How to Choose Shares for Investing in Correcting Market

Author: Eugene Savitsky

Dear Clients and Partners,

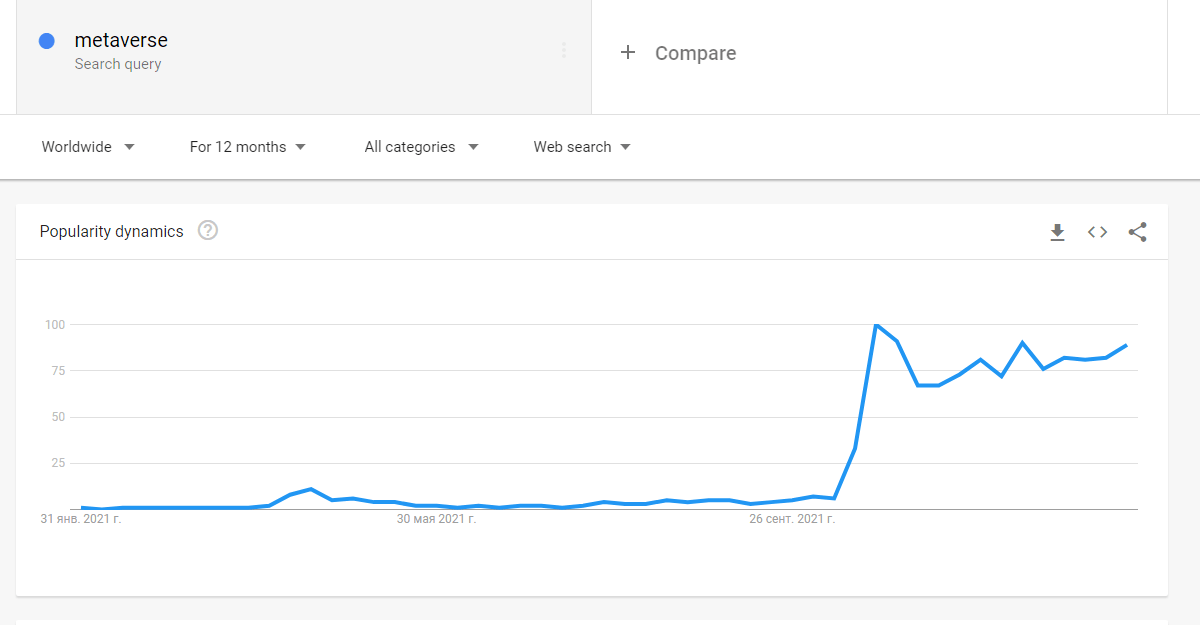

Over the last 10 days, the stock index S&P 500 corrected by 5%. Previous correction was longer but amounted finally to just 6%. Since the beginning of 2021, the index has had five corrections, yet the price has never fallen more than by 6%.

Based on this, we can suppose that the current correction is close to an end, and soon the quotations will start growing again. In this case, the question is: which stocks to buy in such a market?

Today, I will drive your attention to major market players and see which shares they prefer investing in.

At present, the top-3 market participants managing a capital of more than 1 trillion USD includes:

VANGUARD GROUP INC – 4.2 trillion USD

BlackRock Inc. – 3.57 trillion USD

STATE STREET CORP – 1.89 trillion USD

I suggest looking into the portfolios of these funds and check their recent investments. I guess, you will be surprised because you will not see there such well-known companies as Apple Inc. (NASDAQ: AAPL), Alphabet Inc. (NASDAQ: GOOG), or Amazon.com, Inc. (NASDAQ: AMZN).

VANGUARD GROUP INC

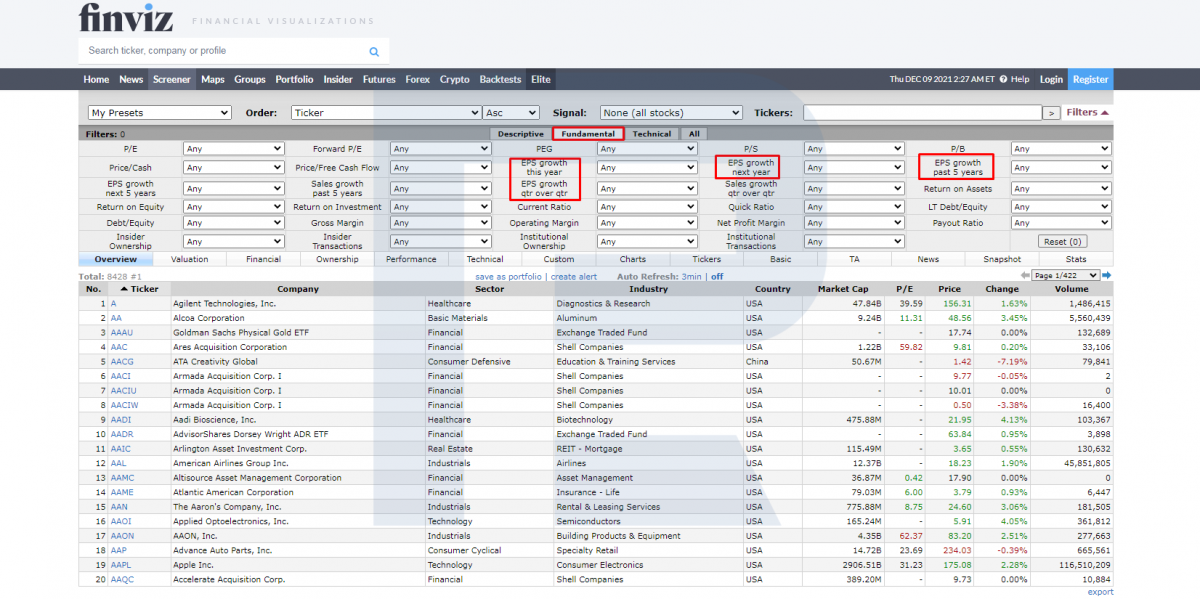

Let us start with VANGUARD GROUP INC. Note that I range the shares by their “weight” in the portfolio, and these are brand-new purchases, i.e. these shares had not been in the portfolios before.

Number one is Lucid Group, Inc. (NASDAQ: LCID).

Lucid Group, Inc. was founded in 2007. It manufactures cars. This investment is evaluated as 900 million USD. In the last quarter, the average share price of the company was 25.38 USD, while now they are trading for 48 USD.

VANGUARD invested in GXO Logistics about 798 million USD. In the last quarter, the average share price was 78.44 USD and the current market price is 92 USD.

Meanwhile, number three is SoFi Technologies, Inc. (NASDAQ: SOFI).

SoFi Technologies is a financial company founded in 2011. It gives loans for education, refinancing older loans, insurance, mortgage, and provides other financial services.

In SoFi Technologies, VANGUARD invested 751 million USD. In Q3, its average share price was 15.88 USD and the current price is 16.40 USD. Note that with the current price growth, the investments of VANGUARD GROUP already demonstrate profitability.

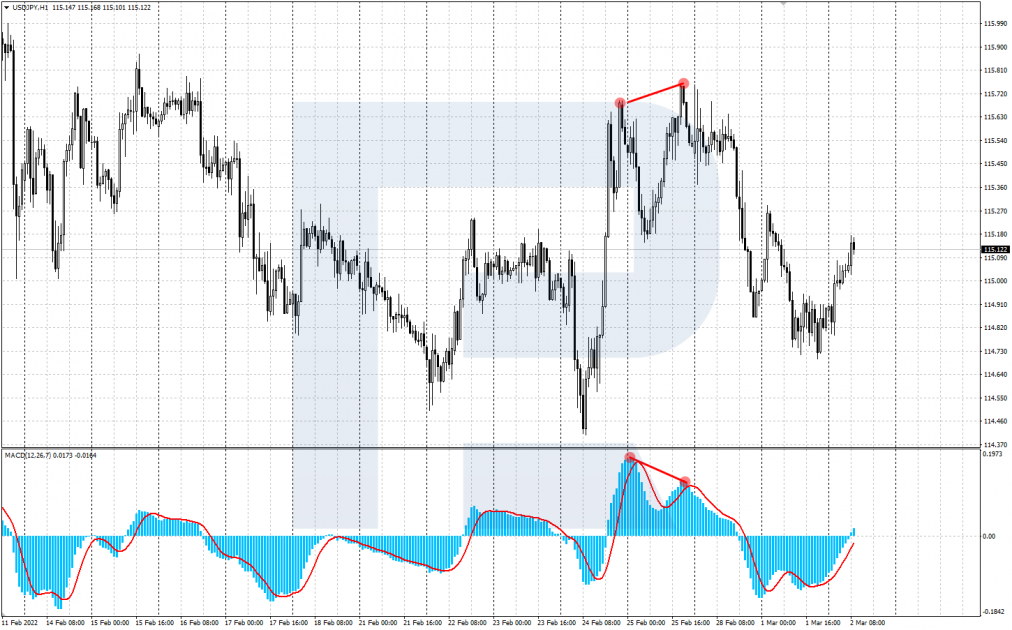

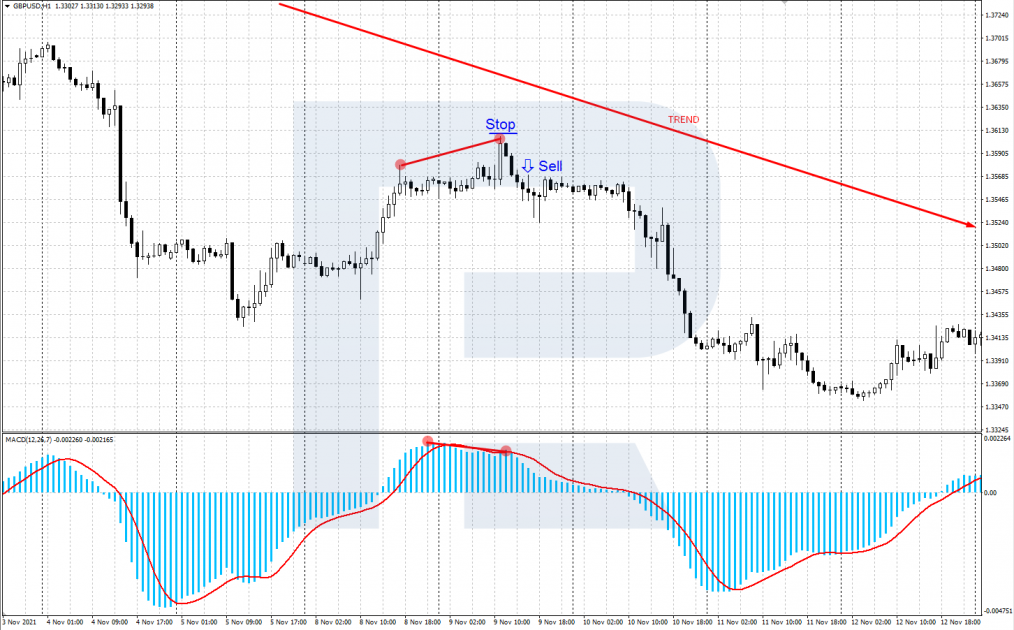

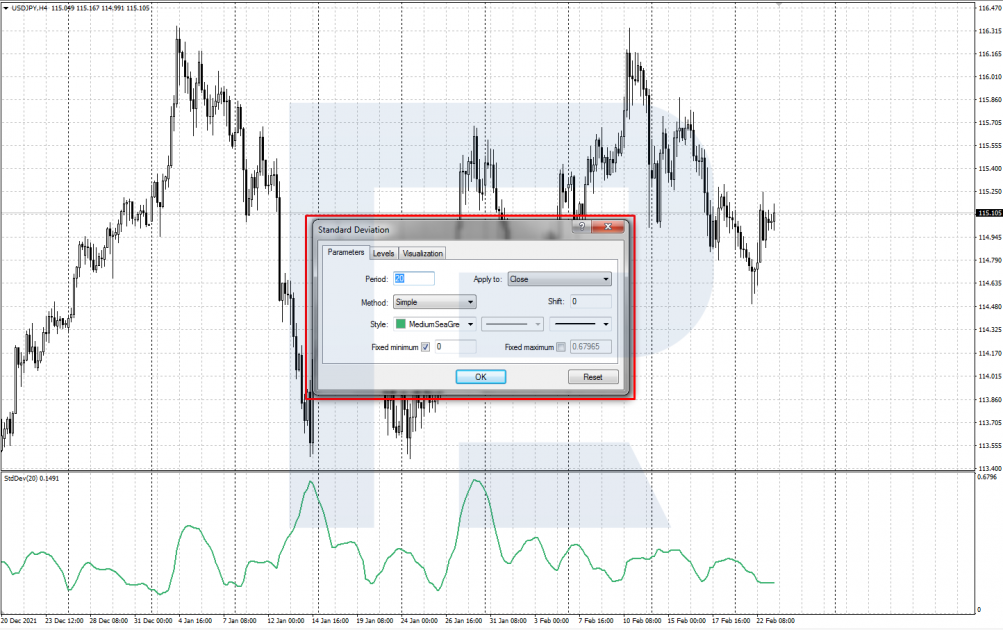

Tech analysis of GXO Logistics shares

Now to the charts of the companies. The shares were bought in Q3, so now we can check how this process affected the share prices of the issuers.

The leader in terms of the sum of investment is GXO Logistics. Since the IPO, the shares of the company have been growing, which is no surprise. Average daily trade volume amounts to 55 million USD. Hedge funds created demand for the shares with their 1.6 billion USD of investments, making the share price grow.

Today, there is an uptrend on the chart, and the quotations have declined to the lower trendline, which means the correction will soon be over, and growth will start again. Another signal to buy the shares will be a bounce off 90 USD.

Bottom line

Corrections give investors a great chance to buy some shares at lower prices. However, there is always a question, which shares to buy. I suggest that we look for possible investments in the reports of major market players that employ dozens or perhaps hundreds of analysts all over the globe.

All the three funds spent on the shares of the named companies no more than 0.02% of their portfolios, which means in the future they will be investing more, making the shares grow.

Currently, keep a close eye on the charts of the shares, checking for support levels, as with Victoria's Secret & Co quotations. This will be a hint on the price, at which it is better to buy the shares.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team