, and increased the duties on Mexican-made goods. Onwards and upwards: in July the rates will be raised up to 10%, in August - up to 15%, in September - up to 20%, and in October - up to 25%.

It is not excluded that such a demonstration of power pursued a double goal: in addition to the punishment of Mexico City, he also wants to scare Beijing: see what we do with the recalcitrant!

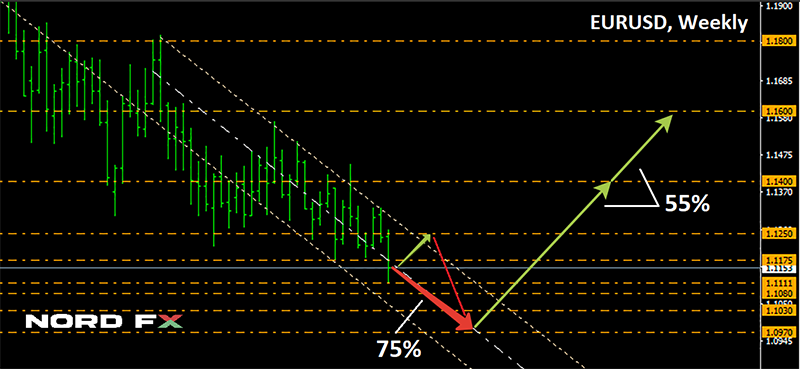

Of course, China is not Mexico, everything is much more complicated here, but, be that as it may, the dollar continued to grow. The results of the elections to the European Parliament also played in its favor. As a result, the pair recorded a local low at the level of 1.1115 on Thursday, May 30, and ended May near the monthly Pivot Point, at 1.1167. Thus, the euro weakened against the dollar by about 350 points in the first five months.

It is appropriate to recall that a year ago at the same time, the European currency lost 2.5 times more, about 900 points, in just a month and a half. So, both traders and brokers have every reason to complain about lower volatility.

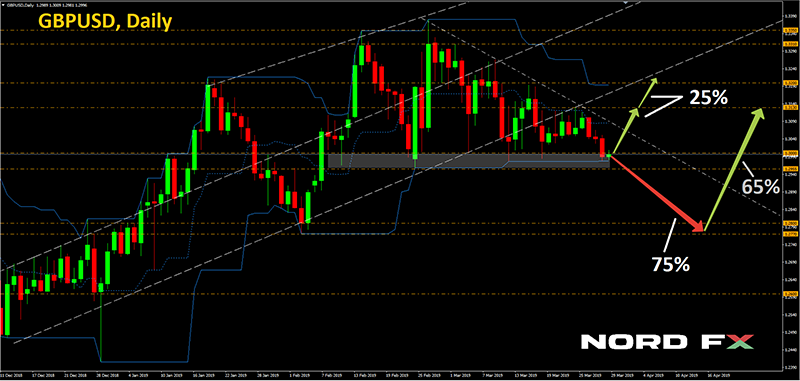

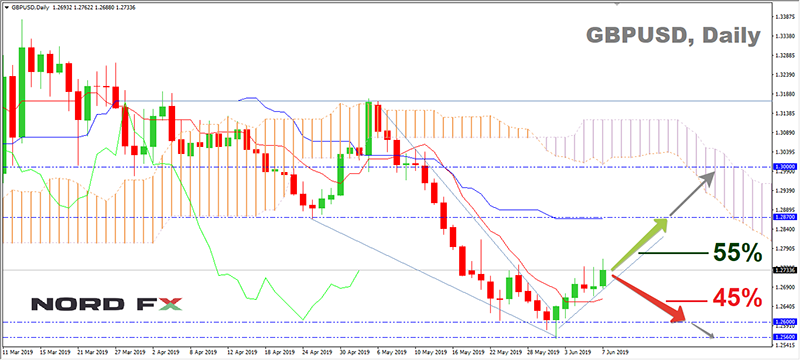

- GBP/USD. After the resignation statement of Prime Minister Theresa May and success of the Brexit supporters in the elections to the European Parliament the pound continues to be under pressure. Recall that 65% of experts, supported by 90% of oscillators and trend indicators, voted for the pair to fall further. This was exactly what happened. The pair not only went down, but also updated the lows of spring 2019, reaching the bottom on the horizon 1.2557, then a rebound followed, and the final chord sounded at 1.2630;

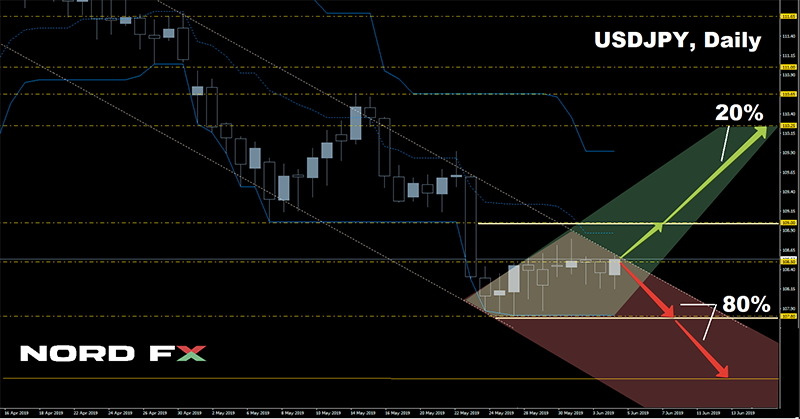

- USD/JPY. The growth of tension entails the growth of anti-risk sentiment. The blow, struck by Trump in Mexico, caused a collapse of almost all market assets, first of all, the oil price. And investors have once again turned their eyes to a safe haven called the Japanese Yen, where one can wait out the next economic storm.

As a result, unlike the euro and the pound, which fell against the dollar, the yen, on the contrary, strengthened, reaching 108.30 on Friday, May 31, where it met summer, fully confirming the forecast given by 75% of analysts, 85% of oscillators and 100% trend indicators;

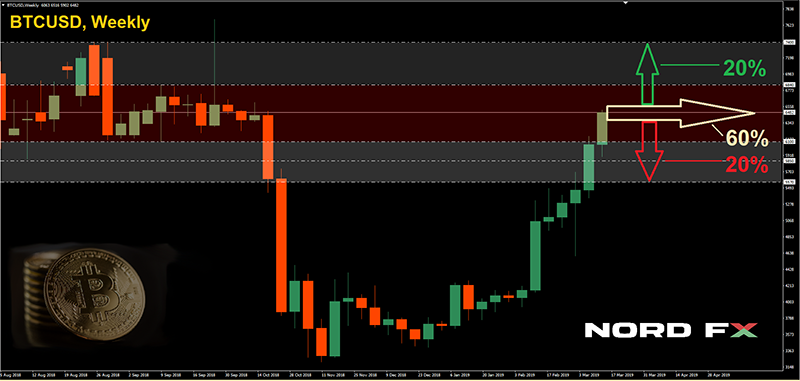

- Cryptocurrencies. For the third week in a row, Bitcoin stubbornly stepped up to the cherished $10,000, moving according to the “step forward, half step back” scheme. So, having fought off the horizon of $7,880, the BTC/USD pair went up sharply late in the evening of Sunday, May 26, reaching $8,955 on Monday. Then a correction of 5.5% followed, and one more spurt upwards, as a result of which it was seen at the height of $9,100. However, it failed to gain a foothold above $9,000, the bulls began to fix their profits, and Bitcoin said goodbye to the spring at $8.510, having risen in price by more than 120% for these three months.

As for the pairs ETH/USD, LTC/USD and XRP/USD, both Ethereum and Litecoin as well as Ripple, after growth following the reference cryptocurrency, returned to the mid-May values by the end of the working week.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

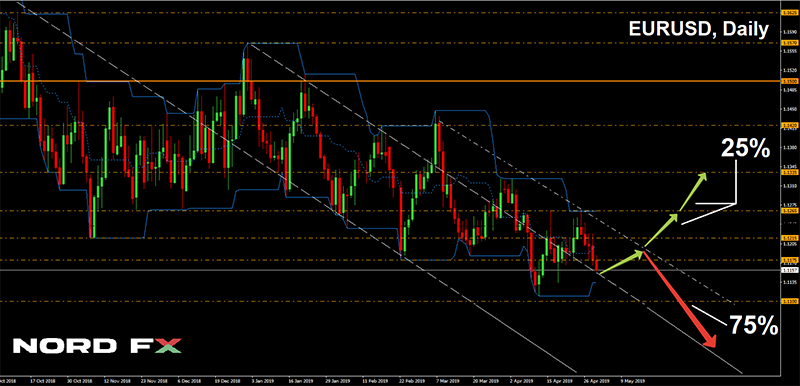

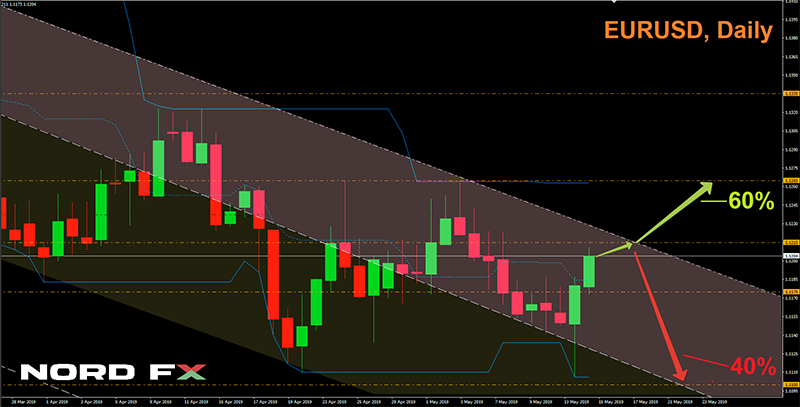

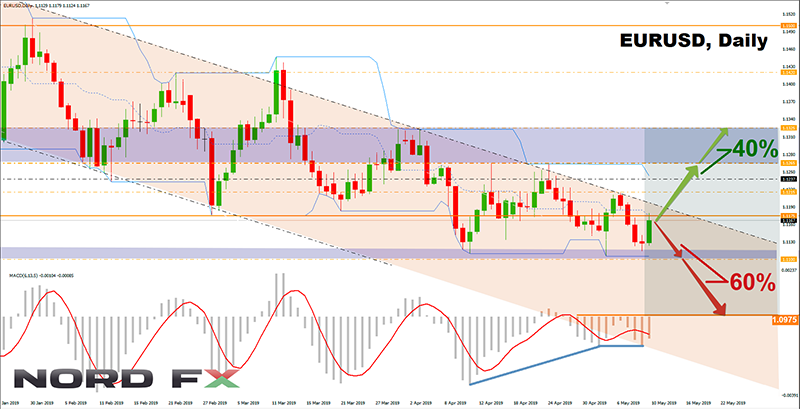

- EUR/USD. In addition to US President Trump, the main engines of this pair are the US Federal Reserve and the ECB. Recall that the current head of the European Central Bank, Mario Draghi, leaves office on October 31. The main contender for his chair now is Jens Weidmann, who, being a supporter of a strong euro, actively supports the increase in interest rates. Representatives of the Fed, by contrast, hint at a possible reduction in the dollar rate due to a possible slowdown in the US GDP. Such a situation should presumably play in favor of the euro. However, according to Bloomberg, the ECB will begin to raise the rate no earlier than April 2020, and during this time a lot can change. Moreover, the political and economic problems of the Eurozone can be observed already now.

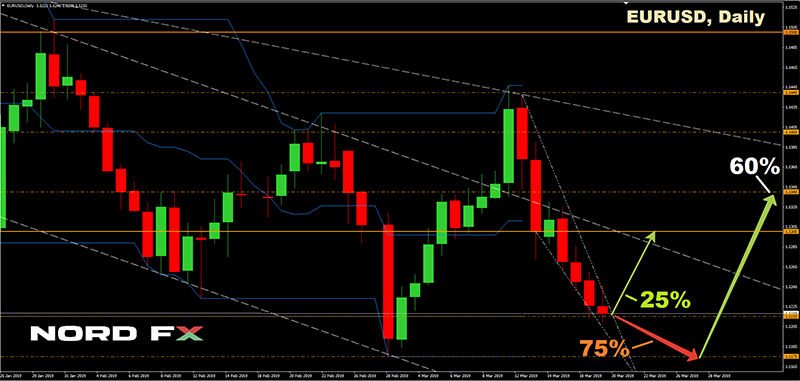

Based on the above, 60% of experts, supported by graphical analysis on D1, vote for the pair to fall to support 1.0975. The next target is 100 points lower.

Most indicators also look to the south: 50% of them are colored red, 25% are green and 25% are neutral gray.

Supporters of bulls are currently in the minority. In their opinion, the pair will not be able to break through support in the 1.1100 zone and it can reach the height of 1.1265-1.1325 on the rebound.

Now, the events of the coming week, which are worth paying attention to. On Monday, June 3, we are waiting for the publication of business activity indices in the Eurozone, the United States and China, and on Tuesday, for the data on inflation and unemployment in the Eurozone. Thursday, June 6, will also be filled with news from Europe. These are data on GDP, the ECB decision on interest rates, and, most importantly, the ECB press conference on monetary policy. And, finally, as usual, we will see the publication of statistics on the US labor market on the first Friday of the month. Experts expect that the NFP may fall by about 30% (from 263K to 190K), which will weaken the dollar for a while;

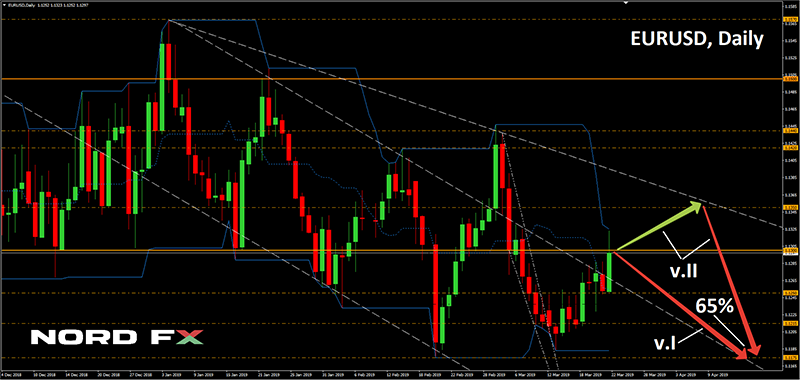

- GBP/USD. The main contender for the post of British Prime Minister today is the former Mayor of London and Foreign Minister Boris Johnson. And this is bad for the pound, since Johnson is a supporter of the "tough" Brexit and exit from the EU without a deal. Such an outcome scares the market, and today 65% of experts, supported by 90% of oscillators and 100% of trend indicators on D1, expect the British currency to weaken further and the fall of the pair first to support 1.2555 and then to the 2018 lows, 1.2475 and 1.2405.

The remaining 35% of analysts believe that the pair’s behavior over the past two weeks is a precursor to a strong correction, as a result of which it can return to the height of 1.2745, or even reach the resistance of 1.2825.

A compromise is offered by graphical analysis on D1. According to its readings, the pair can first rise to the level of 1.2825, and then, turning around, find the bottom in the zone of 1.2405-1.2475;

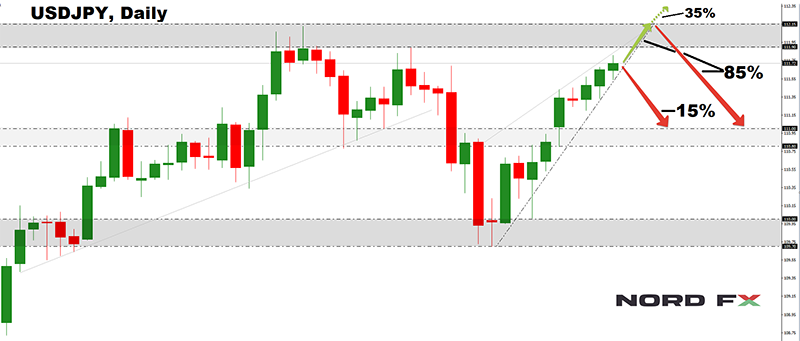

- USD/JPY. Despite the fact that 100% of the trend indicators and 85% of the oscillators on H4 and D1 are colored red, the situation is not that simple: 15% of oscillators are already giving signals that the pair is being oversold. Support levels are 107.75 and 107.00, resistance levels are 109.15, 109.65, 110.35 and 110.65.

As for the experts, the votes were divided as follows: 50% side with the bears, 25% side with the bulls, and 25% are at a loss in the middle. Whose position will be the most correct will depend on the stock markets with which the pair has a strong correlation, and, as usual, on Trump's tweets, dedicated primarily to the course of the US-China trade war. At the same time, when transitioning to the medium-term forecast, the situation changes radically: here it is already 75% who give the palm to the dollar;

- Cryptocurrencies. “Six years ago, in 2013, an unusual message from Luka Magnotta from the Future was published, which predicted the price of Bitcoin, which turned out to be surprisingly accurate. “On average, every year the cost of Bitcoin increased about 10 times,” Magnotta wrote. “It grew from $0.1 in 2010 to $1 in 2011, to $10 in 2012, to $100 in 2013.Then there will be a slowdown, and the price will increase 10 times every two years: Bitcoin will grow to $1,000 in 2015, to $10,000 in 2017, to $100,000 in 2019 and to $1,000,000 in 2021”.

There are still seven months until the end of 2019. Or is it just seven months? In any case, this cryptocurrency must demonstrate a fantastic growth in order to achieve the goal set by Magnotta.

As for the shorter-term forecast, a well-known analyst Peter Brandt has expressed an opinion that, driven by the FOMO (fear of missing out) syndrome of numerous traders, the price of Bitcoin will soon overcome the mark of $10,000. At the same time, Brandt stresses that a rather deep correction is not far off: the bulls will certainly want to take profits, and this sale will stop buyers trying to "jump into the leaving train."

Unlike Brandt, most analysts (70%) have set a more modest goal for the BTC/USD pair, to consolidate above $9,000. The remaining 30% believe that the pair will take a breather and will move in the side channel $7,500-8,500.

In conclusion of this forecast, it should be noted that the time of its writing is Friday, 24:00 GMT. And it is possible that it is the upcoming weekend, as it happened more than once, that the bulls will once again move Bitcoin quotes up.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/